Repay my student loans

Our student loan repayment calculator (UK) takes into account: 1. Once you're on an IDR plan, stay on track with our tips for . How it works: PAYE sets monthly payments at a . You won’t have to repay your loans until April four years after the start of your course, or the April after you leave or finish your course.The compulsory repayment threshold for the 2023-24 income year will be $51,550.This plan has forgiven a total of $153 billion in student debt relief for nearly 4.Limits On Using 529 Plans To Repay Student Loans. Rosie Murray-West.But whatever the threshold is, you'll only ever repay 9% of your earnings over that amount.

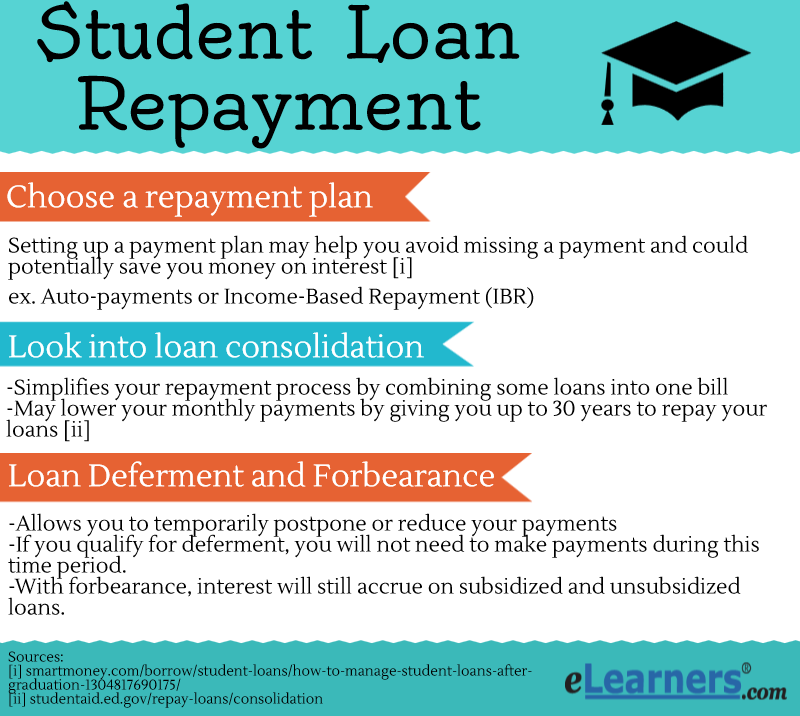

Options for repaying your federal student loan

You’ll repay 9% of your income over £2,082 a month because that is the lowest threshold out of the plan types you have. If you want to get started now, here are some of the best ways to pay off your student loans.Learn how to manage your federal student loans, choose a repayment plan, and apply for loan forgiveness or consolidation.

So, you can’t bypass the limit by taking distributions from multiple 529 plans.

For example, you won't need to repay anything if you're studying, .

Get started repaying your federal student loan

22, 2022, the Biden administration extended the pause on payments and interest on federal student loans for the eighth time. For example, if you have a parent-owned 529 plan and a grandparent-owned 529 .Withdrew within 120 days of when the school closed.

Student Loan Repayment Options: Find the Best Plan

Learn about different repayment plans, loan forgiveness programs, and .

Loan repayment

Loan Repayment

If you are working, you must advise your employer if you have a HELP debt. Footer navigation

What Happens If You Don’t Pay Student Loans?

They are based on your .But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs.50 a year on a Plan 2 loan, or £450 a year on a Plan 5 loan.

Student Loan Forgiveness (and Other Ways the

SAVE Calculator: Estimate Payments on Biden’s New IDR Planstudentloansherpa. Department of Education says that many borrowers eligible for President Joe Biden ’s student loan forgiveness plan who made payments on their debt . You never know what you may be eligible for, so take a look at the options listed below. If you don’t make your full monthly payment within 30 days of your due date, your loan servicer will charge you a late fee. Standard or income-driven repayment plans work for most borrowers. Generally, here’s what can happen if you don’t pay private student loans: If . By paying half the amount you owe every two weeks, you’ll make 13 full payments by the end of the . Create Online Account .Repaying student loans.The tool helps you review different student loan repayment plans and compare estimated monthly payments, total paid over time, and more.

If you need to make lower monthly payments, we recommend that you repay your loan(s) under one of the following income .

Private Student Loans, Pick What You Pay

They are based on your income, family size, and federal student loan debt. Salary Growth – we add this % to RPI which gives you an idea of how much your salary will grow above inflation. Learn ways to prepare for your upcoming student loan . The fee can be as high as 6% of your late .Find out how to make your payments on time and keep the cost manageable. Since March 2020, federal student loan payments have been frozen; no payments were due, and interest rates on outstanding . We've estimated it at 2. lower your payments to make them more affordable, or.Your payments are based on a 9 ½ year pay-back schedule. These options may save you time and money in the long run as you pay off your student loan .comSAVE / New REPAYE Guide - Student Loan Plannerstudentloanplanner.

Note: The Loan Simulator can’t calculate exactly how .As with all student loans, you'll only start paying this back once you're earning over a certain threshold.

What Can Happen If You Do Not Repay Your Student Loans?

.3 million Americans to date, including another $7.

Pay back OSAP

Some plans even offer student loan forgiveness. If you move overseas, you’ll repay directly to the Student Loans Company, instead of having it taken automatically . If you do not earn above the threshold, you will not have to make a repayment on your debt.

FEDERAL STUDENT LOANS

You could pay as little as $0 per month.

Student loan repayment: should I pay back early?

extend your repayment time up to 174 months to make your payments smaller.When you start repaying your student loan, your monthly repayments, what to do if you have 2 jobs or are self-employed, how to get a refund if you've overpaid.You can pay student loans off faster by making larger automatic payments or biweekly payments. Read: 31 Online Jobs For Students in the UK. work out whether your student loan may be written off. The Department of Education has several mechanisms they can choose to apply if a borrower does not repay their loan: They can apply late fees and penalties. If you take out a student loan when you're at college or university you have to repay it.More than 200,000 post-secondary students with student loans are due to convocate this spring.How much student loan you would repay on a £30,000 income Under current rules, someone with an income of £30,000 would pay back £243. Whichever is the soonest? If you do not pay your loans back after 30 years, then your loans will be canceled.Student Loan Repayment Begins.Borrowers can choose from four types of federal student loan repayment plans. Average Inflation (RPI) – affects a few calculations such as the interest on your loan and salary growth. You can: increase your payments to reduce the time it takes to pay back your loan. Your repayment totals 9% of your earnings above the threshold on plan 1, 2, 4 or 5 or 6% of you earnings above the threshold if you are on a postgraduate plan.Federal Student Aid .If you withdraw funds from a 529 plan to repay student loans, you can’t claim the interest through the student loan interest tax deduction.If you have a full-time student loan, you can customize your payments online in your NSLSC account.There are four federal student loan repayment options. You can use this . This pay-back schedule is the average amount of time it takes to pay back an OSAP loan. Your compulsory repayments are calculated based on your income, not the size of your debt. Use the Education Department’s Loan Simulator to choose the right plan for you. If the cases aren’t resolved by June 30, 2023, .comRecommandé pour vous en fonction de ce qui est populaire • Avis

Federal Student Aid

Qualified distributions are limited to $10,000 per borrower.

If payment is 30 days late.For most loans, you’ll have six or nine months after you graduate, leave school, or drop below half-time enrollment before you must begin making payments.

The earliest you'll start repaying your student loan is the April after your course has ended, or the April four years after your course has started, if your course is .

Student Loan Repayment FAQs: What You Need To Know

You only start repaying your Student Loan when you're earning a certain amount of money. Repaying student loans is an excellent way to establish and improve your credit score.4 billion in student loans canceled in . This is a lifetime limit that applies to distributions from all 529 plans. State Laws on 529 Student Debt Use. Use this fact sheet to: work out when you might have to make payments to your student loan;.If you are a student with a plan 1, 2, 4, 5 or postgraduate student loan, you only make repayments if your pre-tax salary is above the repayment threshold.

Student Loan repayment guide 2024

Connect to your personal loan information by registering for online access.Consequences of missed payments may vary among private lenders; review your loan contracts for specific details.Plus, the less time you spend repaying your loans, the less interest you pay. Under some income-driven . Share this guide. understand what happens if you have student loan arrears; and. Right now, the threshold for Plan 4 loans is £31,395, which means if you earn £36,395 a year, you'll repay 9% of £5,000 (the difference between your earnings and the threshold) – a sum total of £450 a year. Because of legislation passed by Congress, monthly federal student loan payments began again in October 2023.Repay your student loan. Calculation: £2,200 – £2,082 (your income minus the lowest threshold . You can make additional payments on your loan at any time if you want to repay it faster.A few simple steps now will help set you up for success as you repay your loan. Who’s eligible: Borrowers who received a disbursement of a direct loan on or after Oct. It's a simple question spilling from the lips of over four million former graduates. You may receive an automatic discharge if your school closed on or after Nov. But the best one for you will likely be the standard repayment plan or an income . Despite the new . Updated May 11, 2023.Borrowers with federal student loans won’t have to make payments, and loans won’t resume accumulating interest, until 60 days after court cases challenging Biden’s student loan forgiveness program are resolved or the Department of Education is allowed to move forward with the program. They can report missed payments and/or defaults to the national reporting agencies, which will impact your credit score, which . We’ve estimated it at 1.