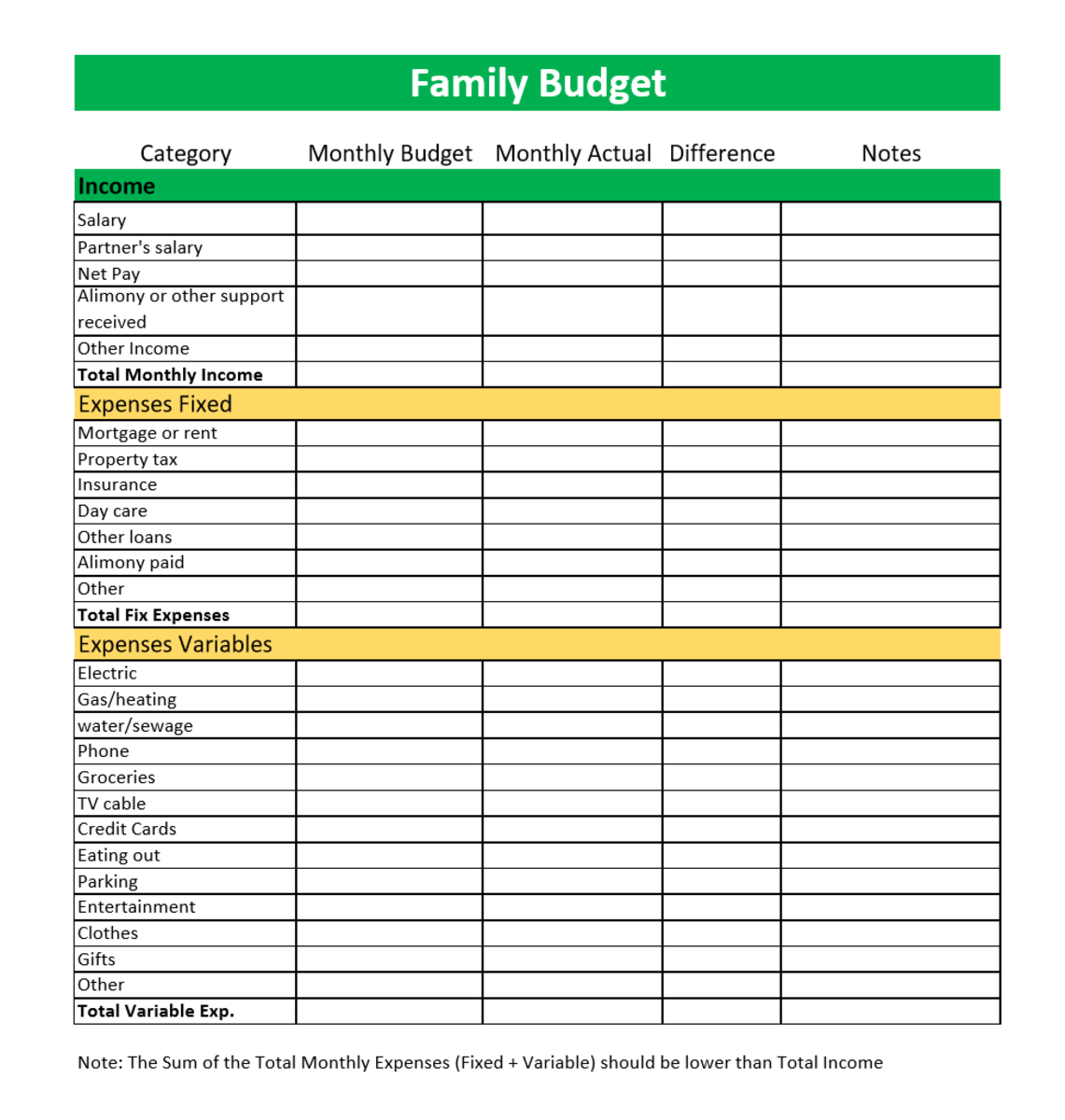

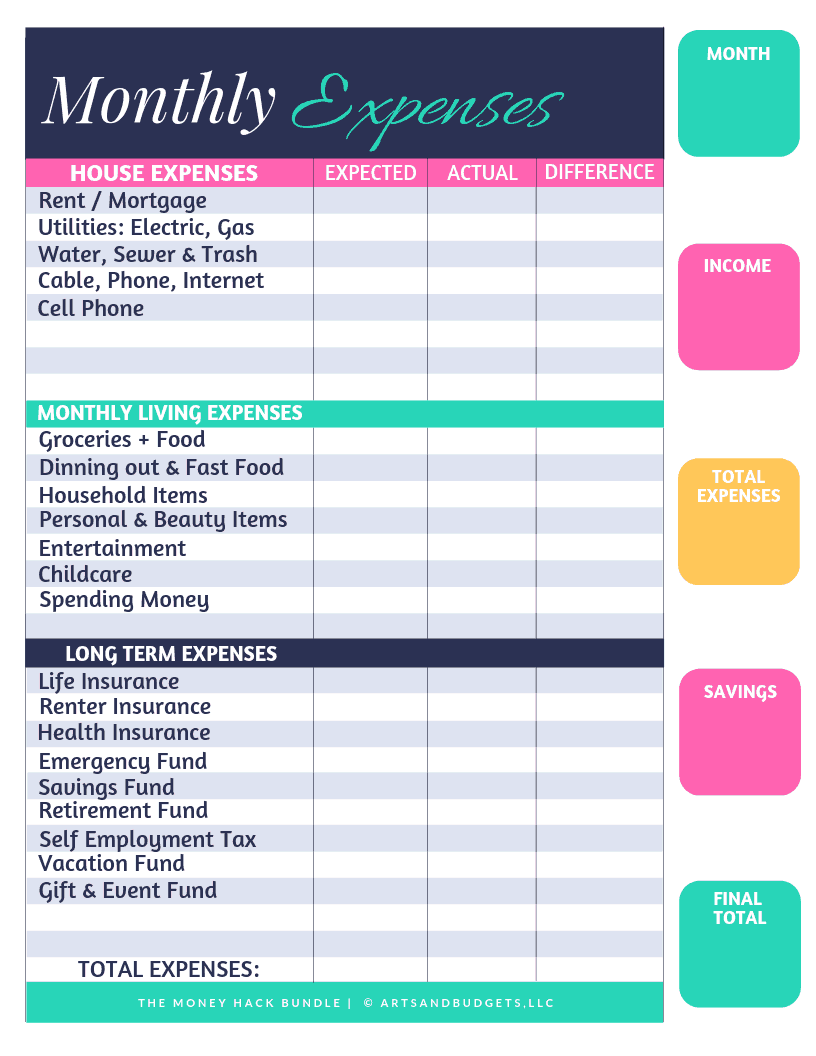

Personal spending account

You can also spend FSA funds on a dependent who needs one. WallyGPT: Free.De très nombreux exemples de phrases traduites contenant personal spending account – Dictionnaire français-anglais et moteur de recherche de traductions françaises. Personal spending accounts (PSAs) are a great way to help you budget and .

What is a Lifestyle Spending Account: Purpose & Benefits

This account has a debit card associated with it, since it is the . To see how you would contribute to and use funds from multiple kinds of FSAs let's look at an example. EFFECTIVE January 1, 2024: The Personal Spending Account (PSA) benefit is available for some employee groups at UBC. Sign up for direct deposit and online claims submissions, if they're available in your plan. Bundrick, CFP®., if you have a $500 massage therapy maximum for the year but continue to receive massage treatments after the $500 is spent, the costs that go over the maximum may qualify for . This is a list of the eligible expenses available for the PSA. Checking Account.Hover over a section of the chart to learn more about spending in specific categories.The second account I recommend is your personal spending or your “food, fuel and fun” account.Personal Spending Accounts (PSA)s, sometimes known as Wellness Spending Accounts (WSA)s, are a great addition to a benefits plan! Employers allocate a set amount of money to each employee for use on eligible items, as determined by the employer.ca or the my Sun Life mobile app.The Ally Spending Account does not have many. A personal spending account can also be used to manage your debts, such as credit cards and loans.dɪŋ / Add to word list Add to word list. Input who you’re submitting the claim for, the type of expense, date, expense amount and hit next. The employer decides what taxable benefits the employee can make claims on. Here's what to know about both accounts. Stretch your health care dollars with a personal spending account.Employers' Guide – Taxable Benefits and Allowances - .You fund your FSA with pre-tax dollars; LSAs are employer-funded, but you pay taxes on what you spend.The choice of FSA vs. common bank fees.A flexible spending account is a health care savings fund offered by employers.A Personal Spending Account (PSA), also known as a Wellness Spending Account (WSA), is a way to add wellness options to any group benefits plan. We all know work can be stressful. It has no monthly service fee, no overdraft fees, and no incoming wire transfers.The Wellness Spending Account (WSA), is a taxable account to help support expenses for you and your eligible dependents as outlined in the categories below. The Humana Access Mastercard® debit card provides easy access to your HSA, HRA, Healthcare FSA and Dependent Care FSA funds. These options are generally over-and-above what is normally covered under a traditional benefits .

Say your employer offers a health care FSA and a dependent care FSA, and allows employees to contribute an annual maximum of $2,750 to the health care FSA and $5,000 to the dependent care FSA.dɪŋ / us / ˈspen. HSA (or HSA plus limited purpose FSA) comes down to your personal financial situation as well as your and your family's health.Sun Life’s Personal Spending Account With Sun Life’s enhanced Personal Spending Account (PSA), employees will benefit from a broad range of expenses in one inclusive list. The eligible expenses and exclusion in each of the categories are not comprehensive and are limited to the extent that are deemed reasonable by Alberta Blue Cross.YNAB, for hands-on zero-based budgeting. If you are eligible . Eye exam: You’re supposed to get an eye exam annually. HSAs and FSAs both help .

Personal Spending Accounts

Sign-in to mysunlife.A personal spending account is a type of bank account that allows you to save money and track your spending.YNAB: $15 a month or $99 a year (free year for college students) Quicken Simplifi: $4 a month, billed annually.99 a month for a year or a one-time fee of $19. Also read: Health Spending Accounts for Canadian Explained.

The Best Budget Apps for 2024

the money that is used for a particular purpose, especially by a government or organization: . They’re a great, tax-free benefit for small businesses to offer their employees, without breaking the bank.

A health spending account is a self-owned insurance plan employers create on behalf of their employees. Cost: Free for the basic version. Fidelity Smart Money.November 09, 2023. Everything you need in a spending account with all of the control you expect. Both HSAs and FSAs are great .

Health Spending Account vs Wellness Spending Account [Explained]

A flexible spending account, or FSA, is a tax-advantaged account offered by your employer that allows you to pay for medical expenses or dependent care.Plan members may also use a Health Care Spending Account to cover expenses after they go over and above the maximum provided by their standard benefit plan (e. Under the “Coverage information” you can find a list of eligible expenses under your PSA.Your Personal Spending Account (PSA) can help support the mental, physical, and financial well-being of you and your family.LendingClub offers a broad range of financial products and services including personal and business loans, auto refinancing, as well as personal and business banking accounts.A Personal Spending Account (PSA) provides employees with additional health and well-being options. The best part about a WSA? The CRA does not govern them! Employers can choose to offer anywhere . EveryDollar, for simple zero-based budgeting. Health spending accounts are also referred to as personal health spending accounts or private health services plans (PHSPs).No matter which type of flexible spending account you have, your FSA will work on a use-it-or-lose-it basis.

20 Ways to Use Up Your Flexible Spending Account

_featured.jpg#keepProtocol)

Add in a pandemic and work-life balance can be especially .Personal Spending Accounts.

What are the types of spending accounts?

99 for lifetime access. You can use a limited purpose flexible spending account (LPFSA) to pay for vision and dental expenses before you reach your deductible and sometimes for qualified expenses after you . • Please keep original receipts for your records. Read detailed benefit booklets, check coverage eligibility instantly, and check your health care spending account (HCSA) or Personal Spending Account (PSA) balances (if .Personal consumption expenditures (PCE) is the primary measure of consumer spending on goods and services in the U. Choisissez parmi 9 080 des contenus premium de Personal .Biden’s dramatic details don’t match the Defense Department’s official account of the plane crash. What this means is the money you put into your FSA must be used up in the course of .

What Is A Flexible Spending Account (FSA)?

The premium version is $1.

Personal Spending Account (PSA)

1 It accounts for about two-thirds . It allows employers to provide tax-free health benefits.99 for one month, $6.

Wellness Spending Account Eligible Expenses reference guide

Examples include: Gym, fitness centre, and . Money Market Account.

HSA, PSA, what the hay?

How Does a Flexible Spending Account (FSA) work? How To Use A Flexible Spending Account (FSA) . Ratings on app platforms and popularity among users point out options to consider.Personal Spending Account.Avoid the hassle of paper claim forms. This type of account allows you to set up a budget and plan for your future.

Group health spending accounts

Whether a company offers a “Wellness Spending Account,” a “Personal Spending Account,” or a “Lifestyle Spending Account” these are all the same.A healthcare spending account is a tax-free savings account as long as it qualifies as a Private Health Services Plan (PHSP) as described by CRA.Personal Spending Account • Sun Life Assurance Company of Canada, a member of the Sun Life Financial group of companies, is committed to keeping your information confidential.Our personal spending accounts offer a variety of unsurpassed features and benefits to match your needs.

Put more money in your workers’ pockets by offering personal spending accounts.Humana Access offers a comprehensive suite of spending account tools for its members. Call today, as people just like you will scramble to get an appointment before . Health Spending Accounts (HSA) have been increasingly popular in recent years for their flexibility in comparison to traditional benefit plans. Start your teen's financial .A lifestyle spending account (LSA) is a financial arrangement that provides employees with a specified amount to cover various personal and lifestyle expenses. Benefits received from the plan are non-taxable if PHSP conditions are met.A Wellness Spending Account (WSA), sometimes known as a Personal Spending Account (PSA), is a taxable benefit that provides additional health and wellbeing options beyond traditional benefits coverage.Under a Health Spending Account, plan members can be reimbursed for medically‐related expenses not covered by provincial health care plans. It’s divided into four equal chunks that are paid out three months apart (in January, April, July, and October).8 Best Personal Expense Tracker Apps of 2024. Get more financial . Let's Get Started. PSA’s provide . Plan members can enjoy the benefit without declaring it on their income tax return. The flexibility and range of options is what . • Please print clearly and be sure to complete all sections of your Personal Spending Account claim form. Empower Personal Wealth, for tracking wealth and spending .noun [ U ] uk / ˈspen. Unlike an FSA — which typically limits spending to strict categories like health, medical, or childcare costs — with an LSA, your employer can allow you to use funds on a wide range of expenses.Flexible Spending Accounts: Example .In the complex landscape of group benefits plans, two increasingly popular options are gaining attention: Health Spending Accounts (HSAs) and Personal Spending .Health Spending Accounts.Download: Android. Goodbudget, for hands-on envelope budgeting. These two accounts sound similar but comprise of different things.

Personal Spending Account Photos et images de collection

Submit claims, check claim status and filter your claim history, download personalized claim forms, find providers who submit claims for you, and sign up for direct deposit.A Lifestyle Spending Account is an account that employers deposit a set amount of money into every month, which .comRecommandé pour vous en fonction de ce qui est populaire • Avis

Ultimate Guide to Lifestyle Spending Accounts

Let's compare: Health Spending Account vs Wellness Spending Account. Specifically, I was looking for an .Personal care, entertainment, dining out and clothing should be included in your personal spending, so make sure you allow for them when you’re deciding how much to live on each week. Learn where to find the best HSAs and if an HSA is right for you.

What Is a Flexible Spending Account (FSA)?

Please use the information provided to you to register for the site and begin taking advantage of your spending account funds.

Best Health Savings Accounts (HSAs) Of April 2024

In general, any medically‐related expense that could be used to meet requirements for deductibility on a plan member's personal income tax return (in accordance with the Income Tax Act) is eligible for . You may also receive up . Earn interest while saving for life's big purchases, Teen Checking Account .

Products and services . Personal spending accounts offer great financial advantages for your workers to help . If approved, any reimbursement amount is usually deposited into your bank account within 2 business . Claims submitted either through the my Sun Life mobile app or through the web are usually settled promptly.