Non essential expenses examples

Discretionary Spending: This category covers non-essential purchases that you make at your discretion. Here are some examples of essential and non-essential expenses.Instead, limit yourself by only putting $100 into that account for the month. Others are recurring variable expenses, such as utilities, groceries and credit card payments.Step 2: Make a list of all your monthly expenses (yes, even the easily forgotten ones).These non-essential costs are probably getting in the way of your financial goals.How to Differentiate Between Essential & Non-Essential .Discretionary and non-discretionary spending are terms used to describe the categories of expenses you use daily in life. Fixed expenses can include essential expenses, such as those needed to maintain a basic standard of living each month.ukWhat are 'essential living expenses'? — MoneySavingExpert .

How to Categorize Expenses

While it’s important to spend on things that give you pleasure—whether it’s a cable subscription or take out once in a while—this kind of spending can get out of hand quickly if you’re not . Ultimately, the purpose of an emergency fund is to prevent someone from taking on high-interest debt like credit cards, payday loans, or other unsecured loans that push them into financial ruin.If this is a bigger part of your budget than the national average, you might want to put some of your non-essential food expenses (like gourmet foods or wine) into one of the non-essential categories .comEssential vs Non-Essential Spending: 3 Lessons Learned .perfectionhangover. Sentence with Antonym. This will force you to review historical expenditure where you may discover things like old subscriptions or duplicate costs. However, an unlimited data plan is .On average, Americans may spend about $18,000 a year on non-essential items, also known as discretionary spending, according to one 2019 study. This is also known as four walls budgeting. How till Crop Back in Non-Essential Expenses - Shuffled Up MoneyHere are some examples that can help you better understand discretionary spending and some easy ways to reduce these non-essential expenditures. a used minivan).

comHow to differentiate between essential and non-essential . It’s important to seating down and determine what parts of your budget exist essential and what pieces yourself could cut back the if necessary. Eating out: Instead of . Some of the most common fixed expense samples .Below are examples of expenses that can be written off, although these vary based on your country: Clothing or job uniforms. They incurred a huge expense during their vacation.7 Examples of Discretionary Expenses - Simplicablesimplicable. Non-essential expenses are extra spendings you made aside from your necessities. But we wants to buy lattes and new clothes.

A Small Business Guide to Discretionary Expenses

On example, ourselves need meal and shelter. Become a member and unlock all Study Answers. Everything else could be considered non-essential (or at least not equally important). An expense may also be discretionary .Essential expenses are required for you to survive, such as grocery, utilities, tax, and transportation.Grocery Store Food.Here are some examples of non-essential expenses: Music and content streaming platforms (Netflix, Disney+, Spotify, etc. For example, getting nails done. Your essentials include: Food. Here are a few items which we tend to pay for that are, for the most part, completely unnecessary.

What are Discretionary and Non-Discretionary Spending?

Common examples include expenses related to research and development, employee benefits, office improvement, and training.35 Antonyms for EXPENSE With Sentences.When to use your emergency fund: examples. Another way to think of discretionary expenses is to classify .

Opposite of EXPENSE

However, don’t confuse non-essential for unnecessary or unimportant. Health insurance benefits. Discretionary expenses are born .Some expenses can contain discretionary, variable, and fixed categories. But some outgoings will not be allowed when working out if we can award any extra help.These non-essential costs are probably hampering your .

Tuition and other Student Costs.Discretionary expenses are also called non-essential expenses or non-essential spending. Transportation.Examples of Discretionary Expenses.Flexible expenses range from non-essential costs that you can reduce or eliminate just by stopping your spending to essential expenditures that require some work to reduce. If you aren't sure if an item is .For example, expenses such as rent, mortgage, utilities, groceries, or medication are essential ones that you need to pay for living.comRecommandé pour vous en fonction de ce qui est populaire • Avis Let's watch when to cut them and how to manage discretionary expense effectively. Sentence with Expense.

Coffee by the Cup.

![How to Create a Budget [ FREE Budgeting Templates]](https://themillennialmoneywoman.com/wp-content/uploads/2020/10/Examples-of-Fixed-vs-Variable-Expenses-1.png)

Obviously, if something is essential, it’s necessary. Practice patience with the 24-hour rule.Discretionary spending is non-essential spending that isn't mandatory for your basic needs like shelter, food, healthcare, work and personal care. Travel We will allow: Public transport (for work, school, shopping etc) If we consider that . Due to the accrual principle in .Non-essential expenses are expenses that arise from wants and not needs. Examples include dining out, entertainment, and subscription services.On the other hand, wants are non-essential items and services that can enhance one's quality of life but are not necessary for survival or basic well-being. Our experts can answer your tough homework and study . Make a List of All Your Expenses. For example, you may need a cell phone for work or health reasons. Seeing the expenses on paper can help them feel less overwhelming and makes them easier to organize.However, sometimes it’s not the typical offenders that are wreaking havoc on our monthly expenses. These expenses are often associated with leisure, entertainment, and personal indulgence.moneysavingexp. If you’re an impulsive person, non-essential spending can be a difficult feat to control. Diese non-essential costs are probably getting in the .Discretionary expenses refer to non-essential spending on goods and services that are not required to maintain basic living standards.Food, rent, mortgage payments and household bills are all essential spends.); Meal delivery services (Uber . Sometimes it’s just the little things that we don’t even think about that are the main culprits. Try it now Create an account Ask a question .Here’s how to budget for non-recurring expenses and keep your finances in check. A lot of these costs don’t feel “non-essential” (excuse the double negative).

What does an essentials-only budget look like for you?

Many expenses are essential, but discretionary spending could get dropped from the budget, and you'd still get by. Here are some examples that can help you better understand discretionary spending .

Now, a zero-based budget doesn’t mean you have zero dollars in your bank account. Some expenses are necessary, such as your rent, mortgage and utilities; others are more luxury or ‘frivolous’ purchases, such as your daily coffee or the cost of your golfing or traveling.Non-Essential Spending: The Extras. Examples are any spending that is not required or that is driven by individual preference (say, a brand new fully loaded Bronco vs.Here are eight simple but effective ways to cut back on your expenses and increase savings.

Expenses

Put any Bonuses Into Savings.

How to Identify Essential & Non-Essential Expenses

Step 3: Subtract your expenses from your income—and that number should equal zero.

You should also need to include your loan payments and health care.

Spendesk

However, you could ask a lovers of your friends or family members to share the account and the subscription costs. The boundary between essential and non-essential may seem .comWhat are Discretionary and Non-Discretionary Spending?seniorfinanceadvisor. Two tools that can help you do this without using cash are Koho and Brightside.Temps de Lecture Estimé: 3 min

Discretionary Expense Definition, Examples, Budgeting

Optional Bills: These are expenses that you choose to incur but are not strictly necessary for survival. Mortgage payments.

8 Simple Ways to Trim Unnecessary Spending

We’ll look at some examples shortly, and many of .Non-discretionary spending = expenses that are essential for your business’s survival.For example, Cagan noted that some business owners want to deduct dog food as an ordinary and necessary expense because they work from home with their pet .

5 Non-Essential Expenses That Are Bleeding Your Budget

It’s a non-essential outlay of cash.

Discretionary Expenses: Definition, Types, and Budgeting

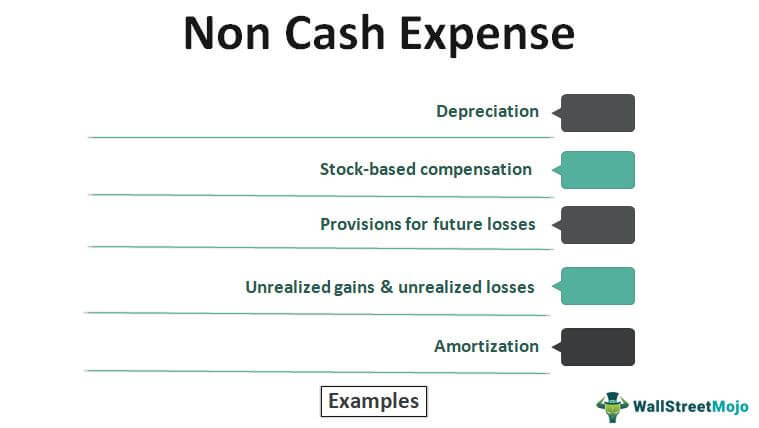

Understanding non-cash expenses is essential for accurate financial modeling and analysis.Here are some examples of essential and non-essential expenses.

It’s deemed more important than the non-essential.When we look at your claim, we class some outgoings as essential expenses and we will allow for these.Step 1: Finding Non-essential Expenses Line-by-line budget. Increasing their savings helped . Basic Clothing. If you are creating an annual budget, estimate what your average monthly payments will be to .Examples of non-cash expenses include depreciation and amortization, which account for the gradual wear and tear of assets over time, and stock-based compensation, which represents the cost of equity given to employees. This method is called zero-based budgeting . It includes things like shopping, hobbies, and travel. Think of upgrading to a new . There’s no better feeling than finding $20 in an old jacket pocket or while you’re cleaning out your car. To find the non-essential expenses in your business, prepare a line-by-line budget for the coming financial year. Practice and let us know if you have any questions regarding EXPENSE antonyms.We all have to have a few necessities in life. See full answer below. However, things such as .

What Are Flexible Expenses + How To Cut Back on Them

Discretionary spending applies to costs and expenses that are non-essential. To maintain compliance with tax regulations and avoid potential issues with the Internal Revenue Service (IRS), it’s crucial to differentiate between deductible and non . The following are financial obligations that are a must – the necessary expenses: Utilities – the monthly bills for things like electricity, water, or gas) Groceries. Proper management of discretionary expenses is crucial for maintaining financial stability and achieving financial . These ‘nonessential essentials’ can be just as important for your wellbeing and general enjoyment of day-to-day life. When it comes to must-haves for their lifestyles, many Americans now rank travel . Your non-essential expenses or discretionary .Press, another example, your monthly Netflix subscription, which is a BIG non-essential expense however we choose get why you can’t get removed of it. Here’s a complete list of opposite for expense. The choice of what we spend on them depends on our decisions and how strapped we want to be budget wise.What Is A Discretionary Expense?

10 Budget Categories That Belong in Your Plan

We will allow: Public transport (for work, school, shopping etc) If we consider that you need a car: Car . Non-Necessities. They encapsulate the essentials, the unavoidable bills and payments without which . These are expenses that you can live without. A simpler way of thinking of the difference .

Discretionary Expenses

Discretionary expenses are those expenses made by a business that are non-essential.A discretionary expense is a non-essential expense that is incurred by an individual, household, or business.

Understanding Discretionary Expenses

Examples include your insurance, auto loan and phone bills.