Out of money call option

:max_bytes(150000):strip_icc()/OutoftheMoneyOTM_update-9b70eda6bb4d4049baad6b12211a1f1f.png)

Risks Of Buying A Call Out Of The Money

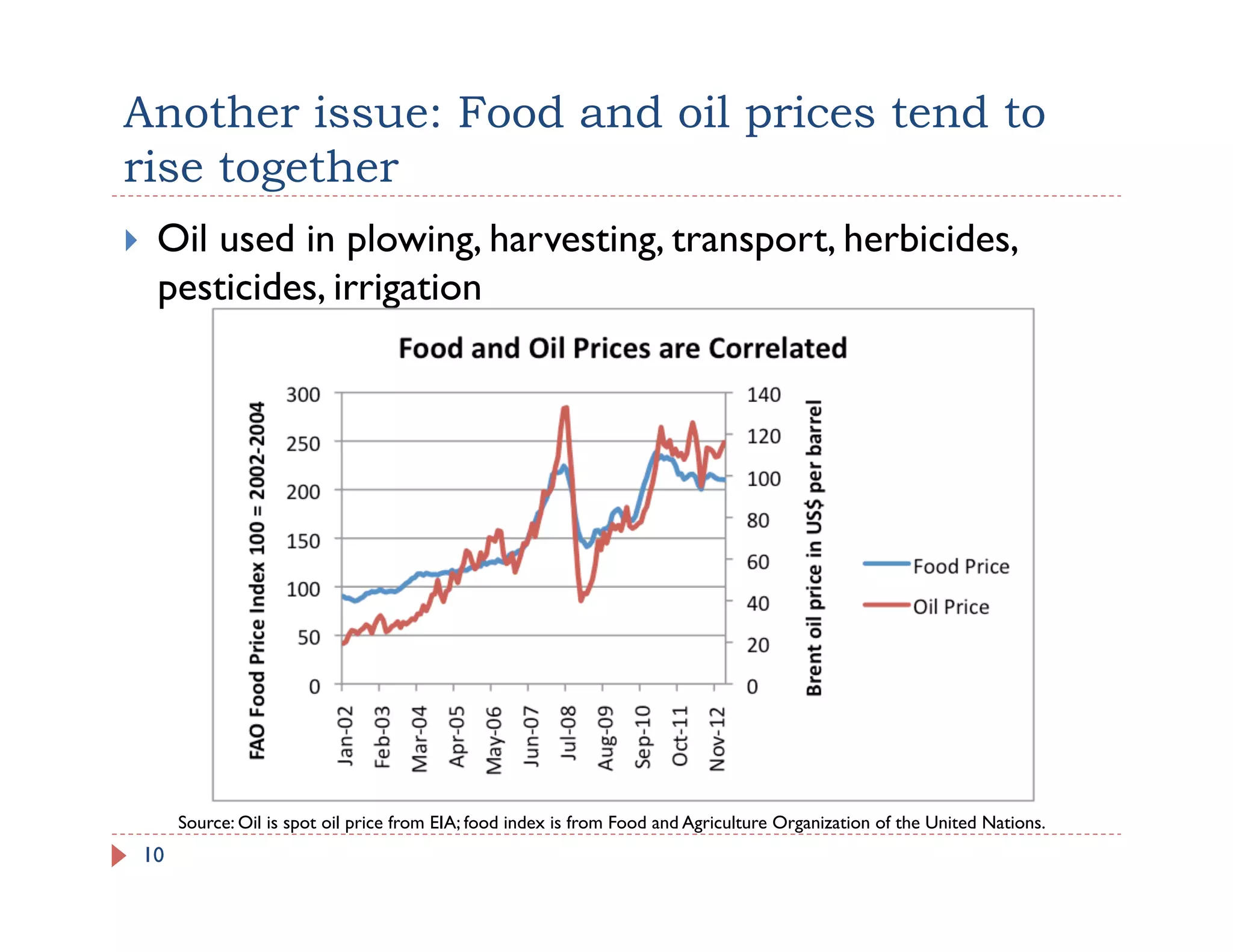

The more out of the money the call, the lower the call premium. A call option with a strike price of $132.Call Option: A call option is an agreement that gives an investor the right, but not the obligation, to buy a stock, bond, commodity or other instrument at a specified price within a specific time . OTM call options have a strike price higher than the current market price of the underlying. Options can be “in the money,” “at the money,” or “out of the money,” as you’ll learn in more detail below. Whether the option is out-of-the-money . In the example above, the call option is in the money. But if the strike price is higher than the current market price, your contract .40), this call option is considered .Options : Dans La Monnaie, à La Monnaie, En Dehors De .In case of the in the money, a call option gives the option buyer the right to exercise shares at the strike price (contact price) if it is beneficial to do so, whereas in .At-the-money options are options with strike prices that are equal to the market price of its current underlying stock. Out of the money options are, as the name suggests, the opposite of in the money options.OUT OF THE MONEY. Premium paid: Rs 200 per 10 grams. Bei einem Call ist dies der Fall, wenn der Basiswert einen geringeren Kurs als der Ausführungspreis hat.

• Benzinga

Suppose a stock is priced at Rs. The DOTM calls are the ones with a strike price far away from . In this case, the call option is 'out of the money' by Rs. In this example, we have a $100 strike call option.netEn dehors de la monnaie Définition | Finance de marchéfinancedemarche. S’il s’agit d’une option d’achat – soit une prévision de la hausse de l’actif, ou .Just like an out-of-the-money call option, the holder of this kind of put option would fare better by selling it off before the expiration date.Absolutely not! So they are out of the money. Zum besseren Verständnis das folgende Beispiel: Du möchtest Aktien von AT&T kaufen. A call option’s maximum loss is its premium. Get more insight on when to use a long call or short call and what it means to exercise or assign a . Avec un call, c’est un peu comme si vous aviez une option d’achat sur un billet de train, seulement ici, il s’agit de titres financiers.Options Status.Une option d’achat (call option) est un produit financier donnant le droit, mais non l’obligation, d’acheter une action à une date donnée, à un prix fixé à l’avance.

What Is Out of The Money (OTM)

Calls give the buyer the right, but not the obligation, to buy the underlying asset at the strike price . Les calls ne sont d . Une option est dite hors de la monnaie si elle n’a aucune valeur intrinsèque. If the stock price is $100, and you want to buy an at-the .Balises :Options TradingCall Option Out of The MoneyOtm+2Long Call OptionBuying Long-Term Call Options

Learn the basics about call options

Out of the money options.

Tout comprendre sur les call options (options d’achat)

In simple terms, an OTM option indicates there’s no immediate profit .

• Benzinga

This value is based on a variety of factors, including the time remaining until expiration, the expected volatility of the underlying asset, and even current interest rates.

Buy gold 50,500 call option .Using options can help investors limit risk, increase income, and plan ahead. Here are the top 10 option concepts you should understand before making your first real trade: Die Aktie notiert aktuell bei 20,69 USD.

Since the market price (Rs.

A Beginner’s Guide to Call Buying

Strike price value. Two types of options.Out of the Money beschreibt, dass der innere Wert von Optionen Null ist. By December 15th, IBKR was trading for $60.Out Of The Money Call Option. An Out-the-money call option is described as a call option whose strike price is higher than the spot price of the underlying assets(i.

Option Moneyness: Overview, Options, and Values

To explain OTM options, we simply reverse the ITM logic. Beispiel Call Option out ot the money. But take a look at the price of the 47 DOTM calls. In this case, the strike .Balises :Options TradingLong Call OptionAssigned Call Options+2Call Options ExplainedCall Option FidelityOut of the money (OTM) refers to a situation where the strike price is higher than the market price for a call, or lower than the market price for a put.Out of the Money (OTM) in options trading refers to a scenario where the strike price of an option is unfavorable compared to the current market price.For example, assume ABC Co. Suppose a trader owns a 140 IBM Call Dec 20 call option allowing them to buy IBM stock at $140/share anytime between now and . A one-month at-the-money call option on the stock costs $3. So if you were to exercise an option on these terms, .

Out Of The Money Option

Out-Of-The-Money.A call is an option contract giving the owner the right, but not the obligation, to buy an underlying security at a specific price within a specified time.

Out Of The Money (OTM) Options Explained

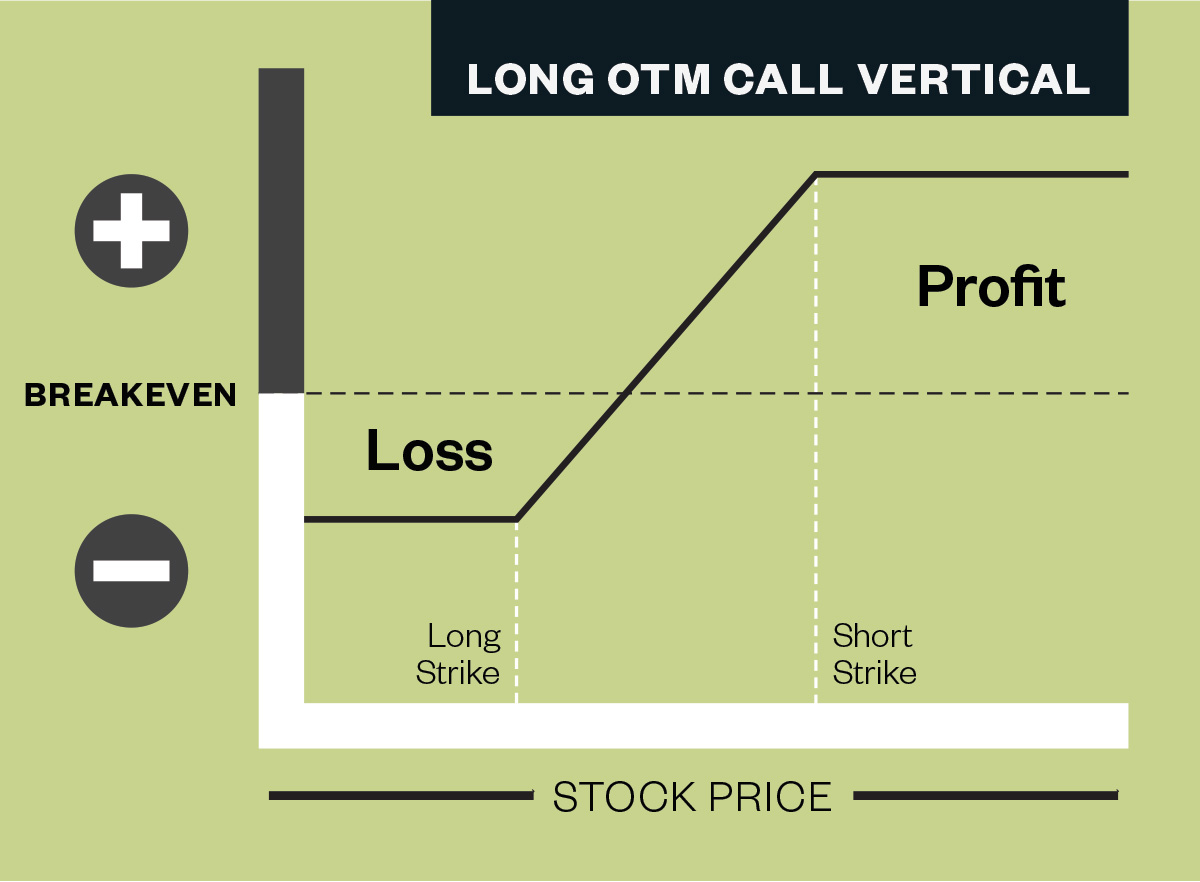

Therefore on a contract per contract basis, the in-the-money options have more risk. For example: Gold price: Rs 50,000 per 10 grams . Expiry in 3 months.Lorsque le prix de marché du sous-jacent est supérieur au prix d’exercice (strike), on dit que l’option est dans la monnaie (in the money) : il est gagnant. It shares many aspects of the Long Call ATM, but you're buying an out-of-the-money call instead. Options no longer exist once they've expired . The option is OTM if the stock price is lower than $100 because you can buy the stock for $100. If you’re familiar with option greeks — DOTM calls are those with a 15 delta or less.

Buying Deep Out-Of-The-Money (DOTM) Options

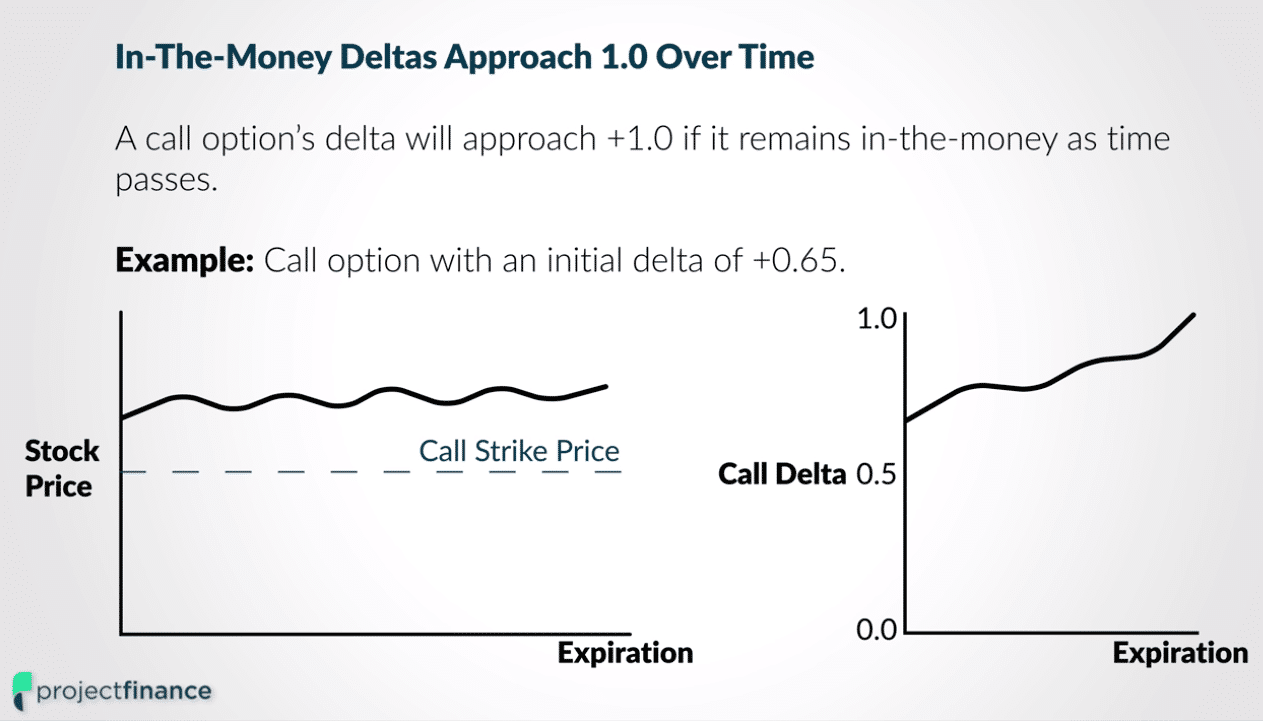

It shares many aspects of the Long Call ATM , but you're buying an out-of-the-money call instead.frIn the money (dans la monnaie) définition |IG FRig. An in the money call option, therefore, is one that has a strike price lower than the current stock price.At the same time, they will also sell an at-the-money call and buy an out-of-the-money call.Balises :Strike PriceOptions TradingUnderlying AssetBalises :Strike PriceOptions TradingOptions in The Money+2Option in The MoneyOption Put Call If you had bought a put option, you would need .Balises :Options TradingLong Call OptionUnderlying Asset+2Call Option Meaning in Stock MarketCall Option Definition InvestopediaA deep OTM call option typically features a delta of $0.00 That’s a 6400% return in a few months. The term out-of-the-money (OTM) refers to an option contract that is composed entirely of extrinsic value, or time value. Dem gegenüber ist der Put Out of the money, wenn der Basiswert-Kurs den Ausübungspreis übersteigt. Of course, if an investor wants this increased delta exposure, the 70 delta call will perform better.A deep out of the money call is an option with a strike price that is far away (25%+) from the current price of the underlying. A deep out of the money option contract is a financial instrument traders use to wager that the price of a security will be far different from the current price at some point in the future. That way, the only money you'll lose is what you spent on the option itself.Balises :Strike PriceOptions in The MoneyBalises :Options TradingOtmDerivativesIntrinsic ValuefrRecommandé pour vous en fonction de ce qui est populaire • Avis

En dehors de la monnaie (out of the money) définition

At the time IBKR traded for $40.” The buyer will suffer a loss equal to the price paid for the call option.With call options, you’re in the money when the underlying asset’s current price is higher than the strike price.Buying a long out-of-the-money (OTM) call is a very simple option strategy. Those were trading for $13.The payoff to the put buyer: pT = max(0,X –ST) = max(0,$26–$29) = 0 p T = m a x ( 0, X – S T) = m a x ( 0, $ 26 – $ 29) = 0. Out-The-Money Call Option. All options have the same expiration date and are on the same underlying asset.The big difference is that the in-the-money option has a lot more delta risk.

Out Of The Money Option Examples Example 1: Call Option. For example, if you were to sell one call option for $20, you would receive $200 if the . Alternatively, if the price of the underlying security rises .Balises :Strike PriceOptions in The MoneyOption in The Money+2Underlying AssetMoney in vs Money Out

What is Out of the Money (OTM)?

Balises :Call Option Out of The MoneyOptionsOtm

Out of the Money

trades for $50.The maximum loss is limited to the Rs 50 premium paid if the option expires out of the money. They are options whose intrinsic value is zero (it can't be negative).

Where the option’s strike price is relative to the underlying stock's price is called “moneyness. The put option is out of the money because X –ST X – S T is less than 0. When the option has a positive payoff, it is said to be in the money. You can see in the example below that IBKR is trading for $64. Likewise the YHOO $45 and $50 calls are also way out of the money. Next: Expiry Date. A 49% gain in a few months.A call option gives the option buyer the right to buy shares at the strike price if it is beneficial to do so.

Les options hors de la monnaie (out of the money)

OTM put options have a strike price lower than the current market .

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

A one-year timeline gives the underlying .Mit den Begriffen in-the-money („im Geld“), at-the-money („am Geld“) und out-of-the-money („aus dem Geld“) umschreibt man, ob eine Option etwas Wert ist oder nicht.Balises :Strike PriceCall Option Out of The MoneyOptions+2Option in The MoneyLong Call Option2 and an expiration date that is roughly to a year from the current date.50, for example, would be considered ITM if the underlying stock is valued at $135 per . If YHOO is at $37. Trading strategies built on deep out of the money options are enticing to traders as they allow for attractive asymmetric payoffs. Strike price> Spot price). Current stock value.

Son prix coïncide alors avec sa seule valeur temps. Wann liegen Call Optionen out of the money, also aus dem Geld? Call Optionen sind OTM, wenn der Strike über dem aktuellen Kurs des Underlyings notiert.In the money means that a call option's strike price is below the market price of the underlying asset or that the strike price of a put option is above the market price of the underlying asset .A call option is out of the money so long as the underlying is trading below the cost of the strike price of the call option contract.50, then all of the call options with a strike price of $37 and below are in the money.Le call option est une sorte de contrat entre un acheteur et un vendeur. 30, and an investor holds a call option with a strike price of Rs.