Non warrantable condo financing florida

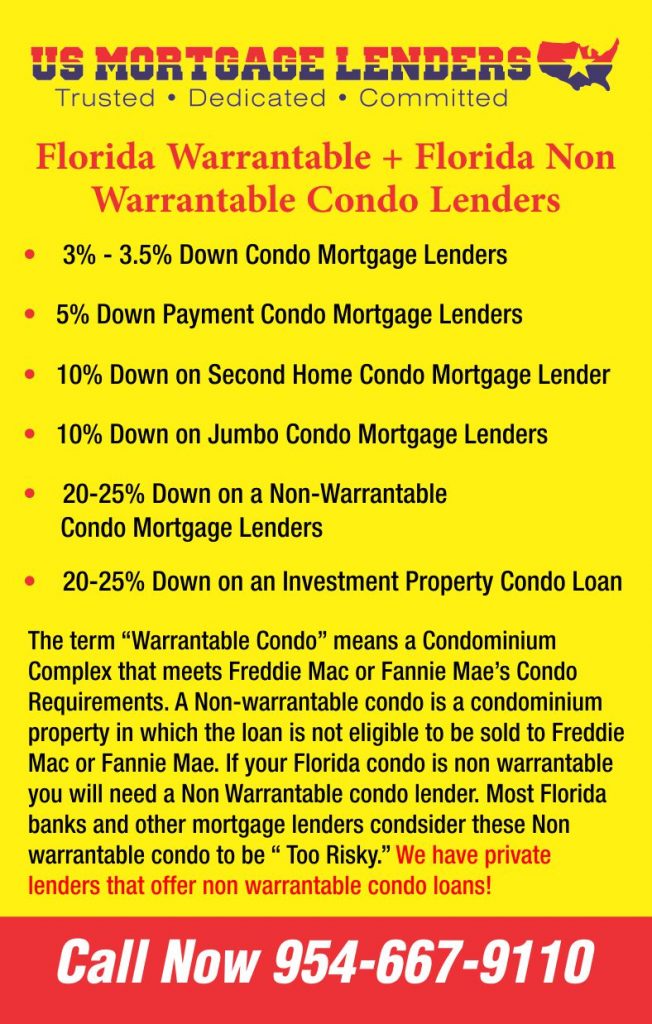

Are you looking to buy a new construction unit in a non-warrantable condo but are unable to get financing? Buying a new construction condo is a great investment. Down payment: 20% for primary . First off, roll up your sleeves and dive into some detective work.com Mortgage Company is expert in Non-warrantable condo loans. Call Today 305-901-2088.

Purchase Loans for Warrantable and Non-Warrantable Condos

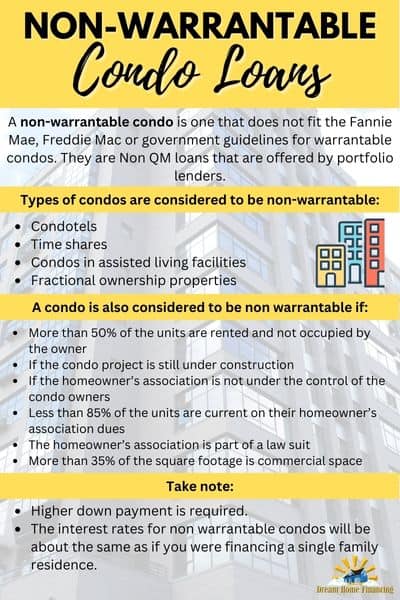

Florida Affordability Calculator Florida Mortgage Calculator Florida Home Purchase Qualifier Florida Mortgage Rate Quote Start Your Florida Mortgage Pre-Approval Fidelity Home Group® 4700 . Non-Warrantable Condominium Financing: What You Need to Know.View photos of the 23061 condos in Florida available for rent on Zillow. Choose one of the 56 cities in Florida . Use our detailed filters to find the perfect condo to fit your preferences. The developer has not turned over the control of the HOA to the owners.In this new section, we have highlighted the importance of understanding the difference between Fannie Mae warrantable condos and non-warrantable condos, the role of the warrantable condo list, and the value of partnering with experienced mortgage brokers to navigate condo financing. Find the perfect building to live in by filtering to your preferences.A non-warrantable condominium is a condo unit or building that fails to meet the minimum financing standards of government-backed mortgage groups. Minimum FICO 720 for Purchase.Although obtaining financing for a non-warrantable condo is often more difficult, it certainly isn’t impossible.Condo buyers in Florida can find flexible non-warrantable condo loan options through Fidelity Home Group of Orlando. Foundation Mortgage is a Miami Beach based Florida Condo Financing Lender specializing in: Conventional Condo Mortgages| FHA Condo Loans | VA Condo Loans | Jumbo Condo Mortgage | .

Facebook (32) · Courtier en hypothèques1101 Brickell Ave 8th Fl, 33131 Miamisite webitinéraire

Non-Warrantable Condo Loans in Miami & Florida

Non-Warrantable Condo Guide (2023)

At Bennett Capital Partners Mortgage, we understand the challenges that arise when it comes to condo financing. FHA, VA, Fannie Mae, and Freddie Mac do not originate and fund . If the ownership in the condo complex is 51% or more non-owner occupants, it is classified as non-warrantable. Speak to a Loan Officer today (888) 508-6055. Speak to our licensed condo specialist or start online.While it may be more challenging to obtain financing for a non-warrantable condo, it is still possible.Understanding the down payment for a condo in Florida is crucial to turning the key to your new home. The 100% HELPER Act Mortgage.

Owning a Non Warrantable Condo in Florida presents unique financing challenges due to the specific requirements of these properties.

Florida offers various options for obtaining condo loans. This means you can purchase one using a conventional loan, an FHA loan, or a VA loan .Our non-warrantable condo programs are designed to offer flexible and competitive financing options for borrowers with lower credit scores or recent credit events.

Non-Warrantable Condo Mortgages

You may find the loan to value ratio up to 90% on rate and term refinances, and . FHA-Approved Condos are communities that have already been certified for use with an FHA Loan in Florida.A condo is non-warrantable if it features any of the following restrictions: The project is still under construction.

Non-Warrantable Condominium Financing: Your Essential Guide

Other features of a non-warrantable condo include: a single .

Non-Warrantable Condo Explained

Condo Financing Problems: Seven Issues to Be Aware Of

A non-warrantable condo is also one that operates as a hotel or provides short-term rentals. Minimum down payment of 10% Self employed with no tax .There is a classification system for condo mortgage loans to determine if it is warrantable or non-warrantable. Typically, a condo is considered warrantable if:. It may have certain . View Loan Assumptions.

Florida Non-Warrantable Condo Loans

Minimum FICO 740 for Refinance.

Non-Warrantable Condo Mortgage Lenders

Call Now +1 321-239-2781.” Unlike traditional banks, which sell their loans to Fannie Mae, Freddie Mac, the FHA or the VA, portfolio . START THE PROCESS.The basic requirements for Non Warrantable Condo loan are as follows: Minimum credit score of 580.Condo financing can be complex, as it involves not only the individual unit but also the condo project and its associated homeowners or condo association. . According to a report by the . With over a decate of experience in Non-warrantable condo financing we are confident we can fund your loan and guide you through the transaction

How to Get a Non-warrantable Condo Loan

Available 7 Days/Week MON - FRI 8am - 7pm SAT - SUN 10am – 6pm Call us (407) 955-4575

Warrantable vs Non-Warrantable Condos: What’s the Difference?

They often hold onto their mortgages rather than sell them on the secondary mortgage market, which means they may not be as concerned with obtaining the approval of the GSEs.TALLAHASSEE — Good news for Florida homeowners: The popular state program that awards up to $10,000 to harden your home is being renewed this year, and .A warrantable condo is a condo property that qualifies for conventional home financing.The Warrantable Versus Non-Warrantable Condominium is warrantable condo with 51% or more residents living in the condo complex who are owner-occupants.Several reputable lenders offer non-warrantable condo loans, including Northpointe Bank, Mortgage Depot, First National Bank of America, Fidelity, Blue Water Mortgage, North .

Condo Mortgage Loans in Miami

These properties are riskier given the lower owner-occupancy density. The Sunshine State's housing market remains as enticing as its beautiful beaches, drawing buyers and investors to consider condominiums as their slice of paradise. Following are rules for condo warrantability: Fannie Mae condo warrantability.While there is no specific credit score requirement for a non-QM loan, having a higher credit score improves the chances of approval.

How to finance a non-warrantable condo in Florida

Commitment to customer satisfaction. Lenders also offer refinances and cash out refinances for non warrantable condos. Florida Non Warrantable Condo Mortgages: Get Approved Today. Small local banks are a good place to start. By keeping these factors in mind, .FHA Condos by City in Florida.In 2024, navigating through the maze of condominium financing options .

Condotel Financing In Florida: What Investors Need to Know

For example, a lender may require a larger down payment, or charge a higher interest rate.

Condo Insurance in Florida

We offer mortgages for Warrantable Condos, Non-Warrantable Condos , Coops, and Condotels property types.

Florida Coop Mortgage Financing

View All Learning Articles.A non-warrantable condo is a condominium project that does not meet the eligibility criteria for conventional mortgage financing.

Florida Non Warrantable Condo Mortgages: Get Approved Today

Non-Warrantable Condominium Financing: What You Need .This approval indicates that the condo .Non-Warrantable Condo (Max LTV 75%) Offers financing options for condominium units that do not meet traditional eligibility criteria.

Warrantable Condos are one that a homebuyer . If you buy a non-warrantable condo, your lender will be unable to issue you a .How much is condo insurance in Florida? The average cost of condo insurance in Florida is $1,400 per year, according to NerdWallet’s rate analysis. Most of the units are rented to non-owners.Non-warrantable condos are more challenging to finance. In 2024, trends favor certain urban and vacation-driven markets for non-warrantable condo sales. As in most cases, you’ll be buying at ground floor pricing.Florida Condo Financing Florida Condotel Financing Florida Non-Warrantable Condo Financing Florida DSCR Loans Florida VA Loans.

Wide range of loan programs for warrantable and non-warrantable condos.Orlando Non-Warrantable Condo Mortgages, Orlando Condotel Mortgages, Orlando Warrantable Condo Mortgages. Contact us today at 1-800-457-9057 to learn more about our Florida condo mortgage loans and get pre-approved.When searching for your dream condo in Florida, it's vital to consider whether the property is part of a Fannie Mae approved condo project.Florida Condo Mortgages and Condo Loans. Loan amounts up to $6 Million.A Non Warrantable Condo is any condo that does not meet all of Fannie Mae or Freddie Mac’s guidelines lending requirements and will not be bought on the market. Is April 2024 a Good Time to Buy a Home? Just Starting .View 57357 condos for sale in Florida.Tip 1: Thoroughly Research Your Non-Warrantable Condo Market. The development includes commercial space, A single individual owns more than 10% of the units.Non Warrantable Condo Refinances.Condotel Mortgage Financing Requirements: Max 75% LTV for Investment Properties and Second Homes [ minimum 25% down payment ] Max 70% LTV for refinances. Check FL real-estate inventory, browse property photos, and get listing information at realtor.View photos of the 46483 condos and apartments listed for sale in Florida.Quick and Tailored Financing Solutions are Available: Bennett Capital Partners showcases its ability to provide rapid and customized financing solutions, even . Conforming Loan amounts up to $766,550 | FHA . All your amenities are brand new and usually buildings allow you to put your own finishing . Updated: Mar 22. These include conventional, FHA, VA, USDA, non-QM, jumbo, private money, or hard money loans. Condo Hotel/Condotel (Max 75% LTV) Provides financing for properties that operate as a combination of a hotel and a condominium. Rates subject to change without notice.The new rules are complicated enough that the Community Associations Institute, a trade group for 43,000 homeowners associations and condo associations, has asked Fannie and Freddie to delay the . We're here to help you achieve . Understanding your local market is crucial. Speak with a local Condo Loan Mortgage Banking Expert | Get Pre-Approved or Apply for a Mortgage Online.Benefit from our experience in getting you the best non-warrantable condo financing at a lower rate.