Real estate investment trusts pros and cons

Like a standard actively managed .

REITs can be a great way for average investors to invest in real estate without the headache of owning and operating it themselves.Understand the pros and cons of real estate investment trusts before jumping in.

Investing in Real Estate Investment Trusts (REITs)

No Active Management. Investing in real estate can be a great way to accumulate wealth and generate rental income. Contact one of our Commercial .So in this article we are going to discuss the pros and cons of real estate investment.

Putting a House in Trust: Why, How, Pros and Cons

The Pros and Cons of Investing in Real Estate Investment Trusts (REITs) Real estate investment trusts (REITs) have become a popular investment vehicle for those looking to diversify their portfolios and generate passive income. But, like any investment, there are certain drawbacks to investing in .

REITs: Definition, Types, and Investing Basics

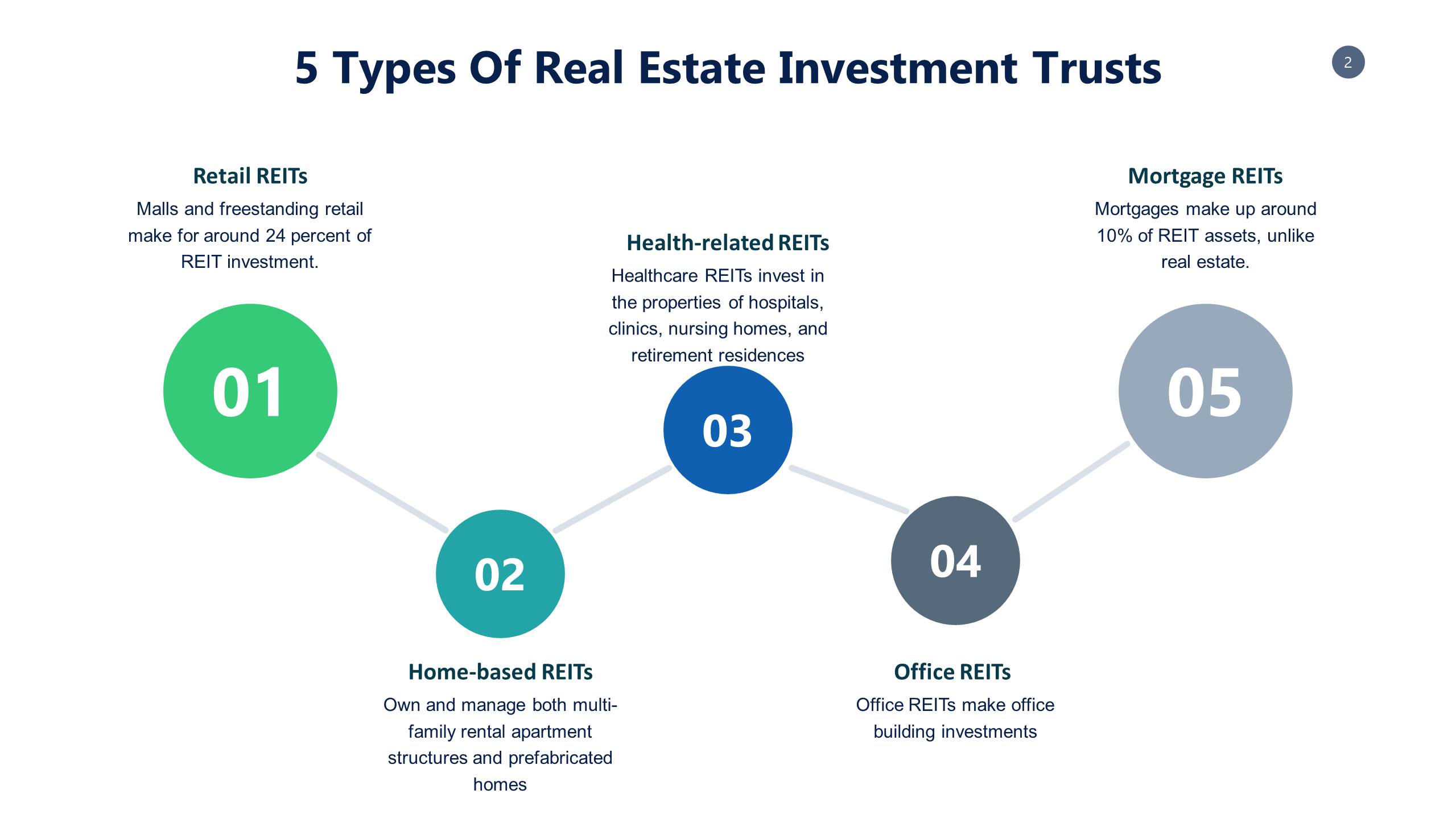

Now that you know what a REIT is and how a company can become one, it’s important to take a look at . 2.

- .

REITs: Pros and Cons to Real Estate Investment Trusts

Let's explore the pros and cons so that you can make smart .The Pros of Investing in REITs.The real estate industry received a much-needed boost recently when the Securities and Exchange Board of India (Sebi) finally cleared guidelines for the real estate investment trusts (Reits). How Does a Company Qualify as a REIT? 3. Real estate is notorious for the number and size of the bubbles it creates. 300-Level (Advanced) | Invest Money. Pros and Cons of REITs. Established by Congress in 1960 as an amendment to the Cigar Excise Tax Extension, REITs were designed to give all investors, not just the wealthy, a chance to invest in . REIT Qualifications.The first and perhaps most obvious con of investing in REITs is the lack of control.

Delaware Statutory Trust Pros & Cons

Buying into a REIT also allows the investor an opportunity for diversification. In this comprehensive .

REIT: What It Is and How to Invest

Choosing A Strategy

What Is a Real Estate Investment Trust (REIT)?

When it comes to diversifying your portfolio, real estate investment trusts (REITs) are an attractive option. Pros of REITs: Cons of REITs: High Dividend Yield – Law requires REITs to pay at least 90% . As an alternative asset, the investment has a . But, DSTs are not for everyone.Excalibur Homes June 6, 2022. They also offer some of the most attractive features of stock investing. But like most investment types, it has pros and cons you should be aware of.A family trust is a trust that benefits the children, grandchildren, siblings, spouse or other family members of the person establishing the trust (grantor). They can make for a good investment provided that the unitholder understands the specific characteristics of the REIT and property type. (This page may contain affiliate .

REITs have been a popular investment since their creation in 1960.

Real Estate Investment Trust (REIT)

Investing in Real Estate Investment Trusts (REITs) can be an attractive option for investors looking to add real estate exposure to their portfolios without the costs and responsibilities of owning physical properties.Commercial Real Estate Investment Trusts (REITs) have become increasingly popular among investors seeking exposure to the real estate market without directly owning properties.The pros and cons of Real Estate Investment Trusts. But that doesn’t always mean a property won’t start producing cash flow in the short-term. They are often great passive investment options, too.The 6 Best REIT Funds to Buy | Kiplingerkiplinger. However, much like every other type of investment, investors must weigh the pros vs the cons. Invest at least 75% of its total assets in real estate. Putting your home in trust can provide several perks that make this method of ownership transfer worthwhile. If they follow this rule, then they aren’t . Some of the most enticing benefits include: Low-risk exposure to real estate.As a real estate investor, there are many pros and cons to consider when investing in Delaware Statutory Trusts (DSTs).Pros and cons of putting your house in a trust Benefits. The federal government currently affords individuals an $11. Date May 24, 2023. For many, real estate represents the ultimate investment. Like any investment, each of these offer their own pros and cons. However, like any investment, there are pros and cons to consider before diving in.5 High-Yield Dividend REITs To Watch | The Motley Foolfool. Family trusts are common in estate . It might be a partnership, corporation, trust, or association. Think of a REIT as a pool of real estate assets traded freely on the stock market exchange. We’ll also look at what to look out for when you’re considering investing in REITs.com10 Best REIT Stocks with High Dividend Yields - Yahoo Financefinance. Real Estate Investment Trusts (REITs) are investments in a piece of a real estate venture.» MORE: What is a good investment? REIT pros and cons.

How To Put Your Home In A Trust

Real Estate Investment Trusts (REITs) — Definition, Types, Pros & Cons. This gives the cash-strapped industry a new route to tap capital. Being a landlord, however, comes with certain risks, .Pros and cons of REITs.It’s worth examining the Delaware Statutory Trust pros and cons if you’re considering an investment. September 7, 2023 • 4 min read. REITs have a special tax status that requires them to pay 90% of their profits back to the shareholders. You become a shareholder in a piece of property that .comRecommandé pour vous en fonction de ce qui est populaire • Avis

Real Estate Investment Trusts (REITs) Explained

What is a REIT and How Does it Work?

REITs are required to pay out dividends to shareholders, which can mean a steady stream of income for you should you decide to invest.Pros and Cons of Investing in REITs. Certain guidelines must . Cost: $100,000. Yes, market corrections happen from time to time, and people may .

The advantages of DSTs include access to larger assets, tax benefits, and lower risk.

Community Land Trust: Meaning, Pros and Cons, Example

Real estate investment trusts reduce the barrier to entry for . The main advantage of investing in .Real estate investment trusts (REITs) are an alternative to buying real estate directly.A trust is a fiduciary arrangement, which means it protects and serves the interests of someone else.A REIT is a company that makes direct investments in real estate by getting mortgages on houses or other real estate. Basically, REITs are a pool of funds invested in real estate assets.

Pros & Cons of Real Estate Investment Trusts

Guide and How to Set One Up

There are pros and cons to owning a real estate investment trust, as there are with any asset. Real estate that is well-chosen appreciates at a rate that often outpaces yearly inflation over time. 3 main types of REITs. Real estate investing involves purchasing property, either residential or commercial, with the intent to generate . REITs often own more than one real estate asset. [1] Putting your house in trust helps ensure that after you die, ownership of your house . That said, there are drawbacks to this particular investment strategy investors need to be aware of: Illiquidity.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Pros & Cons of Investing in REITs

Why REITs: Diversification. However, like any investment, REITs carry risks that should be carefully considered before investing.Delaware Statutory Trusts can potentially solve a lot of problems for real estate investors and those considering a 1031 exchange in this hot market. Passively investing will is typically cheaper than active investing, but it yields fewer returns over time.When it comes to choosing how you’ll invest in real estate, though, there are a few options to choose from. REITs are companies that own, operate, or finance income-producing real estate . Real estate is a good long-term investment. Understanding your risk .Cons Of Delaware Statutory Trusts. Examples of passive investing include crowdfunding opportunities, real estate funds, or real estate investment trusts. Benefits of REITs • Dividends.Learn what a real estate investment trust (REIT) is, how it works, and its advantages and disadvantages. If you’re looking to diversify your investment portfolio by including real estate, REITs are probably the lowest-risk option.The main difference between investing in real estate and stocks is that investing in real estate involves buying properties and renting them out or investing .Real estate investment trusts come in all sorts of shapes and sizes (literally). • REITs (Real Estate Investment Trusts) allow investors to buy shares of companies that own and operate income-generating properties.

They can then use this profit to buy more properties. A 1031 exchange into a DST has several benefits for real estate investors, including the following: Eliminating the Headaches of Tenants Toilets, and Trash.A real estate investment trust—the cool kids call it a REIT, pronounced “reet”—is basically a mutual fund that buys real estate instead of stocks. What is a REIT? A real estate investment trust (REIT) is a company that invests in and finances property 1. Here’s what you need to know if you are .

Delaware Statutory Trust: A Real Estate Investor’s Guide

By investing a fraction of the cost of a single real estate development, the investor can be a part owner of a firm that operates all . When you invest in a REIT, you do not have direct control over the real estate assets held . As soon as the rental is filled with tenants, it’s totally possible to receive passive income from rents every month. REITs are companies that own, operate, or finance income-producing real estate and pay .An irrevocable life insurance trust (ILIT) is an integral part of a wealthy family's estate plan. • Investing in REITs provides diversification and . Pros of Investing in Real Estate Investment Trusts (REITs) 4. 1 This payment is called a dividend. Updated August 29, 2021. Compare different types of REITs by access, asset type, and sector, and find out how to buy them. Real estate investment trusts have both advantages and disadvantages.The pros and cons of investing in a REIT: What you need to know.Real estate investing refers to the process of acquiring properties to generate income, build wealth, or diversify investments. They’re like mutual funds, but rather than investing in some listed companies, you’ll invest in income .

Guide to REITS UK

Explore the pros, cons, and key considerations of investing in REITs.Investing in Real Estate Investment Trusts (REITs) By Rebecca Lake · March 19, .