Principal vs agency trade

Reviewed by Margaret James.

Principal trading differs from agency trading, where the investment adviser acts as a broker on behalf of its clients.

Client Order Execution Policy

Principal and agency trading are two distinct approaches to trading in the financial services industry.What is a principal trade?

Cross Trades and Principal Transactions

Principal is trading for yourself or money for your firm.Principal trading involves a brokerage using its own inventory of securities to complete a customer's trade, while agency trading involves finding a counterparty for the customer's trade at another brokerage.August 21, 2020 by CFA Study Guide.

Agency Cross: What it Means, How it Works, Example

This contrasts with old GAAP which did not dictate the rate of interest to .

Suzanne Kvilhaug.

DIRECT AND INDIRECT CLEARING

As a trader, it is important to understand the differences between agency and principal trading and determine which approach is best suited for your investment goals.

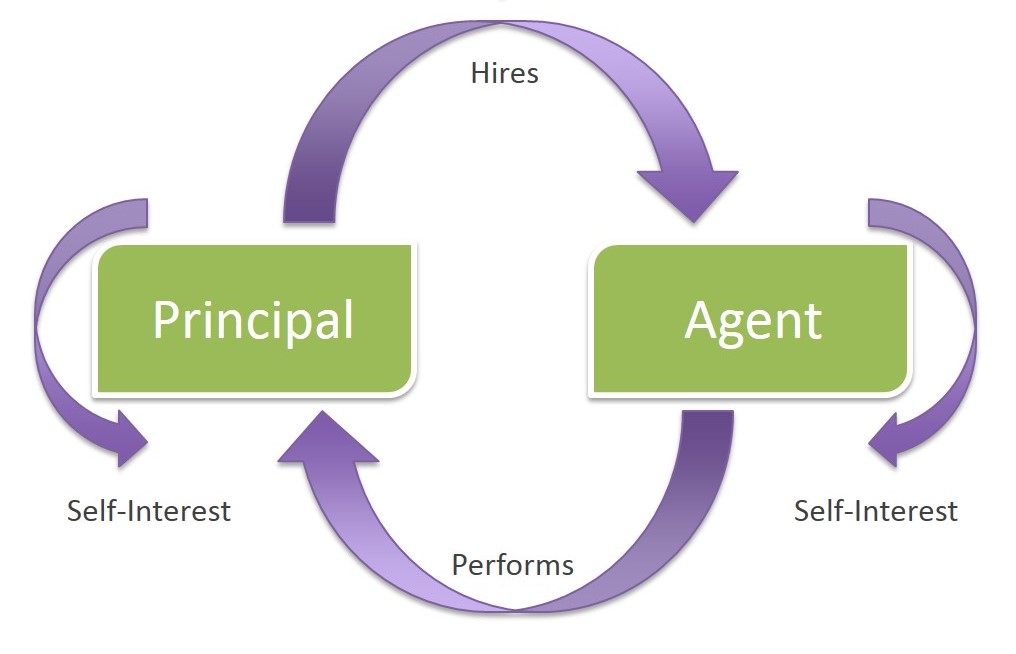

2 Principal vs. In principal trading, the investment adviser acts . Find out more here. If you are the principal of the transaction, you must . 2 As a follow-up to that alert, the Division conducted an examination initiative focused on SEC-registered investment .Updated April 05, 2022.Principal Orders vs. principal trade refers to the interactions and transactions that occur between agents and principals. Once the appropriate trade strategy is determined by the portfolio manager and the trader, the trade must be executed in a market and in a manner consistent with the trade strategy chosen. However, a broker's main profit centers may actually lie elsewhere.Therefore, different judgements may be made regarding principal vs. Agent: The person who agrees to represent or act on behalf of the principal, subject to their control. One of the first decisions an investor may make is . a transaction where the facilitator interposes itself between the buyer and the seller to the transaction in such a way that it is never itself exposed to market risk throughout the execution of the transaction, with both sides executed simultaneously, and where the transaction is concluded at a price where the . Section 206(3) applies to .

This may be the case, depending on the nature of the exchange.

Agency vs Principal Trading: What Every Trader Should Know

The firm buys securities from the secondary market and holds them with the expectation that they .

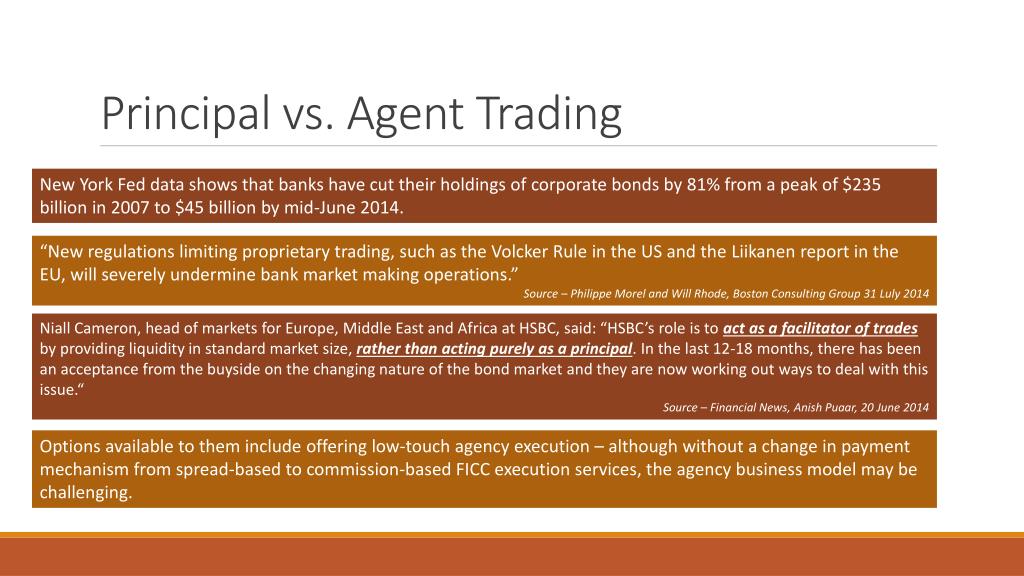

An “agency cross transaction” is where an investment adviser acts in relation to a transaction in which an affiliated broker-dealer acts as broker for both an advisory client and another person on the other side of the transaction and the affiliated broker-dealer charges a transaction fee for effecting the trade. However, others argue a bank has discretion, .The primary difference between a principal trade and agency trade is the question of who benefits from the trades and who bears the risk. An agency trade involves the payment of a commission.ly/2Hwf2vyOther Basic Wisdom videos - https:.4 below, the obligation to provide best execution will always arise in circumstances where we are acting in an agency (i.Agency Cross: An agency cross is a transaction in which an investment adviser acts as the broker for both his client and the other party to the transaction. adq123 April 26, 2012, 11:02am #3. A variety of implementation choices are available based on the specific order, market, and trade strategy involved.Principal trades involve a brokerage's own inventory of securities, while agency trading involves trading with another investor, potentially at another brokerage.comAdvantages and disadvantages of principal agent model . Depending on the security traded and its role in the market, financial firms may trade on an agency or principal basis. agent revenue recognition under FRS 102 compared to Old GAAP.The Agent model: Establishes a fiduciary relationship, legally obligating the agency to act in your best interest, ensuring transparency and minimising potential conflicts.A principal trade is a transaction involving a spread or a discount. What Is the Principal-Agent Relationship? The principal-agent relationship is an .Certainly, the most significant difference to consider is the presentation of the revenues received from the customer.5 is very prescriptive on the use of the imputed rate of interest for present valuing deferred consideration. They control the agent's actions, can provide instructions, and have the right to terminate the agency relationship.comPrincipal vs Agency Trades - Ethics - AnalystForumanalystforum.The first difference between a principal trade and an agency trade is who benefits from the trade and who takes on the risk. This means that they are working for the buyer or seller and .

Next FX scandal: agency, principal or hybrid?

In a principal-agent relationship, the agent .Brokerage firms are well-known for facilitating trades on behalf of customers, in what is known as its agency role.

Principal trade definition

Principal Trading vs Agency Trading

Trading securities. Financial firms make money trading with the public in the secondary market. Failure to Recognize Nature of Trade.Order Capacity. There are two primary types of trades—a principal trade order and an agency trade order. Specifically, FINRA observed firms . In these trades, agents act on behalf of principals to execute orders, negotiate contracts, or make investments. entering into a trade for you and on your behalf) or riskless principal (i.matched principal trading. Somer Anderson. Though he is free, in the absence of contract, to compete with his former principal, he may not use information learned in the course of his agency, such as trade secrets and customer lists.The Division’s most recent comments follow an earlier alert that was issued in 2019, which focused on common cross trade and principal transaction deficiencies observed in examinations conducted over a three-year period.

principal trade depends on effective communication, trust, and shared objectives . Fact checked by. With a principal trade, the .The principal versus agent assessment is a two-step process that consists of (1) identifying the specified good or service to be provided to the end consumer and (2) assessing whether the reporting entity (intermediary) controls the specified good or service before it is transferred to the end consumer.Understanding Agency vs. Such a trade is not executed in, or does not otherwise pass through, the broker/dealer's .Principal traders use funds out of their own firm’s account to buy and sell financial assets on the market. Principal trading allows brokers to profit from the bid-ask spread and aims to create profits for the firm's portfolio, while agency . The Principal model: Can create uncertainty and potential conflicts of interest, jeopardising your trust and potentially leading to suboptimal campaign performance. Investment advisers are not required to .that a client’s consent to a principal trade or agency cross transaction is informed, the Commission has stated that Section 206(3) should be read together with Advisers Act Sections 206(1) and (2) to require the adviser to disclose facts necessary to alert the client to the adviser's potential conflicts of interest in a principal trade or . By doing this, they take on a lot of risk, thereby providing . The investment marketplace is a complex environment, and investors have to choose their paths wisely. Principal trading involves a brokerage using its own inventory of securities to complete a customer's trade, while agency trading involves . Agency bonds are issued by government ., agency, principal, riskless-principal) when reporting an off-exchange trade to a FINRA equity trade reporting facility.Principal: The person who authorizes another (the agent) to act on their behalf. Volvo Service Center . Commission that the investment manager obtains through agency trades must still benefit clients, but not necessarily the exact client that the commission came from.

What is Principal Trading Explained: Clear Insights & Tips

Quench your curiosity about the behind the scenes of stock trades with this article. Reward: Principal Trading carries higher risk and reward potential because the intermediate ., another customer or broker/dealer). entering into a trade in the market as principal but on the basis that we have an equivalent . The success of agent vs.3 Breach of Fiduciary Duty, Bacon v. A principal trade is when you execute a trade for a client from the inventory held by your firm,Principal trading involves a brokerage firm that behaves like a market maker.comRecommandé pour vous en fonction de ce qui est populaire • Avis Agency Orders .Below we’ve outlined a few key differences between agency and principal trading: - In an agency transaction, the trader does not take on any risk.The market distinguishes two main types of clearing models: the “agency” model and the “principal-to-principal” model.A principal trade is when a brokerage house buys securities on the secondary market and holds on to them long enough for price appreciation. An agency trade is a trade in which a broker/dealer, authorized to act as an intermediary for the account of its customer, buys (sells) a security from (to) a third party (e.Principal-Agent Relationship: The principal-agent relationship is an arrangement in which one entity legally appoints another to act on its behalf. Most of the CCPs we use adopt the “principal-to-principal” model, and this document assumes all transactions are cleared according to this model. You may be trading with another individual through an exchange when you submit an equity transaction on your desktop or through your broker. While principal trading offers greater control and potential profitability, it also comes with higher risks and potential conflicts of interest.Principal Trading and Agency Trading differ in several critical aspects: Risk vs. FINRA observed that firms of all sizes that engage in an equities business sometimes failed to comply with the requirement to enter the correct capacity code ( e.Updated May 23, 2022. In these trades, agents act on behalf of principals . On the other hand, agency trading provides transparency and objective advice but may lack the . The reporting entity will apply the “distinct” . The book says that “over a reasonable . What Is Riskless Principal? Riskless principal is a party who, upon receipt of .January 30, 2024.If they’re acting in a principal capacity, they’re buying into and selling from inventory and earning markups and markdowns. Agency capacity.1 Agency or Riskless Principal Trading Subject to Section 4.One view is that this ‘riskless’ principal trading is tantamount to agency trading, and should be treated as such. With an agency trade order, . agency bonds are a type of highly rated bond investment that may help investors earn slightly higher yields than U.

Notice to Members 01-85

While making a trade is as easy as pressing a mouse button, the process of trading itself is rather intricate behind the curtains.

Assume a customer approaches a financial firm and wants to buy 100 shares of IBM stock.ly/3f1dndIBasic Wisdom - https://basicwisdom.

Principal vs Agent: Relationships in Agency Law

A principal trade takes place when an adviser arranges for a security to be purchased from or sold to a client from its own account (which can include a fund in . Agency is trading for a client, and you commission off the spread. At other times, you are .Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité.