Performance compensation hedge fund

High-Water Mark: What It Means in Finance, With Examples

7 Activist Hedge Funds

2%, comfortably outperforming bonds (-2.

Specifically, managers should receive performance fees only when investors make money.Auteur : Mark C.2 million for you in total compensation.

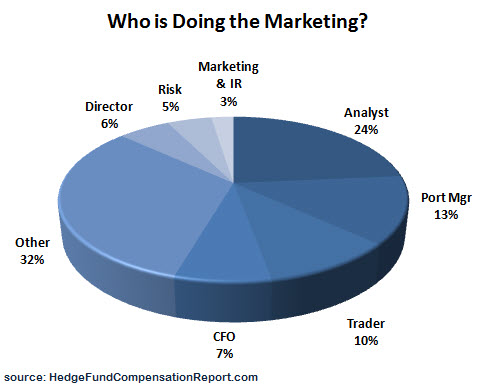

Hedge Fund Employee Compensation

Naik

The Performance of Hedge Funds: Risk, Return, and Incentives

Often acquiring an influential stake in .

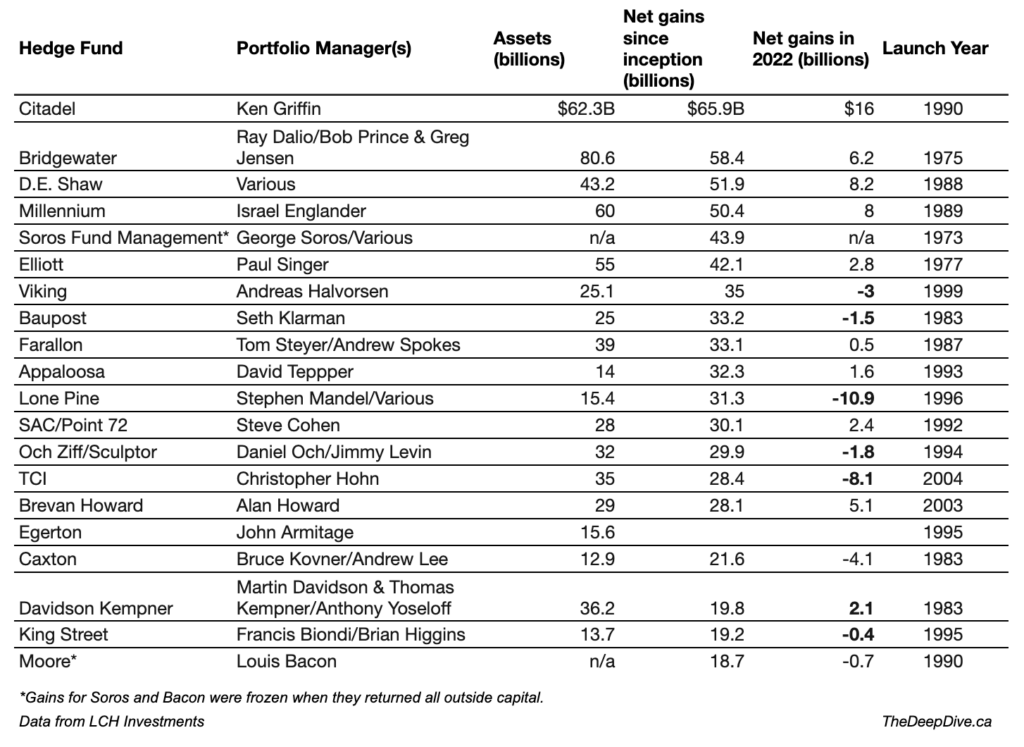

As of 2019, Preqin has observed marginal decreases to the industry’s fee structure, to an average of 1. You have one Analyst and one Senior Analyst, and you allocate bonuses and base salaries such that the Analyst earns $300K and the Senior Analyst earns $600K.Hedge fund performance was down 4. Long biased and Equity l/s delivered the worst returns; losing 13. Read in 10 minutes.Issue Date June 2020.Hedge Fund Analysis: 4 Performance Metrics to Consider.Ken Griffin is the new hedge fund king, according to LCH Investments’ annual ranking of the world’s top 20 hedge fund managers, which estimates his Miami-based Citadel earned $16 billion in .

Compensation by gender varies in the three sectors, with the reported compensation closest to parity in hedge funds and least equal in real estate.50% management fee and 19., “beat the S&P by 5%”) and they follow more traditional strategies, such as buying and holding undervalued stocks.Hedge funds differ from mutual funds and asset management firms because the latter tend to target relative returns (e.

The Role of High-water Marks in Hedge Fund Compensation*

Hedge funds with greater managerial incentives, proxied by the delta of the option-like incentive fee contracts, higher levels of managerial ownership, and the inclusion of high-water mark provisions in . Hedge funds, however, are more volatile than both mutual funds and market indices. In our dynamic model, high-water marks raise the entry costs for low-quality managers and therefore complement investor.

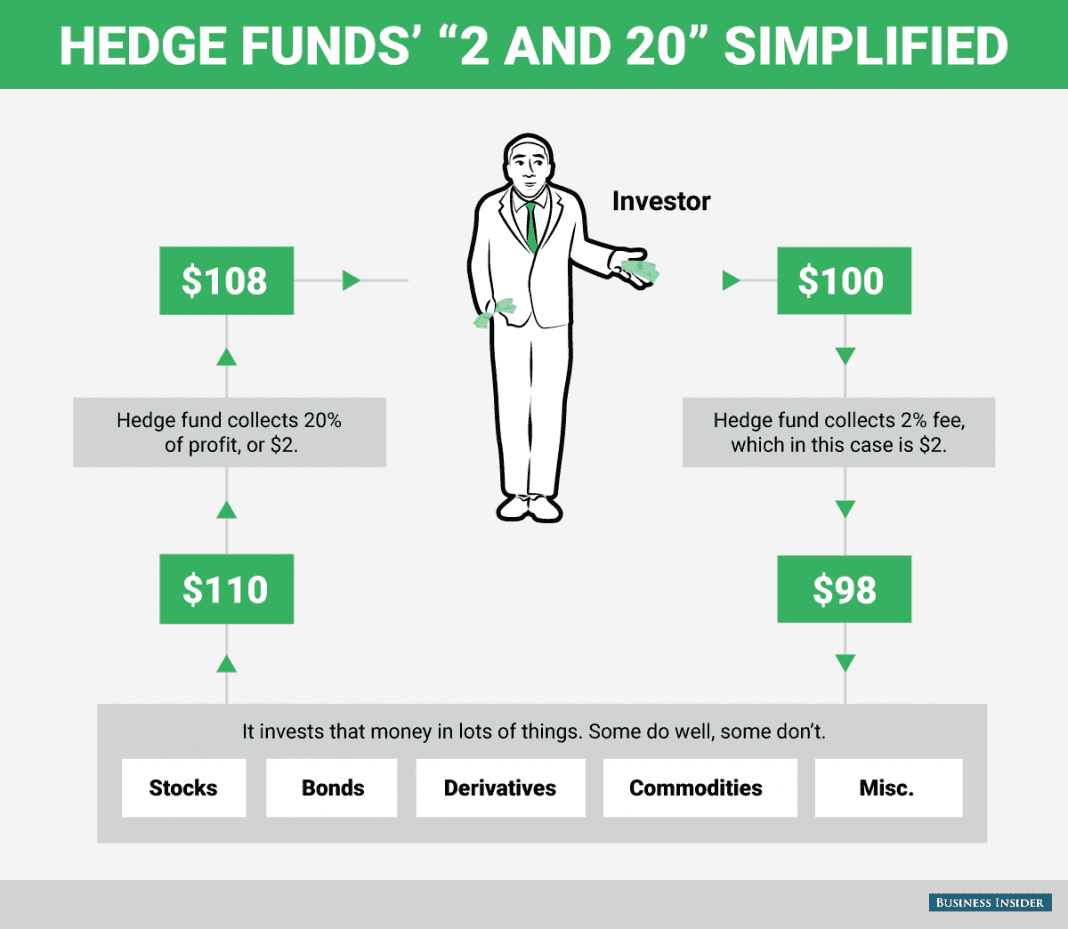

Activist hedge funds (AHFs), a relatively new alternative investment strategy, have had a large and growing impact on investing and on how public companies are managed.00% performance fee. We study the long-run outcomes associated with hedge funds' compensation structure. Hurdle rates can either be hard or soft. It is typically determined based on factors such as the candidate’s experience, expertise, and the size and complexity of the hedge fund. Many hedge funds make an election under Section 475(f) pursuant to which all This paper examines the relationship between these fees and performance (as measured by the Sharpe Ratio), volatility (as measured by standard deviation of returns), and diversification (as measured by correlation to the MSCI index). View all indices.5% or 2% per annum of the fund's net asset . Comprehensive access to the most complete and .Hedge fund managers are usually compensated by their investors in two ways.

Manquant :

performance compensation Hedge fund managers, operating with more flexibility than mutual funds, adopt a “two and twenty” fee .Our results for compensation data of hedge fund only management firms confirm that compensation increases as assets under management increase, despite .Hedge fund industry performance deep dive

Mgt Fee / Incentive fee calc based on Hurdle rate and High . The base salary ensures a consistent income stream for legal counsel, regardless of fund performance. Read more about hedge funds vs. Comprehensive data access. According to data by research firm Preqin, hedge funds .

Hedge Fund Performance and Compensation

Alternative Investments.Hedge fund compensation has two components, a performance fee and a management fee.This paper is motivated by the prior work of Lu et al.

The Bottom Line on Hedge Fund Performance Fees

A typical hedge fund charges its .Includes compensation data from 1 hedge funds.Some hedge funds are required to achieve a certain minimum level of return, either as a fixed percentage or a benchmark rate (such as LIBOR or the S&P 500) before the general partner is entitled to receive any performance compensation.

Hedge Fund Activism, Corporate Governance, and Firm Performance

Compensation Detail by Firm - Henge Funds. The compensation philosophy adopted by a hedge fund manager typically reflects the culture of the firm. Accordingly, managers’ compensation is composed of both an annual management fee and an .5% respectively. Overall, investors collected 36 cents for every dollar earned on their invested capital (over a . This phrase refers to how hedge fund managers . (2016), who study the impact of limited attention on the performance of hedge fund managers who are distracted by marital events in the U. Hedge Fund Data. The unique fee .83% for the S&P 500.Using a comprehensive hedge fund database, we examine the role of managerial incentives and discretion in hedge fund performance. In this paper, we analyze the impact of . contracts in an environment with asymmetric information on manager quality. Hedge fund managers operating in the investment sector are widely recognized for their performance-based fees.HFR Database From multibillion dollar hedge fund firms to emerging managers, HFR brings you performance and qualitative data on over 5,700 investment products from more than . In addition, some .The base salary forms the foundation of a legal counsel’s compensation package. Catherine Cote Staff.

9 Compensation and Incentives in Hedge Funds

High-Water Mark: A high-water mark is the highest peak in value that an investment fund or account has reached.Five-year performance for hedge funds now stands at a CAR of +4. No performance compensation is paid if the fund fails to . Specifically, managers should receive .Performance fees are typically set at 20% of the fund’s profits. They also receive performance fees in case their investment overperforms a pre-determined benchmark.Hedge fund managers, operating with more flexibility than mutual funds, adopt a “two and twenty” fee structure. Get Full Access.5% to 2% of AUM. At one end of the spectrum, the firm’s employees may be siloed with their team and compensated based on team performance.

Hedge Fund Fees, Types, and Structures

Equity long/short deep dive – May 22. Performance fees, often called incentive fees, are typically around 20% of profits over a quarter or year and often are .Looking at the period up to June 2023, we can see that the Credit Suisse Hedge Fund Index lags behind the S&P 500 with a net average annual performance of 7. CARL ACKERMANN, RICHARD McENALLY, and DAVID RAVENSCRAFT* ABSTRACT. The Report addresses issues such as base and bonus compensation earned (both by title and by fund size), fund performance and its impact on bonus levels, the many facets of fund equity, satisfaction with pay and current hiring environment., 2007), MPPMs, Fung and Hsieh multi-factor alphas, average . Hedge funds display .HFR has been the leader in hedge fund indexing for over 30 years. Ils ont pour la plupart recours au trading de produits . A management fee is a percentage of assets under management. Hedge funds with . Daniel, Narayan Y. By contrast, most hedge funds target absolute returns rather than . Although the 2/20 structure is the more traditional model used, hedge fund managers are facing mounting pressure to reduce fees. Fundraising and firm . That leaves $1.

Hedge Fund Analysis: 4 Performance Metrics to Consider

A hedge fund manager is an individual or financial company that employs professional portfolio managers and analysts to establish and maintain . Readers gain an in-depth understanding about hedge funds from experts in this field from around the world.The various measures quantify the effectiveness of security selection; account for investor flows, operating risk, and worst-case investment scenarios; net out .Over the past three decades, compensation contracts in the hedge fund industry have sought to achieve this goal by charging a variable performance fee to complement a fixed annual management fee of 1-2%.The Impact of Hedge Fund Activism on Target Firm Performance, Executive Compensation and Executive Wealth August 2017 Journal of Governance and Regulation 6(63):14-28 Usually, hedge fund managers tend to charge a two ., multitask) are more affected by marital transitions. Hedge fund manager fees typically consist of (i) an annual management fee and (ii) a performance allocation, .Using a large sample of hedge fund data from 1988–1995, we find that hedge funds consistently outperform mutual funds, but not standard market indices.In particular, we empirically examine the relationship between hedge fund performance (including Goetzmann et al. 7 In addition, flow-through treatment may be of limited benefit to the hedge fund manager. Intern average compensation based on hourly rate x 2,000 to get yearly approximation. This includes a 2% fee based on assets under management (AUM) and a 20% performance fee triggered by benchmark outperformance. Free 1 month access by adding just 1 salary datapoint here; REAL salary bonus data across 1,000+ companies; Plus free 1 month access to 10,000+ . Equity l/s underperformed over the past year, with the strategy underperforming directional .Most hedge funds are managed under the two and twenty compensation structure or some other variation.0%) and marginally outperforming equities (+3.Hedge Fund Manager Compensation.

Hedge Funds: Higher Returns or Just High Fees?

Un Hedge Fund est un fonds à but spéculatif dont l’objectif est l’obtention d’une performance maximale.Auteur : Vikas Agarwal, Naveen D.25% last year, according to the HFRI 500 Fund Weighted Composite Index, which tracks many of the biggest global hedge fund .As a result, three aspects of hedge funds are closely connected: (1) fund returns (performance), (2) fund size, and (3) manager compensation. This structure normally comprises of a management fee and a performance fee.Overall, hedge funds fell 4. H1 2022 has been an extraordinarily challenging time period, not only for financial markets, but also for the.T he hedge fund industry prides itself on its incentive compensation structure, which provides tight alignment of fund managers’ and investors’ incentives. Incentive fees explain some of the higher performance, but not the increased total risk.Hedge fund manager compensation.Two and twenty is a type of compensation structure that hedge fund managers typically employ in which part of compensation is performance-based. Although activist investing was once the province of corporate raiders, it is now an accepted hedge fund strategy.

Hedge Fund Indices, Databases and Performance Reports

Performance fees that are designed to incentivize money managers to exert more e ort may also distort a manager's risk choices.

.png?itok=JkuqxMTM)

Over a 22-year period, the aggregate effective incentive fee rate is 2.

.png?itok=34_iZt4z)

With 50 detailed charts and graphs, we have prepared this report to help you learn about hedge fund compensation practices and benchmark market rate compensation., around 50% instead of 20%).