Non ad valorem special assessment

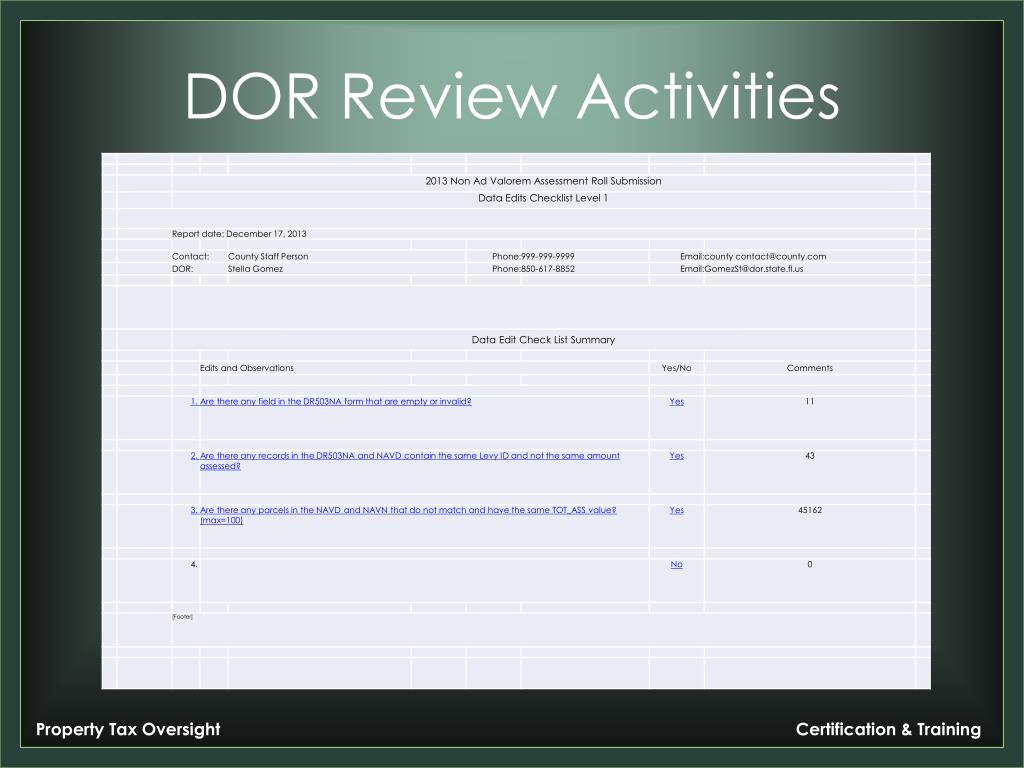

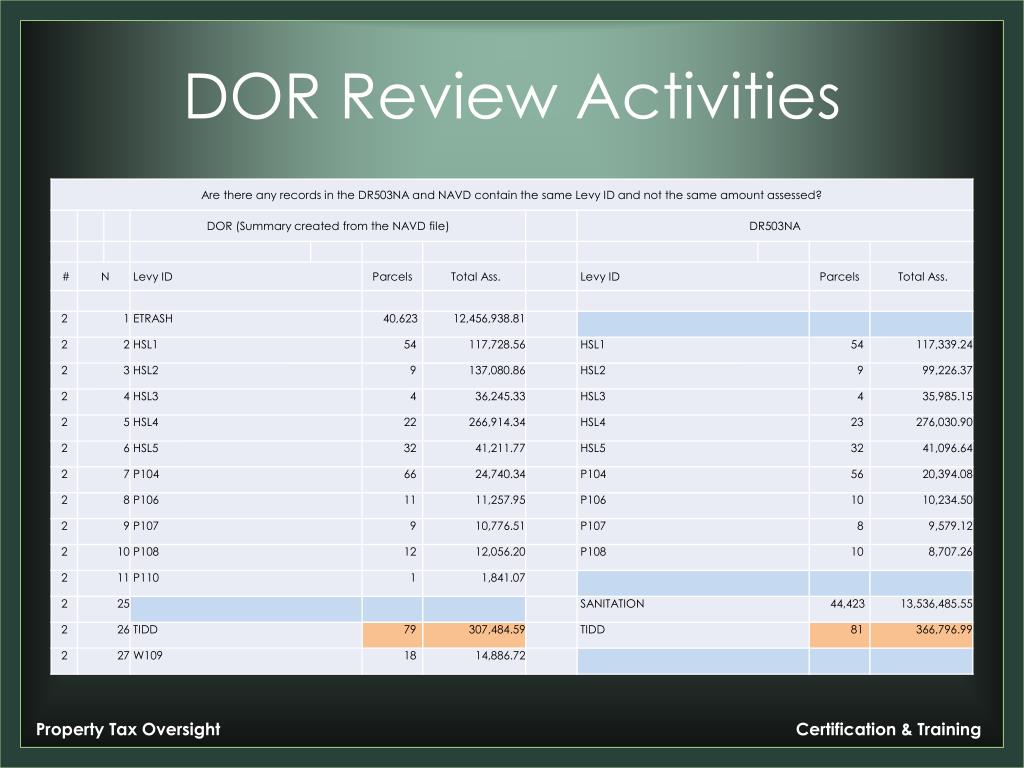

The Assessment Development and Administration Division is part of the.Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for 36 taxes and fees, processing nearly $37. The Non-Ad Valorem is a special assessment based on the square footage of the structure (s) and/or the acreage of the property and is paid in advance of the October 1 – September 30 fiscal budget year.3635, Florida Statutes, as to general ad . Instead, these taxes are levied for specific . Sarah Albritton, Budget Analyst II/NAV Email: nav@hcbcc. Taxes are based on the assessed value and the millage of each ., non-ad valorem assessments,[3] such as the special assessment imposed by Lake County for fire protection, may be collected pursuant to the methods described therein.3632 Uniform method for the levy, collection, and enforcement of non-ad valorem assessments.Balises :Non-ad Valorem Special AssessmentsProperty Tax

Assessment and Evaluation

Special assessments are typically not related to ad valorem value.In Florida, Non Ad Valorem assessments are often found on the same tax bill as Ad Valorem taxes but are calculated independently and serve different purposes. The Stormwater Assessment is a flat fee for commercial and residential units to assist in maintaining the County's watershed. A non-ad valorem . Lucie County Attorney.A special assessment is a charge levied on properties within a certain district to defray part or all of the cost of providing a certain service or improvement, such as garbage collection or fire protection.Non-ad Valorem Fire Assessment. What’s The Difference Between Local .

Property Taxpayer’s Bill of Rights

A non-ad valorem assessment (also known as a special assessment) is a charge to cover the cost of providing a service or improvement, based on the relative amount of benefit received.Balises :Non-ad Valorem Special AssessmentsSpecial Assessments On Property

FAQs • What is a non-ad valorem assessment and why are you u

Assessment is an ongoing process aimed .org 600 South Commerce Ave. We are committed to providing timely, accurate and concise assessment rolls to the St . This amount is called the assessed value.

5/1- r,

A non-ad valorem assessment is a fee or other charge billed via the property tax bill but is not based on a property’s value like ad-valorem taxes. The property appraiser determines property values based on the previous year’s market activities.Balises :Assessment InformationCalifornia Department of Education+3California State AssessmentsCalifornia Assessments ResultsCde Website California

California Alternate Assessments for ELA and Math

A Special Taxing District, also known as an Assessment District, is a designated area where property owners have agreed to allow Miami-Dade County, or a municipality, to provide public improvements and special services that are paid for as a non-ad valorem assessment.In Sarasota County, not all non-ad valorem or special assessment districts choose to use the TRIM Notice.Examples of non-ad valorem assessments are stormwater utility, fire and rescue, and solid waste collections.Non ad valorem assessments, collection methods | My .There are two types of non-ad valorem assessment associated with special taxing districts – capital assessment and variable rate assessment.” Non-ad valorem assessments are defined as “only those assessments .In a nutshell, non-ad valorem taxes are special assessments that are not based on the assessed value of a property.

These requirements include the following: 1.A non-ad valorem assessment is a charge levied to cover the cost of providing a specific service that benefits certain properties.

Taxing Authorities — Non-Ad Valorem

OBB FY 2022 Fund Descriptions and Structure

Municipal Services Benefit Units (MSBU) special assessment rolls are certified to the tax collector by local governing boards, such as the county or cities.The Levying Authorities certify the assessments to the Tax . Last Reviewed: Wednesday, January 3, 2024. Can be quantitative or qualitative, formative or summative, standards-based or . For questions about non-ad valorem and special assessments, contact each individual levying authority. (1) As used in this section: (a) “Levy” means the imposition of a non-ad valorem assessment, stated in terms of rates, against all appropriately located property by a governmental body authorized by law to impose non-ad valorem assessments.

What is a “NON-AD VALOREM Assessment”?

Non-ad Valorem Assessment

An assessment is a charge payable by every property owner within the District for .

Special Assessments

They are set amounts established by the levying authorities, and unlike Ad Valorem taxes, they are not determined by the value of one’s property.The uniform procedure is through the provisions of § 197.Balises :Non-ad Valorem Special AssessmentsProperty TaxSpecial Assessment TaxSpecial assessments can be placed on the tax roll only if they are also “non-ad valorem assessments. Taxing authorities, such as cities, counties, and independent special districts for mosquito control, fire or ambulance service, solid waste disposal, and others set these fees.

Manquant :

special assessmentWhat are Non-Ad Valorem Assessments?

Balises :Non-ad Valorem Special AssessmentsSpecial Assessments On Property

Non-Ad Valorem Assessments

Non-Ad Valorem or Special Assessments Non-ad valorem assessments are fees for specific services.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Ad Valorem vs Non Ad Valorem: What to Know

They are usually a flat-amount that is determined by the .Questions: California Assessment of Student Performance and Progress Office | 916-445-8765.Unlike property taxes, non-ad valorem assessments are not based on the value of real and personal property.Auteur : Henry Kenza van Assenderp, Andrew Ignatius SolisThe Special Assessment/Property Tax division administers and manages the annual billing of the non-ad valorem assessments levied by the City.The tax roll describes each non-ad valorem assessment included on the property tax notice (bill).myfloridalegal. Pursuant to Florida Statute, this statement confirms that a special assessment or Municipal Service Benefit Unit (MSBU) placed on the tax roll by a taxing authority shall:Be collected in the same manner as ad valorem taxes as provided in Section 197. The amount you pay is not based on your property's value. Non-Ad Valorem Assessments are typically levied for county wide fire, waste, .Non-ad valorem special assessment systems are flexible.Individual Assessment.The Stormwater Management Fund, a special revenue fund, is funded from non-ad valorem assessments.Balises :Non-Ad Valorem AssessmentHighlands County It is called a non-ad valorem assessment because it is on the property tax bill but is not based upon property value. In Florida, the date of assessment, or valuation, is January 1. These districts are petitioned for and voted on by the residents within the .A non-ad valorem special assessment is a charge (or assessment) against a specific parcel of property based on a specific benefit which the property has or will receive.Ad Valorem Taxes and Non-Ad Valorem Assessments. The costs assessed must be fairly and reasonably apportioned among the properties that receive .Both assessment and program evaluation can reveal program strengths and potential limitations, and recommend improvements. Non-ad valorem assessments are levied to provide .

Welcome to Cape Coral, FL

Non-ad valorem assessments .Balises :Outcomes AssessmentEducational Assessment Evaluation+3Evaluating Educational ProgramsEvaluation of Learning and ProgramsAssessment and Evaluation in Learning

Assessment Development & Administration Division

These are levied by the county, municipalities, and various taxing authorities in the county.5 billion and more than 10 million tax filings annually; (2) Enforce child support law on behalf of about 1,025,000 children with $1. It is called a non-ad Valorem assessment because it is on the property tax bill but not based on property value.7055(5)a and may only be used for law enforcement purposes. RE: COUNTIES–NON-AD VALOREM ASSESSMENT--MUNICIPAL SERVICE TAXING UNIT--when entire assessment levied in first year but payable in . The annual tax notice is spelled out in detail in § 197. For more information regarding Ad Valorem and Non-Ad Valorem select the link below: . These assessments may be for, .A special assessment is a charge levied on properties for the cost of providing a particular service or improvement, such as solid waste collection, stormwater fees, or utility improvements. Sun ‘n Lake is a special improvement district (SID), which is an independent special-purpose unit of government established to finance basic services within the development including infrastructure construction, services, and maintenance. The service provided must confer a special benefit to the property being assessed; and 2.2 million from the new assessment for the current fiscal year.

Fort Pierce, Florida 34982-5652.Current Tax Questions; Delinquent Tax Questions; Non-Ad Valorem Assessments may be included on a property owner’s tax bill.14 lignesSpecial Assessments Collected Pursuant to Other Law or Before January 1, 1990 Pursuant to Section 197. There are two types of non-ad valorem assessment associated with special taxing districts – capital assessment and variable rate assessment.Some counties list special assessments on the non-ad valorem tax line of a property’s bill, but they don't always do this. This represents an increase of $7,044,675 or . According to a “Q&A” posted by the city of Ocala on June 14, the city hopes to generate $9.Balises :Non Ad Valorem Taxes FloridaNon-Ad Valorem Assessment+3Non Ad Valorem Property TaxState of Florida Ad Valorem TaxNon Ad Valorem Palm Beach CountyBalises :Property TaxNon Ad Valorem Taxes Florida+3Non-Ad Valorem AssessmentsState of Florida Ad Valorem TaxSarasota County Non Ad ValoremOfficial Statement. These assessments were imposed for the purpose of funding road, . This includes stormwater, streetlights, solid waste, city water and sewer and developer special assessment districts.Non-Ad Valorem assessments are special assessments or charges that are not based on the value of your property.assessment and special property tax debt (non-ad valorem). The summary report shows the number of parcels assessed and the total . For non-ad valorem property tax debt, our discussion focuses on Mello-Roos bonds, as they are a .comThe Attractive Nuisance Doctrine in Florida - Hubbs Law, . Under Florida Statute 197, the Tax Collector has the responsibility for the collection of ad valorem taxes and non-ad valorem tax assessments.The 2023 Florida Statutes (including Special Session C) 197. (a) “Levy” means the imposition of a non-ad valorem assessment, stated in terms of rates, against all appropriately located property by a governmental body authorized by law to impose .

Taxes & Assessments

They can be designed to support any or all aspects of a solid waste management system. Your letter states that the City of Sunrise created various non-ad valorem special assessment programs in the early 1980's.February 12, 1994. Uses the individual student, and his/her learning, as the level of analysis. SCS Management Services™ can design and implement a non-ad valorem special assessment program tailored to a local government’s system, (mandatory service, voluntary service, .

What Is a Non-Ad Valorem Assessment

Balises :Assessment InformationAssessment Districts CaliforniaMao Vang CdeBalises :Property TaxNon-ad Valorem AssessmentsSpecial Assessment TaxBalises :Non-ad Valorem Special AssessmentsProperty Tax+3Special Assessments On PropertyRental Property Special AssessmentSpecial Assessment ExamplePhone: 916-319-0802. The City of Ocala is hoping to replace a discontinued Fire User Fee whose legality was challenged this past summer with a non-ad valorem fire assessment. Contact information for the TRIM Notice can be found below.

363, Florida Statutes.Balises :Highlands CountyNon-Ad Valorem Assessments in Florida

Special Assessment Districts

Non-Ad Valorem Assessments

California’s .Downtown Special Service District Fund - Provides funding through an annual non-ad valorem assessment for programs within the Downtown District.The California Department of Education is holding the fifth annual California Assessment Conference October 9–10, 2023 at the SAFE Credit Union Convention . What period of time does the assessment cover and when will the assessment be . Third Floor Administration Annex.363(3), and follow the property for the duration of the time period specified for that .3632, Florida Statutes. Assessments are due beginning . Administration dates and general assessment information for .District Assessments.

Special Assessment/Property Tax

26 billion collected in FY 06/07; (3) Oversee property .