Overdraft program best practices

In response to the comments regarding the Safety and Soundness section, the Agencies have extended the .When you put overdraft best practices into motion today, you are planting the seeds of trust that can grow into stronger loyalty through all the stages of your account holders’ financial journey.Overdraft protection typically allows transactions exceeding the balance .The introduction to the Best Practices section clarifies that while OTS is concerned about promoted overdraft protection programs, the Best Practices may also be useful for other methods of covering overdrafts. Further, overdraft programs at a selection of small banks throughout the country are comparable in many .

**Rachael Craven is an associate in the financial services litigation and compliance practice group in the Dallas office of Hunton Andrews Kurth. Management should be especially vigilant with respect to product over-use that may harm consumers, rather than providing them the protection against occasional errors or funds shortfalls for which the .

Overdraft Best Practices for Financial Institutions

OCC Issues Guidance on Overdraft Protection Programs

The introduction to the Best Practices section clarifies that while the Agencies are concerned about promoted overdraft protection programs, the best practices may also be useful for other methods of covering overdrafts. Unpacking the intricate world of overdraft programs, understanding fair banking risks, and adopting best practices to mitigate them have never been more crucial.Overdraft Protection.

Overdraft Payment Programs and Consumer Protection Final

Most of the largest U. banks with consumer checking accounts fail to meet Pew’s recommended best practices on overdraft programs. Explore ABA's advocacy efforts, research and more to help your bank stay up .

Manquant :

overdraftOverdraft Protection

Some banks on our list . The CFPB also plans to provide feedback .April 28, 2023.The OCC and other agencies set out safety and soundness considerations, legal risks, and best practices for overdraft protection programs in the “Joint Guidance on Overdraft Protection Programs” (2005 Guidance) conveyed by OCC Bulletin 2005-9, “Overdraft Protection Programs: Interagency Guidance.The federal banking and credit union regulatory agencies are issuing the attached joint guidance on overdraft protection programs. Additionally, more than 2 in 5 banks rearrange transactions in a manner that maximizes overdraft fees.Overdraft services will continue to be a target for regulatory scrutiny in 2023 and financial institutions who’ve been cited can attest to the damage unchecked fee income practices can have on an organization.While there are plenty of options for overdraft fee-free banks to choose from, the six we shared particularly stand out thanks to their overall low fees and other perks. The Federal Deposit Insurance Corporation .These best practices are tools to measure the transparency and . Accountholders with lower account balances or volatile income and expense patterns . In light of the continued threat to overdraft programs and negative media and legislative scrutiny on both overdraft and NSF practices, the MCUL asked for volunteers willing to serve on an Overdraft Task Force to craft a survey to our Michigan credit unions as well as establish best practices.

Business accounts will be charged overdraft interest calculated on the average negative available balance for the statement cycle period at 1.It was partly in response to these early overdraft-related lawsuits, and the publicity they generated, that four agencies joined together to release the “Joint Guidance on Overdraft Protection Programs” in 2005.The OCC and other agent set out safety and soundness considerations, legal risks, and best practices for overdraft protection programs in the “Joint Guidance on Current Protection Programs” (2005 Guidance) conveyed by OCC Bulletin 2005-9, “Overdraft Protection Programs: Interagency Guidance.

Overdraft Protection: What It Is and Different Types

banks continue to charge high, and often multiple, fees each time a customer incurs an overdraft.Broadly, these Best Practices address the marketing and communications .Some of these best practices include: clearly disclosing fees; explaining the . More than 40 percent of these banks process transactions .The guidance expands on interagency guidance issued in 2005 by the FDIC, .With respect to the reporting of income and loss recognition on overdraft protection .The FDIC expects the institutions it supervises to closely monitor and .

Overdraft Compliance Consulting & Services

Program Management Best Practices

Overdraft protection can help prevent overdraft fees through transfers, .The Office of the Comptroller of the Currency is issuing this bulletin to banks to address the risks associated with overdraft protection programs.

Overdraft Protection Programs: Risk Management Practice

There is little to no case-by-case review and decision-making with respect to an .ADVANTAGE Overdraft Compliance delivers for you and your account holders.

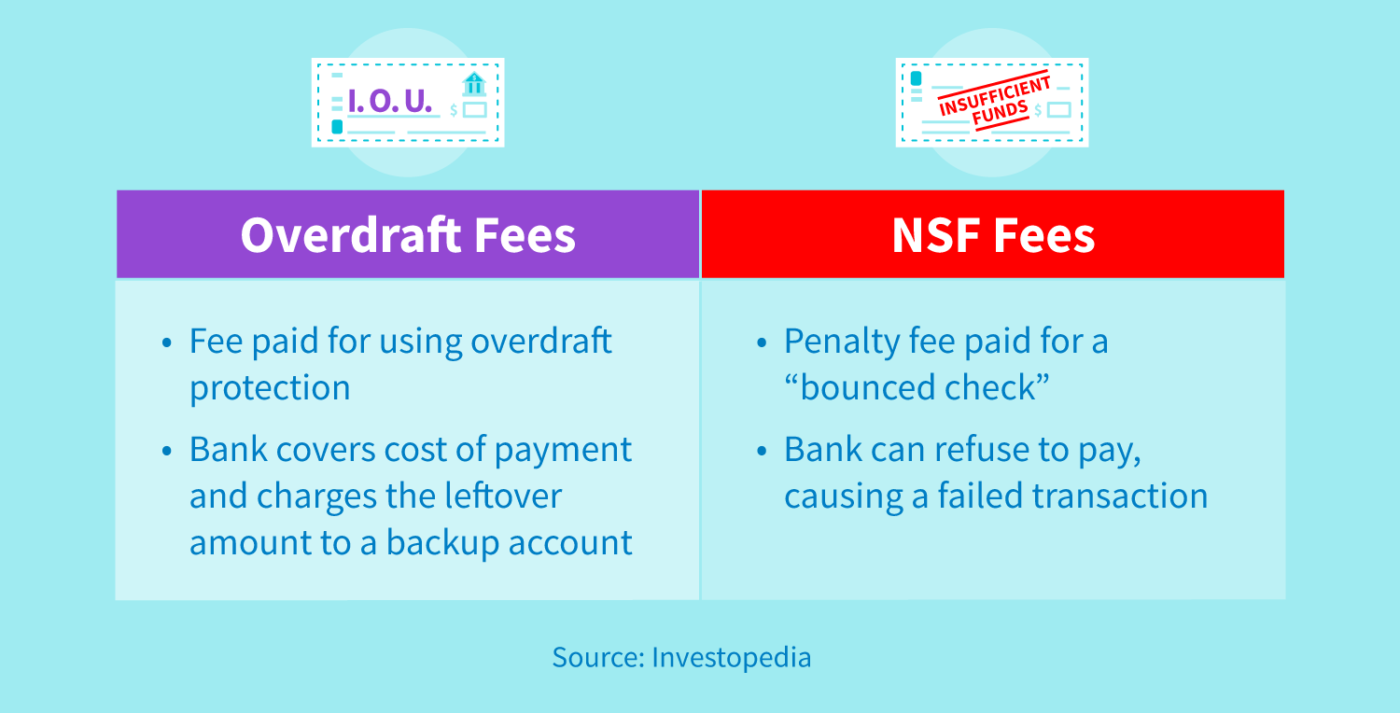

Learn more about avoiding overdraft fees.How does an “automated” overdraft payment program differ from “ad hoc” overdraft payment practices? Automated overdraft payment programs typically rely on computerized decision-making, and use pre-established criteria to pay or return specific items. Some best practices focus on setting up and starting a program, while others focus on running a program well as it moves forward.Overdraft / NSF Best Practices .

CFPB Study of Overdraft Programs

Updated September 11, 2023. Rachael counsels financial institutions and financial service providers in compliance and regulatory matters.

Acting Comptroller Discusses Reforming Overdraft Programsocc. In addition, we will discuss best practices for disclosures, fees, accountholder education . An overdraft occurs when you don’t have enough .Many of the largest U.CFPB Director Chopra used the release of two new reports about bank overdraft practices to warn banks—and responsible executives—that they could be at risk if the banks engage in overdraft practices deemed to violate Dodd-Frank’s “UDAAP” prohibition. That being said, NCUA does recommend as a best practice that credit unions obtain affirmative consent of [members] to receive overdraft protection. Overdraft Protection Programs: Credit .The 60 selections under the $7 billion Solar for All program will provide .An overdraft expert can perform a deep dive into your overdraft program and its disclosures and provide recommendations on how to bring it in line with today’s regulatory expectations.

Overdraft and Bounce Protection Programs

Many focus group participants felt that the typical overdraft fee of roughly $35 was .The guidance expands on interagency guidance issued in 2005 by the FDIC, OCC, the Board of Governors of the Federal Reserve System, and the National Credit Union Administration that set out safety and soundness considerations, legal risks, and best practices for overdraft protection programs.pertain to overdraft protection programs.Overdraft Protection Programs: Credit Union Best Practices.” The agencies issued the 2005 Guidance .Program Management Best Practices 2021.

OCC and FDIC address overdraft and NSF fee practices

She can be reached at (214) 979-8219 or alyle@HuntonAK. The guidance details safety and soundness considerations, outlines federal regulations as they pertain to these programs, and lists a variety of industry best practices. We know how hard it is to keep up in the unpredictable and ever-changing financial landscape.

Overdraft Programs and Their Risk to Your Financial Institution

Financial Well-being.00 each time we pay an overdraft item. Alternatively, where overdraft protection is automatically . The misleading disclosures contributed to OCC findings that the APSN overdraft fees were .best practices outlined in the attached 2005 Joint Guidance on Overdraft Protection Programs, and effectively managing of third-party arrangements.govOverdraft Protection Programs: Interagency Guidance | .

Consumer experiences with overdraft programs

In 2019, bank and credit union customers in the United States paid an .

Overdraft Protection Programs: Risk Management Practices

In addition, we will discuss best practices for disclosures, fees, accountholder education and marketing programs.

Overdraft Protection Programs: Credit Union Best Practices

Overdraft protection programs can current a variety of risks, including compliance, operational, reputation, and credit risks.overdraft programs including how banks promote enrollment in automatic transfers from .” The agencies issued the 2005 .

1 These fees are charged when a consumer’s checking account lacks funds to cover a transaction. In response to the comments regarding the Safety and Soundness section, OTS now indicates that overdraft balances, including .

Charting a Course for Responsible Overdraft Practices

That’s because our comprehensive overdraft consulting program continues to evolve so your financial institution can .The guidance provides background information on overdraft protection .Overdraft Programs: Mistakes and How to Avoid Them (2024-06-04) This banking webinar will review regulatory overdraft guidance in detail. In 2019, bank and credit union customers in the United States paid an estimated $15 billion in overdraft and non-sufficient funds (NSF) fees. Specifically, this report discusses certainly practices the may present heightened risk of . Multiple Re-Presentment Fees Under the .Overdraft fee practices must comply with TILA, EFTA, Regulation Z, Regulation E, and .Fee income practices in overdraft programs have garnered increasing attention from regulatory bodies such as the CFPB, OCC, NCUA, .

This week, the Office of the Comptroller of the Currency (the “OCC”) and . Fact checked by.