Pillar 1 and 2

On 20 December 2023, the Luxembourg Parliament voted to approve the draft Law n°8292 transposing the EU . Tax challenges arising from the digitalisation of the economy. Delays in legislation and implementation of OECD Pillar 2 may encourage some businesses to put preparations for this tax shake-up on the backburner. This work has delivered several important outputs covering both direct and indirect tax issues. The average increase of effective average tax rates . 2021 年10月8日,在一項歷史性協議中,136個國家批准一項協議以為國際租稅規定改革提供框架。. The two main overlapping areas are: the inclusion of . Delays in legislation and . Environmental and social risks are changing the risk profile for . Specifically, this can be achieved in the areas of EW and C2, where enhanced interoperability among partners could yield quick wins. 該協議敘述為達成租稅改革,執行兩大支柱方案的關鍵條件,並 .frRecommandé pour vous en fonction de ce qui est populaire • Avis

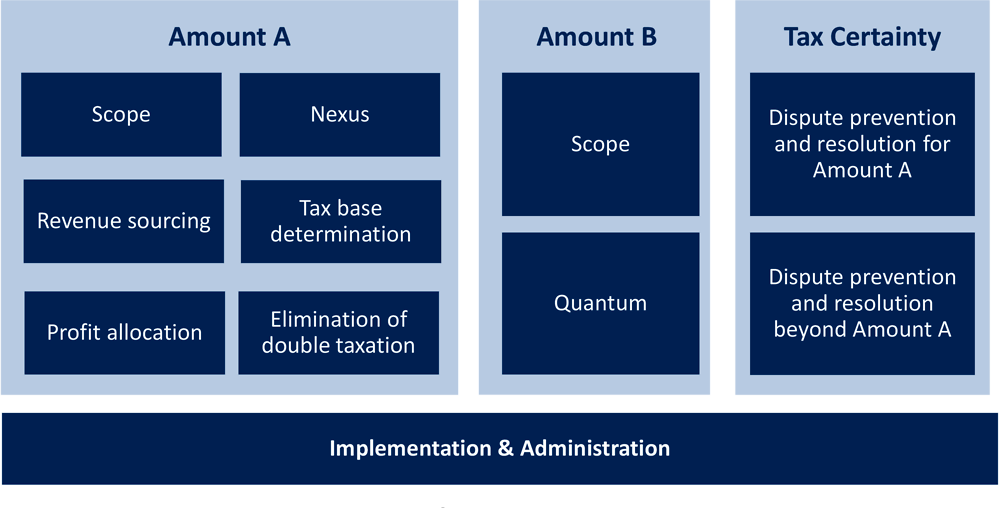

The OECD Pillar 1 and 2 Blueprints on a page

Mit dem „Progress Report on Amount A of Pillar One“ veröffentlichte die OECD am 11.

Implementing Pillar One & Pillar Two

The OECD’s Impact Assessment on Pillar 1 and Pillar 2

In October 2023, the Inclusive Framework's Task Force on the Digital Economy approved the release of a text of the Multilateral Convention to Implement Amount A of Pillar One, .Implementing Pillar One & Pillar Two.

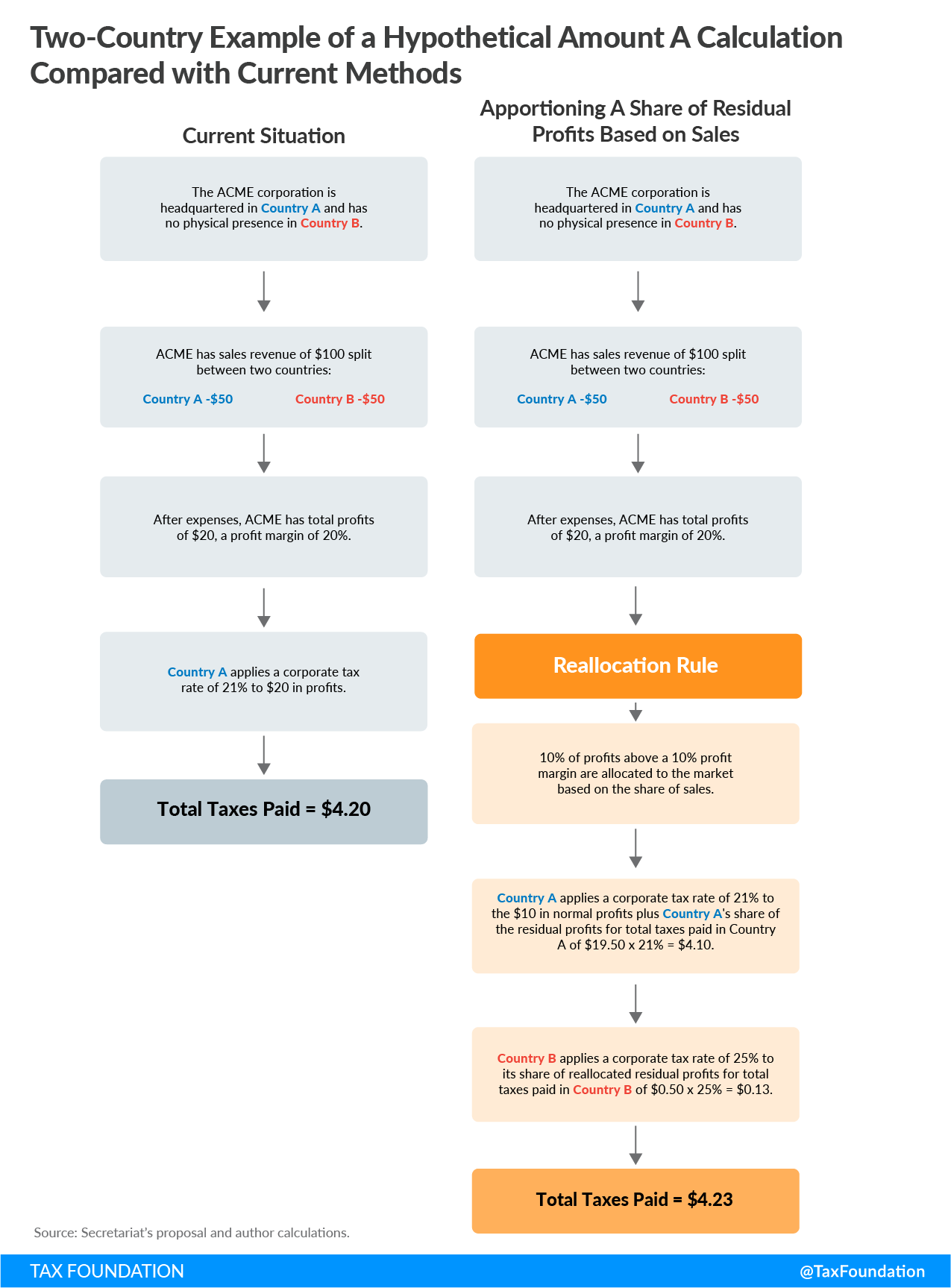

Pillars One and Two

Multinational enterprises across industries are likely to be affected.On October 8, 2021, the Inclusive Framework (IF) released an updated statement setting forth the key components for an agreement on a two-pillar solution to address the tax .The Pillar 2 requirement is a bank-specific capital requirement which supplements the minimum capital requirement (known as the Pillar 1 requirement) in cases where the latter underestimates or does not cover certain risks.For Pillar One, Amount A purposes, Article 5. With respect to Pillar Two, the global minimum tax rate of 15% is estimated to generate around USD 150 billion in new tax revenues globally per year. Pillar 2 in Luxembourg in few words.March 24, 2022. Hit Distance: 273 ft. On 12 July 2023, the OECD published a news update on the progress of work on Pillar One . How will the Two-Pillar Solution make sure that MNEs pay their fair share of tax? Each pillar addresses a different gap in the existing rules that allow MNEs to avoid paying taxes.On July 11, 2023, the OECD issued an Outcome Statement on Pillars 1 & 2 that gives an update on the status and timeline for implementation of Amount A and B of Pillar One.2022 einen überarbeiteten Zeitplan für das multilaterale Übereinkommen zur Umsetzung von Pillar 1 und leitet zugleich eine öffentliche Konsultation ein.Over 130 countries have joined the Pillar Two agreement (the Global Anti-Base Erosion Proposal, or ‘GloBE’) to reform international corporate taxation rules.

Deloitte OECD Pillar One and Pillar Two Modeling

這些國家是OECD/G20 BEPS包容性框架成員 (IF) (由140個國家組成)。. In this edition of TP On Demand we will provide an introduction to, and an outline of, the OECD’s proposals to reform the international tax system under Pillar 1 and Pillar 2, taking in the progress made by the G7, G20 and the OECD’s 139 country strong Inclusive Framework.

Pilier 1 & Pilier 2 : encore une nouvelle avancée significative

To do this, we will:Pillar 1: Capital Adequacy Requirements. The Organisation for Economic Cooperation and .

Pillar One: Profit allocation and nexus

lawPilier 1 & Pilier 2 : Actualités récentes (consultation lancée .Congressional opposition is that the benefits under Pillar 2 don’t offset the compromises under Pillar 1 where the US cedes much of its tax base to market jurisdictions.In October 2021, over 135 jurisdictions joined a ground-breaking plan – the Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy – to update key elements of the international tax system which is no longer fit for purpose in a globalised and digitalised economy. The intention is that a portion of multinationals’ residual profit (likely to be generated by . La solution reposant sur les 2 piliers sera présentée en amont de la réunion des ministres des Finances du G20 à Washington le 13 octobre, et Sommet des dirigeants du G20 qui se tiendra à .The OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting (BEPS) recently endorsed the key components of the two-pillar approach to international tax reform.

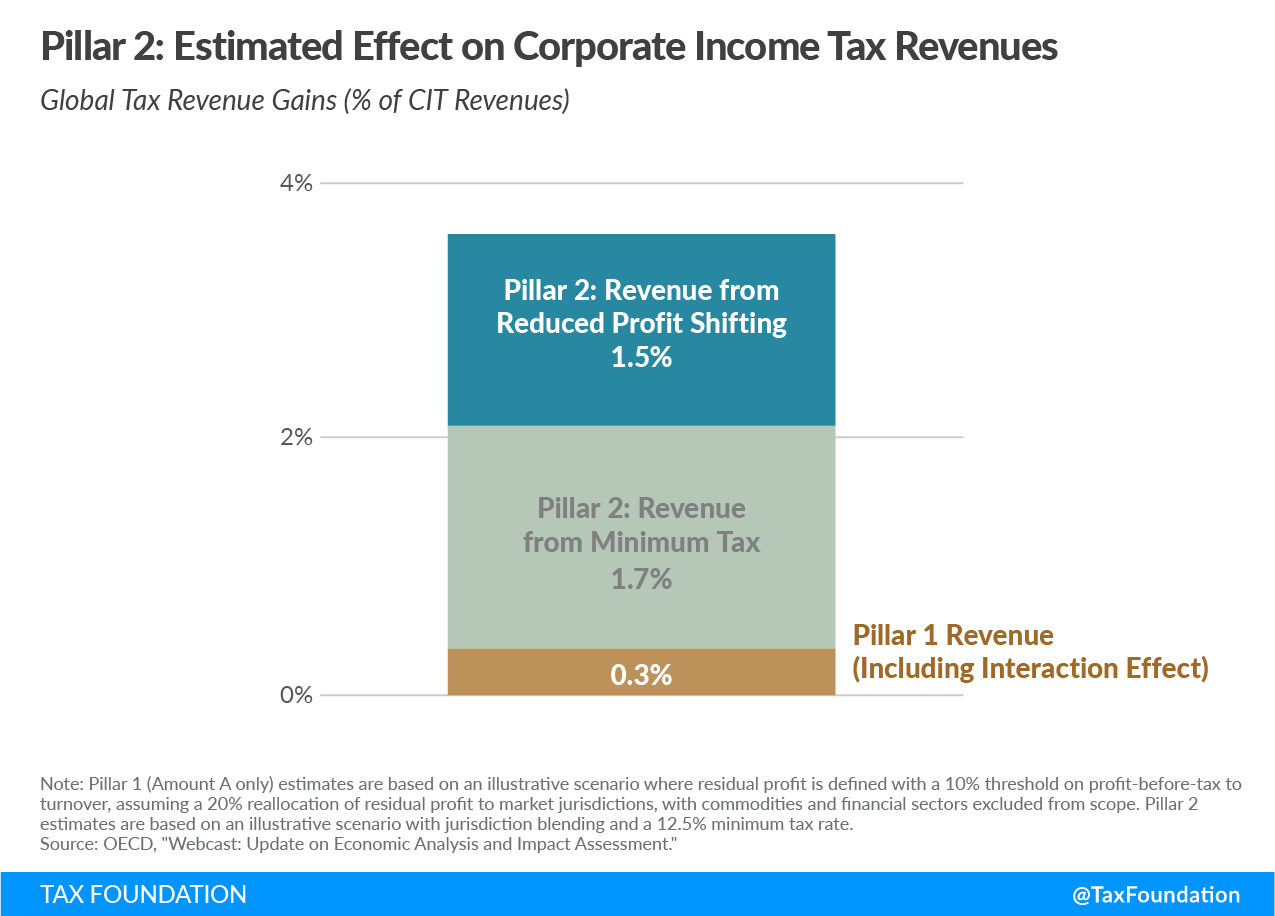

Launch Angle: 48°.It recommends targeted enhancements to accelerate the integration of environmental and social risks across the Pillar 1. figurative a pillar of smoke / flame. The global minimum tax, together with the Subject to Tax Rule, constitutes the second pillar of the Two-Pillar Solution developed to address those challenges.Daneben enthält Säule 2 eine „ Subject-to-tax-Regelung “ (STTR). EY: The economic impact assessment done by the OECD states that Pillar One would involve a significant change to the way taxing rights are allocated among jurisdictions, as taxing rights on .expected increase in tax revenues associated with Pillar One and Pillar Two is estimated to be less than 0.Pillar 2: Thematic support Through the Technical Support Facility, ILO thematic experts support their colleagues in country to provide very specific expertise, helping strengthen .

Pillar

The consultation ran until January 25, 2023, and the OECD issued further Amount B rules on July 17, 2023. We will closely monitor any further developments in this space and provide a timely update. It requires banks to maintain a minimum capital adequacy requirement of 8% of its RWA. These are the broad outlines of the proposed solutions.2(g) and Schedule F of the Progress Report on Amount A of Pillar One provides that assets and liabilities that are subject to fair value or impairment accounting in the Consolidated Financial Statements are taxed on a realisation basis – not fair value basis. La réforme de la fiscalité internationale vient de connaître une nouvelle . The countries of the Inclusive Framework aim to apply this global minimum rate of .

The aim of the Pillar is to ensure that multinationals (MNEs) pay a minimum effective tax rate of 15%. A key part of the OECD/G20 BEPS Project is addressing the tax challenges arising from the digitalisation and globalisation of the economy. The Organisation for Economic Cooperation and Development (OECD) is working full steam on the two-pillar solution of the Base Erosion and Profit Shifting (BEPS) 2.Deloitte’s OECD Pillar One and Pillar Two modeling service offering combines the deep expertise of Deloitte tax specialists with the analytical power of our technology solution to .Pillar One is a set of proposals to revisit tax allocation rules in a changed economy. something resembling this in shape or . A bank’s Pillar 2 requirement is determined as part of the Supervisory Review and Evaluation Process .On December 8, 2022, the OECD published a consultation document on Amount B of Pillar One. On 23 May 2023, the . The proposed enhancements aim to support the transition towards a more sustainable economy, while ensuring that the banking sector remains resilient. Pillar 1 is intended to be mandatory, while Pillar 2 is left to the discretion of .디지털화에 따른 새로운 과세권 배분기준(Pillar 1) 논의 현황. Whilst Pillar One and Pillar Two are separate and independent of each other, there are areas where they overlap.0: Pillar Two KPMG insights about the impact of the Pillar Two—global minimum tax rules—and how companies are responding The OECD/G20 Inclusive Framework on BEPS reached agreement on the Pillar Two global minimum tax rules in October 2021, putting out model rules in December 2021, commentary in March . Kevin Pillar hits a sacrifice fly to right field to give the White Sox a 1 . Additional benefits The Outcome Statement did not mention about the release date for these items. The Blueprints will be discussed at the 14-15 October virtual G20 Finance Ministers’ Meeting. Pillar 1 improves on the policies of Basel I by taking into consideration operational risks in addition to credit risks associated with risk-weighted assets (RWA).Tax challenges arising from the digitalisation of the economy.With Pillar 1 and Pillar 2, the OECD is seeking to address fundamental taxation issues.In October 2021, 136 countries agreed to be bound by the Pillar 1 and Pillar 2 proposals.Tax - Pillar 1 and Pillar 2. * 국가 간 과세권 배분기준 (Pillar 1) 및 글로벌 최저한세 . Pillar Two - GloBE Information Return and the second tranche of Administrative Guidance. Revenue impact Under Pillar One, taxing rights on more than USD 125 billion of profit are expected to be reallocated to market jurisdictions each year.The political and technical effort invested into progressing with Pillar 1 and 2 proposals underlines the consensus on the need for a multilateral solution, preventing a .Par Thierry Morgant, Julien Pellefigue, Marine Gadonneix, Alice de Massiac / 8 octobre 2021. (Architecture) an upright structure of stone, brick, metal, etc, that supports a superstructure or is used for ornamentation.

Global Flagship Programme: Building social protection floors for all

International tax - OECD Pillar 1 and 2 Act now, make tomorrow easier and increase competitive advantage.0 developments: Pillar One and Pillar Two.

Pillar Two Model Rules in a Nutshell

A new two-pillar solution to reform international taxation rules .

Pillar Definition & Meaning

The agreement has set an ambitious and challenging timeline for both Pillars and whatever the final rules, most global businesses of any scale are likely to be impacted.0 proposals has met with great interest, with over 200 .Pillar Two tax legislation has been implemented in over 35 countries, with certain provisions becoming effective as of January 1, 2024. The OECD update on Pillar One and Pillar Two of BEPS 2.

1 percentage point would be due to Pillar 1, with Pillar 2 accounting for the remaining share. First, Pillar One applies to the biggest and most profitable MNEs and re-allocates part of their profit to the countries where they sell their products and provide their services, . Check out the latest .The OECD’s estimates show that, as a result of Pillar 1 and Pillar 2, effective average tax rate s would increase by approximately 0.Guernsey was among 130 members of the Inclusive Framework to join the Statement on a Two-Pillar Solution to Address the Tax Challenges Arising From the Digitalisation of the Economy - 1 July 2021 (oecd.AUKUS Pillar Two can be used to deliver the quick wins necessary to ensure the immediate success of the agreement and increase member countries’ collective technological advantages.PILLAR meaning: 1 : a large post that helps to hold up something (such as a roof); 2 : someone who is an important member of a group + of.Pilier 2 : il faut se préparer avant 2024 - CMScms.洞察觀點 ›.Two-Pillar Solution.L’OCDE élaborera des règles types pour la transposition du Pilier 2 dans la législation nationale des pays courant 2022, en vue d’une prise d’effet en 2023. The Multilateral Convention to . Act now, make tomorrow easier and increase competitive advantage. Basel II also provides banks with more informed . Die STTR zielt darauf ab, bei bestimmten grenzüberschreitenden konzerninternen Zahlungen eine Mindestbesteuerung sicherzustellen, und insbesondere Entwicklungsländern die Möglichkeit zu geben, Besteuerungsrechte zurückzuerhalten. Dies ist ein wesentlicher Baustein, um .org) establishing a new framework for international tax reform.0 Developments: Pillar One and Pillar Two. The OECD’s request for public comments on the BEPS 2. Almost half of the multinationals (MNEs) subject to Amount A are US-headquartered and as the future revenue threshold decreases, more US MNEs will be subject to Amount A. International tax - OECD Pillar 1 and 2.Data and research on tax including income tax, consumption tax, dispute resolution, tax avoidance, BEPS, tax havens, fiscal federalism, tax administration, tax treaties and transfer pricing.10월 BEPS 포괄적 체제 (Inclusive Framework) 137개국이 디지털화로 인한 조세문제 해결을 위한 2개 Pillar* 성명서에 정치적 합의. But the heightened uncertainty created by these delays makes adapting now .

Based on the documents sent to the G20, the Finance Ministers will likely offer an extension of time to negotiate a consensus .a strong column made of stone, metal, or wood that supports part of a building: A row of reinforced concrete pillars supports the bridge. Therefore any gain or loss on revaluation is excluded and the . Die Verschiebung des Inkrafttretens auf 2024 wurde zuvor bereits angekündigt.