Old age security canada payment

In most cases, Service Canada will be able to automatically enroll .34 not applicable not applicable Old Age Security pension (age 75 and over) 6,7 784.67 for ages 75 and older.

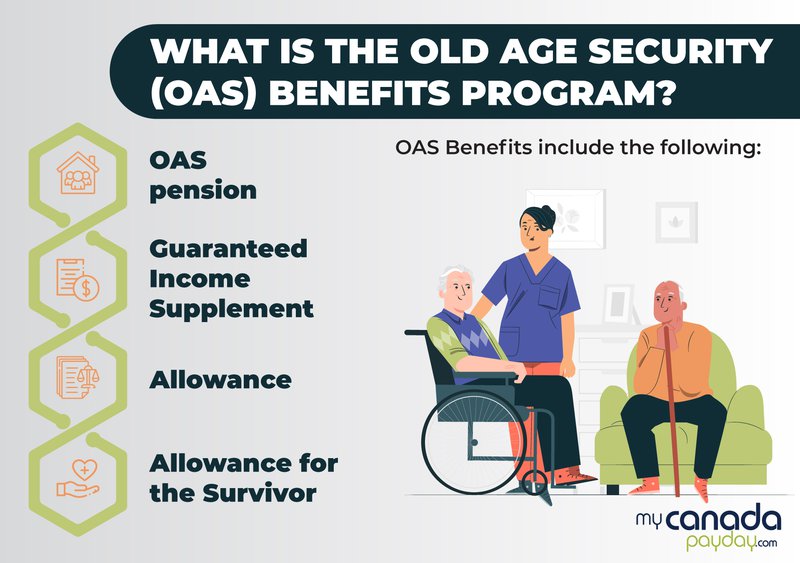

Canada Pension Payment Dates.Old Age Security (OAS) payment dates typically fall near the end of each month, with the next payment coming on April 26, 2024.The maximum monthly OAS benefit is $713. Because your payments will have already been converted into the local currency of the country where you live, you should get a better exchange rate, and you might also pay lower banking fees for cashing your cheques. It is considered taxable income and is subject to a recovery tax if your individual net annual income is higher than the net world income threshold set for the year ($79,054 for 2020). submit an eServiceCanada request form to have a Service Canada representative call .The OAS benefits include: the OAS pension, which is paid to all individuals aged 65 and older who meet the residence requirements; the GIS for low-income . Enrollment is often automatic, and the amount you receive depends on age, income and how long you lived in Canada as an adult.Old Age Security (OAS) is a benefit paid monthly to most Canadians aged 65 or older.45 if your annual individual income is less than $129,260 (these numbers are for April to June 2021 and may change every year).

Old Age Security in Canada: Eligibility & How to Apply (2024)

You do not have to apply. Anyone who chooses to receive their payment via cheque can expect it to arrive in the mail a week or 2 after the scheduled payment date.If eligible to receive OAS, the amount of your payments are based on years of residency in Canada, as well. * 2013 is the .OAS Benefit Increase and Changes in 2024 - Savvy New .Old Age Security pension (age 65 to 74) 6,7 713.

Old Age Security: OAS Payment Dates and Amounts for 2024

Guaranteed Income Supplement. The toolkit will help you find out if you are eligible for these benefits and how to apply.If you lived in Canada for less than 40 years (after age 18), you will receive a OAS partial payment amount.Canadian Seniors: Maximum OAS Payments Are Increasing in 2024. Payments for the Old Age Security will be disbursed soon, with the initial payment of 2024 scheduled for January 29.You will receive the one-time payment for older seniors if you: were born on or before June 30, 1947, and.

Canadian Seniors: Maximum OAS Payments Are Increasing in 2024

The maximum monthly amount you could receive from April to June 2024 if you are between the ages of 65 and 74 is $713. Your monthly payment will increase every month you delay, up to age 70. Other Old Age Security Benefits; One-time payments ; Do you qualify for Old Age . For those aged 75 and over, the upper threshold is $153,771. Find out if you’re eligible for this benefit, how much you could . The Old Age Security pension is reviewed in January, April, July and October to reflect increases in the cost of . You can start receiving your Old Age Security (OAS) pension as early as age 65.For individuals aged 65 and above, you are eligible for Old Age Security, a monthly stipend providing crucial monetary support to Canadians during their retirement years. marital status.comOld Age Security (OAS) increase for April to June 2022pensioncanada.Most Canadians will receive monthly Old Age Security (OAS) payments when they become seniors. The CPP retirement pension is paid monthly to seniors who contributed to the plan during their working years. Includes Old Age Security pension, Guaranteed Income Supplement, Allowance and Allowance for the Survivor. Old Age Security and Canada Pension Plan payment dates.The Old Age Security pension is a monthly payment available to Canadians age 65 and older who apply and meet certain requirements. The Old Age Security pension is indexed on the basis of the cost of living four times a year (January, April, July and . Written by Enoch Omololu, MSc (Econ) Updated: April 3, 2024.

Old Age Security: Do you qualify

You should apply for the Allowance 6 to 11 months before . For 2023, the threshold is set at $86,912.Old Age Security Payment Amounts.

Old Age Security (OAS) Pension: 2024 Payment Dates and More

For questions regarding your OAS pension, call 1-800-277-9914.Old Age Security program.

Understanding the basics of the OAS program

Old Age Security Payment Amounts and Canada Pension Plan Payment amounts.Old Age Security. Project stage: Beta.You must send the Old Age Security Return of Income form to the Canada Revenue Agency (CRA). were eligible for the Old Age Security pension in June 2021.

August 28, 2024.Seniors Minister Deb Schulte said today that seniors who qualify for Old Age Security (OAS) will be eligible for a one-time, tax-free payment of $300, and those eligible for the Guaranteed Income .

Use On this page to help you browse and see .caRecommandé pour vous en fonction de ce qui est populaire • Avis

Old Age Security

The Allowance for the Survivor is a monthly payment you can get if: your annual income is less than the maximum annual income threshold for the Allowance for the Survivor. Start benefits estimator. You will have to apply if your spouse or common-law partner has passed away and you are between the age of 60 and 64. This supplement maxes out at about $919. spouse or common-law partner, if applicable.Do you qualify for Old Age Security; Extra payments based on your Income and Age. Death benefit (one-time payment): $2,500. The OAS Program is administered by the federal Department of Employment and Social Development Canada through Service Canada. According to the government of Canada, the maximum . February 27, 2024. In many cases, we will let you know by letter when you could start receiving the first payment. Your payment amount is based on your years in Canada .

One-time payment for older seniors

January 29, 2024. It is one of the federal government’s benefits administered to Canadian seniors.67 not applicable not applicable Guaranteed . Old Age Security (OAS) provides monthly payments to seniors who are 65 years or older, are or were Canadian citizens or legal residents, and have resided in . Survivor's pension (65+): $607. Spending time outside Canada may change the way you receive your OAS and CPP . Today, Canada’s Minister of Seniors, Deb Schulte, announced the highest quarterly adjustment to existing OAS payments since July 2014. If you are eligible, you will automatically receive . March 26, 2024. The Supplement is based on income and is available to Old Age Security pensioners with low income.34 for ages 65 to 74 and $784. For 2021, the threshold was $79,845 and for 2022 the threshold was $81,761.

Maximum benefit amounts and related figures

The Canada Pension Plan ( CPP) is a monthly payment made to people who contributed to the CPP during their working years.

Old Age Security: How much you could receive

Making sure you receive all the benefits and pensions you are entitled to as a senior, such as OAS, can be difficult.

What is Old Age Security (OAS) in Canada?

Disabled or deceased contributor's child benefit: $228.Old Age Security Clawback.Public pension benefits when living outside Canada.Every year, Old Age Security payments are made around the same time each month, but they do vary based on the day of the week that the date falls.

How Much Is Old Age Security (OAS) in 2024 & Who Qualifies?

In most cases, Service Canada will be able to automatically enroll you for the OAS pension. The Old Age Security (OAS) clawback, or OAS pension recovery tax, affects those with a net annual income above a set threshold. To alleviate this problem over the longer term, the federal government (after a further amendment to the BNA Act) introduced the Canada Pension Plan in 1965, while Québec launched its own scheme, the Quebec . If you’re eligible for Old Age Security (OAS), your payment amount will depend on the length of time you’ve lived in Canada or other countries after the age of 18.Old Age Security (OAS) provides monthly payments to seniors who are 65 years or older, are or were Canadian citizens or legal residents, and have resided in Canada for the required number of years.

Deciding when to start your public pensions

The Allowance is a non-taxable payment you can get if: you are age 60 to 64.

OAS Payment Dates (2024)

The Old Age Security pension is a monthly benefit paid to Canadians.

Unlike CPP, it is not . To make sure that your OAS pension payments are not interrupted, be sure to submit your Old Age Security Return of Income form by April 30 .

About the Old Age Security

Your income is considered, too.

What is Old Age Security?

Tables of amounts for Old Age Security, Guaranteed Income Supplement and the .You can start collecting your Canada Pension Plan (CPP) retirement pension as early as age 60 with a permanent reduction. Just as well, the lowest-income seniors will be able to receive an old age security supplement called the OAS Guaranteed Income Supplement or GIS. Do not apply earlier than 11 months before you turn 60. Old Age Security payment amounts. the specific date that you’ve chosen.If you meet the eligibility requirements, you will receive one taxable grant payment of $500.OAS Payment Dates for 2024. Those who receive both OAS and qualify for GIS could receive an . The first step is to figure out how much higher your .

Old Age Security: While receiving OAS

It will take about 5 to 10 minutes to complete.

No matter what your marital status, you’ll receive the maximum monthly OAS payment of $618. It is considered taxable income and is subject to a recovery tax if your individual net annual income is higher than the net world income threshold set for the year ($81,761 for 2022). The minimum age to . Goods and services tax / . Apply for Direct . In addition to the Old Age Security . This tax is 15% of the difference between the OAS clawback .Benefits Finder. Old Age Security ( OAS) is a monthly payment available to Canadians over the age of 65. If the CRA does not receive this form, you will stop receiving your OAS payments beginning in July .This estimator helps you find the Old Age Security (OAS) benefits you're eligible for and estimates your monthly payments.Receiving your Old Age Security ( OAS) and Canada Pension Plan ( CPP) payments in the local currency can save you money.

To receive it, you must: be 65 or older ; have a legal status in Canada ; have lived in Canada for at least 10 years after age 18.