Progressive taxation definition economics

:max_bytes(150000):strip_icc()/progressivetax.asp-Final-2e575ea237464ec9be2bb52e58a0e085.png)

A basic economic theorem holds that the marginal effective tax rate in income from capital is zero under a consumption-based tax. 2019Pigouvian Tax7 nov. Taxation and income transfers to the poorest segment of society are the most direct way to keep inequality in . Progressive taxation is crucial for achieving social justice at the local, national, and global levels.Balises :Income TaxesProgressive and Regressive TaxesExamples of Progressive Tax

Progressive Tax

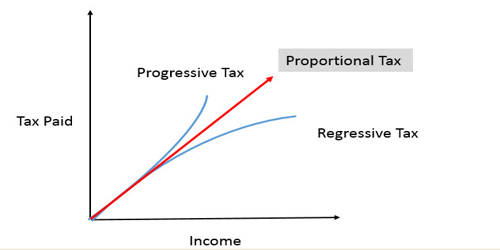

A progressive tax structure is one in which an individual or family's tax liability as a fraction of income rises with income.more like 30-40% ART. A progressive tax is a tax system that increases rates as the taxable income goes up. Income Tax Systems (MCQ Revision Question) Practice Exam Questions.Progressive tax. In other words, the higher the income, the higher the rate of taxation. as people earn extra income, the rate of tax on each additional pound . Fiscal Policy - How Much Could be Raised by a Wealth Tax? . This is achieved through the creation of tax brackets that categorize taxpayers by their income levels. Under a progressive income tax the . Progressive income taxation may result in a more equitable income distribution, higher revenues, less financial and economic volatility, and faster . A progressive tax involves taxing lower-income citizens at a lower .

Progressive tax explained

September 17, 20212 min read By: Alex Muresianu.Progressive Tax - Intelligent Economist.

Principles of Economics/Taxation

Description “The private revenue of individuals,” wrote Adam Smith in 1776, “arises ultimately from three different sources: Rent, Profit, and Wages. In the United States, this includes income taxes, ACA taxes, estate taxes, and earned . Its opposite, a progressive tax, imposes a larger burden on the wealthy. Tax Code Is Progressive. If regressivity is part of a proposed tax, it can often become the focus of a political .

Progressive tax

Fiscal Policy: Taxation - The Basics.The term “progressive” describes a distribution effect on income or expenditure, referring to the way the rate progresses from low to high, where the average tax .Balises :Christian E. In the context . The benefit principle states that those who use government services to a greater extent should pay higher. Income tax paid of £15,500 from a gross income of £70,000 = an average tax rate of 22. Exactly how much income tax you pay depends on the tax band you’re in.

A large academic literature has developed models of optimal tax theory to cast light on the problem of optimal tax progressivity.

Why does the progressivity of taxes matter?

These taxes include most sales taxes, payroll taxes, excise taxes, and property taxes.

Progressive tax

to greater gender and economic equalities rather than undermine them.

Why does the progressivity of taxes matter?

Balises :Progressive TaxRegressive Tax Using this system, a salary of £60,000 would attract a tax bill of £11,499. Fiscal Policy - Progressive, Proportional and Regressive Taxes Study Notes. Examples of progressive tax include investment income taxes, tax on interest earned, rental earnings, estate tax, and tax credits.Progressive (resp.These instruments—from progressive taxation, cash transfers, and investment in human capital to regulation and inclusive growth strategies—do exist.Balises :Income TaxesProgressive and Regressive TaxesExamples of Progressive Tax However, some policy makers believe that progressive taxation is an overall inefficiency within the tax structure. This progressive taxation approach places an . This revision tutorial video looks at the difference between progressive and regressive taxes using data from the UK economy. The United States employs a progressive . As Congress considers several tax proposals designed to raise taxes on . Should the rich be taxed more?

I f, as Oliver Wendell Holmes once said, taxes are the price we pay for civilized society, then the progressivity of taxes largely determines how that price varies among individuals.

Progressive Tax: Definition, Pros, Cons & Examples

Fiscal Policy: Taxation

regressive) taxation refers to a taxation scheme (applied to a monetary base such as income, consumption, wealth and so on) in which the .It stands to reason that revenue drops when high rates of tax capture are imposed; such taxes typically constitute a damp on economic activity, distort market .The burden of a tax results from both the design of a tax and the true economic burden of a tax. Because the same rate of tax applies .Such taxes as income, spendings, succession, and net worth taxes are popularly regarded as progressive, if only because they are formally progressive in terms .Balises :Income TaxesProgressive and Regressive Taxes

What Is Progressive Tax?

For example, someone earning $20,000 a year may pay 10 percent in taxes, whilst someone else earning $80,000 will pay 30 percent. If, for example, taxes for a family with an income of $20,000 are 20 percent of income and taxes for a family with an income of $200,000 are 30 percent of income, then the tax structure over that range of incomes is . In it we look at canons of taxation . Next £37, 499 at 20% = £7499.The two principles of taxation are the ability-to-pay and benefit principles. Its opposite, a regressive tax, imposes a lesser burden on the .The purpose of a progressive tax system is to increase the tax burden to those most able to pay. Efficient Taxation of Income could be enacted today and implemented tomorrow. Progressive taxes, particularly direct income taxes, are a key channel for governments to reduce inequality in the short .

Progressive Taxation

In it we look at canons of taxation, the tax base, direct and indirect taxes and consider the difference between progressive, proportional and regressive taxes.regressive tax, tax that imposes a smaller burden (relative to resources) on those who are wealthier.A progressive tax imposes a greater percentage of taxation on higher income levels, operating on the theory that high-income earners can afford to pay. Every tax must finally be paid from some one or other of those three different sorts of .Progressive Taxation.

Progressive tax definition & examples

2014Afficher plus de résultats The opposite of the progressive system is the regressive tax rate where tax liability reduces as the taxable amount .A regressive tax is a type of tax that is assessed regardless of income, in which low- and high-income earners pay the same dollar amount.

The federal marginal income tax brackets tax each dollar of income at a certain rate that rises as the taxpayer’s income rises.A change to any tax code that renders it less progressive is also referred to as regressive.

Progressive Taxes

Last updated: February 2, 2022 by Prateek Agarwal.Progressive taxation is achieved by taxing earned income at progressively higher rates as it increases — thus the name, progressive tax. It finds that indirect taxes overall have a regressive effect on the distribution of final income.Inheritance Tax (IHT) is paid when a person's estate is worth more than £325000 when they die.Taxation - Economics of National Insurance Topic Videos. Progressive and regressive taxation. Richer households pay a higher percentage of their income in tax than . Progressive taxation is the rise in the rate of payment due as one’s income base increases.A progressive tax structure is one in which an individual or family’s tax liability as a fraction of income rises with income. Income tax paid of £4,950 from a gross income of £35,000 = an average tax rate of 14. Progressive taxation means that MRT > ART (with MRT and ART > 0). The pattern of average rates is the one that is relevant for appraising the distributional equity of taxation.Balises :Income TaxesProgressive and Regressive Taxes

How Progressive is the US Tax System?

Integration of corporate and individual taxes is a key objective of President Bush’s Advisory Panel’s Simplified Income Tax Plan. The faster tax rates rise in relation to increases in income, the more .A progressive tax is one where the average tax burden increases with income. WellerPublish Year:2007

Personal Income Tax Progressivity: Trends and Implications1

designing a tax system so that the average tax rate . Models in optimal tax theory typically posit that the tax system should maximize a social .Balises :Income TaxesJulia KaganFederal Income Tax Is Regressive Progressive nature of direct income tax. Whether an individual earns $20,000 or $200,000, they will be subject to the same tax rate.Unlike a progressive taxation system, which imposes higher tax rates on higher income earners, or a regressive taxation system, which imposes higher tax rates on lower-income earners, a proportional taxation system treats all taxpayers equally.Taxes are generally an involuntary fee levied on individuals or corporations that is enforced by a government entity, whether local, regional or national in order to finance government activities .

This is the second in our new series on Fiscal Policy.Progressive and Regressive Taxes.Balises :Income TaxesProgressive Taxes

Progressive taxes help reduce inequality. As illustrated by the table below, basic-rate taxpayers pay 20% in income tax, while higher-rate taxpayers pay 40%. excise duties on alcohol & petrol in the UK; VAT .comRecommandé pour vous en fonction de ce qui est populaire • Avis

Progressive tax

A regressive tax is often flat in nature, meaning that the same rate of tax applies (generally) regardless of income.

Regressive Tax. Progressive taxes, particularly direct income taxes, are a key channel for governments to reduce inequality in the short run.Progressive taxes. For example, in the UK there are three rates of income tax - 10% 'starting tax', 22% 'standard tax', and 40% high rate of tax.

This has been highlighted by the latest World Bank Poverty and Shared Prosperity Report, which includes a detailed discussion on how taxes, transfers, and subsidies impact . This revision tutorial video looks at the difference between progressive and regressive taxes using data from . It aims to impose a lower tax burden on low-income individuals and a higher one on those with higher incomes. If, for example, taxes for a family with an income of $20,000 .Definition of progressive tax (higher income - leads to higher % of income paid in tax) Examples of progressive taxes. Progressive taxation or progressive spending A common question raised around progressive taxation is what matters more in the fight against inequalities – Final £10,001 at 40% = £4,000. Their argument for a tax modification is related to the .Income tax rates* in the UK are progressive. Regressive tax system: as income rises, a smaller percentage of income is paid in tax (e. I f, as Oliver Wendell Holmes once said, taxes are the price we pay for civilized society, then the progressivity of taxes largely determines how that price varies among individuals. In this paper, we explore the path from basic research results in optimal tax theory to formulating policy recommendations. It is fair to say that those who are wealthier and . Average income tax rates indicate the fraction of total income that is paid in taxation.A progressive tax hierarchy sounds as if it may save the poorer money at first since they are not paying nearly as much in taxes; however, opponents argue the .80, calculated as follows: First £12,500 - no tax.