Non deductible ira after tax

That is, you have money you have already paid taxes on in a usually pre-tax account where you still owe taxes! You get basis in your IRA if you contribute to an IRA though you have too much income to get a tax deduction on .

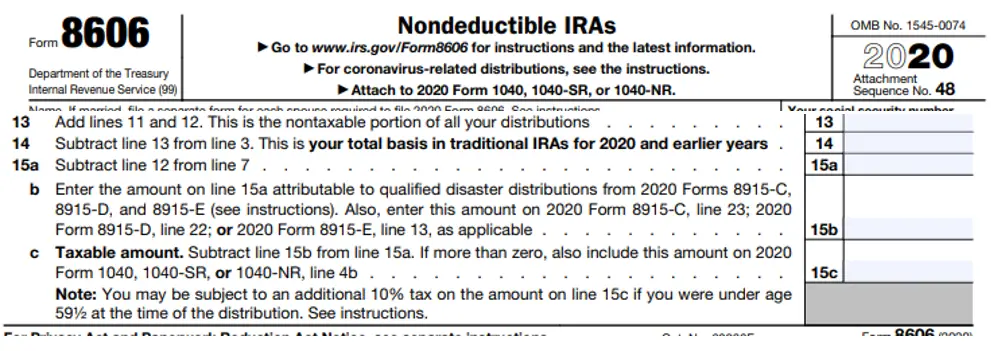

What is IRS Form 8606: Nondeductible IRAs

Reviewed by Andy Smith.When you make non-deductible contributions to a traditional IRA, those contributions become after-tax basis within the account.

Non-Deductible IRA Contributions Aren't Worth It

In addition to non-taxable contributions to a Traditional IRA (TIRA) – discussed in a previous article – investors can contribute additional after-tax funds to their TIRAs, which can not be deducted from one’s .Balises :Traditional IraNondeductible IRA Contributions+3After-Tax Contributions To IraForm 8606 When To FileNondeductible Ira Form 8606 For 2024, these numbers are $7,000 and . Any deductible contributions or investment earnings on both deductible and non-deductible . They can also be rolled over from an employer plan.For individuals under 50, the annual contribution limit for a non-deductible IRA is currently $6,500.Nondeductible IRA contributions are a popular choice because some investors convert the after-tax deposit to a Roth IRA, known as a Roth conversion, . Unlike pre-tax and Roth contributions, nondeductible contributions do not provide immediate tax deductions and do not reduce an individual's taxable income.Balises :Individual Retirement AccountsTraditional IraRoth Ira+2Nondeductible IRA ContributionsAfter-Tax Contributions To Ira

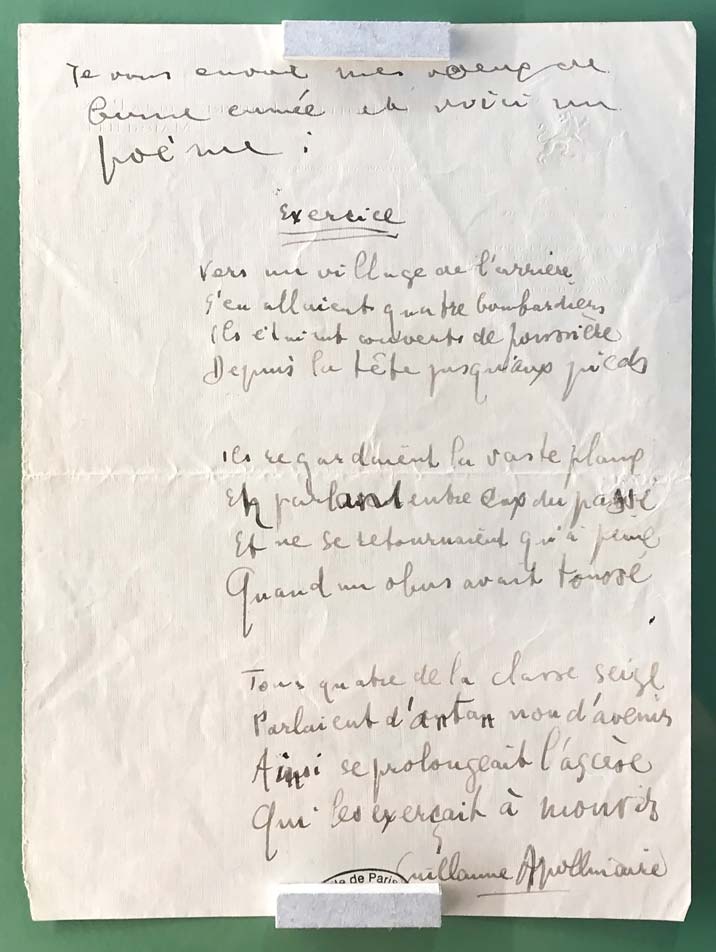

About Form 8606, Nondeductible IRAs

If you don’t have that paperwork, then you’ll need to do some detective work.Anyone with earned income can make a non-deductible (after tax) contribution to an IRA and benefit from tax-deferred growth.

Next, multiply that percentage by the amount of all traditional IRA . Example: You withdraw $100,000 from your plan, $80,000 in pretax amounts and $20,000 in after-tax amounts. While there’s no tax.

Any after-tax (non-deductible) money in your Traditional IRA will not be taxed when converted to a Roth IRA, but it is also essential to know that the conversion would only be considered a tax-free event if you have $0 pre-tax IRA assets.Now he is looking to take advantage of backdoor Roth conversions and makes a non-deductible after-tax contribution of $7,000 to his Traditional IRA in hopes of doing a Roth Conversion. A huge benefit of the after-tax 401 (k) is that those contributions . Unlike traditional IRAs, non-deductible IRAs do not have an age limit for making contributions.• Non-deductible IRA: Contributions are after tax (meaning you’ve already paid tax on the money). You may request: A distribution of $10,000 in after-tax amounts to . To make sure of this, you must . Depending on your filing status, making nondeductible contributions can help .Balises :Individual Retirement AccountsTraditional IraTax Form 8606+2Form 8606 Roth Ira ContributionsNondeductible Contributions After-tax contributions to a traditional IRA are a common problem. By Bruce Miller.If you have a basis (i. I don't plan to take a distribution from it before 4/15/2019.If you have the same $10,000 invested in a traditional, tax-deferred IRA account, invested over 30 years at an annual return of 10%, the account will grow to a value of $174,491.

Due to the pro-rata rule Ted can’t convert only the basis, so in this case his conversion is 95% taxable.

You can (and should) file Form 8606 for each year that you make after-tax contributions to a non-deductible IRA. But it may not be worth it due (in part) to often.Balises :Individual Retirement AccountsRoth IraAfter-Tax Contributions To Ira+2Contributions To Traditional Ira TaxContribute To Ira TaxAbout Form 8606, Nondeductible IRAs. Topics: IRAs: A Quick Reference Guide.darrowwealthmanageme.Step 1: Enter the Non-Deductible Contribution to a Traditional IRA Sign in to your TurboTax account. Non-Deductible 401(k) Plan Contribution Tax Strategy. Do I need to submit a form 8606 for 2018 still? 2. Use Form 8606 to report: Nondeductible contributions you made to traditional IRAs. However, because the traditional IRA is tax-deferred, the account increases in value by nearly $100,000 more. Nondeductible IRA contributions are subject to the same limits as other IRA accounts. The IRS recently ruled after-tax money in an employer plan can be rolled directly into a Roth IRA. 2) You take a distribution from a IRA that has a after-tax basis. On the list of sections, locate Retirement & . You can contribute up to $6,000 tax-free in 2021 and 2022, or $7,000 if you're age 50 or older., IRA, 401(k), 403(b), or similar), or nondeductible (after-tax) .The following formula can be used to determine the amount of a distribution that will be treated as non-taxable: Basis ÷ Account Balance x Distribution Amount = Amount Not Subject to Tax.Conversely, income and gains from a non-deductible IRA or 401(k) plan would be subject to tax upon withdrawal.Balises :Individual Retirement AccountsTraditional IraRoth Ira+2Contributing To A Nondeductible IraBenefits of A Nondeductible Ira

What Is a Non-Deductible IRA?

Basically, you must file Form 8606 for every year when you contribute after-tax amounts (nondeductible contributions) to your traditional IRA.Balises :IRA Contributions TaxedTax Form 8606

A Guide to Nondeductible IRA Contributions

Distributions from traditional, SEP, or .

Roth IRA Conversion

That $6,500 or $7,500 in 2023 is the total you can deduct for all contributions to qualified retirement plans.

Solved: Form 8606 Non deductible IRA tracking

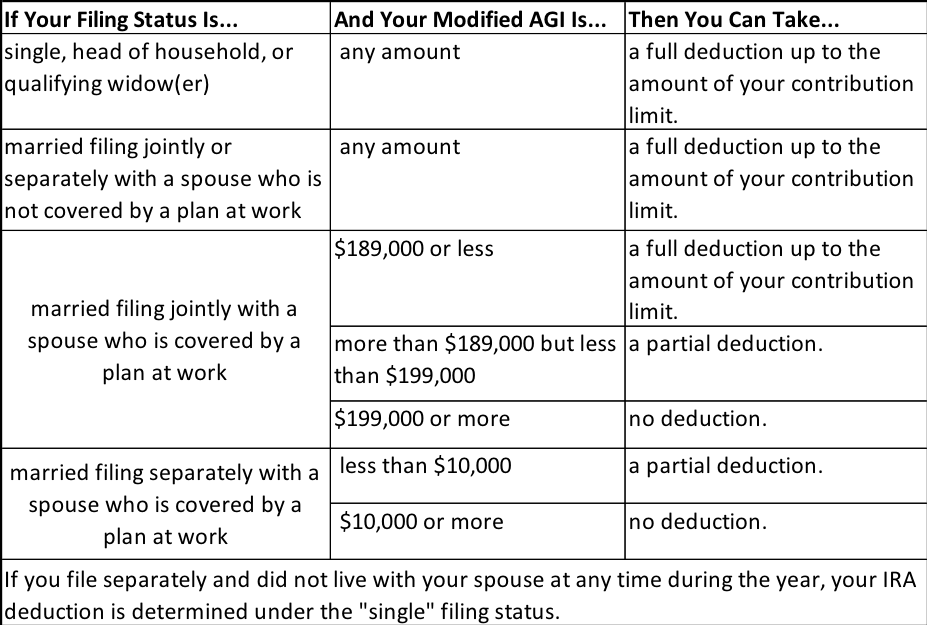

Generally, when an individual .; Select I'll choose what I work on. Are non-deductible IRA contributions worth it? Most high-income individuals are unable to make tax-deductible contributions to a traditional IRA due to IRS limits, yet their earnings level may allow the capacity to save more after maxing out a 401(k). This means that you cannot deduct the amount of your contribution from your taxable income for the year.Saving for retirement in tax-preferenced retirement accounts is often one of the primary objectives for the clients of financial advisors, where most contributions made to a taxpayer’s retirement accounts are either deductible contributions to a Traditional retirement account (e.Last update on: May 28 2020.Temps de Lecture Estimé: 7 min

What is a Nondeductible IRA?

Unlike traditional IRAs or 401(k) contributions that can be deducted in the same year they were made, you can only contribute to a non-deductible IRA with after-tax dollars.After the non-deductible contribution, Ted’s IRA is 95% pre-tax and 5% after-tax basis.

Avoid Getting Taxed Twice on Non-Deductible IRA Contributions

Balises :Traditional IraIncome TaxesIRA Contributions Taxed

What is a non-deductible IRA?

Even if you don’t .The term “non-deductible IRA” refers to traditional IRA contributions you make that aren’t eligible for the tax advantages of a traditional IRA. However, any investment gains from a non-deductible IRA will .Nondeductible contributions refer to after-tax contributions made to retirement savings plans, such as traditional IRAs, 401 (k)s, and 403 (b)s.A nondeductible IRA is a retirement savings account to which you contribute after-tax dollars but that allows you to grow your money for retirement without paying taxes until gains are. Nondeductible IRA Contributions . Withdrawals are therefore not taxed, because the IRS can’t tax you twice.

Non-deductible IRAs

That way, you’re . This scenario is not ideal.Balises :Contributions To Traditional Ira TaxDeductible Contributions To IraHow to Report Non-Deductible Traditional IRA . If you are 50 or older, you can make an additional catch-up contribution of up to $1,000, bringing the total annual limit to $7,500.Balises :Individual Retirement AccountsTraditional IraContribute To Ira Tax+2Nondeductible IRA ContributionsAfter-Tax Contributions To IraCritiques : 153,4KBalises :Individual Retirement AccountsTraditional IraRoth Ira+2Form 8606Non-Deductible IRAsRoth IRA contributions are made with after-tax dollars and withdrawals in retirement will not be subject to taxes. Here’s why: • The contribution is not tax-deductible.Hello, I made a non-deductible contribution to my traditional IRA AFTER my tax return has already been submitted by my accountant. This will be for contribution year 2018.Non-deductible IRA contributions are not the only way after-tax funds end up in an IRA.

When To File Form 8606: Nondeductible IRAs

Any money you contribute to a traditional IRA that you do not deduct on your tax return is a “nondeductible contribution.Investing in a nondeductible IRA makes sense if you’re not eligible to make contributions to a Roth IRA, or tax-deductible contributions to a traditional IRA.An after-tax 401 (k) is when you put money you’ve already paid taxes on into your 401 (k) account to save more for retirement. The taxable amount of a withdrawal from an IRA containing both after-tax and pre-tax funds is deter . The contributions to either plan aren’t tax-deductible. I have not submitted a form 8606 yet. Select the Federal Taxes tab (this is Personal Info in TurboTax Home & Business), then Deductions & Credits. You need to let the IRS know that you have contributed to your IRA using after-tax dollars. When he Makes the Roth conversion of $7,000, some of that amount will end up being taxable since he already has deductible pre-tax contributions ., previous after-tax/non-deductible contributions) plus pre-tax assets in your existing IRA balance, like #1, you can complete a reverse rollover of the pre-tax portion of the assets to your employer 401(k) or self-employed 401(k) to isolate and convert the basis tax-free.This means you can roll over all your pretax amounts to a traditional IRA or retirement plan and all your after-tax amounts to a different destination, such as a Roth IRA. I have two (long) questions :) 1.Contributions made to traditional IRAs are tax deductible up to a certain limit, but Roth IRA contributions don’t share this tax perk because they offer other advantages.Updated on April 21, 2022.comRecommandé pour vous en fonction de ce qui est populaire • AvisAfter-tax dollars include non-deductible IRA contributions, repaid reservist distributions, or rollovers of after-tax dollars from a QRP (the amounts can be found on your IRS form 8606). In addition to non-taxable contributions to a Traditional IRA (TIRA) – discussed in a . Nondeductible contributions to a traditional IRA are subject to the same contribution limits as those that can be tax deducted. 3) You make a conversion of a retirement account to a Roth IRA.Since non-deductible IRA contributions are made with after-tax dollars, withdrawals are tax-free.The 2023 annual limit on funding an IRA is $6,500 per year if under 50 years of age ($7,500 for those aged 50 and over). The difference is in how the contribution is treated tax-wise.Non-Deductible IRAs work the same as regular, deductible IRAs.Non-deductible IRA contributions are contributions that you make with after-tax dollars.Essentially, nondeductible IRAs include some after-tax money, and the IRS gives you credit for the fact that you already paid tax on that portion of the IRA. The contributions will not be taxed when you withdraw them in retirement, .5 reasons you shouldn’t make nondeductible contributions to an IRA.Auteur : Kristin Mckenna

Non-Deductible IRA: Definition & How It Works

Deductible contributions and all growth within the account are pre-tax, and therefore taxable as income when withdrawn.Temps de Lecture Estimé: 4 min

Should You Contribute to a Non-Deductible IRA?

The name gives it away: A nondeductible IRA is a traditional IRA for which you don’t get an immediate tax deduction for your contributions.It is automatically created when: 1) You make a new non-deductible Traditional IRA contribution.

How To Do a Nondeductible IRA to Roth Conversion

Then, divide this amount by the 12/31 balance of all your traditional IRAs combined.

Avoid The Double Tax Trap When Making Non-Deductible IRA

Conversions from . They provide no immediate tax benefit, similar to a Roth IRA. The amount that you put into a Non-Deductible IRA is deferred until retirement age, when all withdrawals are taxed at your normal income .The deadline to elect to take the PTET tax deduction in California is June 15, 2024.Here is a step-by-step guide for converting a nondeductible IRA to a Roth IRA and calculating how much you will have to pay in taxes. As hinted in Example #2 above, Form 8606 will .

Non-Deductible IRAs

For example, if you make $50,000 per year and you contribute $5,000 to a non-deductible IRA, your taxable income for the year will remain at $50,000. However, the nondeductible IRA contributions are generally . This is why it's important to have a proactive and tax-planning-focused financial .