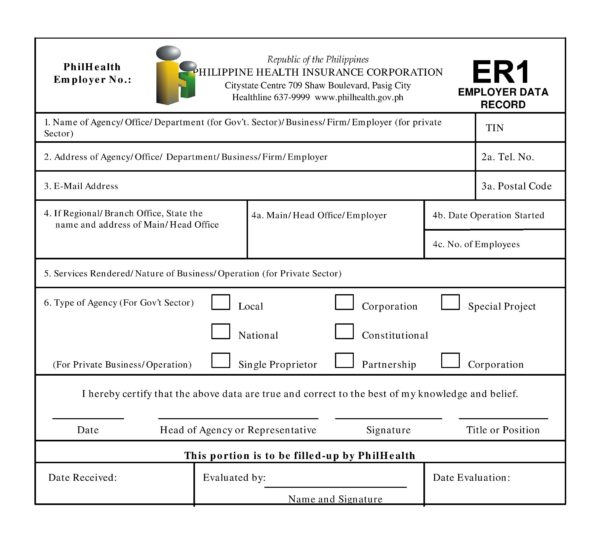

Register as an employer uk

How to Register as an Employer. Last updated Monday, December 11, 2023.

Employment status: Employee

Listed below is the information that you will need to register as an employer: Company UTR.

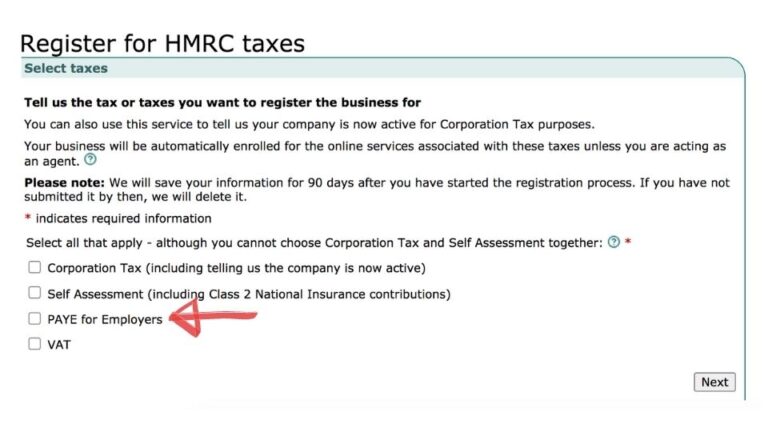

PAYE and payroll for employers: Setting up payroll

You hire somebody who has another job elsewhere, or. Registering as an employer may take time, so start the process as early as possible. Updated 8 November 2018.2 Select Your Business Structure.

DBS Update Service

Monday to Friday, 9am to 5pm (except public holidays) Find out about . Register as an employer and set up PAYE ; Choose how to run payrollWhen you are in the UK in the role of an employer, you will have to register for PAYE as an employer, generally, after that, you receive a unique reference number for your .

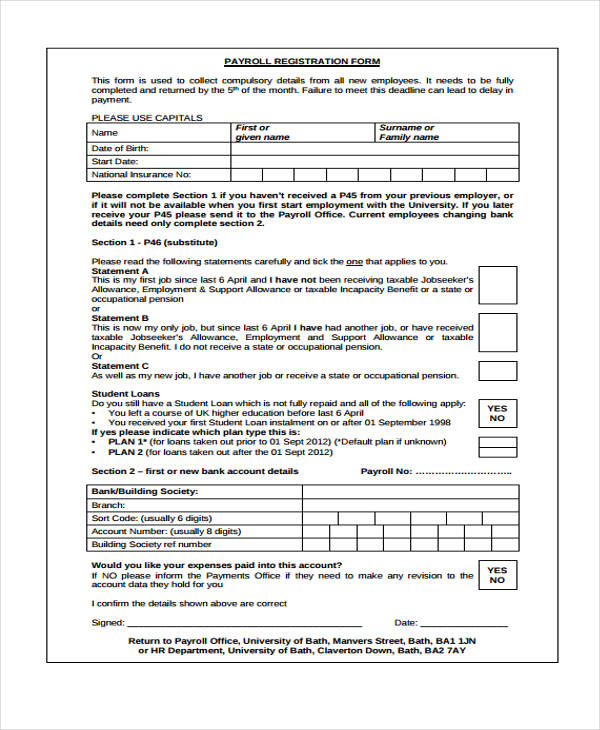

How to do your first payroll and register for PAYE

Join the APAR as an apprenticeship training provider.

Registering for PAYE as an Employer

The annual cost is divided by the number of paydays in the year .

Enrol if you did not register online.Employment status (worker, employee, self-employed, director or contractor) affects employment rights and employer responsibilities in the workplace

Employment status: Employee

Outside UK: +44 151 268 0558. This can only be . Planned downtime.

You can also join the premium customer service scheme to get . The new system does not apply to EEA or Swiss citizens you already employ in the UK. Unless you're going to pay all your employees less than the Lower Earnings Limit for National Insurance (£123 per week), you must register as an employer with HMRC before you take on any members of staff.uk/register-employer.

Registration of employers for Pay As You Earn (PAYE)

You must register even if you’re .

Recruiting people from outside the UK

Registering as an employer

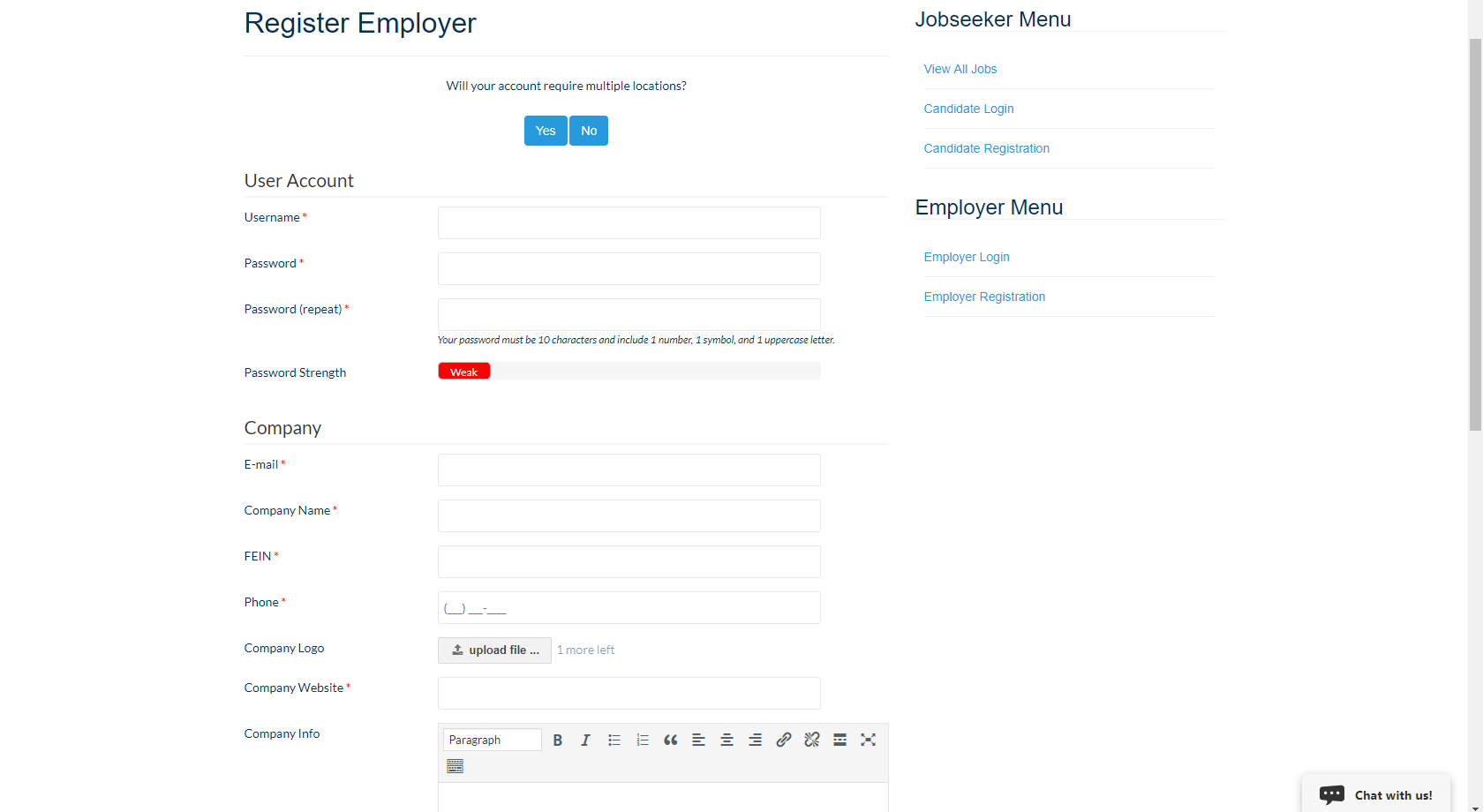

Number of employees including Directors. Will you need to register for CIS.Call us on 0345 564 5774 or send us an email to [email protected] must tell HM Revenue and Customs ( HMRC) when you take on a new employee and be registered as an employer. If you hire an employee, you must register as an employer. You must enrol and make an employer’s contribution for all staff who: are aged between 22 and the State Pension age. earn at least £10,000 a year. Application route 2: join the register as an employer . This is the same as £533 a month or £6,396 a year. Intend to provide expenses and benefits to employees. Service availability.Sponsorship, employer and education helpline.I'm neck deep in m.The employer is required to register as an employer with His Majesty’s Revenue and Customs (HMRC).What you need to do if you set up as a sole trader - check your employment status, understand your obligations, and register for tax. Before you pay your new starter follow these steps.How to pay PAYE and National Insurance for employers, including Construction Industry Scheme, student loan deductions, reference numbers, bank details, deadlines and payment booklets.

Register as an Employer

EEA and Swiss citizens who were . Telephone: 0300 123 4699.

Registering as an employer

Fax: 03000 523 030.To hire an employee in the UK, you will need to register with HM Revenue and Customs as a new employer if the employee: will earn more than £120 a week; will receive a pension .

Employing people

If you pay less than . Register as an employer for PAYE: service availability and issues.You will need to register as an employer with HMRC if any of the following are true: You are paying your employee at or above the National Insurance Lower . As an employer, you will have to deduct the following from your employee’s . Step 1: Determine Your Employer Status.You must register as an employer with HMRC as soon as any of the following apply to your company: You employ a worker who earns more than £120 per . You employ somebody who receives a pension, or. You’ll usually need a sponsor licence to employ someone to work for you from outside the UK.You usually need to register as an employer with HM Revenue and Customs (HMRC) when you start employing staff or using subcontractors for construction work.UK, we’d like to know more about your visit today.You need to register with HMRC so you can pay tax and national insurance for your employees. You must notify Revenue of your name and address and your intention to pay staff.

UK visa sponsorship for employers

Get an online share code to prove your right to work if you’re eligible or check what documents you can use instead. Find out about call charges. This is not the case. We’ll send you a link to a feedback form. normally work in the UK . Employers looking for training for apprentices.Register as an employer with HM Revenue and Customs (HMRC) and get a login for PAYE Online. Not a bad process, but there are a couple of quirks to watch out for.You need to have a sponsor licence to hire most workers from outside the UK.When you must register as an employer? You would assume that when you take on an employee you must register as an employer. Opening times: Our phone line opening hours are: Monday to Friday: 8am to 6pm. Welsh: 0300 0200 191.For UK registered companies, the employer can complete the registration process online at: www. Business address. You will need . This includes citizens of the EU, Iceland, Liechtenstein, Norway and Switzerland who . Alternatively, call HMRC on 0300 200 3200 or you can use HMRC Chat Online, Employers enquiries: chat – Ask HMRC – GOV.Looking to fill a number of niche positions and preserve its tight-knit company culture, a premier UK price comparison website uses Indeed to match its specialised positions with quality candidates.Who you must enrol.

Use the Employer Checking Service

ukRecommandé pour vous en fonction de ce qui est populaire • Avis

Register as an employer for PAYE: service availability and issues

4 Enter Your Employees First Pay Day.You need to register as an Employer if have employees who are: Paid more than £120 per week including expenses and benefits and don’t have another job or .

Registering as an employer with HMRC

It will take only 2 minutes to fill in. Contact email address. How do I set up my first payroll and register for PAYE? How much should I pay my employees? Pensions, benefits, .During the tax year, the employer works out the taxable amount of the benefit and adds this to the employees’ actual monthly pay.As a business you must register as an employer if you hire: employees; labour only sub-contractors; Jersey resident directors; This includes non-resident employers employing people locally and individuals hiring an employee, for example a nanny. Choose payroll software to record employee’s details, calculate pay and .Critiques : 478 It can take up to 15 working days to get your employer PAYE reference number.1 Sign Into Your Online Business Account.You normally need to register as an employer with HM Revenue and Customs ( HMRC) when you start employing staff, or using subcontractors for construction work.

So, if you have employees, then you are by default required to register for PAYE with the UK .From your employee’s P45, you’ll need their: full name. For companies registered outside the UK, the registration process can only be completed by telephone.Do I need to register as an employer? Whether you operate as a sole trader, company, or partnership, you will need to register as an employer with HMRC and set up .

Registering as an employer with HMRC

You cannot register more than 2 months before you start paying people.

How to Set Up & Register for PAYE as an Employer

Once registered, the client passes to us details of the reference numbers allocated by HMRC. You provide an employee with benefits or .Use the Employer Checking Service.3 Enter Your Tax Reference Number. Telephone: 0300 0200 190. If your business is a limited company and you’re taking a salary, you may well have already registered the company . Date 1 st payment will be made to employees. In this article.5 Submit Your Application.DBS customer services. student loan deduction status. You can also find out .

Once you have registered your business, or if you are already registered as a business, you can apply for your PAYE number by registering as an employer.The Update Service is an online subscription that lets employers carry out a free, instant online check to view the status of an existing standard or enhanced DBS certificate.

PAYE Online for employers: Enrol if you did not register online

You should do this through MyEnquiries in Revenue Online Service (ROS) before paying your employee.Employment status (worker, employee, self-employed, director or contractor) affects employment rights and employer responsibilities in the workplace Here’s what you need to do: Register online with .

Registering as an employer.

customerservices@dbs.

Employers: general enquiries

When you start employing staff, you will need to register with HM Revenue and Customs (HMRC) online – you must register even if you are only employing yourself.