Personal guarantee for commercial lease

As a tenant, you may be in a situation where your cash . In the past, the requirement for a personal guarantee on a commercial lease was not common, but since the .

Why Do I Have to Sign a Personal Guarantee for a Commercial Lease?

1 Know your leverage.

PERSONAL GUARANTEE Sample Clauses: 320 Samples

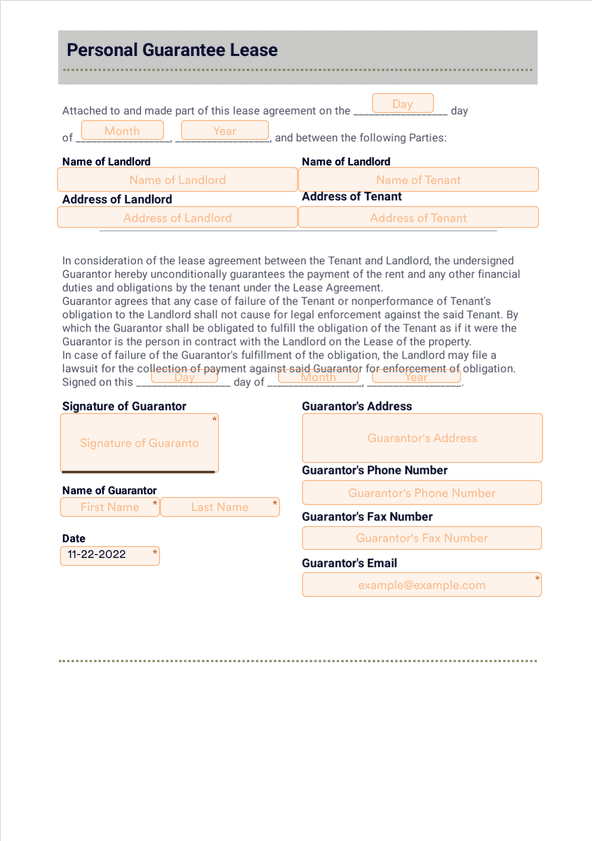

When the lessee (tenant} of the commercial property has less than good credit, the landlord may require a personal guarantee that funds will be available.Updated September 12, 2023. Step 4: Sign the agreement as a guarantor.

Understanding a Personal Guarantee in a Commercial Lease

Personal Guarantees in Commercial Leases: What You Should Know

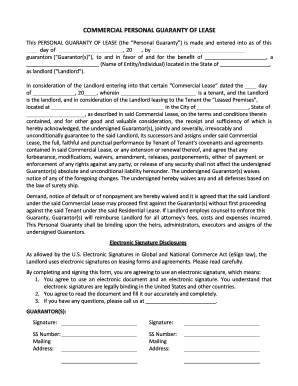

In a personal guarantee, the guarantor (usually the business owner) agrees to be responsible for the lease payments owed by the business under the terms of a commercial lease if the business fails to .Take a look at what a Florida commercial lease agreement looks like. A real estate (lease) personal guarantee requires a third party (guarantor) to fulfill the lease obligations in the event of default by the tenant . Reply reply First_Prize • Extremely common as everyone here has said. The landlord is recommended to charge an application fee for conducting the credit check which can range between $50 to $200. One of the first steps to negotiate lease terms without a personal guarantee is to assess your leverage as a tenant.Personal Guarantee Form for Commercial Lease - PDF, Word. A real estate lease personal guarantee form is a document a tenant issues to their landlord as part of the .

Author - Stephens Scown.The real estate lease personal guarantee form enables the guarantor to guarantee a lease in case the tenant violates the terms of the rental lease agreement. Updated October 11, 2023. If the tenant does not pay all rent and fees under the lease, and their . If a tenant is leasing the premises in his or her own name, then personal guarantees are less likely to be required.A personal guarantee commercial lease is a legally abiding contract that makes a business owner assume personal liability for responsibilities and obligations.In a commercial lease, the concept of a guarantor plays a crucial role in ensuring the fulfilment of lease obligations. You could offer to guarantee the commercial rent for a set period of time after an early termination. This website expands on what a personal guarantee is and the recent demand for it when leasing commercial property. Cook (Listen @ 00:44 »)The Landlord leases to the Tenant the property (Herein, the “Premises”) located at (insert property address).The Tenant shall have the right to use and occupy .

Personal Guarantee Commercial Lease: All You Need to Know

Business Know-How.Create Document.A personal guarantee for a commercial lease allows a landlord to use your personal assets to cover costs if you fail to pay rent, maintenance fees, or other related . Thus the co-signer/guarantor is proportionately .

, office, residential, commercial, etc. As such, a director or shareholder .3) Personal guarantee What is a personal guarantee? A personal guarantee is exactly that, a personal guarantee from directors and/or shareholders that stipulates that the obligations of the lease will be fulfilled by the incoming tenant. Restructuring Advice.Most commercial loans will require a personal guarantee and its non-negotiable, especially with larger lenders.Essentially, a personal guarantee in a commercial lease is pretty much what it sounds like: it makes you personally liable for rent if the business can't pay. Despite their shared purpose, indemnities and guarantees differ in their .

Types of Guarantees in Commercial Leases

This means that .The Good Guy Guarantee is a Limited Personal Guarantee where the guarantor is fully chargeable for the payment of the rent and potentially other lease obligations of the tenant. Leverage is the ability to influence the outcome of the .What if a personal guarantee is in place? However, a personal guarantee does not require the tenant or company directors to provide any payment upfront.Critiques : 55

PERSONAL GUARANTY AND COMMERCIAL LEASES

An individual who signs a personal guarantee acknowledges that, even if the company .

Guarantees in commercial leases

If the tenant never breaches the lease, the landlord may never draw on the guarantee.A personal guaranty is a separate legal document from the commercial lease.

Personal Guarantees in Commercial Leasing

A commercial lease application is completed by a potential tenant and reviewed by a landlord to verify a business’s income and liabilities.

Free Commercial Lease Application Form

Many commercial landlords require that a guarantor secure the obligations and liabilities of a tenant as a prerequisite for entering into a lease.

Restructuring your commercial property lease can deliver unparalleled cost savings for businesses of all sizes. I’d direct you to look at two other points . Parties Involved: While this may sound common sense, the lawyer confirms that the correct parties have entered into the lease agreement. Last reviewed: July 31, 2022 .

It is not unusual for a landlord to require the principals of the business-tenant to execute security instruments called guarantees.

PERSONAL GUARANTEE. You should try to negotiate an earlier end date, perhaps a term of 12 months, as long as you are timely with lease payments. While the commercial lease is signed by the owner or an officer of the business on behalf of the corporation, a personal guarantee is signed by the business owner or owners personally. These instruments serve to allow the landlord to sue the principals of the business- tenant . This can be tapped in the event you default.A personal guarantee is common when singing on behalf of a residential tenant that doesn’t have the financial capability to be approved for a lease and for commercial leases.As tenant defaults have increased, landlords are frequently requiring personal guarantees of commercial leases (and similarly on small business loans as .If your lease is 5 years ask that the personal guarantee expire on the 36 month.Do I have to personally guarantee the lease for commercial property? When a limited liability company takes on a property the landlord will often ask for a third . In the current environment and more than ever, it is important to understand the seriousness and the risk that personal guarantees can have on businesses currently leasing or intending to . This only applies while the tenant remains in possession of the leased space, but only if certain conditions are met. I have not been a commercial landlord yet, but if/when I do, I would also require it. These agreements are meant to further secure a tenant’s obligations under the lease and enhance the landlord’s recourse for tenant defaults under the lease.Landlords commonly request guarantees in commercial leases for restaurants and bars. How to get out of a personal guarantee on a commercial lease. What to Include in a Commercial Lease. Enquire today to see how we can help you! About Us. There are five ways you can use to get out of a personal guarantee on a . Unless you are a major national tenant, commercial leases typically require a personal .The Premises consist of approximately (insert square footage) of rentable (insert type of space, e.Most businesses lease commercial space under the name of the corporate entity if the business operates as such. If you have the the financial means offer to provide a letter of credit for a set dollar in lieu of a personal guarantee.

What is the significance of a personal guaranty in a lease?

These items are generally included in commercial leases in addition to common clauses and disclosures:

4 Tips on Negotiating Personal Guarantees when Leasing

A personal guarantee of a commercial lease is a contract, signed by the landlord and an individual affiliated with their tenant–often an owner or high-level . In the event of default, personal guarantees require the guarantors to pay back the defaulted amount.When a tenant enters into a commercial real estate lease, there is often a request for the tenant to sign a personal guarantee.I'm in my third commercial lease, all three have had personal guarantees. Please DO NOT ever, ever, ever sign one! “Never sign a Personal Guarantee!” ~ Amanda B.Please enter the same name as it reflects in the original lease agreement. Blank spaces, .Cedar Dean is on hand to help commercial property tenants and business owners secure affordable leases that benefit them. For valuable consideration, the receipt of which is acknowledged, the undersigned (“Guarantor”) irrevocably, absolutely and unconditionally guarantees to OptConnect the full and prompt payment by Customer of all of Customer's obligations under this Agreement.

Personal Guarantee (Guaranty) for a Lease Agreement

Org

Your Guide to Commercial Lease Personal Guarantees

I would not have rented to myself when I got my first tiny 1000/sq/ft warehouse. A guarantor is typically required when a tenant’s financial stability or leasing history is uncertain.Personal Guarantee – If a business cannot pay the lease or other expenses, this clause would require the tenant (usually the CEO) to personally be liable.

Model Lease Guaranty

In this respect, if the tenant breaks the contract and fails to pay rent, the guarantor is obliged to cater to the unfulfilled obligations. But if the tenant is a company, it is common practice for landlords to insist on a personal .

Understanding commercial leases and personal guarantees

Guarantors are the people (or other legal entities) who agree to be responsible for the debts of the tenant, should the tenant default. This could be a .Getting a Commercial Lease — Without Signing a Personal Guarantee | ZenBusiness Inc.In most cases, providing a bank guarantee over a personal guarantee is advised. Step 5: Enter your information like print name, detailed address, phone number, and email address on the .

Free Lease Personal Guarantee Form

This may mean .Indemnities or personal guarantees required; . Team ZenBusiness .Personal guarantees can provide several advantages for landlords and tenants in commercial lease agreements, such as reducing the risk of non-payment or default by the tenant, especially if they . Unless you are a major national tenant, .Directors personal guarantees in commercial leases – be careful! March 9, 2017. Offer other business assets as the .The “base” Guaranty consists of a full Guaranty of a Tenant’s obligations under a commercial lease (the “Lease”), to be signed at the same time as the Lease.Guarantees and indemnities are ancillary agreements often included in commercial leasing transactions. Prospective tenants should always attempt to eliminate the requirements of a guaranty.Sample Clauses.When you’re preparing to sign a lease on a commercial property as a business owner, don’t be surprised if the landlord demands that you also sign a . Some landlord’s will insist on a third party guarantee to be given for a lease.