Present value annuity table pdf

Present Value of an Annuity with Continuous Compounding.

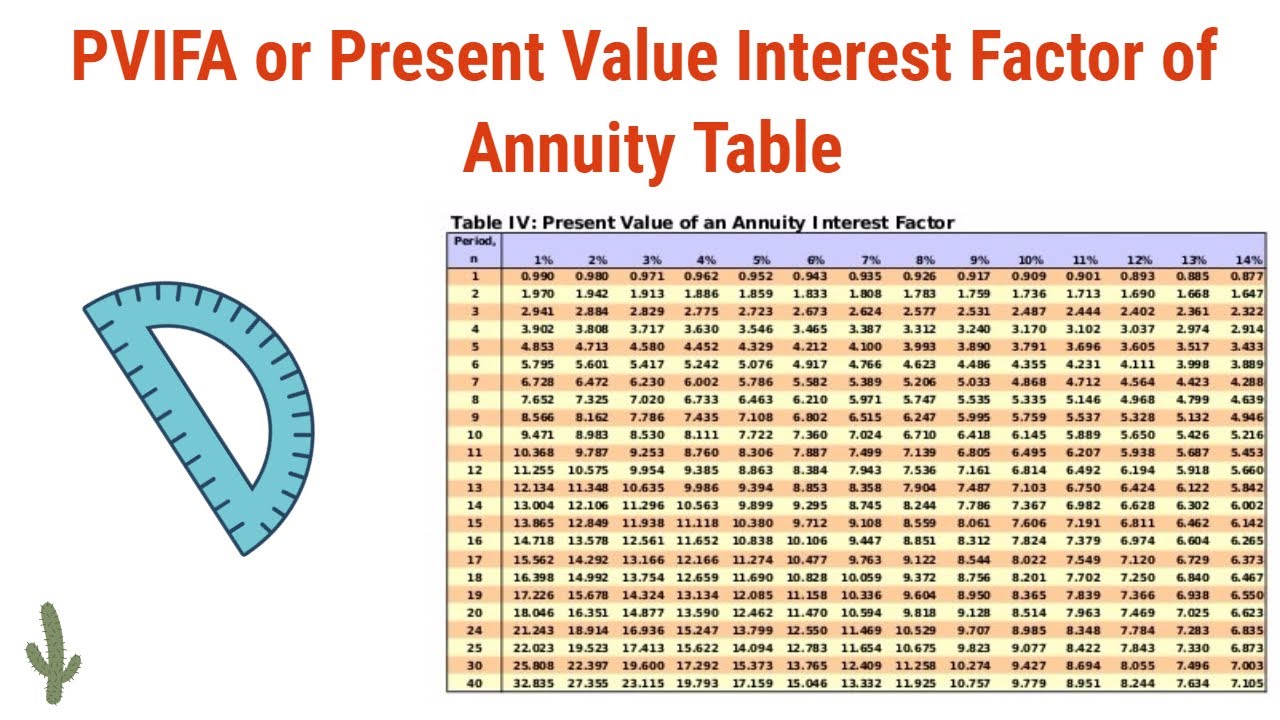

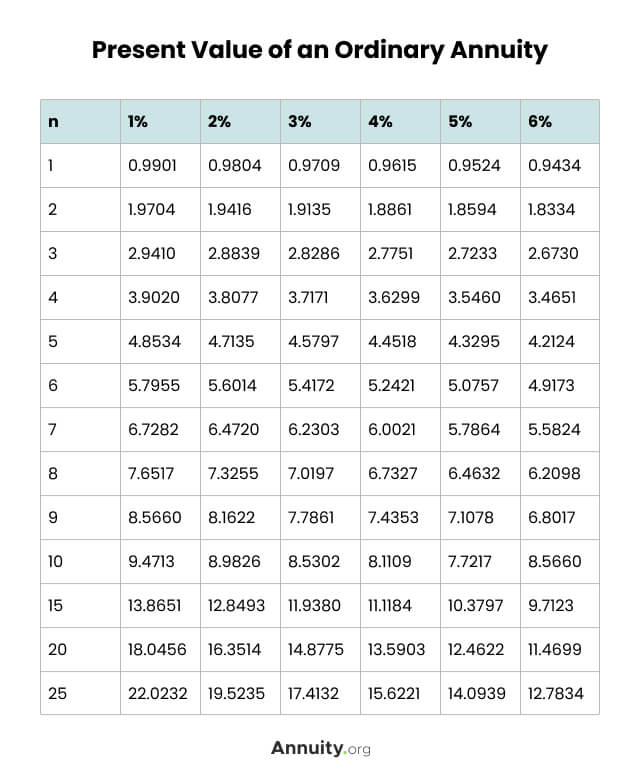

Present Value Interest Factors Annuity (PVIFA) Table

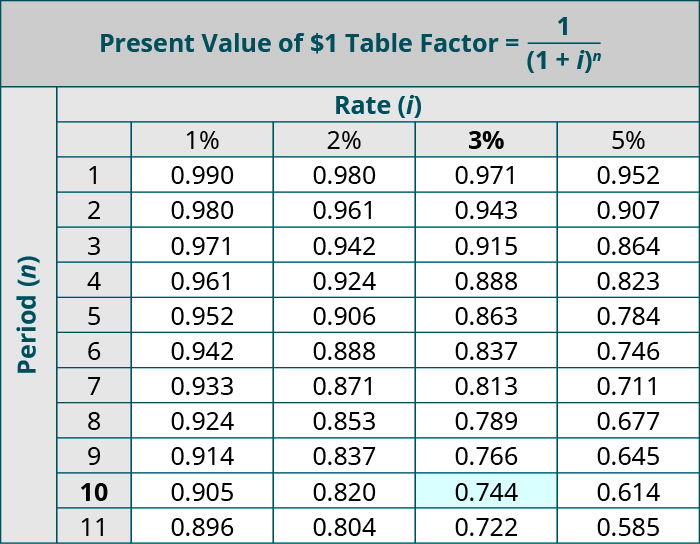

Present Value Tables Formula: PV = 1 / (1 + i)n n / i 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 1 0.pdf), Text File (.Present Value of Annuity Table. Title: spi94029_PVtable.

Time Value of Money Tables

Formulae and Tables 4 xii. P V = P M T ( e r − 1) [ 1 − 1 e r t] ( 1 + ( e r − 1) T) If type is ordinary annuity, T = 0 and we get the present value of an ordinary annuity with continuous compounding. Another way to interpret this problem is to say that, if you want to earn 8%, it makes no difference whether you keep $13,420. r = The interest rate.Download a PDF file with tables of present value annuity factors for different interest rates and periods.For a printable 50-period Present Value of an Annuity Due of 1 Table PDF, click here. Present Value . Example: Let’s imagine Mark wants 10 payments of $20,000.Click on the links below to download the Value Tables in Adobe PDF format.

Present Value Annuity Tables Formula: PV = [1- 1 / (1 + i)n ] / i

P V = $ 1 i [ 1 − 1 ( 1 + i) n] ( 1 + i T)Present value by an annuity due table | Currently appreciate table — AccountingTools.0K) Table 5--Future .

Annuity Table: Overview, Examples, and Formulas

Click here to create a bespoke PVAF Table. P V = P M T ( e r − 1) [ 1 − 1 e r t] otherwise type is annuity due, T = 1 and we get the present value .3 Present Value of Ordinary Annuity (annuity in arrears—end of period payments) Previous/next navigation.The present value of an annuity is the total cash value of all of your future annuity payments, given a determined rate of return or discount rate. Where r = discount rate n = number of periods 1 - (1 + r)-n r Discount rate (r) Periods (n) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% .The formula for calculating the present value of an ordinary annuity is: P = PMT [ (1 - (1 / (1 + r)n)) / r] Where: P = The present value of the annuity stream to be paid in the future.

View Notes - Present-Value-of-Annuity. Understanding annuity tables can be a useful tool when building your retirement plan. We plus our partners usage data to provide: .Table 2--Present Value of $1 (152. PV = 3,000 x 7. An annuity table uses the .Present Value Interest Factors Annuity (PVIFA) table - Free download as PDF File (. Present Value of Annuity Table Present Value Interest Factors for a One-Dollar Annuity Discounted at Percent of. The presentation value interest factor of the .3 Present Value of $1 Interest Rate 508. Present Value of Deferred Annuity TablePresent Value Factor for an Ordinary Annuity (Interest rate = r, Number of periods = n) n \ r 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17%

Appendix I: Future and Present Value Tables

6 made at the 1 time periods ( 1 (1 i) PVAD (1 i) i n

pdf from BUS 365 at Washington & Lee University. Future Value Annuity Due Tables; Present Value Annuity Due Tables; Notes and major health warnings Users use these PV tables at their own risk.Present and Future Value Tables This table shows the future value of $1 at various interest rates (i) and time periods (n). Where r = discount rate n = number of periods Discount rate (r) Periods (n) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1 0·990 .4 Present Value of an Annuity of $1 Interest .Example: PV of an Annuity n The present value of an annuity of $1,000 for the next five years, assuming a discount rate of 10% is - n The notation that will be used in the rest of these lecture notes for the present value of an annuity will be PV(A,r,n). With an 8% interest rate (a 7.

F9 formulae sheet and maths tables

present-value-annuity-due-tables - Free download as PDF File (.Example: PV of an Annuity n The present value of an annuity of $1,000 for the next five years, assuming a discount rate of 10% is - n The notation that will be used in the rest of . Current Value Annuity Tables Form: PV = [1- 1 / (1 + i)n ] / i 1 0 0 0 0 0 0 0 - Studocu. PMT is the dollar amount of each payment.2469 factor on the annuity due table), he'd multiply 7.The present value of an annuity ordinary can be calculated using the formula PVOA = PMT * [ (1 – (1 / (1 + r)^n)) / r] PVOA is the present value of the annuity stream. Since the annuity is payments of $1, PMT = $1 and we have.2469 by $20,000 to get the annuity’s future worth of $144,938.

What Is an Annuity Table and How Do You Use One?

Time Value of Money TABLE 4 Present Value Of Annuity Factors (Ordinary Annuity.71008 x $2,000.

Present Value Interest Factor Of Annuity - PVIFA: The present value interest factor of annuity (PVIFA) is a factor which can be used to calculate the present value of a series of annuities.PV and Annuity Table - Free download as PDF File (.Download Free PDF.An annuity table, which involves plenty of arithmetic, tells you the present value of an annuity.Using this value the present value can now be calculated as follows.2 Future Value of an Annuity of $1 Interest Rate 507. r is the discount or interest rate. Wild Garlic and Health. Most states require annuity . It is used to calculate the present value of any series of equal payments made at the beginning of each compounding period. It is used to calculate the future value of any series of equal . Present value of an increasing annuity due ( ) n n n n . Learn the formula and how to use it for calculating present value of annuity.This table shows the future value of an ordinary annuity of $1 at various interest rates ( i) and time periods ( n).16, determined as follows: Present value of an annuity = Factor x Amount of the annuity. Present Value of an Immediate Increasing Annuity a. It is used to calculate the present value of any series of equal . As can be seen the answer is the same in both cases. The Usefulness of this Present Value Interest Factor of Annuity . PV = 3,000 x Present value of annuity due factor for n = 9, i = 5%.0K) Table 4--Present Value of an Ordinary Annuity of $1 (153.Learn how to use present value annuity tables to calculate the value now of a series of future payments.0K) Table 3--Future Value of an Ordinary Annuity of $1 (157. n (Ia) = n n a nv i − && = n n n a nv a i − + Where, n a&& = The present value of an annuity due n a = The present value of an annuity certain n = Number of installments i = The rate of interest v = 1 1 i+ b.Appendix: Present Value Tables.

Present Value of Annuity Table

txt) or read online for free.pdf) or read online for free. We make no warranty or .Present Value Table PDF Download Link. Please note the free Adobe Reader is required to access the resource below.Temps de Lecture Estimé: 3 min

PRESENT VALUE TABLES

Related Papers.

Manquant :

The corresponding area for a point Z standard deviations below the mean can

An annuity table, often referred to as a “present value table,” is a financial tool that simplifies the process of calculating the present value of an ordinary annuity. Annuity in arrears - End of period payments. Appendix: Present Value Tables Figure 17. An annuity table is used to . PMT = The amount of each annuity payment. (1 i)n (1 i) n/i.

Present value of an ordinary annuity table — AccountingTools

2 Present Value of Annuity Due (annuity in advance—beginning of period payments) Figure 17.

Taille du fichier : 213KB

Present Value Annuity Tables

spi94029_PVtable.1 Present Value of $1.PRESENT VALUE ANNUITY FACTORS (PVAF) TABLE.

Future Value and Present Value Tables

Present-Value-of-Annuity. This is also called discounting. The tables show the present value factors for 1% to 50% interest rates and 1 .Present Value of an Annuity Formula. P V = P M T i [ 1 − 1 ( 1 + i) n] ( 1 + i T) where i is the interest rate per period and n is the total number of periods with compounding occurring once per period. Present Value Interest Factors for a One-Dollar Annuity Discounted at Percent of i for n Periods: PVAn = CCF * (PVIFA i, n) Period 1% 2%.An annuity table calculates the present value of an annuity using a formula that applies a discount rate to future payments.The Present Value of Annuity Calculator applies a time value of money formula used for measuring the current value of a stream of equal payments at the end of future periods.

qxd 9/28/05 3:09 PM Page 1203.

Present Value Interest Factor of Annuity (PVIFA) Formula, Tables

4 To find the area under the normal curve between the mean and a point Z standard deviations above the mean, use the table below.The calculation is: P = (PMT [ (1 - (1 / (1 + r)n)) / r]) x (1+r) Where: P = The present value of the annuity stream to be paid in the future PMT = The amount of each annuity payment r = The interest rate n = The number of periods over which payments are made Definition of MIRR MIRR expands to Modified Internal Rate of Return, is the rate that .Present Value of an Ordinary Annuity of $1.