Portfolio diversification checker

If you have opted for running account, please ensure that your broker settles your account and, in any case, not later than once in 90 days (or 30 . Arnott, CFA Apr 16, 2024.Achieving investment portfolio diversification is all about striking the right balance between risk and potential for financial reward.This portfolio backtesting tool allows you to construct one or more portfolios based on the selected mutual funds, ETFs, and stocks.Calculating Portfolio Diversity involves using the PD formula: PD = (1 – Σwi^2) Where:PD is the Portfolio Diversity. With our proprietary Diversification Score® tool, an investor can . Diversification is the Key: .Katherine: OK, but with how the market’s been, I just don’t want to set up my portfolio to fail.Updated September 20, 2022.Temps de Lecture Estimé: 6 min

Calculate your investment portfolio diversification with Sharesight

Cost: Limited free version and fee-based options. There are many types of .We aim to examine the portfolio diversification effects of sustainable assets on financial and energy market assets from two new bird’s-eye perspectives of distribution normality and CVaR-return optimization, which can widely include the magnitude of the portfolio’s price return distribution and which are consistent with those of sustainable .Portfolio stress testing is a way to evaluate if a portfolio is truly diversified, by evaluating its performance during specific adverse scenarios. Darauf würden noch die möglichen Investitionen in andere Anlagen kommen.Measure Diversification to Reduce Portfolio Risk.

The Dangers of Over-Diversifying Your Portfolio

Updated April 11, 2024. The calculator takes . Treasury bills (like SGOV), U.Why Simpler Has Been Better for Portfolio Diversification.The 4 Top Portfolio Management Apps.

Portfolio Diversification Done Right

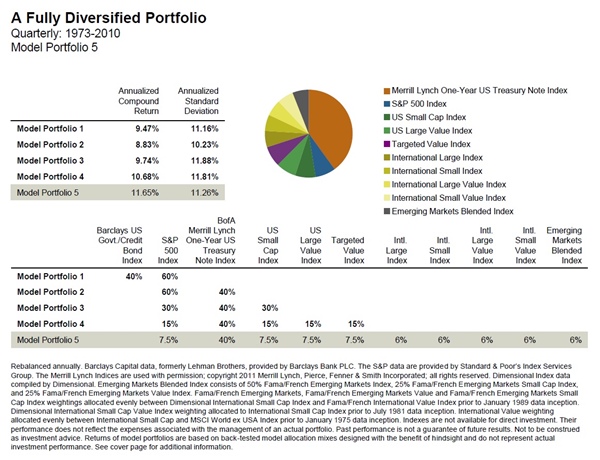

This factor changes dynamically, so focus on portfolio . Request new OTP in 00: 60.Diversification won’t help in every market, and it doesn’t . You can analyze and backtest portfolio . Now, technically step 3 is optional but as someone who is really interested in investing, I think it's crucial.Our asset allocation tool shows you suggested portfolio breakdowns based on the risk profile that you choose. Backtest Asset .Here is a 4-step guide to diversification.

Asset Allocation Calculator

Complete investment portfolio tracker.You have invested a high amount in just one sector.

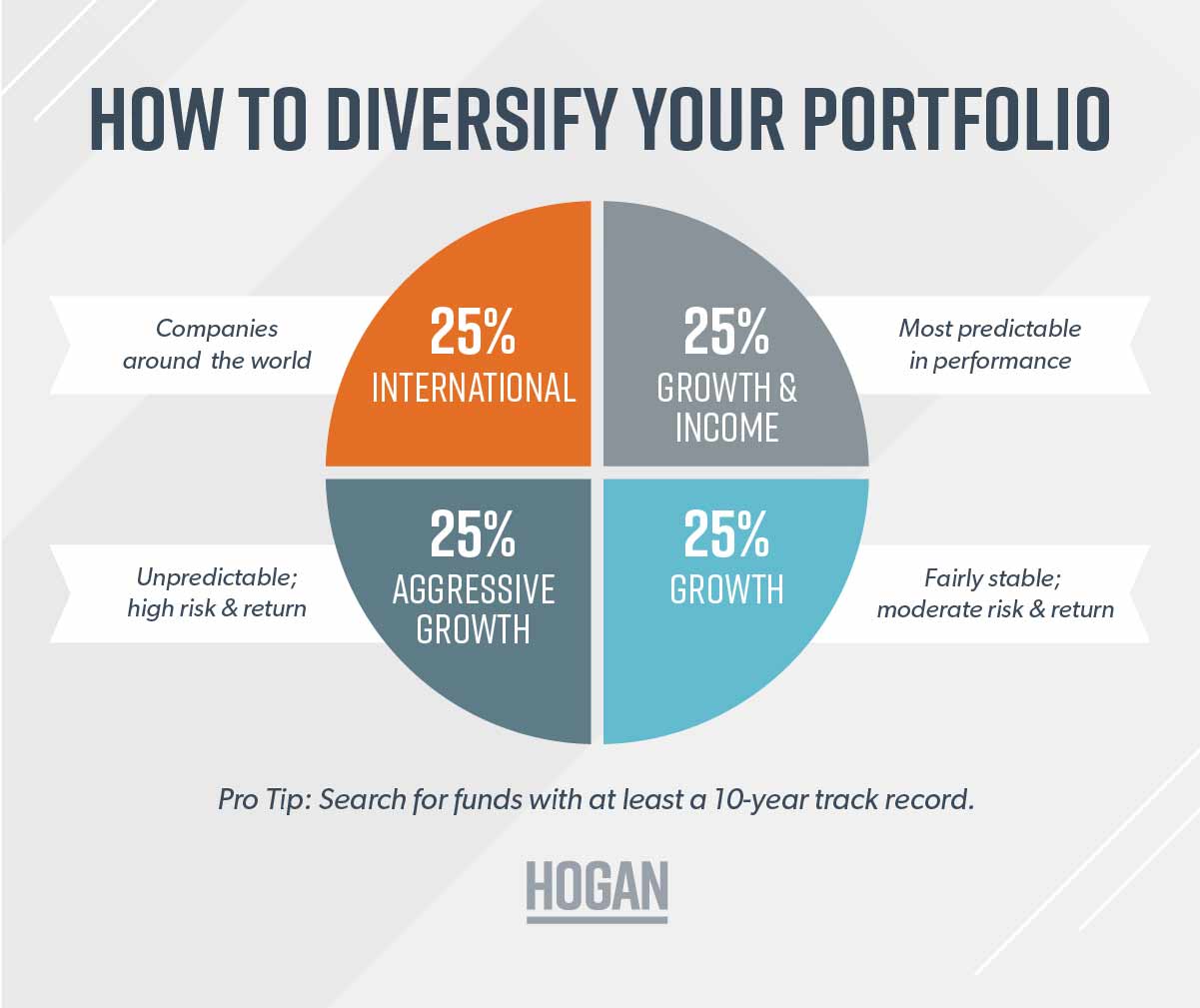

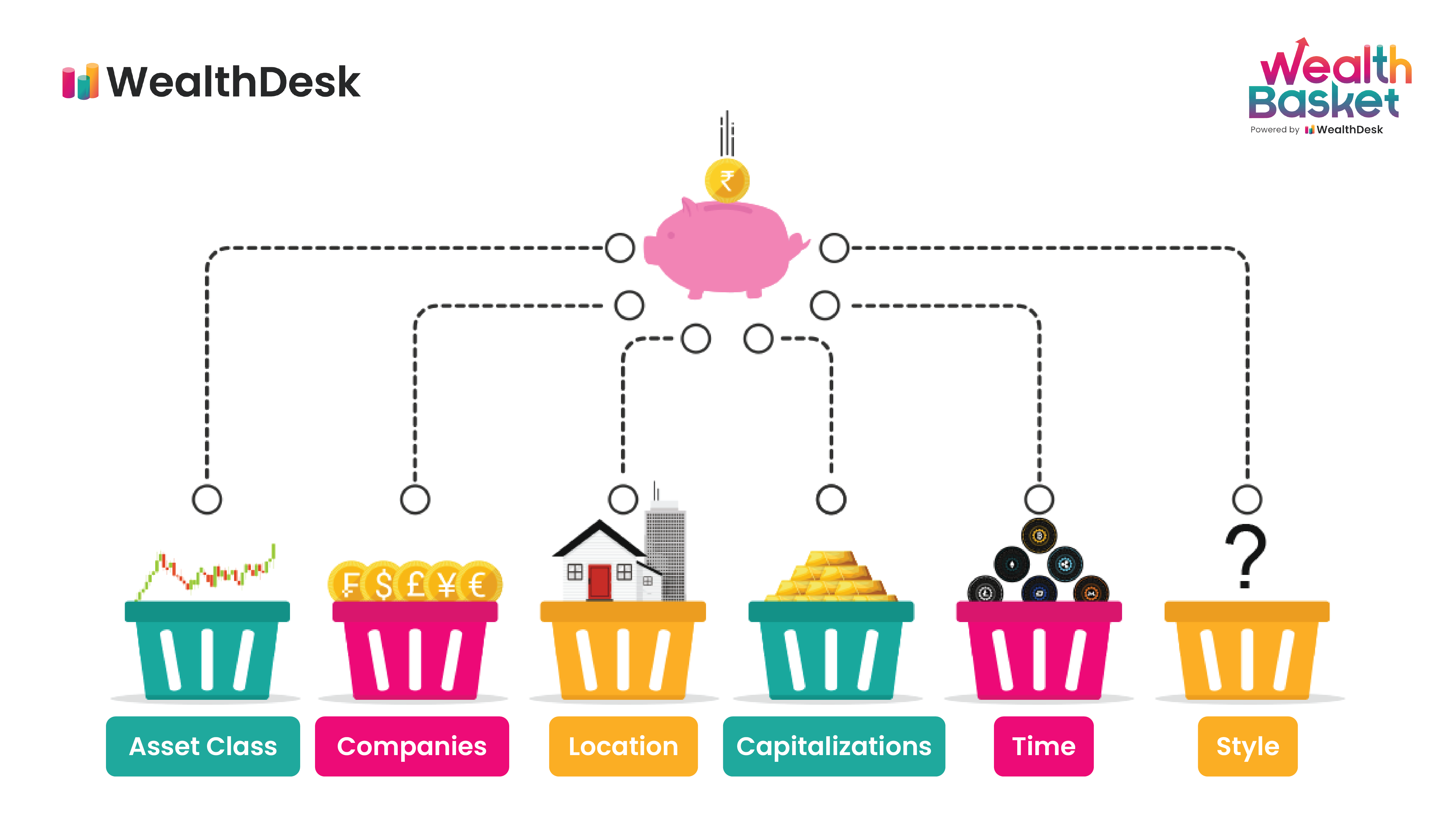

Ways to Achieve Investment Portfolio Diversification

Si vous souhaitez avoir un portefeuille diversifié, vous devez rechercher différents investissements d’origines .

Backtest Portfolio Asset Allocation

The Importance of Diversification

The museum has a .

Portfolio diversification is rooted in something called Modern Portfolio Theory, which is a strategy that focuses on investing in different asset classes as a way to reduce a portfolio's.

Gallery of Examples

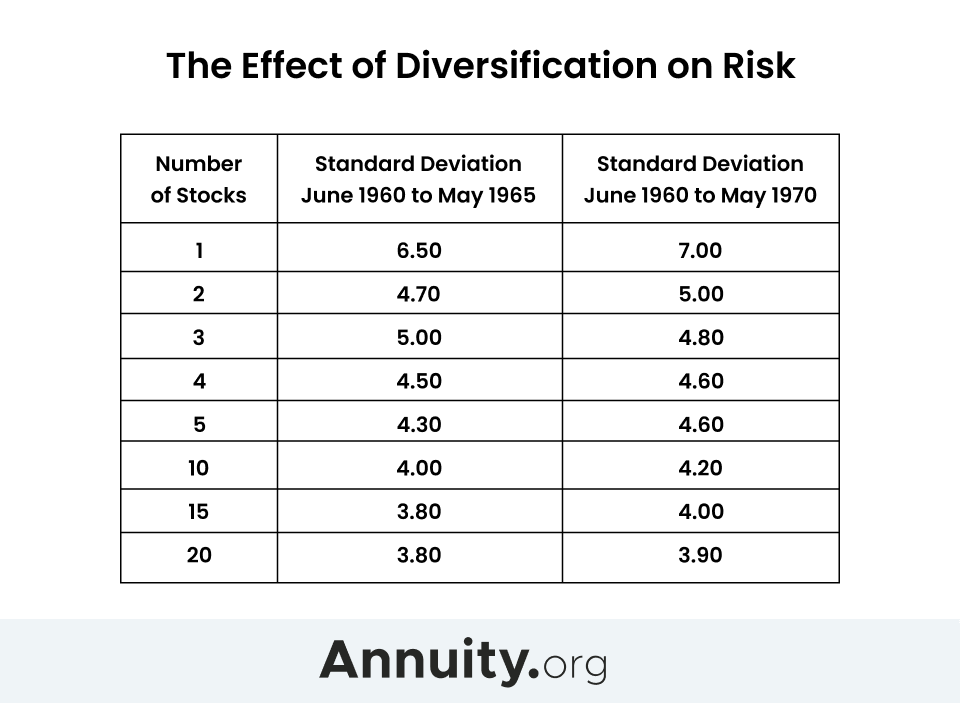

Diversifying your money into multiple investments can help reduce your portfolio’s risk. The 2024 NFL Draft prospects are putting their best . Treasury bonds (like TLT), short-term U. There are several things that investors do to protect their portfolios against risk.Step 3: Using Portfolio Visualizer to tinker with my allocation.Mutual funds have a reputation for having built-in diversification — but that’s not always true. Investition von 2000€ pro Einzelaktie empfehlen und bei min. Carole: So, here’s the thing. There are several tools available online, such as Morningstar and Value Research, that . Determine the weight of each asset as a decimal (the proportion of your total portfolio .000€ vorhanden sein um eine gute Diversifikation zu ermöglichen. Here's how to build a diversified portfolio, with five examples.Quantifying how diversified is a universe of assets. Check the frequency of accounts settlement opted for. This gallery of examples highlights typical use cases of the different tools provided by Portfolio Visualizer. If you don’t pay attention to your fund’s specific portfolio, you could actually end up . Use your Schwab Portfolio Checkup™ to: Check your sector and fixed . wi is the weight of each asset in your portfolio.Check to make sure your portfolio is still diversified and aligned to your goals and risk tolerance.Mutual fund portfolio overlap research tools helps to know portfolio overlap when you invest in two or more different funds investing in the same asset.Over-diversification will turn the portfolio unfavourable in the long run and will simply be cumbersome and expensive for the investor. Essentially, it follows the principle of not concentrating all investments in one area. Effective Rebalancing for Greater Risk Adjusted Returns. Private & Secure Wealth Tracking. Portfolio tracker to track stocks & MFs.

Gallery of Examples. Fact checked by Marcus Reeves.The portfolio analysis tool assists in creating a complete picture of your entire portfolio, including portfolio rebalancing, diversification, risk and return analysis, asset allocation information, historical performance data, benchmarking, and tax efficiency analysis.Portfolio Visualizer is the second free tool that I use on a regular basis to check on my investments and optimize my allocation and diversification. The mutual fund portfolio overlap tool lets you compare and know the extent of commonalties between the portfolios of 2 or 3 equity funds. stocks (like VTI), and gold (like . Manage your Stock and Mutual funds easily. Portfolio Visualizer is the second free tool that I use on a regular basis to check on my investments and optimize my allocation and diversification. Select each tab to compare your current portfolio allocation relative to your target asset allocation. MPT was first created by Harry Markowitz in the 1950s, and he eventually won a Nobel Prize for it. This property . Also, helps you to check your allocation to mutual funds and if it reflects your profile. is to spread a portfolio across multiple asset classes, such as stocks, mutual funds, bonds, and cash.Mutual fund portfolio overlap tool.Balance is an important part of life, and that’s true when it comes to your portfolio as well.

How to Diversify Your Portfolio in 2021

There aren’t many easy-to-find tools on the web or elsewhere to help an investor check how well diversified a portfolio is.

Check out the video recap for our latest Trader Survival Guide on Portfolio Diversification to find out why it's vital in helping traders and investors manage risk. Make sure your mobile number matches the one linked to your PAN, and verify .One effective tool for investment advisors to determine the amount of diversification necessary for a portfolio is modern portfolio theory (MPT). Fractions d’actions, immobilier et métaux précieux. Arnott, CFA Apr 10, 2024 .Here are the best two ways after which you’ll be able to reduce mutual fund overlap in portfolios. We have sent a unique OTP to your specified mobile number. From Property 7, the minimal correlation between a long-only portfolio invested in a universe of assets and at least one asset in that universe is equal to the inverse of the squared diversification ratio of the most diversified portfolio, $\frac{1}{DR \left( w_{MDP} \right)^2}$. 15 Stocks That Have Destroyed the Most Wealth Over the Past Decade.

Diversified Investment Allocation Tool

Swift has been a supporter of the museum, Rush said.When allocating to diversifiers from equities, as represented by the S&P 500 TR index, the tool shows that the resulting portfolios historically generated higher returns and lower .There is little difference between owning 20 stocks and 1,000, as the benefits of diversification and risk reduction are minimal beyond the 20th stock.Take control of your investments today by unlocking the insights that true portfolio diversification can offer.The 40/30/30 portfolio showed a reduced correlation to the performance of stock and bond markets. For instance, index fund investments result in 100% mutual fund overlap due to shared underlying indexes. Select a Benchmark.

/ModernPortfolioTheory1_2-8e6110a86b02462c89b401a46ad2118f.png)

Free Portfolio Analysis

Step 2: Ensure that the portfolio has both high-risk and low-risk funds. There are no holdings in this portfolio! Use . And while you may be thinking of diversification, which is an . And that’s because no asset class (whether we’re talking equities, bonds, alternative investments - such as commodities, property or cash) performs well all the time. We use historical returns and standard deviations of stocks, bonds and cash to simulate what your return may .

Consider the fallout from . You would have left nearly $14,000 in returns on the table due to your diversification. However, because you diversified 40% or $1,200 into the bond fund, your bond investments would be worth $1,286 and your XLK shares would be worth $22,603. This is how your investments are spread across multiple sectors and industries.

Diversification Calculator

Portfolio diversification aims to mitigate the impact of underperforming individual investments by incorporating a mixture of assets with varying risk and return characteristics.

50 Aktien (Annahme 2% der Wertpapiere) wären das 100.

Analysis

Please check the information provided.Free Portfolio Analysis: Asset Allocation, Portfolio risk, Portfolio Diversification. Holding different asset classes is still .Portfolio Tracker. fixed income, equity and gold. Qu’est-ce qu’un portfolio ?

How to Build a Diversified Portfolio

Finally, some risks simply can't be diversified away.

How to Diversify Portfolio Across Different Classes

Portfolio Modeling and Analysis.In finance, diversification means reducing portfolio risk by investing in a variety of assets that do not move in lock-step with one another. Sharesight is a portfolio tracker that can monitor the performance of your investments using data that's .All diversification really means (in investing terms at least) is that it’s a good idea to have a mix of investments in your portfolio as it can help reduce risk.Wir würden deshalb eine min.

You can also invest in mutual funds, index funds, and ETFs.

Mutual Fund Portfolio Overlap

Portfolio Diversification

If you had just left that $10,000 investment alone, your portfolio would be worth $36,418 today.Diversification across different classes.The easiest way to identify mutual fund portfolio overlap is to compare the portfolio holdings of two or more mutual funds.the traditional belief that the way to reduce risk.The permanent portfolio has the same investment objective as the all-weather portfolio — to perform well under any set of market conditions — but utilizes one less fund. Investors should note that real estate is also an . Visual Analysis and Optimization for .

Free tools for portfolio analysis

You can use this data to assess the performance and health of your portfolio.Diversifier votre portfolio pour une répartition optimale des risques.

The Diversification Ratio: Measuring Portfolio Diversification

Reviewed by Andy Smith. Keep track of your investments with real-time information.