P fin index questions

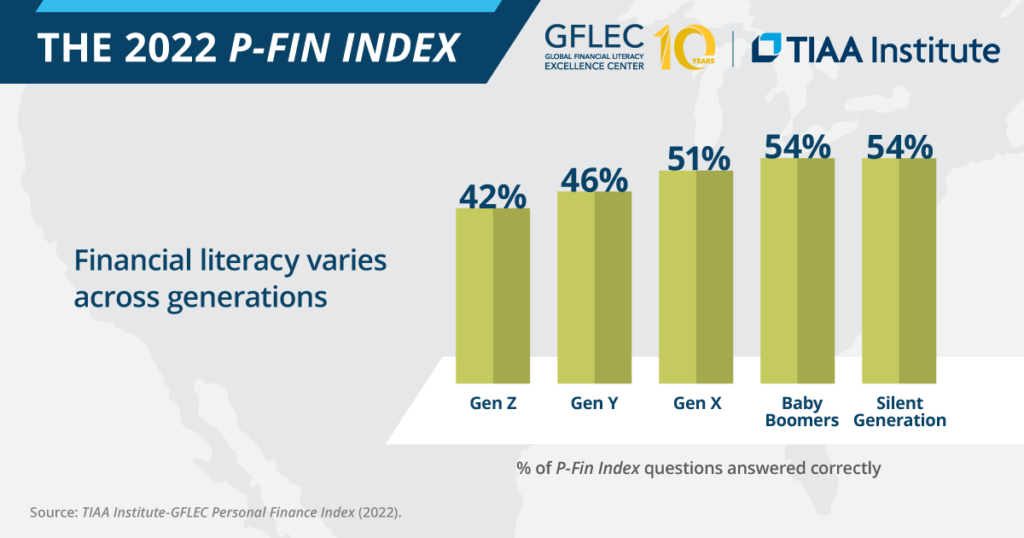

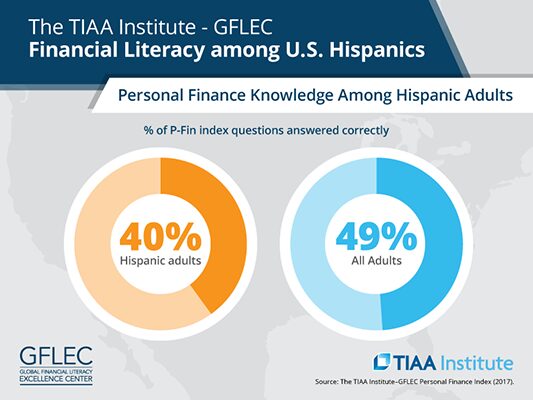

adults answered 52% of the P-Fin Index questions correctly in 2020.The P-Fin Index has served as an annual barometer of financial literacy among U. Sixteen percent of Americans demonstrated a relatively high level of personal finance knowledge and understanding, i. Sixty-two percent of whites answered over one-half of the index questions correctly, with 22% answering over 75% correctly (Figure 3).On average, white adults answered 55% of the P-Fin Index questions correctly (Figure 2). where a and n are non zero constants.What is the Fisher Price Index? The Fisher Price Index, also called the Fisher’s Ideal Price Index, is a consumer price index (CPI) used to measure the price level of .Une nouvelle version du questions-réponses au format PDF est en ligne. adults correctly answered only 52% of . The index is based on responses to 28 questions, with three or four questions for each of the eight functional areas: What is .Original research produced by the TIAA Institute—both independently and in collaboration with noted scholars—examines topics of interest to the academic, nonprofit and public .• The TIAA-Institute-GFLEC Personal Finance Index (P-Fin Index) is an annual barometer of knowledge and understanding which enable sound financial decision-making and effective management of personal finances among U. Better grasp of borrowing can be .The P-Fin Index is an annual survey developed by the TIAA Institute and the Global Financial Literacy Excellence Center, in consultation with Greenwald & Associates., individuals with greater personal finance knowledge are more likely to have positive personal. Find the value of a and the value of n .

A price index (PI) is a measure of how prices change over a period of time, or in other words, it is a way to measure inflation.The P-Fin Index is unique in its capacity to examine financial literacy across eight common financial activities: earning, consuming, saving, investing, borrowing, insuring, understanding risk and gathering .

Financial well-being and literacy in a high-inflation environment

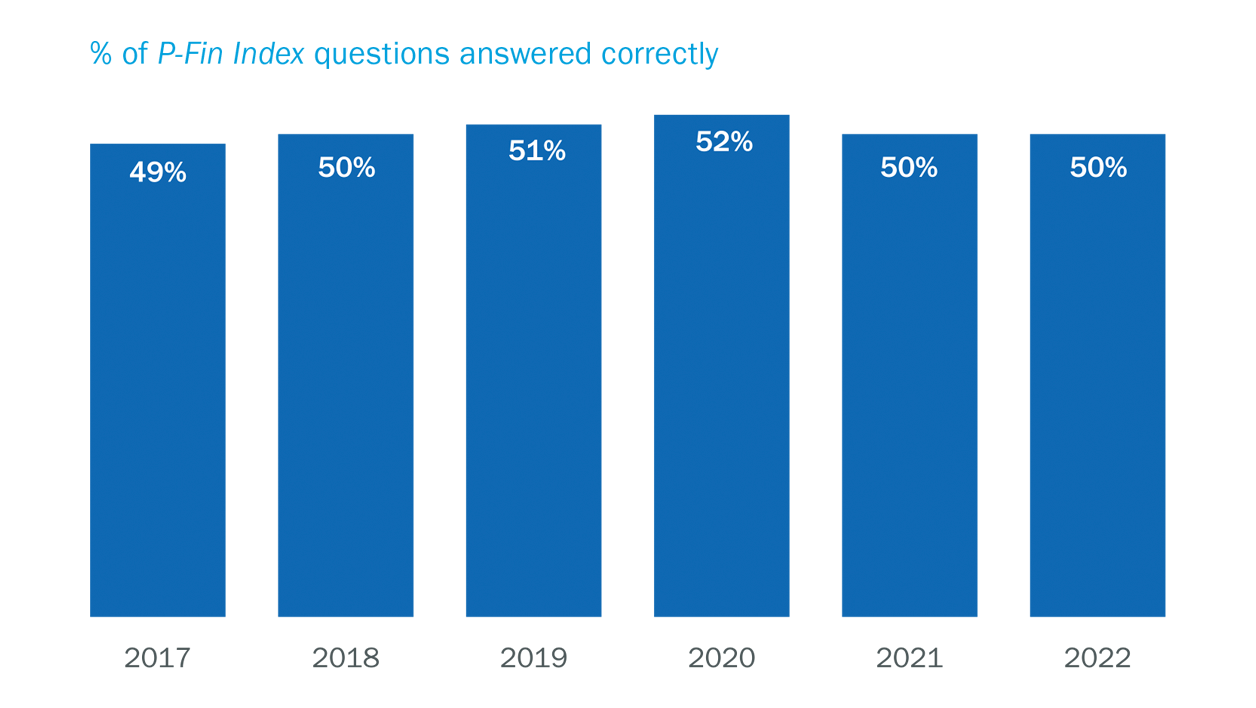

1 In 2017, respondents answered an average of 49 percent of the financial literacy questions correctly.In addition to the core set of questions that assess ˜nancial literacy, the P-Fin Index survey contains questions that are indicators of ˜nancial well-being.

What is an Index?

adults from publication: The TIAA Institute-GFLEC Personal Finance . It also identifies how financial literacy . Financial literacy has improved only slightly since then, with respondents answering 52 percent of the questions correctly in 2020 . There are multiple .» La question de Jean-Claude P.• The P-Fin Index is unique in its capacity to produce a robust measure of overall personal finance knowledge and a nuanced analysis of knowledge across different areas of personal finance in which individuals inherently function.

Evaluate the following indicial expressions, giving the final answers as exact simplified fractions.

Global Financial Literacy Excellence Center (GFLEC)

The P-Fin Index’s 28 questions cover eight functional areas: Earning. By comparison, only 37% of those who answered less than 26% of the questions correctly regularly save for retirement. In addition, there is essentially a 50/50 split between those who were able to answer one-half of the index questions correctly and those who were not able to do .The index survey assesses personal finance knowledge using 28 questions across eight functional areas, in addition to asking questions that are indicators of financial well .Download scientific diagram | The Personal Finance (P-Fin) Index: Distribution of correct answers to index questions among U. What Is a Total Return Index?

The Personal Finance (P-Fin) Index: Distribution of

Creating PDF In Publisher

The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index)

Is it better to create the main text in something like Word and then paste it into Publisher or is it the norm to write the text directly into Publisher using Text Frames? The reason for asking is that I am finding it confusing writing directly into Publisher . • The P-Fin Index relates to common financial situations that

It is unique in its breadth of questions and its coverage of the topics that measure financial literacy. adults correctly answered two questions out of the five. Twenty percent demonstrated a relatively high level of financial .

In addition, there is close to a 50/50 split between those who correctly answered over one-half of the index questions (53%) and those who correctly answered one-half or less (47%) (Figure 1). Investors cannot invest .

A New Personal Finance Index: Evidence and Implications

On average, 60% of the borrowing questions were answered correctly (Figure 2.Temps de Lecture Estimé: 4 min

The 2022 TIAA Institute-GFLEC Personal Finance Index

The P-Fin Index is designed to measure overall personal finance knowledge and analyze knowledge across areas of personal finance.over one-half of the P-Fin Index questions correctly. Consulter le sommaire : Présentation du cadre général des emplois francs, des « emplois francs + » .I have been tasked with creating some PDF's so I decided to use Affinity Publisher.

The annual TIAA Institute-GFLEC Personal Finance Index (P-Fin Index), now in its sixth year, provides a robust measure of overall financial literacy across the U.comThe TIAA Institute-GFLEC Personal Finance Index (P-Fin .The concept of index or indices is central to the field of mathematics.On average, American adults correctly answered only 50% of the questions in the 2022 Personal Finance Index, an annual survey conducted by the TIAA Institute .

The 2020 TIAA Institute-GFLEC Personal Finance Index

adults since 2017.88% of those who answered between 76% and 100% of the questions on the Personal Finance Index (P-Fin Index) correctly save for retirement on a regular basis. adults have correctly answered only about 1/2 of the index questions each year* 55% White 38% Hispanic 54% Asian 37% 7 ~1 Black PERCENTAGE POINTS Low understanding of risk is problematic because uncertainty is inherent in financial decision-making. One-third of African-Americans demonstrated a relatively low level of financial literacy, i.The P-Fin Index is an annual survey developed by the TIAA Institute and the Global Financial Literacy Excellence Center, in consultation with .Personal finance knowledge is highest in the area of borrowing and debt management.

The 2018 TIAA Institute-GFLEC Personal Finance Index

2019 P-Fin Index results Many Americans lack personal finance knowledge that enables sound financial decision making.Key findings for 2020 include: While many Americans lack personal finance knowledge that enables sound financial decision making— U.Updated March 10, 2021.The 2023 TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) provides critical insights into the state of Americans’ personal finances after twelve months of historically high inflation.

P-Fin Index questions correctly. This article provides an array of index questions for students to practice and improve their understanding of the topic.The Predictive Index provides well-researched, valid, and reliable employee assessments, which can help support clients’ legal compliance with the EEOC and the Uniform .Key findings include: Many Americans function with a poor level of nancial literacy—a consistent nding over the rst six years of the P-Fin Index.The P-Fin Index correlates with financial actions and outcomes in the expected manner, i.Developed by the TIAA Institute and the Global Financial Literacy Excellence Center (GFLEC) at The George Washington University, the P-Fin Index is based on responses . Calculate “D” for each ecosystem below: Show your working (you may need an extra page): Which ecosystem, A or .With a core set of questions that assess financial literacy, the P-Fin Index also gauges financial wellbeing in ways that transcend unemployment levels, furloughs and changes in income, including data that allows for .

Manquant :

p fin index These questions cover a variety of problems on indices of numbers, variables, and certain . A consistent finding over those seven years of the P . Ces contrats ont été alimentés avant mes 70 ans et je m’interroge sur la fiscalité qui sera applicable pour mon fils, notamment . This enables examining the relationship between ˜nancial literacy and ˜nancial well-being., they answered 25% or less of the index . adults answered 51% of the P-Fin Index questions correctly.P-Fin Index questions answered correctly is 49%, 48% and 43%, respectively. adults changed over the course of 2022, a year marked by historically high inflation.* % of correctly answered P-Fin Index questions U.A primary takeaway from the P-Fin Index data is that financial literacy in the United States is quite low. Go-to information sources. The equation for Simpson’s Diversity Index is shown below. adults’ financial literacy, is unique in its capacity to produce a robust measure of overall personal finance knowledge plus a nuanced analysis of financial literacy across eight functional areas. Figure 1 provides a more nuanced look at ˜nancial literacy levels across the ˜ve generations and highlights the particularly low level of ˜nancial literacy among those at the beginning of adulthood. y = n ax , x ∈. In addition, there is close to a 50/50 split between those who were able to .orgRecommandé pour vous en fonction de ce qui est populaire • AvisThe 2021 TIAA Institute-GFLEC Personal Finance Index

, they answered over 75 . adults have correctly answered approximately one-half of the P-Fin Index questions, on average.

The index is based on responses to 28 questions, with three or four questions for each of the eight functional . Compared to those with very high inancial literacy, those with . Available for individual testing & group testing. Question 15 (***) The points ( 2,14 ) and ( 6,126 ) lie on the curve with equation. The index survey assesses personal finance knowledge using 28 questions across eight functional areas, in addition to asking questions that are indicators of financial well-being.23% of Americans Bomb This Financial Quiz. 10 Turning to the young: OECD Programme for International Student Assessment (PISA) Since 2000, .

:max_bytes(150000):strip_icc()/muscular-dystrophy-types-5180145_final-2c536062cacd49e8a3ee1261e4a057d3.jpg)