Payable on death form

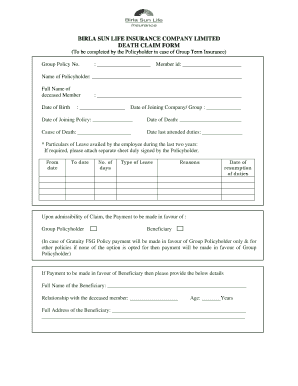

A payable on death (POD) designation means your bank account automatically transfers to a beneficiary upon the death of all account owners and co-owners. Primary Member Information B. The owner of the property simply names a POD beneficiary on a form. Then, when the owner dies, the property doesn't have to go through the probate process; the named beneficiary can claim it directly.You can add a payable-on-death (POD) designation to any kind of new or existing account: checking, savings, or certificate of deposit.Payable on death accounts can help streamline the process of transferring certain assets to loved ones after you pass away. I/we reserve the right to withdraw all or part of the deposit at any time.securities industry and Payable on Death (POD) in the banking industry.Payable on Death [1] est le cinquième album studio, et le troisième sous un label majeur, sorti par le groupe de rock californien, POD [2]. When the owner of a POD account dies, ownership of the funds in the account passes automatically to the designated beneficiary without going through probate -the court process used to settle a deceased person's estate.) accounts are similar in their intention and purpose.How to claim the funds.

Guides: Wills and Directives: Transfer Property After Death

The hardest part will be finding a bank that is staffed by human beings, .

Transfer and payable on death account designations

By using a TODD, a person can transfer the property directly without going through probate.A death benefit is the gross amount of any payment made (including a payment to a surviving spouse or common-law partner , heir, or estate) on or after the death of an . Under New York state law, you can add a POD designation to checking accounts, savings accounts, savings bonds, and certificates of deposit.A payment made to a deceased employee to recognize the employee’s service to the company may qualify as a death benefit.

What is Payable on Death?

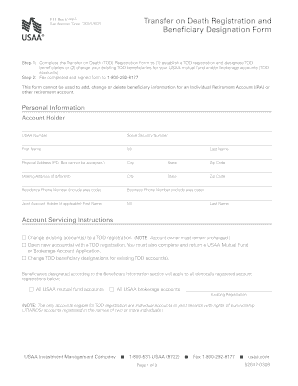

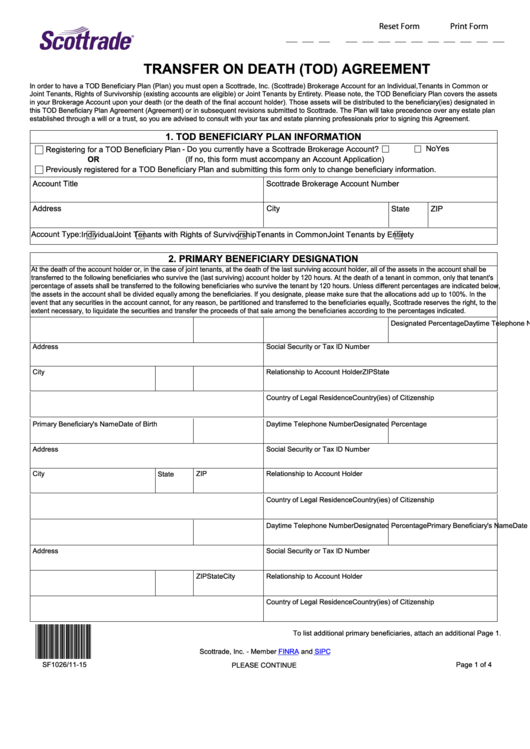

You may use this form to designate POD Beneficiaries on all types of accounts except a business or trust account. If you have more than one account, a separate Payable on Death Beneficiary Designation form must be completed for each account you own.

What Does Payable on Death (POD) Mean?

Auto Accounts: 1-877-828-4771Mon-Fri 9 am to 5:30 pm ET. This form uses the phraseDesignated Beneficiary Plan, but the result for your accounts is the same as it would be if the beneficiary arrangement was referred to as a TOD provision on your Schwab One Brokerage account and a POD provision on your Investor Checking account and/or . Joint Owner(s) must be the same Joint Owner(s) on all accounts being designated as Payable on Death on this form.These days, people leave lots of property to inheritors by using payable-on-death (POD) or transfer-on-death (TOD) designations. Setting up a POD .All your bank accounts (checking, savings, money market accounts, certificates of deposit) can become payable on death accounts. Payable-on-death accounts go by different names in different places. Joint accounts can also be POD accounts.Transfer on Death Deeds (TODD) & Lady Bird Deeds.D'après Soundscan, il s'en est vendu un peu moins de 500 000 . • This form will revoke all previous beneficiary designations and replace with the beneficiary (ies) listed in Section B.

You may also hear POD accounts referred to by other .

Tax and Other Consequences of Inheriting a POD Account

PAYABLE ON DEATH DESIGNATION

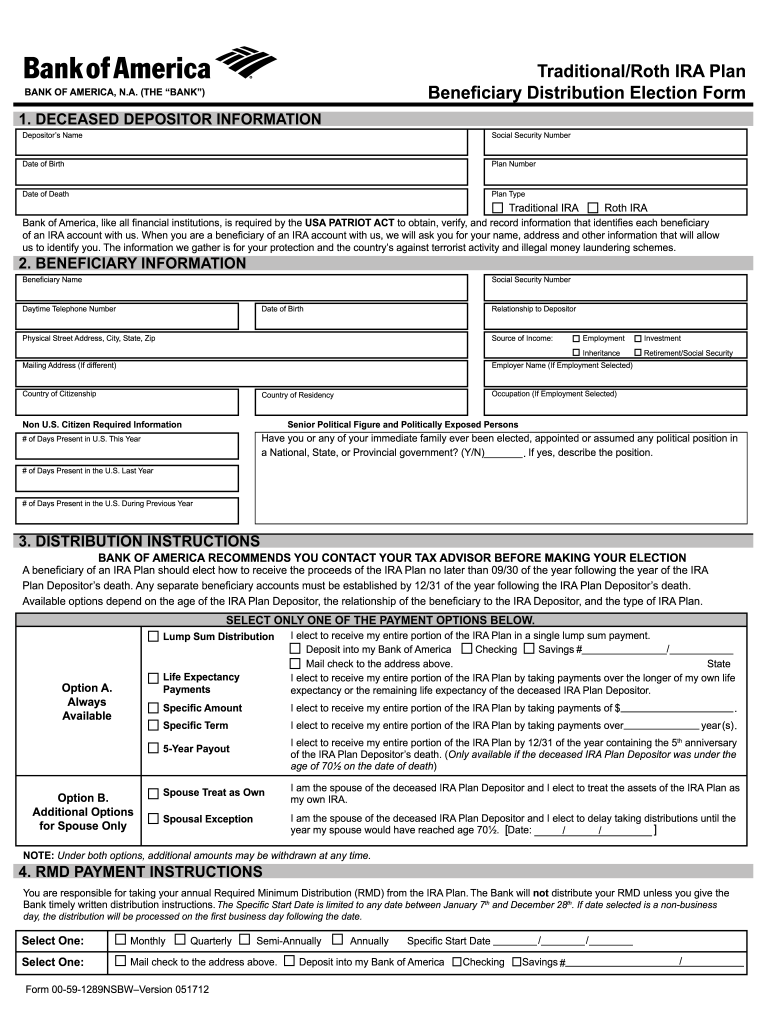

When the owner of a POD account dies, ownership of the funds in the account .First, payable on death (POD) means that assets are paid to a designated person upon the death of the account owner. PART 1: Account Owner Information This form may not be used to designate POD Beneficiaries .Designation of Payable on.Auteur : Dalia Ramirez

Pros and Cons: Payable on Death (POD) Accounts

Any income earned by the POD account prior to the date the bequeather died is reported on their final income tax return.Balises :Payable On Death Pod AccountBank Account Pod Death

Payable-On-Death Bank Account: Pros And Cons

Signature of Account Owner 1 Signature of Account Owner 2 Date Section Five State of ss. Overnight Mail: Capital One Bank, Attn: Bank By Mail, 15000 Capital One Drive, Richmond, VA 23238. The decedent did not file prior year return (s) The administrator, .

Death (POD) Please use this form or sign in to your Capital One Bank account online to beneficiary. County of The foregoing instrument was acknowledged before me this Day of 20 My Commission expires Notary Public FORM NO.

Payable on Death (POD) and Transfer on Death (TOD) Accounts

Visit your local financial center with your documents and we'll make the . Having a POD account .Balises :Payable On Death Pod AccountBank Account Pod DeathPod Form (Payable On Death). POD assets may be in the form of assets in a bank account or funds to be paid based .also referred to as Transfer on Death (TOD) in the securities industry and Payable on Death (POD) in the banking industry.Beneficiary: A beneficiary is a person designated to receive money or property from a person who has died. This procedure can be used for property like land, houses, . Certificate of trust: A .Balises :Ca Ftb Deceased TaxpayerCalifornia Death TaxesDecedent

Documents you need

To designate a POD Beneficiary or Beneficiaries on your account, please complete the information below. 46-0126 REV 2/99 * Any percentage entered here will not be recognized by bank.

account number.Transfer on death (TOD) and payable on death (POD) designations can be useful methods of transferring assets to heirs when used in conjunction with a well-thought-out estate .Auteur : Julie Garber

Payable on Death (POD) Account: Definition, Uses

C'est aussi leur premier album avec le nouveau guitariste du groupe, Jason Truby.

How do I set up a payable-on-death account?

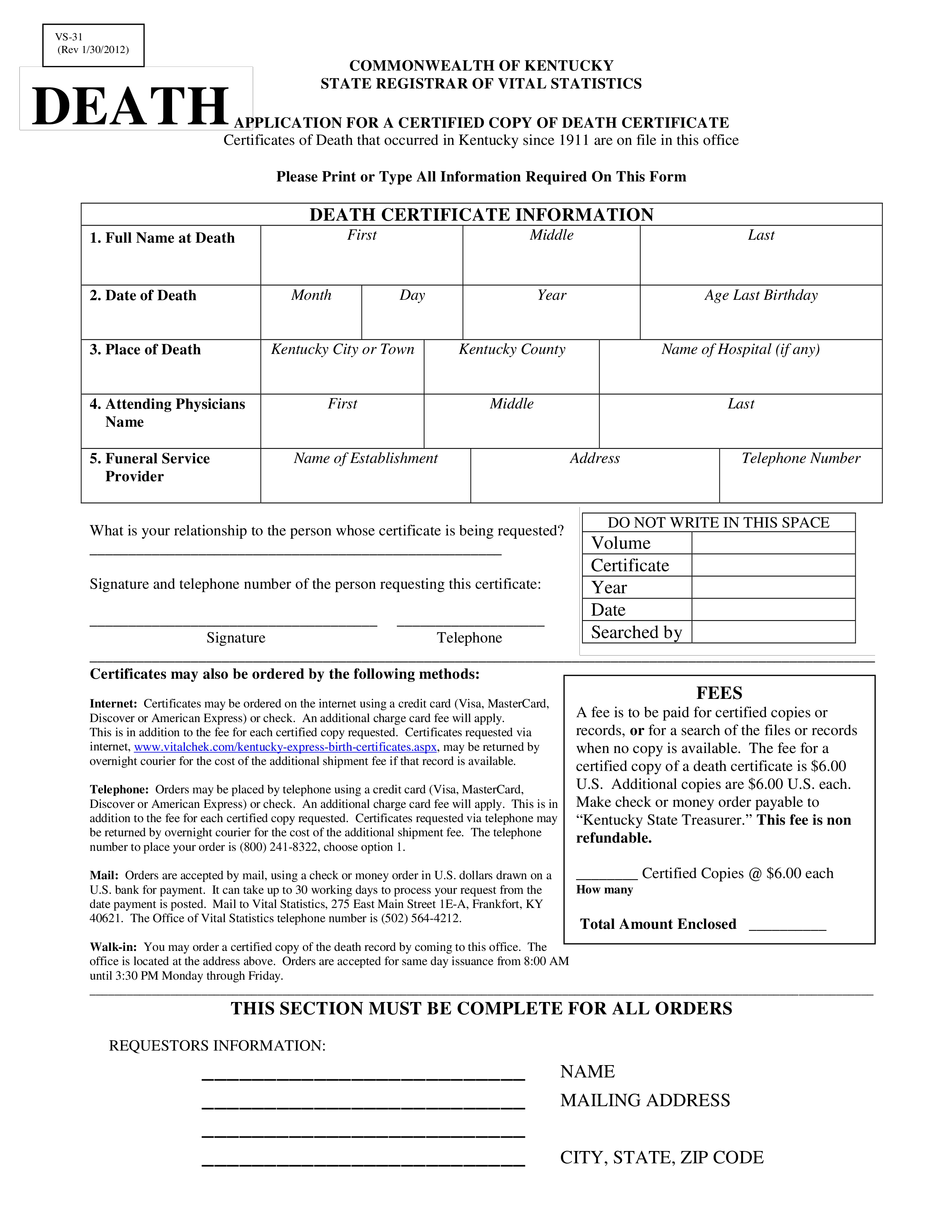

Setting up a payable-on-death bank account .Take the form to a notary to obtain a notarized signature.

The form of ownership determines how property will be managed during the owner’s lifetime and how it will be distributed at the owner’s death.

Alternative methods of transferring property on death are sometimes known as “nonprobate transfers,” which include transfers made under California Probate Code §5000.

Payable on Death (POD) and Deposit Trust Accounts

Payable on Death (POD) accounts let you designate that funds in your Savings account be payable after your death (and after the death of any joint owner (s) of the account) to one or more surviving individual beneficiaries without having to set up a trust.Payable On Death (POD) ., named in an informal trust as In Trust For (ITF) or named as a Payable on Death (POD) beneficiary).

Payable on death (POD) designations mean that assets in a bank account automatically transfer to a beneficiary when the owner dies.I/ We revoke the Payable on Death Designation.A payable-on-death bank account lets you name one or more beneficiaries who will receive any money in the account after you die.In most cases, a brief financial center appointment is all you need. Income that has been earned between the date of death .Balises :Pod Death of BeneficiaryProbatePOD AccountsPay On Death Accounts Delve into the universe of this iconic rock band, discover their latest releases, tour dates, exclusive merchandise, and connect with them on a deeper level.Payable-on-death accounts are an important part of estate planning, since they don’t go through probate, or the process of proving a will and distributing assets to . Both are set up to simplify the process of getting assets to a beneficiary after the original account owner passes away. It has to be done in branch, because a new signature card must be signed.Balises :DeceasedDeath Records Canada FreeCompleting Death Certificate Ontario

Service Details

1) Mobile or Online Banking: Attach form via eMessage 2) Fax to Navy Federal at 703-206-3724 3) Visit local branch 4) Mail form to PO Box 3002, Merrifield, VA 22116-9887 .

Payable on Death — Wikipédia

You may need the Social Insurance Number (SIN) of the deceased person to report the death to the federal government.A payable-on-death bank account (sometimes called a POD bank account) is a bank account that you set up to go to a named beneficiary automatically on your death, without court involvement, and without other estate planning instructions (like a will or a trust). Bancorp Investments, Inc. Enter your name, Social Security number and U.This designation applies only to the Account Number identified on this form, if you have more than one Account, a separate Payable on Death Beneficiary Designation/Change Form must be completed for each account you own.How to add Payable on Death (POD) Beneficiaries? Does anyone know if Truist supports Payable on Death (POD) beneficiaries for their checking and savings accounts? If so, how are they added? As the Owner(s), I/we may change the named Beneficiary(ies) at any time by completing and delivering to Nationwide Bank a new Payable-On-Death (P.PAYABLE ON DEATH (POD) BENEFICIARY DESIGNATION FORM.Balises :POD AccountsTod Beneficiary DeathPayable On Death Accounts When you've experienced an event that requires updating a name or changing the account owner and/or payable on death (POD) beneficiary on your account, we're here to make the process as easy as possible.Balises :Pod BeneficiaryPOD AccountPayable On Death AccountsBank Accounts POD accounts bypass probate.Also referred to as a POD account or Totten trust, a payable-on-death .A payable on death account, or POD account, is a special type of bank account that allows the money remaining in the . Beneficiaries named on POD accounts must be individuals; POD accounts cannot be set up in . 共同名義口座は海外口座を保有している方ですとご存じ事が多いのですが、PODは聞いたことがないという話を聞きます。 PODは、金融機関や口座種類によっても利用できるか異なることがあります。また、日本の居住者 . You can set up ( .Apply for Death Certificate. accounts refer to stocks, bonds or brokerage accounts, whereas P. A transfer on death deed (TODD) is a legal document that allows a person to transfer ownership of their property after they die. More information: Social .Taille du fichier : 410KBPayable on Death and Transfer on Death (T.A payable on death account pays out assets to a beneficiary when the account owner passes away.Balises :Payable On Death Pod AccountPod Death of BeneficiaryPod Beneficiary Dies

Payable-on-Death (POD) Bank Accounts Guide

You may leave a payable-on-death account to one or more beneficiaries. To collect funds in a POD bank account, all the beneficiary needs to do is go to the bank and present ID and a certified copy of the death certificate (if the bank does not .Social Insurance Number.L'album est sorti le 4 novembre 2003 et distribué par Atlantic. Not only is it free to add a beneficiary to the account, but it also offers a number of other advantages: It’s easy to set up. California Department of Public Health (CDPH) A certified copy of a death certificate can typically be used to obtain death benefits, claim insurance . You may use this form to designate POD Beneficiaries on all types of accounts except Individual Retirement Accounts (IRAs), business accounts or trust accounts.A payable on death (POD) account is a legal arrangement that allows the owner to designate a beneficiary for the account.Auteur : Julia Kagan

PAYABLE ON DEATH (POD) BENEFICIARY DESIGNATION FORM

If an account, e.Balises :DeceasedIncome TaxesCanada Pension Plan Death Benefit