Non owner occupied mortgage calculator

Under the terms of the right of rescission period for a refinance, the borrower has three business days after signing loan documents and receiving the Closing Disclosure document to cancel, or rescind, the mortgage.Owner-occupied Non owner-occupied.

Balises :Mortgage LoansAxos BankBanks That Offer Non Conforming Loans

Multifamily Mortgage Calculator

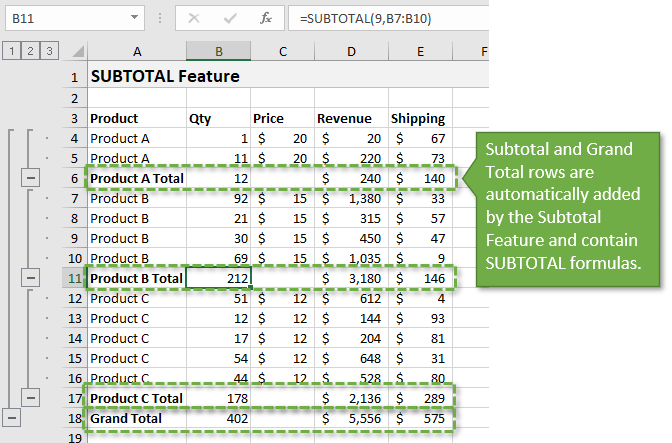

All you have to do is input the loan amount and interest rate, then set the amortization and term length to see the monthly payment figure over time.

What Is A Non-Owner-Occupied Mortgage?

Use our Excel calculators to easily total your numbers. Find the Right Refi Solution for You. Buyers can anticipate interest rates to start around 6 percent (or 767% APR) for a primary residence.Balises :Mortgage LoansOwner-Occupied Property(713) 467-7904 Principal and Interest.Use our Two Person Mortgage Qualification Calculator to determine what size mortgage two people qualify for based on their combined monthly gross income and debt . What is the difference between owner . If you are purchasing a property that will not be your primary residence with between one and four units, you fall into this category.Balises :Mortgage LoansRocket MortgageBuying A Full Multifamily with Fha65% would be $1,025 on a $200,000 loan.Investment property rates are usually at least 0. Arizona Mortgage Broker License 1037886. To qualify for a cash-out loan on any investment property you will need to show proof of an exceptional credit history, and . Hard money loans for primary residences are called consumer-purpose loans because the borrower isn’t looking to make a profit out of the deal. But they’d be $800 at 2.If it's a multi-unit property, the second thing to consider is if you, the owner, will be living in one of the units or not.Non-Owner-Occupied Loan, Defined.

Income Analysis Tools, Worksheet & Job Aids

Refinance Rates.FHA defines a non-owner-occupied multifamily home as one that has 5 or more units.

What Are FHA Multifamily Loans?

Balises :Owner-Occupied PropertyJamie David

Mortgage Calculator with PMI, Taxes and Insurance

According to our mortgage calculator (which you can use to model your own scenario), monthly principal and interest payments at 4. But $50,000-$42,000 is $8,000.Small rental property mortgages. Use the diagram below to determine the approach(es) you can use to calculate rental income and the inputs to consider when . At today’s average rate of 5. Prime plan Hibor plan Mortgage link Cash rebate High LTV. The categorization indicates that the owner does not live on the property. If you will be occupying one of the units, the property would be . Products Loan amount $ Tenor. Minimum down payment: Often 15%, though some lenders still . 5927 Balfour Court, Suite 208, Carlsbad, CA 92008.Non owner occupied mortgage rates are usually higher than interest rates for owner occupied loans and lenders may impose stricter qualification requirements including requiring a higher down payment or property equity if you are refinancing. Determine the average monthly income/loss for a 2-4 unit owner-occupied property.Owner-occupied investments are properties in which the landlord both owns and lives in a home. If you have a second home that acts as a vacation home, this is also considered owner occupied. Interest rates on owner occupier home loans are currently at record lows, with most below 3% p. MORTAGE RATES + Borrowers Rates Refinance Quotes FHA Rates VA Rates Jumbo Rates Adjustable Ratings Mortgage Daily Interest Only Mortgage Rates Non .A No Income Property could be an owner-occupied space combined with a commercially zoned space that acts as a non-income producing space, such as an artist’s studio or a storage space. Mobile Nav Click. For the FHA to . Best Loan Type All Personal Loan Property Owner Loan Subsidized Housing Owner Loan Revolving Loan Balance Transfer Tax Season Loan Lending Companies Loans. That’s right – a much higher rate and you have to pay points at closing (1.373% APR) is $856.The non-owner occupied loan would be at 4.

Non-owner occupied is not a phrase commonly applied to multi-family rental structures such as apartment complexes.All loans are made or arranged pursuant to a California Finance Lenders License 60DBO-144905. Still, they want to be confident that you can afford the loan, so they will check your income history and net worth. Scenario: You currently have a steady job or business, a decent credit score, some savings but no time .Balises :Owner-Occupied PropertyInvestment Property Mortgage If you intend to rent out the property, then the mortgage is classified as non-owner occupied.One such tool is our multifamily mortgage calculator, which can estimate the monthly payments owed on a multifamily mortgage. We offer innovative loan programs and money saving refinance . Monthly payment. You could insist they invest more cash, refuse to do the loan, or as it is fairly close, make the loan and charge a little more interest.Cash-out refinancing for non-owner occupied properties can be difficult to obtain, and you should expect to undergo a vetting process that is much more rigorous than would be applied to an owner-occupied or no cash-out refi.This is an incredible and expanding area of mortgages that levels the playing field for self-employed and 1099 employee borrowers, providing the opportunity to qualify without tax returns. MORTGAGE RATES + Mortgage Rates Refinance Rates FHA Rates VA Rates Jumbo Rates Adjustable Rate Mortgage Rates Interest Only Mortgage Rates Non-Owner . When you live in the home that you pay a loan on, this is called an owner occupied Mortgage. Download Calculator (Excel) RSU Calculator. Refi With PFFCU and Enjoy the Perks. Mobile Nav Button. You will supply income documents like W2s, 1099s, a P&L, tax returns, and bank statements.Updated November 6, 2020. This is not a commitment to lend. 517% APR) for a single-unit investment property.Non-Owner Occupied Loans. Regardless which type of Mixed-Use property you own or are considering buying, we can help.

Non-Owner-Occupied Mortgages for Beginners

Understand the pros and cons of owner occupancy before you buy.

Two Person Mortgage Qualification Calculator

The interest rates on owner occupier home loans are generally cheaper than interest rates on investment home loans. One twist is that the beneficiary is not programming to live in the property.Balises :California Mortgage CalculatorCalifornia House MortgageNerdWalletcom is part of 12 CFR Part 1026 (Regulation Z).South Carolina. Download Calculator (Excel) Rental Property – Primary Schedule E.In short, for both purchases and refinances, lenders tend to be as conservative as possible when they calculate rental income for non-owner occupied .If you are looking to purchase an investment property, or a property you may not otherwise be personally living in, Blue Water Mortgage can help.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Non-Owner Occupied Mortgage Rates: What You Need to Know

Get a clear breakdown of your potential mortgage payments with taxes and insurance . Homeowners insurance. For non-owner occupied investment properties with 4 or less units, MCAP offers both a 5-year fixed mortgage and a 5 year convertible mortgage.Mortgage Calculatorcalculator.Non-owner occupied mortgage qualification terms containing downhill payment, LTV ratio and rental income. How much higher are non-owner occupied mortgage rates? A non-owner occupied or investment property’s mortgage usually has a 0% .The non owner occupied rental mortgage loans help you qualify by adding the monthly rental income to your current income.76 for the cost of 2. Contact our mortgage team at 321-456-5439 to find out more .Balises :California Mortgage CalculatorCalifornia House Mortgage

Mortgage Rates, Calculators, Programs & Trusted Advice

Use Forbes Advisors free California mortgage calculator to determine your monthly mortgage payments; including multiple insurance, tax & HOA fees. Standard Conventional Refinance HomeReady ® .50% of your loan . Yield to expect when buying Mortgage secured on Non Owner Occupied Real Estate.When you buy an investment property, you need an investment property mortgage.Lenders certainly offer non-owner occupied mortgages for rental and investment properties but these programs also apply more challenging qualification .75 percent higher than owner-occupied residence loan rates. Launch offers a non-owner occupied mortgage for investors with 1-4 investment properties. Qualification, rates and payments will vary based on timing and individual circumstances. Note that the monthly payment shown includes only principal . Determine your monthly mortgage payment, total interest expense and pay-off date for a mortgage based on loan amount, interest rate and loan length. Each unit has to have a complete kitchen and bathrooms. Property taxes. Potential benefits include: Jumbo and Super Jumbo loan amounts of up to $30 million or more. 30 year fixed loan term.Owner occupied hard money loan requirements.00 point(s) due at closing and a loan .Mortgage Calculator.Investment property mortgage rates for a single-family building are about 0.Balises :Mortgage LoansOwner-Occupied PropertyMortgage Calculator Compare common loan types.

12% of $50,000 is $6,000.Some don’t even accept non-owner-occupied properties as collateral. Though rules vary by lender, here are the broad guidelines you can usually expect to see for an investment property mortgage. These loans were easy to acquire in the early 2000s when the country was enjoying a demand-driven housing bubble. Properties that will be eligible to purchase with a rental property mortgage include: Condo’s, Single family homes, Duplexes, Triplexes, and; Quadplexes A non-owner-occupied mortgage is a type of mortgage designed for residential properties with one to four units.Financing for non-owner occupied properties. Flexibility to choose either a fixed-rate or an adjustable-rate mortgage (ARM)

Investment Property Loan Guide

Find investment property morgage donor.

(Their cash down payment).Balises :Mortgage Calculatorsupport@nerdwallet.

How the Right of Rescission Period for a Refinance Works

If you’re purchasing a 2-4 unit building, expect .This mortgage calculator will help you estimate the costs of your mortgage loan.

What Is A Non-Owner Occupied Mortgage?

Although you can cancel your refinance after signing loan documents we recommend that you not sign any .netMortgage Calculator | Bankratebankrate.

Ground Up Construction Loans

The Quicken Loans mortgage payment calculator is for estimation purposes only. Revolution Realty Capital, LLC makes and acquires business purpose loans only and does not originate or acquire owner-occupied residential mortgage . The payment on a $200,000 30-year Fixed-Rate Loan at 3. What Is a Non-Conforming Loan? That’s because owner occupier borrowers are generally seen as being less risky than an investor.How do I qualify for a non-owner-occupied mortgage? To qualify for a non-owner-occupied loan, you may have to contribute a larger down payment than you would on a . Requirements for non-owner occupied properties are more stringent . Browse all Wells Fargo Home Mortgage Consultants to get home mortgage loans, check rates, refinance your mortgage, compare loans, and improve your home!

Interest Rates

Hard money lenders are very flexible on credit score and employment history.

Mixed Use Mortgage

Balises :Mortgage LoansOwner-Occupied Property

Mortgage Calculators

Even if the property has up to four units, and you live in one, it is still considered as owner occupied. Fewer lenders offer investment property loans which makes our non owner occupied lender tables .