Possessory interest in real estate

Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité. With a possessory lien, the lender holds onto the underlying.What is a Possessory Interest? A taxable possessory interest (PI) is created when a private party is granted the exclusive use of real property owned by a non-taxable . A leasehold provides the tenant with a present possessory interest in real property that will revert to the freehold estate owner at the .

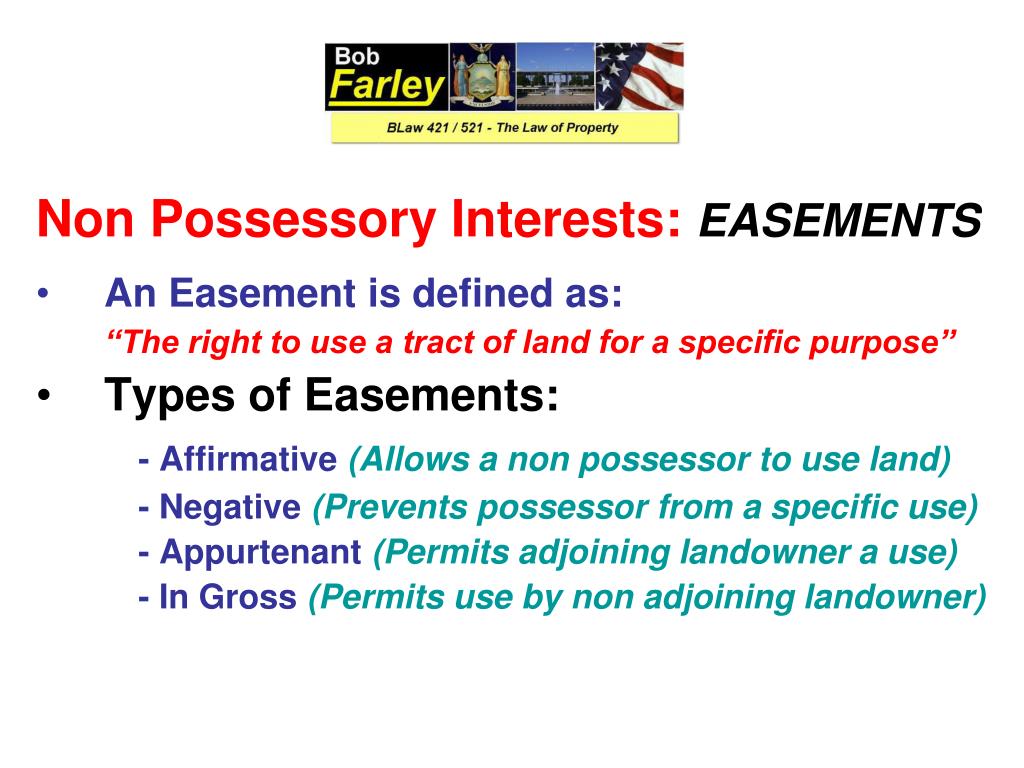

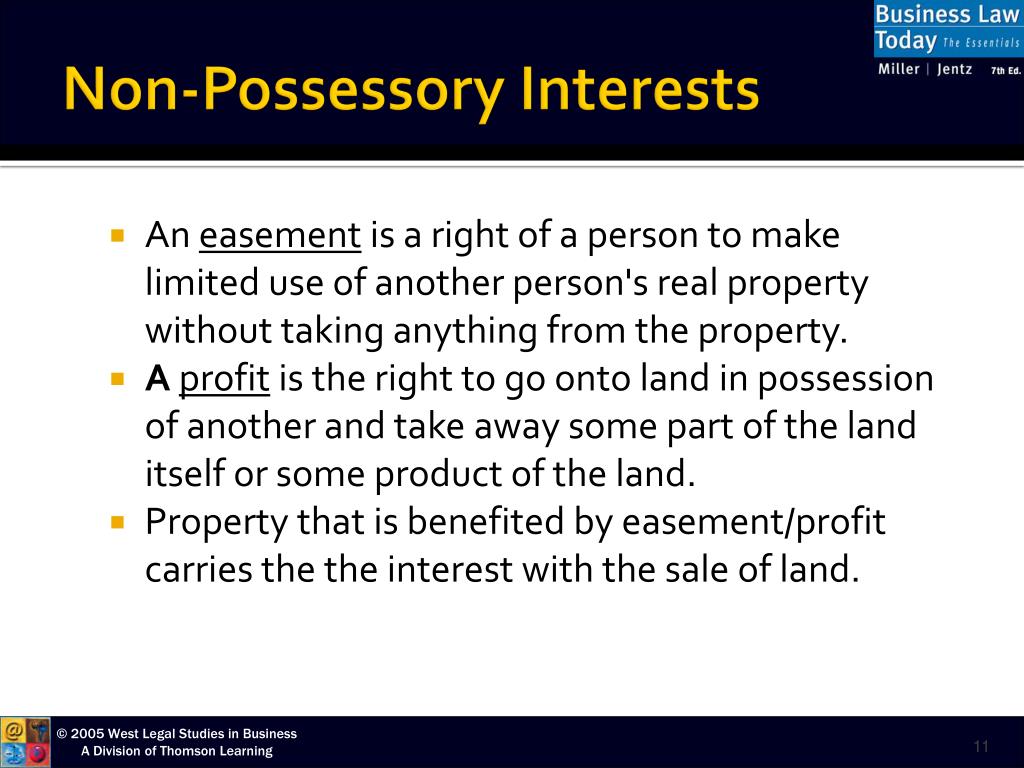

Tax Sales and Non-Possessory Interests in Real Estate

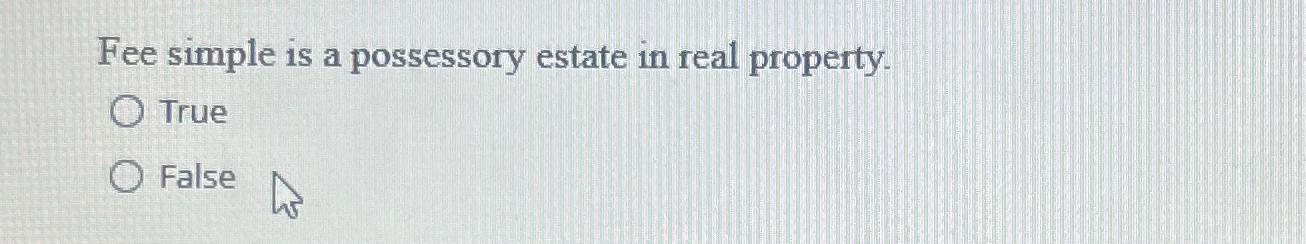

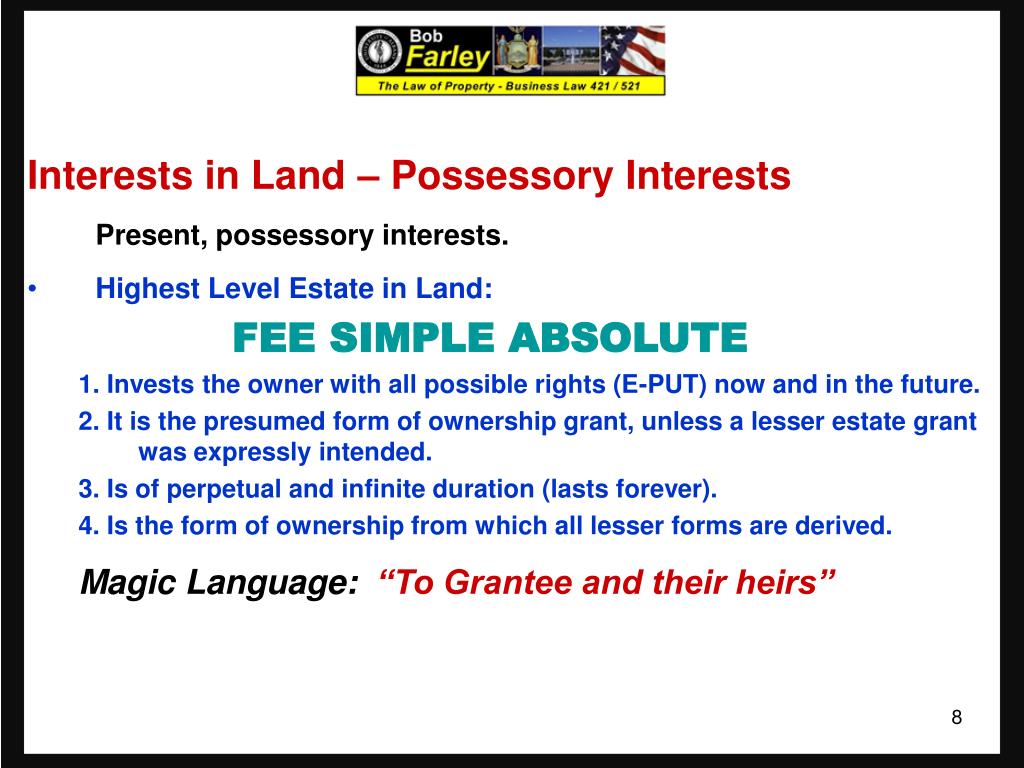

Estates are of many kinds, but one generic difference is between ownership estates and possessory estates. The history of possessory interest can be traced back to English common law, where it .Tax Code Section 23. easement and freehold estates b. Last updated: Jul 19, 2021 • 5 min read.Possessory Interests in Real Estate | Casetext. Possession, however, does not grant proprietary rights, but only possessory rights. This is different from a future interest, which is a right to possess the property in the future.A legal title entails numerous responsibilities, such as the upkeep, use, and ownership of real estate. The first installment of this new series introduces the .A Non Freehold Estate (leasehold) is a type of estate whereby the holder of the estate has possessory rights and interest to a property, albeit will terminate at some point in favor of the FREEHOLD Estate owner(s). Taxable Leaseholds.Possessory and nonpossessory liens are legal claims to an underlying asset that secures a debt or other financial obligation.Real Property Nonpossessory interests—claims, limitations, liabilities, or charges—that are attached to real estate are also called encumbrances since they encumber or burden a .Possessory Interests in Real Property. Real Property: Future Interests (click to enlarge)Use of the term and its application in this connection have resulted in confusion and misunderstanding of appraisal terminology and misapplication of . A person whose life determines the length of a life estate. Fee simple estates and life estates are ownership estates, while . Express grant or reservation in an instrument of conveyance (i. Posted by ft Editorial Staff | Aug 8, 2021 | Feature Articles, Real Estate, Video | 0. For example, a tenant with a long term lease has a possessory interest, .Possessory Interests Held in Real Estate | firsttuesday Journal. However, the appraised value may not be less than .

At common law vested interests were alienable even if they had not become . Because the life tenant's rights will revert to the remaindermen at the end of the life estate, he or she also has an obligation to make repairs and pay taxes and interest .The two main types of property interests in real estate are possessory and non-possessory rights. A taxable leasehold or other possessory interest in real property that is exempt from taxation to the owner of the estate or interest encumbered by the possessory interest is appraised at the market value of the leasehold or other possessory interest. As a result, the transfer of property when it is owned, is more difficult . The individual holding.The amount and type of interest that an individual has in real property is called an estate in land.This includes anything from blocking the street or sidewalk, drinking in public and/or public intoxication, fighting, public urination or defecation, vandalism, littering, etc.

The person in possession of the property on the lien date is liable for the entire subsequent fiscal year’s taxes. freehold estates and leasehold estates C.

Property Ownership Interest in Real Estate

An interest in property that entitles the holder to possess and occupy the property, now or in the future; an estate, which may be either a freehold or leasehold. Abstract: A new term, possessory interest, purporting to describe a lessee’s interest in tax exempt real estate for ad valorem tax purposes, has been coined in California.

Possessory Interests in Real Estate

• Foreclosure on the property for non .

Your Guide to Laws for Homeowners in Los Angeles

An ownership interest in real property is a combination of a bundle of different rights, the rights to possession, use, transfer, encumber and exclude.En savoir plus

Real Estate and Manufactured Homes Assessments

easements and liens D.Let’s discuss how these issues apply to Right of Way, Easements, and Partial Interests in Land.

A Simple Explanation of Taxable Possessory Interest

An interest might allow its .Possessory Interests in Real Estate (2:45) - YouTube. easements and freehold estates B. Any writing purporting to assign or transfer a leasehold interest or possessory interest in residential property under a lease for a term of more .Possessory interest is similar to future interest where all rights to the property legally are bestowed for a certain amount of time by the owner until an event, such as termination of . However, a holder of a possessory interest frequently pays significantly less property tax than the private owner of a similar property. Possessory Interest .real estate owned by a government agency for its exclusive use, a taxable possessory interest occurs.What is Possessory Interest? - CourthouseDirect. This term is commonly used in the field of real estate law and allows a person to retain ownership and control of property even if they do not have legal title to it.

possessory estate

The first chart shows present possessory freehold estates in land, including fee simple/fee simple absolute, fee tail, fee simple determinable, fee simple subject to condition subsequent, fee simple subject to executory interest, life estate, and life estate pur autre vie. • The death of the owner. freehold estates and leasehold estates c. Possessory interests are interests in real property that exist as a result of: (1) A possession of real property that is independent, durable, and exclusive of rights held by others in the real property, and that provides a private benefit to the possessor, except when coupled with . • Written by: Walter R. Unfortunately, no provision is made for the Assessor to prorate the taxes if the possessory interest is terminated after the lien date.The debtor’s interest in property also includes “title” to property, which is an interest, just as are a possessory interest, or lease-hold interest, for example.Simply put, the remainder interest is a property interest that takes effect only after the termination of the prior estate (the life estate), so it is a future possessory interest in . The result of Segal v.Simply put, the remainder interest is a property interest that takes effect only after the termination of the prior estate (the life estate), so it is a future possessory interest in real estate.

Possessory Interests in Real Estate (2:45)

orgRecommandé pour vous en fonction de ce qui est populaire • Avis Among ownership estates, the principal division is between present estates and future estates.A taxable possessory interest (PI) is created when real estate owned by a government agency is leased, rented, or used by a private individual or entity for their own exclusive .comWhat Is Taxable Possessory Interest (PI)? In real estate, the right of a person to occupy and/or exercise control over a particular plot of land; distinguished from an ownership interest. The statutory rights of dower and curtesy gave the non-owning spouse a right to a life estate in one-half of the real property owned by the other spouse at the time of that . liens and leasehold estates, Which statement about a fee simple absolute estate is FALSE ? A.courthousedirect. Not recognized in all states.auRecommandé pour vous en fonction de ce qui est populaire • Avis

Possessory Interests in Real Property

This is often used to calculate how . An interest held by a married person in the real property owned by a spouse; refers tp a husband's interest in his wife's property. 375 (1966), is followed, and the .Summer 1978, Vol 3, No 1.A possessory estate, also called a present possessory estate, is a type of property ownership where the holder has the present or current right to possess the real . names real estate . A person who has a property right or a claim against property is said to have an interest in the property.

Right of Way Easements and Partial Interests in Land

Future, Remainder & Executory Interest

, the sale of property).

Common Equitable Interest Examples

what are the two main types of possessory interest in real estate a. A life estate is a type of joint ownership of real property with ownership “split” between a present interest and a remainder interest. Written by MasterClass. Fee simple estates and life estates are ownership estates, while leasehold interests are possessory. A.

What Is Taxable Possessory Interest (PI)?

Possessory interests are interests in real property that exist when a person or entity leases, rents or uses real estate owned by a government agency for its exclusive use .A present possessory estate in land is an interest where you have the current right to possess and use the real property.A possessory estate, also known as a present possessory estate, is a type of real property ownership where the holder has the current right to possess the property.Chapter 3: possessory interests in real estate.The tenant may have a possessory interest for any specific term, such as 1 month, 1 year, 5 years, or 99 years. easements and liens d. Abstract: A new term, possessory . A future interest is an estate in land where you have a present interest . of the property covenant of warranty prepayment clause covenant of seizin, A mortgage is BEST defined as a legal document that: a.A possessory interest in real property; either a freehold or a leasehold estate.Study with Quizlet and memorize flashcards containing terms like Which of the following is NOT a minimum mortgage requirement? By Barbara Strapp Nelson. Physical Considerations.Possessory Interest Definition.

Estates

For real estate in New Jersey acquired by a married person prior to May 28, 1980, a life estate interest was provided by means of dower for the wife and curtesy for the husband.The lien date for real property tax is January 1 each year. While an estate in land grants the right to possess the property, an interest, such as an . I hearby convey to A the right to use XXXX of my property for XCCC to access A's property.Possessory interest refers to the right of an individual to occupy a piece of land or possess a piece of property.Section 20 - Taxable Possessory Interests (a) Possessory Interests. A person with a possessory interest does not own the property, but . Improvements such as buildings exemplify improvements on the land, whereas utilities or drainage facilities are .A Guide to Ownership Interest in Real Estate. easement, deed, recorded plat) 2.

Manquant :

possessory interestOwnership not only provides possessory rights, such as the right to use the property, but also proprietary rights, such as the right to dispose of property or to transfer it to another person. Click the card to flip 👆.The problem with it is that future interests may vest (“vest in interest”) before they have become possessory (“vest in possession”), if there is no precedent condition to their becoming possessory other than the natural expiration of the preceding estate. Although this type of ownership appears to be absolute, there are some circumstances in which it can .1 The taxation of this interest is similar to the taxation of owners of privately owned property. - Lawpathlawpath. creates an obligation to repay a loan under specific terms b.Who owns the property when there is a life estate?

Ownership interest in a property involves access to the bundle of rights that are granted with .

possessory interest

Some events that will end a freehold estate include: • The transfer of the property to someone else (e. Download (PDF) Summer 1978, Vol 3, No 1.

An estate is an interest in real property.