Refinance private student loans reddit

But if you can get a lower rate, go for it.Balises :Refinancing Private Student LoansRedditSoFiAdvice

Should You Refinance Private Student Loans?

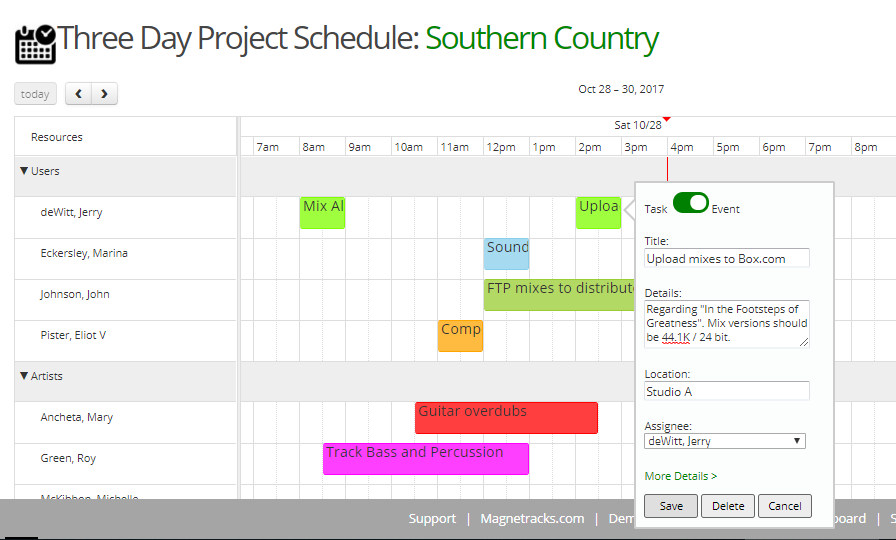

Sofi and earnest offered me 6-7%.However, the President just ordered all student loan interest to be suspended on Federal Student loans. I have 4 separate loans with Sallie Mae, they currently total to just over $27,000.In February 2021, came refinance number 4 on a much more aggressive payment timeline (5 years vs 10) as I had the resources to start paying these loans down in earnest.For instance, I took out a $10k loan in ‘03 to pay for college at $5k per semester. J'ai environ 37 000 $ de prêts étudiants privés répartis sur 4 prêts.

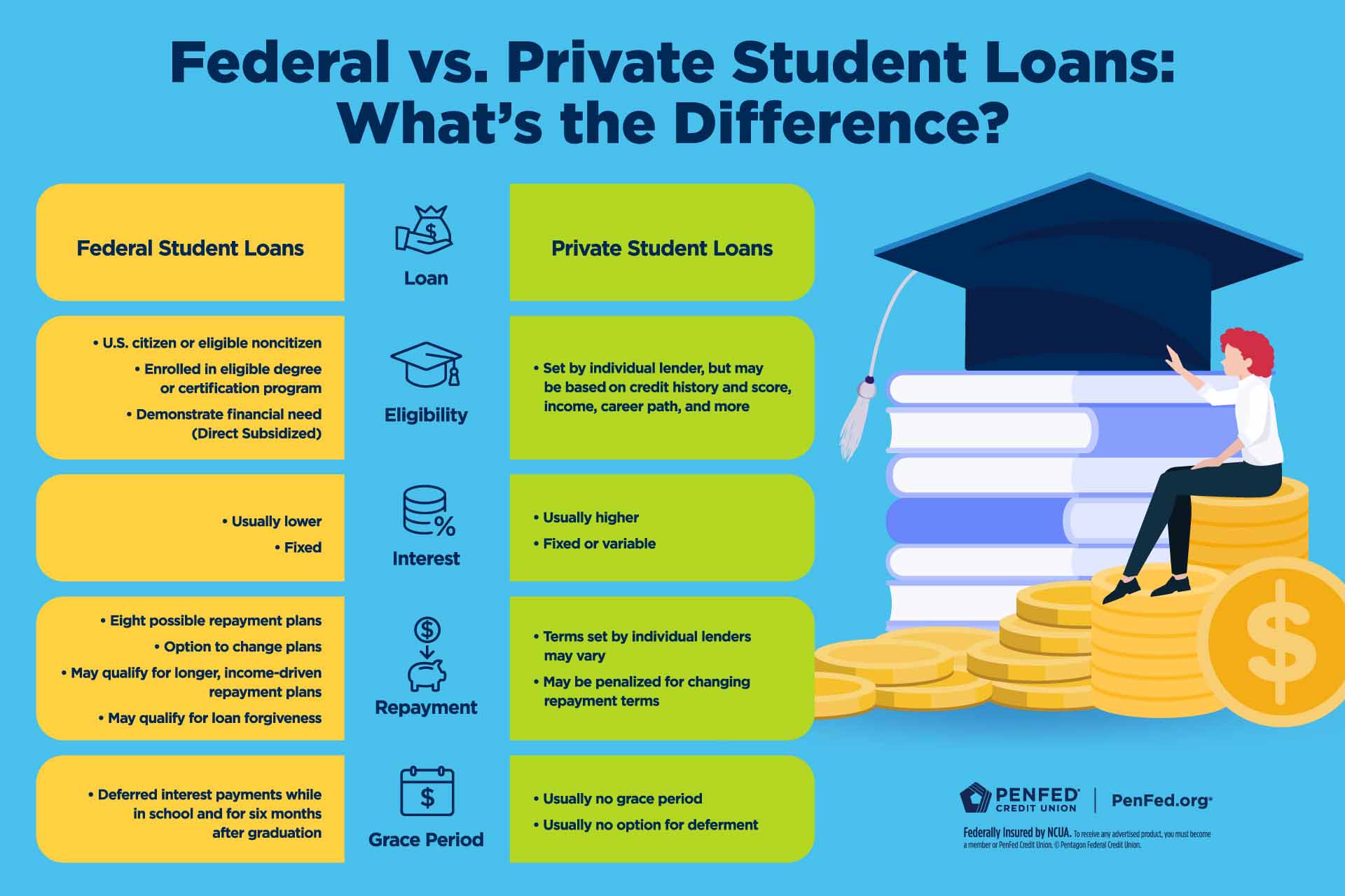

I already have private loans so I am ok to refinance them and do not lose anything from the government.You can refinance both federal and private student loans — even if you’ve previously consolidated or refinanced them.Top student loan refinance companies: Citizens Bank: No degree requirement and co-signer release after 36 payments, but higher rate ceilings.Needless to say the grind is on and it is incredibly difficult to save money living like this. Since they're already private loans refinancing is usually a very good idea with practically zero downside.I'm 24 with $100k in private student loans.Refinancing Private Loans.

Best place to refinance student loans : r/StudentLoans

Le taux moyen est d'environ 9%, avec une mensualité de .

When the second half of the loan was dispersed in Jan ‘04, the balance jumped again to just shy of $27k.Those rates are atrocious, you should absolutely try to refinance everything down to at least under 10% if you can get approved.

Manquant :

reddit Not everyone will qualify to refinance student loans.Temps de Lecture Estimé: 5 minGuide to Refinancing Private Student Loans

They were originally through SunTrust Bank, which sold all of their stuff to American Education Services. Nerdwallet, Credible, etc) to get a list of 3rd party companies to refinance with or just apply directly through the aggregator site. Splash Financial: A marketplace comparing rates from multiple lenders, potentially offering exclusive options. Little frustrated.

While not a financial advisor, I would NOT recommend refinancing your federal student . Go with whoever gives you the best fixed interest rate. After reading your experience, I am going to look into SoFi.Private loan refinancing is primarily refinancing, though it can include a consolidation step where multiple loans are paid off (and lenders absolutely sow confusion on this via their marketing copy). There's 4 loans all ranging in interest from 8% to 14%, and I'm paying $900 a month (which just barely covers interest).Private Loan Refinancing. 35k in debt per year for a 4 year degree, on top of your federal loans brings you to 170k in debt.The new loan has its own terms and interest rate. You won’t get a lower interest rate. So whatever refinanced rate you get is the only rate you will have, but if you accrued interest on your old loan during school or due to non-payment, that will become part of the principal of the new loan (assuming it wasn’t already).I have 87k between two private student loans with SallieMae, and 106k in multiple federal loans (sub/unsub loans and parent PLUS loans). You're out of luck Reply reply Basket-Beautiful • No- Reply reply Top 1% Rank by size . So I have about 65k in private student loans and I’m struggling with the monthly payment. Lenders generally want to see a completed degree, a reasonable debt-to-income ratio, a good credit score, and a few months' worth of on-time payments . Forfeiting access to all federal loan perks/benefits is called out in the fine print when you refinance your federal loans into private loans.Balises :Private Loan RefinanceRedditRefinancingStudent Loan Refinance

Best Student Loan Refinance Lenders Of March 2024

Refinance Private Loans In Another Name : r/StudentLoans

You can use an aggregator site (like Nerdwallet or Credible or similar) to get a list of refinance companies and then spend the afternoon applying. (Auto-debit, on time, etc) The balance is now currently at $86k, with a 3. (Reuters) - Social .For private student loans the finance charge is what they refer to as the total interest paid over the term of the loan.

$100,000 private student loan help : r/StudentLoans

Shopping around every 12-18 months to see if you can refinance private loans to a lower interest rate is a good practice.

Manquant :

redditCan You Refinance Student Loans?

Consolidation pulls your student loans out of default, but it will not remove the default from your credit history.The summary of the info I said below and in the other reddit is that I mean to question how long everyone waits to refinance their loans after they refinanced before.Student loan refinancing is when you take out a new private student loan to repay one or more existing student loans. Because private student loans don’t carry the same benefits and protections as federal student loans, there are fewer risks when. About a year ago I tried using SoFi to refinance and consolidate my loans in hopes of a lower monthly payment (and also because Sallie Mae is horrible). You should refinance and hopefully find a lender that’s willing to give you an in school deferment.

Lessons learned from refinancing $100k+ student loan debt

REUTERS/Dado Ruvic/Illustration/File Photo. I have a 615 credit score so refinancing is hard, anyone have any advice? Or know a .

Manquant :

redditPrivate student loans can help you pay for college when federal aid is not enough. This lawsuit is not going to end the pause sooner.

When you refinance, you consolidate some or all of .

Manquant :

redditTop 5 Best Student Loan Tips From Reddit Everyone Should Read

To qualify, you’ll need: Credit .

Refinancing private student loans : r/StudentLoans

Discover stands out for its generous options for borrowers who are struggling to make . I’ve made aggressive payments towards the loan monthly, and have been nothing but happy and satisfied with my choice to use the company. Student loans can be a heavy financial burden, and refinancing is a route to ease that load. Refinancing can make sense if it can save you money, but not everyone should refinance. You're attempting to borrow more than 3x that. The recommendation is too not borrow more than your average starting salary.Balises :Refinancing Private Student LoansRedditFederal LoansUnited StatesBalises :Refinancing Student Loans A Good IdeaFinancial literacyJuno Which for the average Bachelors degree is 50k per year. No one is going to refinance with the enemy.Luckily, I work in education so I will hopefully have the federal loans forgiven after ten years.

My refinancing experience (LendKey) : r/StudentLoans

Just something to consider before you pull the trigger on a refi. Here’s how it works: A new private company—typically a bank, credit union or online .Refinancing isn't a one-and-done thing, you should generally shop around every 12-18 months to see if you can lock in a lower fixed rate. Make Sure You’re Eligible for Student Loan Refinancing. Med school is hard and it’s isolating. You will want to apply to at least 3-5 companies so you can compare offers and go with whoever gives you the lowest fixed rate. One interest rate is 9% fixed, and the other is 13.Balises :Refinancing Private Student LoansFederal LoansSoFiGuide I recommend refinancing private student loans for a better interest rate.Credit Score and Student Loan Refinancing.SoFi is so dumb. The day I signed the loan I wrote a review of my experience, . I’ve been making payments on my private student loan for 18 months now. Lowering your interest rate can decrease your monthly . All this lawsuit did was become the enemy with everyone who has student loans.

Refinancing Private Student Loans in Jan 2024

You cannot “consolidate” private loans (but you can refinance them).Top 10 Student Loan Refinancing Tips From Reddit Everyone Should Read.If you refinance private student loans with more favorable terms than your existing loans — for example, at a lower interest rate — you can save money over the life .

Manquant :

redditWhen to Refinance Student Loans

If you want to refinance your student loans, reach out to a lender to start the process. I called them up and they said my DTI ratio was too high due to my federal student loans (which I was not refinancing).This is case where the cost of the program is too high. I have felt so hopeless regarding the private loan, and have been apprehensive about even trying to find a place that will refinance 100k in private student loans.With a 14% interest rate you should absolutely look into refinancing.37% fixed rate (with autopay) with a 10 year term and payments of around $730/month.

: r/StudentLoans

I'm not 100% sure, but if you refinance your loans may not be eligible for this suspended interest.I would recommend refinancing just your private loans if you can find a lower interest rate.In this reddit post on student loans, user Zaerth talks about their experience with refinancing their private loan.

Issues with refinancing/consolidating my private student loans

When you refinance student loans, you can save money by replacing existing education debt with a new, lower-cost loan through a private lender.

Which student loan refinance option should I do?

Refinancing private student loans.

Sallie Mae loan, should I refinance : r/StudentLoans

They applied through SoFi, found a rate they liked, input my student loan amount, and was at the stage of getting approved when SoFi .Refinancing means you’re combining multiple debts into a single private loan.

Private student loan refinancing : r/StudentLoans

Here's the refinancing boilerplate: With private student loans the general advice is to try to refinance every 12-18 months to chase lower interest rates while you aggressively try to pay it off. Deciding to refinance private student loans is a personal choice. The federal loans I hooked up with income-driven repayment so they're tamed for now, but the private SallieMae loans are merciless. i graduated from undergrad May of . The first day the loan was dispersed for fall semester, my balance (which should have been $5,300 with the “disbursement fee”) was over $21k.Student loan refinancing can mean big savings in the right circumstances.About one year ago I refinanced multiple student loans with Earnest and got a refinanced loan at a rate over 35% lower than the average of my original loans. “ I'm going from paying nearly $900/month toward . I've tried through my local bank, PNC .Refinancement des prêts étudiants privés. Decide if refinancing is right for you.

8 Best Private Student Loans Of April 2024

Refinancing — A refinance loan is a popular option for debt relief. TLDR: my private student loan interest rates are high and growing exponentially and i’m looking to refinance. I have a 770+ credit score and make decent money as an RN. Check the terms and conditions to be sure of course. They committed corporate malpractice. I do not have loans from the government.When Refinancing a Private Student Loan Makes Sense. I constantly hear the advice to ./r/StudentLoans: Reddit's hub for advice, articles, and general discussion about getting and repaying student loans.Student Loan Refinancing Community

Refinancing Private Loans : r/StudentLoans

Refinancing means you’re combining multiple .

What should I do? Refinancing isn't a one . They offered me a 4.Refinancing through a private lender could give you the opportunity to lower the interest rates on your loans and save money over the life of the loan. Members Online • Objective-Sign-2467 .

Should You Refinance Your Private Student Loan?

The best option for you can.Refinancing to a 10-year loan term at 5% interest will save you $5,494 in total and $46 per month — enough to make a dent in an electricity, cable or phone bill.When you refinance student loans, you're taking out a new private student loan to replace your existing student loans. It can be super confusing to know what the . I've been looking to refinance somewhere as I just can't feasibly pay that .May 22nd (SAME DAY): Received email from Lendkey that I did not qualify for the 3. More posts you . You can shop around with other private refinance companies if you feel uncomfy with SoFi, they're all approximately equal so whoever gives you the best fixed interest rate is usually the best option Reply reply [deleted] • Comment removed by .