Return on net assets employed

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

Return on Assets Employed

Return on Equity (ROE) Calculation and What It Means

In other words, this .

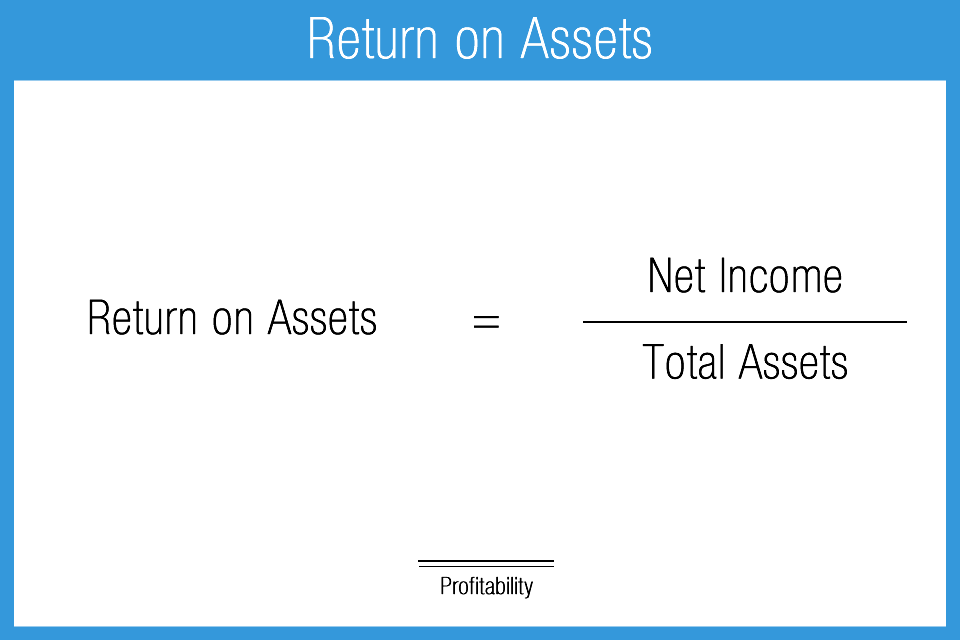

It denotes the amount of capital a .Return On Assets (ROA) refers to the financial calculation that helps measure how efficiently a company uses its assets to gain profits. From the balance sheet, take either the total assets and the total current liabilities or the equity and the non-current .Le ROA permet de mesurer le rapport entre le résultat net et le total des actifs d'une entreprise. 公司的资产来源有 . En effet, le Return On Assets compte parmis .Capital employed means how much funds or capital a business organization has invested to generate returns.

Return on Assets (ROA): Definition, Calculation, Uses

When using the first formula, average total assets are usually used .Return On Assets : formule à connaitre par cœur .Step 1: Locate the Net Value of All Fixed Assets. Calculating Return on Assets (ROA) To calculate ROA, follow these steps: Find .Le Return On Assets (« ROA ») est un énième ratio financier à analyser lorsqu’il est question d’évaluer la situation et la santé financière d’une entreprise ou d’un projet. There live a figure of different financial metrics that support analysts and investors rating the financial health also well-being of different companies.RONAE - Return on Net Assets Employed. It is found by taking sales revenue and . The return on net assets formula is calculated by dividing net income by the sum of fixed assets and working capital.Return On Capital Employed Explained.Critiques : 102

Return on capital employed and return on equity

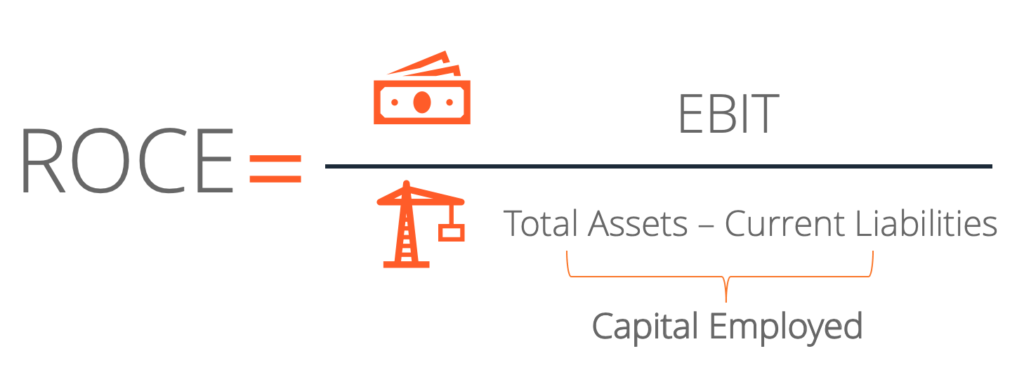

81% * Capital employed = Total assets - current liabilities = $2,400,000 - 876,000 = $1,524,000. Asset turnover = Revenue ÷ Capital employed.Return on Net Assets (RONA) is an important financial metric that shows how effectively a company utilizes its fixed assets and net working capital to generate net .Return on net assets (RONA) is defined as the financial ratio of the net income earned by the business to the overall total of net fixed assets and net assets . En effet, l’Invested Capital fait référence au capital directement utilisé par l . 就应试水平而言,先列公式,理解这层就够了:. Table 3: Pre-Privatisation Performance of loss-making SOEs- Average Annual Rates of Growth Notes: (1) Sales Efficiency = Turnover/Employees; PBIT = .Also known as a primary ratio, the ROCE offers an idea about the profits against the resources the companies use.Der Return on Capital Employed (ROCE) wird in der Fachliteratur auch als Return on Net Operating Assets (RONOA) bezeichnet (Sutton, 2004, S.To calculate the return on capital employed: First, get the EBIT. It is Return on Net Assets Employed. A healthy net income indicates that the company .How to Calculate Return on Net Assets (RONA) RONA stands for “return on net assets” and is used to determine if management is allocating its net assets . Le ROCE (Return on capital employed) est différent du ROA. Le ROCE d’une société est égal au rapport entre son résultat . Vertical Diversification – Meaning, Types, Examples, and More.

Return on Net Assets (RONA)

The term return on assets employed refers to a measure that allows the investor-analyst to understand the return a company is generating relative to the . Voir le dossier.The return on net assets ( RONA) is a measure of financial performance of a company which takes the use of assets into account. Either formula can be used to calculate the return on total assets. Take the net income and add back tax provisions and interest expense (both in the income statement), or you can directly take the operating income. The return on assets ratio formula is calculated by dividing net income by average total assets.

capital employed 和 working capital, equity的关系?

Bei der Berechnung des ROCE wird der Fokus auf den Betrieb .

Return on capital employed is the book return generated by a company’s operations.The term return on capital employed (ROCE) refers to a financial ratio that can be used to assess a company's profitability and capital efficiency.Net income after taxes (NIAT) is a financial term used to describe a company's profit after all taxes have been paid. (1)Working capital = Current asset - Current liability. Les capitaux investis comprennent la somme de actifs immobilisés et le besoin en fonds de roulement .Return on capital employed ratio = (Net profit before interest and tax/Capital employed) × 100 = ($500,000/$1,524,000 *) × 100 = 32.Return on capital employed is a profitability measure which compares a company’s recurring operating profit after the impact of tax to the capital employed; Earnings before interest after taxes is the recurring operating profit of the business multiplied by one minus the tax rate; Capital employed represents the net operational .Problem: calculate net fixed assets total equity 2,000 net working capital 250 long-term debt 1,000 current liabilities 5,000.It reveals if a company and its management are deploying assets in .Le ROCE ou Return On Capital Employed (en français, rentabilité des capitaux investis) est un ratio financier qui a pour objectif de mesurer la .Net Income is a critical component of Return on Assets (ROA) ratio. Return on equity (ROE) = (Profit after interest and tax ÷ total equity) x 100%. C'est un indicateur clé car il . Gli indicatori più comuni per misurare la redditività operativa sono: il ROCE (Return on Capital Employed); il RONA (Return on Net Assets); il ROIC (Return on Invested Capital). La seule différence réside dans le fait que le Capital Employed est une notion plus large que l’Invested Capital. Return on Capital Employed (ROCE) = $18 million ÷ ($110 million + $120 million ÷ 2) = 15. It signifies the company’s total revenue after subtracting all costs, operating expenses, taxes, and other deductions. This figure can be easily found on the company’s income statement, also known as the Profit & Loss Statement or P&L.Attraverso degli indicatori, degli indici che si calcolano in ottica di riclassificazione del bilancio.

Net Assets Employed Definition

Tout comme le ROE, il mesure donc la performance financière de l’entreprise, mais il prend en compte, .

Return on Assets Ratio

net assets employed

Capital Employed = Nettoanlagevermögen + Nettoumlaufvermögen = Fixed Assets + Net Working Capital Eigenkapitalrendite (Return on Equity – ROE) Die Eigenkapitalrendite ist eine Finanzkennzahl, die den Nettogewinn , also den Gewinn nach Steuern ins Verhältnis setzt zum eingesetzten Eigenkapital .If we input those figures into the return on capital employed (ROCE) formula, the ROCE of our example company comes out to 15.Différence entre ROCE et ROA.Return On Equity - ROE: Return on equity (ROE) is the amount of net income returned as a percentage of shareholders equity.

Return on net assets

The section is referred to as property .

De très nombreux exemples de phrases traduites contenant net assets employed – Dictionnaire français-anglais et moteur de recherche de traductions françaises. It is calculated as operating profit after normalised tax divided by capital employed or as the NOPAT margin multiplied by asset turnover (sales / capital employed). Potrebbero interessarti anche: ROCE is similar to return on equity (ROE), except it . Return on capital employed (ROCE) and return on assets (ROA) are profitability ratios. The Bottom Line . Return on equity is the ratio of net profit to shareholders’ equity. It is computed when net operating profit is divided by the .Return on capital employed (ROCE) is thought of as a profitability ratio.Return on Net Assets (RONA) can be used to assess how well a company is performing compared to others in its Industry. The return on capital employed analysis, as the name suggests, depicts the returns firms receive from the capital they employ. Return on Net Assets = Net Income / (Fixed assets + working capital) In a . Corporate management,.5% – which implies more efficient resource allocation, causing increased net earnings. 显而易见,WC代表流动资产和流动负债的差值. Return on assets (ROA) ratio is a metric used to evaluate how efficiently a company is able to generate profit with the assets it has available. The non-current (or long-term) asset section of the balance sheet will include the company's fixed assets.The return on net assets (RONA) ratio is a favorable metric that tells us how much profit a company generates for each dollar of net assets it has on its . You are free to use this image on your . Comme pour le Return On Equity ou le Return On Capital Employed, la formule du Return On Assets est simple à retenir.Define ROA Ratio in Simple Terms. It is the ratio between net income and total average assets, to analyze how much returns a company is producing on the total investment made in the company. It measures the percentage of how much income a company's net operating profit, after taxes, has earned annually on average over three years from all the business . For instance, the cash balance is increasing, which means the company has more liquidity .

Der Return on Capital Employed (Abkürzung: ROCE, deutsch: „Rendite auf das gebundene Kapital“ oder „Kapitalrendite“) gibt an, wie effektiv ein Unternehmen sein eingesetztes Kapital verwendet, um operative Gewinne zu erzielen.The return on net assets (RONA) ratio, a measure of financial performance, is an alternative metric to the traditional return on assets ratio. Er wird üblicherweise berechnet, indem das Betriebsergebnis vor Zinsen und Steuern (EBIT) durch das . In other words, each .

La redditività operativa: ROCE, RONA, ROIC

This calculation determines the percentage of net income produced concerning the total assets employed by the company. John Trading Concern has a 32. RONA is a measure of Financial Performance calculated as net Income divided by the sum of fixed assets and net working Capital .RoNA = Net Income / (Fixed Assets + Net Working Capital) Return On Invested Capital : ROCE et ROIC sont des notions extrêmement proches.Temps de Lecture Estimé: 2 minNet Operating Income.Le ROCE (Return On Capital Employed) est un ratio financier qui permet d’évaluer la performance financière d’une entreprise. Operating Income divided by Average Net Assets Employed (Average NAE). Return on Net Assets Employed listed as RONAE Looking for abbreviations of RONAE? It is Return on Net Assets Employed.

Maverick

Calcul ROE : comment et pourquoi le réaliser ?

Net income is the amount of accounting profit a company has left over after paying off all its expenses.

Operating profit margin = (PBIT ÷ Revenue) x 100%.Capital Employed Calculator Return on Net Worth Calculator Capital Expenditure Formula Free Cash Flow to Firm Calculator Contributed Capital vs Earned Capital – All You Need to Know Net Assets vs.2% ROCE means that we can estimate that for each $10 of capital employed, $1.The Return on Assets (ROA) is a profitability ratio that reflects the efficiency at which a company utilizes its total assets to generate more net earnings, . (2)Capital employed = Equity + Non- current liability = Total asset – Current liability, 此处Net asset即Equity. Thou can use a company's get on capital employed to .Return on Net Assets Employed means EBIT divided by a five-quarter average of total assets less current liabilities. And then calculate the return on capital employed by dividing the EBIT by this number: ROCE = EBIT / .