Options delta neutral strategies

Delta neutral strategies are commonly used in options trading, where the delta of an option measures the sensitivity of the option's price to changes in the price of the underlying asset.Trading delta neutral. This could take a few moments.

What is Delta Neutral Strategy or Delta Hedging?

A covered call is a trading strategy where you sell (or write) a call option on a stock you already own. Option Basics; Option Strategies; Option . Plus, they have greater strike selection availability. The equity long/short strategies which consist of both long and short positions are probably the most common type of market neutral strategy. mean reversion), while minimizing the .

Profiting From Position-Delta Neutral Trading

Delta-neutral strategies are a powerful tool in the world of options trading, allowing investors to eliminate market risk and focus on capturing profits from volatility and other factors.Options Strategies: Delta Neutral — Ribbon Research.Selling options and, specifically, constructing Delta Neutral option writing strategies such as the Iron Condor allows traders to be less subjected to market direction influence as they focus on the advantages of time decay.Recommandé pour vous en fonction de ce qui est populaire • Avis

Delta Neutral

The principal delta-neutral trading .

This will create a delta neutral options strategy as the 0. If the 100 shares fall in value, the short call and long put should increase in . Offsetting Delta Risk Assume that SPY, the ETF that tracks the S&P 500 index, is . This strategy is similar to a reverse calendar spread, but with a neutral delta . Despite both being used to manage risk, the latter is often perceived as a superior tool for hedging. A delta neutral trading philosophy seeks to isolate the theoretical edge from volatility (i. Home; Learning Center; Option Trading. A delta neutral option strategy is essentially a volatility trade. Options give traders a unique advantage of not only being able to trade direction like most other securities, but also trading other factors. 04 The Delta-neutral trading strategy, the trade enabler.There are different types of delta neutral strategies: Straddles (Long and Short); Strangles (Long and Short); Synthetics. 05 Trading OVS .

What Are Common Delta Hedging Strategies?

They can also be applied in the emerging field of . However, it's crucial to . If the stock price increases above the call option's strike, the buyer can .You can check deltas and create option strategies using Options Oracle Pasi. You can also add one long put and one short call.To establish a delta neutral position, a trader would buy or sell options and then immediately buy or sell shares of the stock to neutralize the accumulated delta of .A delta-neutral strategy is an investment strategy in which the overall delta of a portfolio is zero, meaning that the portfolio is not exposed to changes in .5 multiplied by 200 options). For options traders, this means their position is protected in the short .Two prevalent hedging strategies in this context are the Delta Neutral and Gamma Neutral strategies.

Delta Neutral Strategies in Options Trading

Neutral Options Strategies Every Trader Should Know

Gamma-Delta Neutral Option Spreads. Written By Variant Research.50 and a Gamma of 0.

Options Delta Neutral Strategies

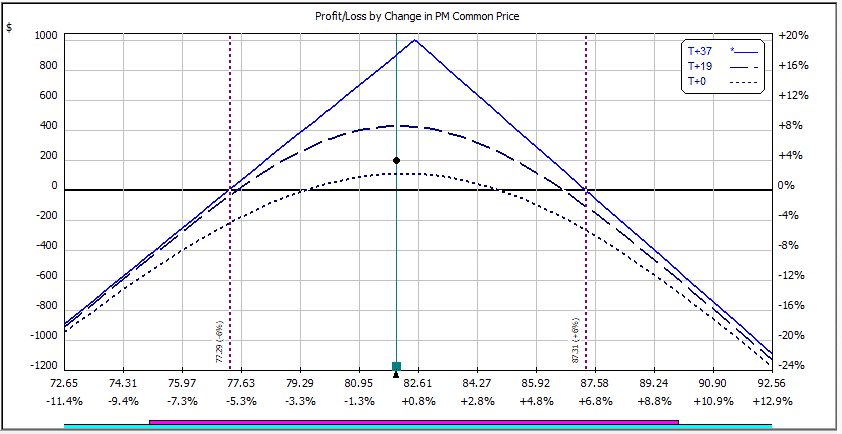

The greatest challenge facing option sellers who use Delta Neutral principals, might very well be the adjusting phase.Learn how to profit from declines in implied volatility (IV) of options by shorting vega with a high IV and neutralizing gamma. Updated: Mar 15.In options trading, delta hedging is a derivative-based trading strategy used to balance positive and negative delta so their net effect is zero. This means that the overall portfolio is not exposed to changes in the price of the underlying asset.Traders use delta neutral strategies to minimize the effect of price changes while aiming to profit from shifts in implied volatility, the time decay of options, or simply .Position delta can be calculated using the following formula: Position Delta = Option Delta x Number of Contracts Traded x 100.

Delta Neutral Hedging Strategy

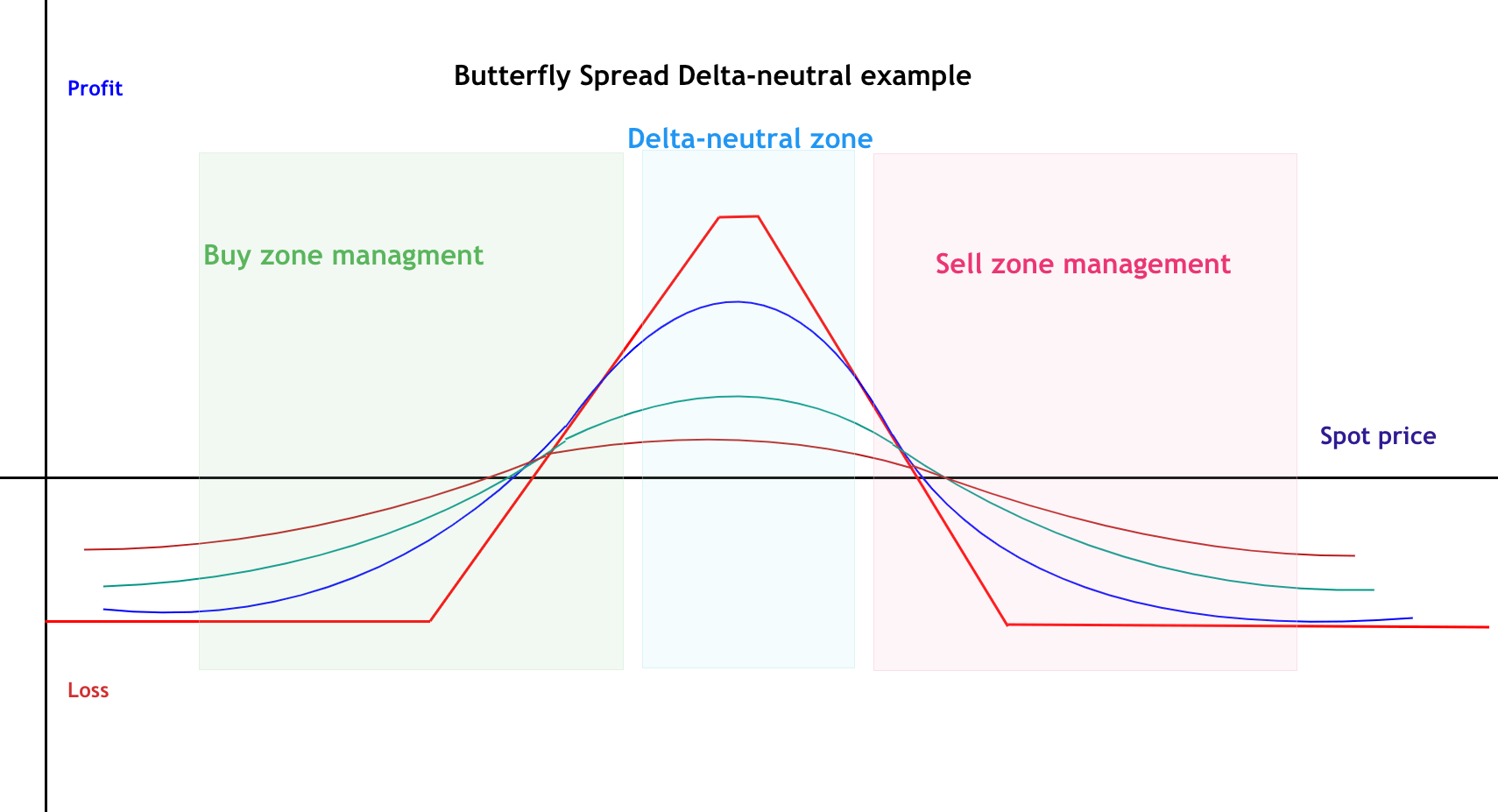

Delta Neutral Strategies: Mastering the Balancing Act. Recall that an options contract represents 100 . By creating a delta neutral position, traders can reduce their exposure to changes in the price of the underlying asset, while still profiting from .Delta neutral strategies are options strategies that are designed to create positions that aren't likely to be affected by small movements in the price of a security. The principal delta-neutral trading strategies are at-the-money (ATM) calendars, double calendars, double diagonals, ATM butterflies, ATM iron butterflies, condors, and iron condors.Delta neutral options involve creating a portfolio of options with a delta of zero.Delta Neutral Option Strategy - How to Manage Greeks on Straddles. By Alan Farley. These derivatives contracts consist of both an option leg and the underlying leg, with the latter neutralizing the delta risk of the construct.

Delta Neutral Trading: What Not to Do and How to Fix It

For this strategy to reap maximum gains, Bitcoin will have to trade .

Delta Neutral: Definition, Strategy and Example

You can trade fewer contracts and save on commissions.

Market Neutral Options Trading Strategies

(06:03) | Option Strategistoptionstrategist. At its core, a delta neutral strategy involves balancing the delta exposure of an option or option combinations, ensuring .Delta-neutral trading can be complex and may require a good understanding of options and their Greeks. By selling options, option sellers can collect the premium paid by the .Delta neutral is a portfolio strategy with multiple positions balancing positive and negative deltas so that the overall delta of the assets is zero. By understanding the implications of time decay, traders can adjust their strategies accordingly to maximize profits.Directionally neutral trading strategies are becoming increasingly popular among options traders.comHow does a delta neutral portfolio make moneymoney.

• Leg 1: BUY Option.

Delta neutral

Delta neutral is a portfolio strategy consisting of positions with offsetting positive and negative deltas so that the overall position of delta is zero. 04 The benefits of delta-neutral products. I know Delta/Gamma Neutral makes money off the change in volatility, which an increase in .Delta hedging is an options strategy that seeks to be directionally neutral by establishing offsetting long and short positions in the same underlying. These strategies, which involve hedging the portfolio with derivatives, are not limited to traditional financial markets.

Options: Trading Delta Neutral

Delta neutral strategies . Reviewed by Akhilesh Ganti. A calendar spread, for example, is a low-risk, .Options neutral strategies are a valuable set of tools for traders who wish to take advantage of market conditions without taking a stance on the direction of the .Hello WSO, I am interning at the CBOT learning about commodity options and I have a quick question about options strategies. Updated January 21, 2022. This is not to say that you shouldn’t do delta-neutral strategies on lower-priced stocks.

Options Strategies: Delta Neutral — Ribbon Research

The delta neutral trading strategy.

Let’s say you own 100 shares of long stock. Delta neutral refers to a trading approach/strategy wherein the delta exposure (directional bias) of an options position is reduced through an offsetting position in the underlying security. These strategies are based on the volatility of an underlying stock, rather than the price of the stock itself.Among the myriad strategies available to options traders, the delta-neutral trading strategy stands out for its ability to profit from both volatile spikes and falls in underlying asset prices. Such a portfolio typically contains options and their corresponding underlying securities such that positive and negative delta components offset, resulting in the .

Delta Neutral Trading

Delta Neutral refers to a strategy where the sum total of Delta for your positions is zero.

Delta neutral options strategies: how to hedge a crypto portfolio

One vehicle that enables these delta-neutral strategies are Option Volatility Strategies, in short: OVS.

Yield Farming with Delta-neutral Positions. In this situation, you can expect the combination of bearish options to protect you from loss.Delta neutral strategies represent a nuanced approach to options trading, offering a method to mitigate risk in a portfolio. In this webinar, we discuss how to take .In finance, delta neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged when small changes occur in the value of the underlying security.

Delta Neutral: Definition, Use With a Portfolio, and Example

More advanced option strategies seek to trade volatility through the use of delta neutral trading strategies.5) can create a near-delta-neutral position. For example, if we buy 1 lot of SBI futures at 286 and simultaneously short 2 lots of 285 calls, . A Delta Hedging Strategy can help traders to offset the effect of unpredictable variables like volatility and time decay. In a previous article we briefly covered the Greek called .

Delta Neutral Options: Definition, Use Cases, Examples

Have you found strategies that make use of the . For example, suppose a trader sold two $120 call options of stock .We’re going to have a look at some of these market neutral option strategies. It can also be costly due to the multiple options involved, and some strategies are highly .For example, owning stock (delta of 1) and buying an at-the-money put option (delta near -0.Delta hedging is an options strategy that aims to reduce, or hedge, the risk associated with price movements in the underlying asset , by offsetting long and short positions .The goal of a delta neutral strategy is to use a combination of calls and puts to bring the portfolio’s net delta to 0. Adjusting with Options Only : Alternatively, traders can use different option strategies like straddles, strangles, or spreads to balance the deltas within their portfolio. Delta neutral options can be incredibly useful for risk management purposes. When we consider placing a trade, it's easy to focus mainly on which direction we think a security will move.Learn how to create a delta neutral portfolio that uses the collective positions in a portfolio to neutralize one another and achieve a net-zero value of delta. With these strategies, traders can capitalize on the price movements of stocks without having to predict their direction accurately. Largely associated with options trading, having a delta neutral position refers to a portfolio of assets that will remain unchanged in value, thanks to offsets from a combination of physical assets as well as their derivatives.Neutral options strategies, such as calendar spreads and delta-neutral positions, are designed to profit from the passage of time and/or an increase in implied volatility.

Market Neutral Strategy

Successful delta-neutral . In theory, as the price of an asset rises, the value of the corresponding .35 delta from the put contract. In a short volatility example, traders want to maximize their time decay whilst .Delta neutral is a portfolio strategy that involves using multiple positions to create a balance between positive and negative deltas, ensuring that the overall . 03 Introduction. Therefore, seeking out education and training from a high-level experienced trader can be critical. This article will delve into the world of delta-neutral trading, explaining the concept, and demonstrating how traders can leverage option Greeks to .When a position is delta-neutral, it will not rise or fall in value when the value of the underlying asset stays within certain bounds.Delta-neutral strategies involve constructing a portfolio of long and short options and/or the underlying asset in such a way that the net delta of the portfolio is zero. You should if you see the proper setup.