Return on stockholders equity

:max_bytes(150000):strip_icc()/Stockholdersequity_Sketch_final-5230009146b749cc85d8b57339a52dad.png)

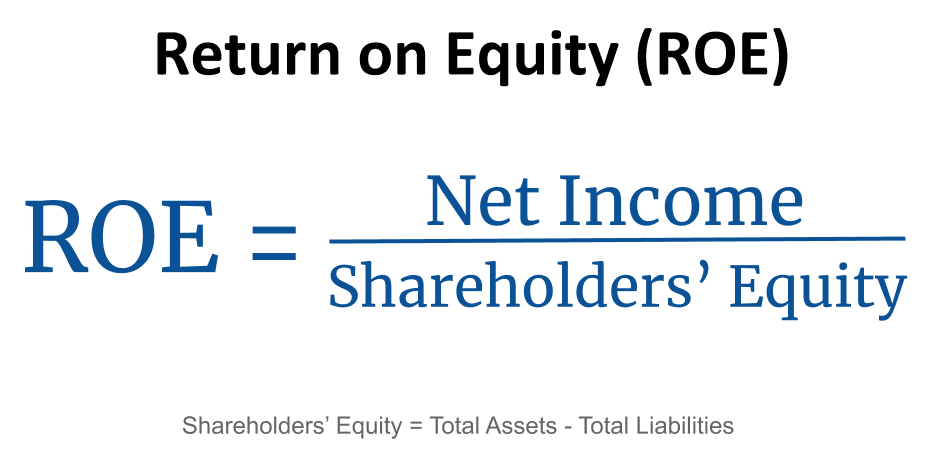

Similar to the metric. In reaction to the impressive Q1 print, Argus analyst Stephen Biggar upgraded his rating for Goldman Sachs to buy from .Return on equity is a financial ratio that shows how well a company is managing the capital that shareholders have invested in it.Return on equity (ROE) is a financial performance metric that's calculated by dividing a company's net income by shareholders' equity. Return on equity is so . Preference Stock.

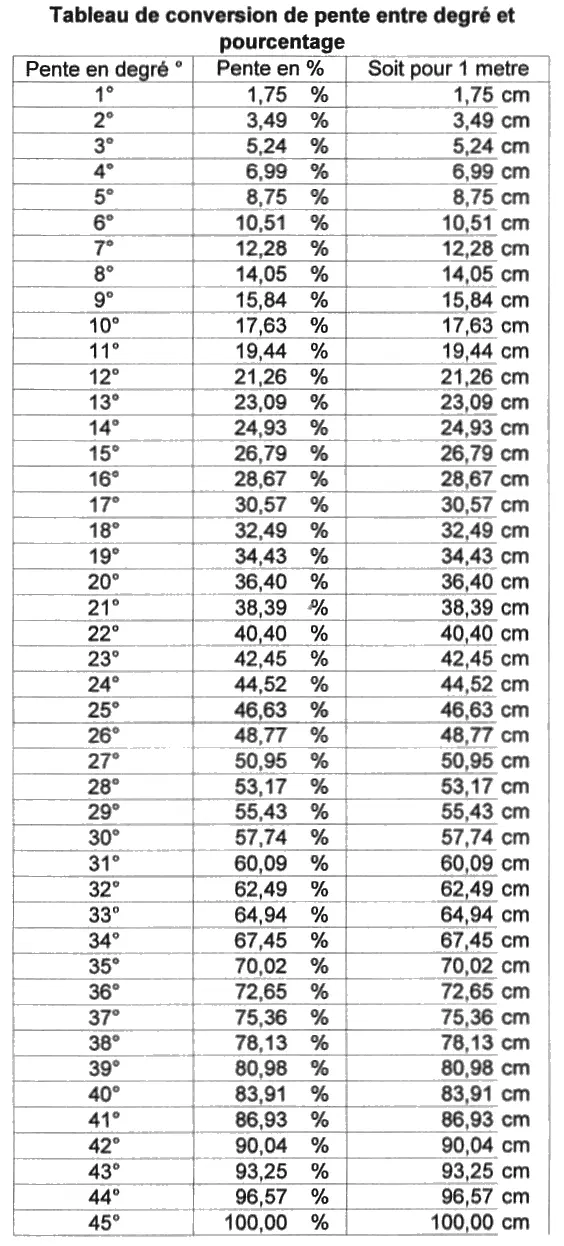

What Is Stockholders' Equity?

Return on Equity Calculator

How to Calculate Return on Equity (ROE) and Examples

Analysis of Debt. 作 用 反映所有者权益所获报酬的水平. Tesla share holder equity for 2021 was $31. However, return on stockholders equity is typically available on the company's balance sheet.

Return on equity (ROCE) is an alternative to return on equity (ROE).ROE = $21,906,000 (net income) ÷ $209,154,000 (avg.

PepsiCo Share Holder Equity 2010-2023

myaccountingcourse.Tesla share holder equity for 2023 was $63.A consistent return on equity (ROE) of 20% or higher is considered a good ROE. The ROCE would then be: ($170,000 / $1,100,000) * 100 = 15.ROE is a financial ratio that tells you how much profit a public company earns from its shareholders' equity, or the value of the company's assets minus its liabilities. get full access to the entire website for at least 3 months from $62. Inventory Turnover - A ratio that measures the number for times a company's inventory is sold and replaced over the year.The return on total assets.1047 by 100 to convert to a percentage) By following the formula, the return that XYZ's management earned on shareholder equity was 10. Determine the company's earnings per share on common stock.Return on Equity (ROE) is a measure of a company’s profitability that takes a company’s annual return (net income) divided by the value of its total shareholders’ equity (i.

Stockholders Equity

In this article, you will get to understand the components of stockholder’s equity in the balance sheet, its calculation, and [.

Return on Equity (ROE): Definition & Formula

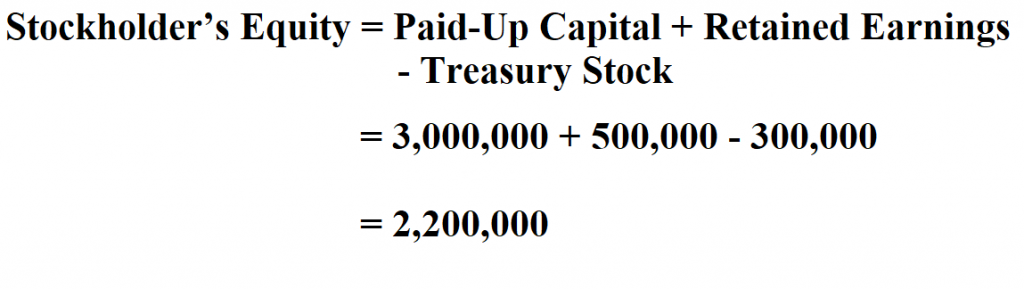

Stockholders' equity is what's left when you take a company's assets and subtract its liabilities. Tesla share holder equity for 2022 was $45. It shows the firm’s ability to . Calculated as: Income from Continuing Operations / Total Common Equity.Stockholders Equity = Total Assets − Total Liabilities.DALLAS, April 23, 2024 /PRNewswire/ -- Texas Instruments Incorporated (TI) (Nasdaq: TXN) today reported first quarter revenue of $3. For most companies, higher stockholders' equity indicates more stable finances and more flexibility in case of an economic or financial . Example of Stockholders Equity Statement. (NYSE: GM) today reported first-quarter 2024 revenue of $43. The data is hidden behind: .Share Holder Equity. 外文名 Rate of Return on Common Stockholders’ Equity. Hence, it is also known .

Return on equity (ROCE) adalah alternatif dari return on equity (ROE).Return on Equity (ROE) is a financial metric that calculates how efficiently a company is operating in relation to its shareholders' equity.comHow to Calculate Return on Equity (ROE): 10 Steps (with . However, calculating a single company's return on equity rarely tells you much . However, there are some caveats, which I’ll dive into shortly.47% (after multiplying 0. Starbucks Corporation (SBUX) had Return on Equity of -51. The Net Income used in the numerator is often adjusted for one-time and non-recurring items to present a clearer view of future earnings.Stockholders' equity is the value of a business's assets that remain after subtracting liabilities.The formula for calculating stockholders' equity is: Stockholders' Equity = Total assets – Total Liabilities. 定 义 企业净利润与平均净资产的比率. Earnings per Share and Price-Earnings Ratio A company reports the following: a. It can be represented with the accounting equation : Assets -Liabilities = Equity.

Conceptually both are the same.Return on common equity (ROE) mengukur berapa persen yang diterima oleh pemegang saham biasa untuk setiap laba bersih yang dibukukan oleh perusahaan.Return on equity measures a corporation's profitability by revealing how much profit a company generates with the money shareholders have invested. However, common . It shows how efficiently a firm is . Return on Common Equity (ROCE) is a crucial financial ratio that measures a company’s ability to generate profits from its invested capital.Current and historical return on equity (ROE) values for Apple (AAPL) over the last 10 years. #2 – Retained Earnings.Current and historical return on equity (ROE) values for Starbucks (SBUX) over the last 10 years. In this article, we will explore the concept of ROCE, its . It expresses the amount the owner or owners of a company has invested in the business over time.

Return on Common Equity (ROCE): Perhitungan dan Interpretasi

ROE is the measure of a company’s annual return (net income) divided by the value of its total shareholders’ equity, expressed as a percentage. If you were to calculate this variable manually, you would subtract total liability from total assets to get shareholder equity. If required, round your percentages to one decimal place.要说财务分析里最重要的指标那就是ROE了,ROE是“Rate of Return on Common Stockholders’Equity”或“Return on Equity”的简称。. To calculate ROE, one .Return on common equity (ROE) measures what percentage is received by common stockholders for each net profit recorded by the company.Metrics similar to Return on Common Equity in the efficiency category include:.De très nombreux exemples de phrases traduites contenant stockholders' equity – Dictionnaire français-anglais et moteur de recherche de traductions françaises.Return on Equity (ROE) is a metric used to estimate the financial performance of a company in terms of how well a it uses its net assets (equity equals the company's .GS stock offers a dividend yield of 2.3% increase from 2022. #4 – Other Comprehensive Income.

PepsiCo share holder equity for 2023 was $18. To calculate book value, divide total common stockholders’ equity by the average number of common shares . Investors and analysts often use ROCE as an indicator of a company’s financial performance and management efficiency. Let's understand the formula's constituent parts.The return on equity, or “ROE”, is a metric that represents how profitable the company has been, taking into account the contributions of its shareholders.Components of Stockholder’s Equity Statement.

How to Calculate Ending Stockholders' Equity

Semakin tinggi ROE perusahaan, semakin baik sebuah perusahaan dalam menciptakan laba dan value bagi investornya karena perusahaan sudah mengetahui cara menginvestasikan kembali pendapatannya agar dapat meningkatkan laba dan value .Return on Equity Calculator - ROE formula & calculationgigacalculator. This amount appears in the firm's balance sheet as well as the statement of stockholders' equity.Shareholder’s equity decreased due to share buyback and accumulated losses that flow through the Shareholder’s Equity.Determine average shareholders’ equity: ($1,000,000 + $1,200,000) / 2 = $1,100,000.

How To Calculate Return On Equity (ROE)

Get 1-month access to Walmart Inc.

Return on Equity

Round your answer to the nearest cent.9% increase year-over-year. Treasury Stock. The ROE metric answers the . #1 – Share Capital.comReturn on Equity (ROE) | Formula | Example | Ratio . Shareholders' equity is calculated by subtracting liabilities .Return on equity (ROE) is a financial performance metric that shows how profitable a company is.Equity: Generally speaking, equity is the value of an asset less the amount of all liabilities on that asset.

return on common stockholders' equity

64% for the most recently reported fiscal year, .The Company stockholders’ equity also known as shareholders’ equity is an account contained in the balance sheet.Return on Equity – commonly known by its shorthand ROE – is the ratio of a business's net profit or income to shareholders' equity. (Total assets at the beginning of last year were $2,942,000 .The return on equity ratio or ROE is a profitability ratio that measures the ability of a firm to generate profits from its shareholders investments in the company.Question: Determine (a) the return on stockholders' equity and (b) the return on common stockholders' equity. is the most widely used formula to calculate the stockholder's equity. Return on equity measures a corporation's profitability by revealing how much profit a company generates with the money shareholders have .Return On Average Equity - ROAE: Return on average equity (ROAE) is an adjusted version of the return on equity (ROE) measure of company profitability, in which the denominator, shareholders . Share holder equity can be defined as the sum of preferred and common equity items.这个比率通常也被称为 净资产收益率 ,英文缩写ROE(Rate of Return on Common Stockholders’ Equity )。 中文名 权益净利率. Is the company's financial leverage positive or .DETROIT, April 23, 2024 /PRNewswire/ -- General Motors Co.

shareholders' equity) ROE = 0. In other words, this is the company's .Total stockholders' equity represents either the source of a company's assets, the owners' residual claim of a company's assets after its liabilities have. As a measure of financial performance, it .De très nombreux exemples de phrases traduites contenant return on common stockholders' equity – Dictionnaire français-anglais et moteur de recherche de traductions françaises. Colgate Dupont Return on Equity = (Net Income / Sales) x (Sales / Total Assets) .Return on equity represents the percentage return a company generates on the money shareholders have invested. Debt to Equity since 2005. To calculate the return on common equity ratio, or ROE ratio, use the following formula: Net profit attributable to ordinary shareholders is arrived at by . Net Income to Stockholders Margin CAGR (3y) - Three-year compound annual growth rate in net income to stockholders margin.comRecommandé pour vous en fonction de ce qui est populaire • Avis

How to Calculate Return on Equity (ROE)

How to Calculate Return on Equity | ROE Formula, .9% increase from .

Stockholders' Equity: Formula & How It Works

1 定义; 2 方程式; 定义 .Shareholders' equity: A key component in the ROE calculation is to determine the shareholders' equity.Return on equity (ROE) is a vital financial metric that reveals how effectively a company uses shareholders' equity to generate profits. 中文名称是“净资产收益率”,反映的是股东权益的收益水平,衡量的是资本的运作效率,或者说股东投入资本的利用效率。. We then compare net profit to how much they initially invested.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Return on Equity (ROE)

Return on Common Equity (ROCE): Calculation and Interpretation

66 billion, net income of $1.; Avg Operating Income .Stockholders' equity is the remaining assets available to shareholders after all liabilities are paid. Tesla is the market leader in battery-powered electric car sales in the United States, with roughly 70% market .Current and historical return on equity (ROE) values for Dell (DELL) over the last 10 years. PepsiCo share holder equity for the quarter ending March 31, 2024 was $18.

Return on Equity (ROE)

Return on Equity (ROE): Definition and How to Calculate It

ROE is calculated by dividing a company's annual net .patriotsoftware.

Apple ROE 2010-2023

It is calculated either as a firm's total assets less its total . The return on equity. It provides valuable insights . 别 名 净资产收益率.