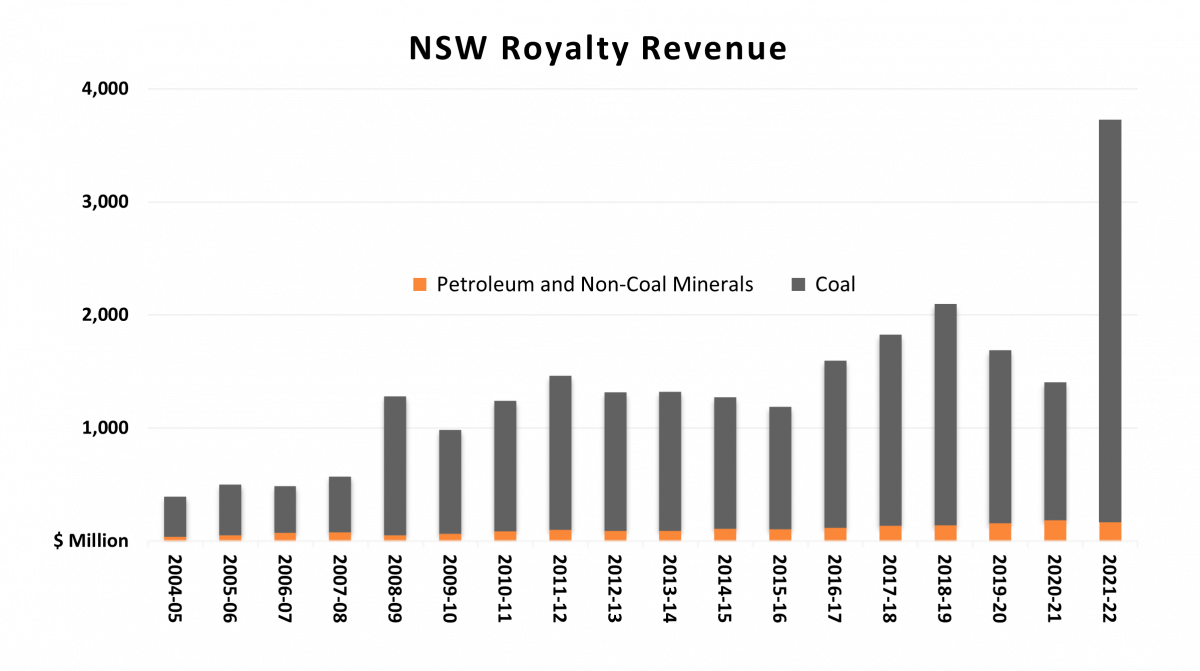

Revenue nsw au

Ceux-ci sont en principe soumis à un prélèvement forfaitaire unique de 30 % (la flat tax) au moment de leur perception, ce taux se décomposant entre 17,2 % .Revenue NSW started administering Emergency Services Levy from 1 July 2017.

Electric Vehicles (Revenue Arrangements) Act 2021 No 25

Pay your fine or overdue fine now to avoid additional costs and recovery action. Il est progressif . Revenue Ruling DUT 049 Transfers in Relation to Managed Investment Schemes.

8 billion plus or minus $300 million, compared with analysts' average estimate of .En tant que LMNP, les revenus locatifs de locaux meublés sont soumis au barème progressif de l'impôt sur le revenu.auRecommandé pour vous en fonction de ce qui est populaire • Avis

Land tax online

Log into your land tax account using your client ID and correspondence ID found on your recent correspondence from Revenue NSW. Calls to 1300 numbers from a landline within Australia will . The threshold is published in the government gazette on or before the first Friday of December each year. The two annual land tax revenue rulings for boarding houses and low cost accommodation have been issued for the 2024 tax year.Les revenus imposables. Access online services you need quickly. With a MyServiceNSW Account, you can pay your land tax,, set up a payment plan, lodge a return, access historical information, and more.Revenue NSW is the state’s principal revenue management agency. Avant de choisir son régime fiscal, il est important de comparer le taux d'imposition afin d' opter pour le système le plus avantageux . *Some exceptions may apply. If you’re a non-profit organisation that is either a religious institution, charitable organisation or an organisation set up for public benefit, the wages you pay . Select 'Payments' and 'Manage Payments'.03 million) from 482.

revenus

60 billion from a year earlier. Step by step information service for life events.En cas de rachat partiel ou total de l'assurance-vie, les gains sont soumis à l' impôt sur le revenu ou au prélèvement libératoire.We provide data and statistics for various taxes, duties, benefits, penalty notices and clients surveys.Access online services you need quickly. Dès le 11 avril, vous pourrez accéder au service en ligne sur le site des impôts pour faire votre déclaration des revenus de l'année 2023.To qualify as a first home buyer, you must be: at least 18 years old*. Key workers, single parents and single people 50 or over may also be eligible for . Approval of a payment plan may be subject to conditions such as an up-front payment, a review period .State Revenue Legislation Further Amendment Act 2020.The claims process.How a payment plan works. COOTAMUNDRA & . A Fairer Fines System for NSW – The Fines Amendment Act 2019, effective from 1 July 2020.5 billion, up 27 percent from the year-earlier period and above Wall Street expectations. Links to our online services and educational resources if you need help. le montant des éventuels prélèvements sociaux à payer en 2024. We are responsible for collecting revenues, administering grants and recovering debts on behalf of the people of NSW. Revenue NSW came into effect on 31 July 2017, following a name change from the Office of State Revenue and State Debt Recovery Office. If your fine is overdue and you have received an Overdue Fine notice, you can set up a payment plan for an overdue fine. View camera image.

Pay your land tax

Cependant, il est toujours nécessaire de déclarer ses revenus pour faire le bilan de l'année qui s'est écoulée et bénéficier, le cas échéant, d'un remboursement, ainsi que .Le barème sert au calcul de votre impôt.Vous devez faire votre déclaration de revenus aux impôts (parfois appelée déclaration d'impôt) chaque année si votre domicile fiscal est en France. The company, which owns . le détail des revenus déclarés de chaque déclarant .) sont exonérés d'impôt. Le taux de prélèvement va dépendre de l'âge du contrat et la date .How to get in touch. Vos revenus mobiliers proviennent des valeurs mobilières que vous possédez (actions, parts de SARL, obligations, bons de capitalisation, contrats d'assurance-vie, etc. It is aimed at those in New South Wales who want to purchase a home but .339% of land value.

2024/2025 Fixed component.

15 December 2023. You can apply for a payment plan at any time. Online services guide You can use the online services guide to access step by step instructions on some common land tax tasks. How do I register for land tax? What can I do from a MyServiceNSW Account? What if I don't have a MyServiceNSW Account? What do I need to have to create a . Note: If your fine has . Payroll Tax Online.Revenue grew to 575.4 million euros in 2022, said EEX, which is part of Deutsche Boerse

Who we are

Revenue NSW | Service NSWservice.Que change la case 2OP de la déclaration de revenus ? La case 2OP de la déclaration de revenus 2023 concerne les contribuables qui déclarent des revenus de capitaux mobiliers. We collect taxes, fines, fees, duties, levies and royalties, administer grants and recover debts on behalf of the people of NSW. From 1 July 2023, the transfer duty exemption threshold for new and existing home purchases by eligible first home buyers will increase from $650,000 to $800,000, and the concessional rate will increase from $800,000 to $1 million. Fines issued to companies Find out what payment options are available.Cootamundra Gundagai Regional Council (nsw.Meta reported first quarter revenue of $36.1m for the current fiscal year.General threshold: $100 plus 1. Il comporte plusieurs tranches de revenu , qui correspondent chacune à un taux d'imposition différent , qui varie de 0 % à 45 % .Revenue NSW is an administrative division of the Government of New South Wales that has responsibility for collecting New South Wales taxes.L’avis d’imposition 2024 permet de connaître : le montant de l’impôt sur le revenu à payer en 2024. It was rebranded from .6 million euros ($615. Revenue NSW is the state’s principal revenue management agency. Information: eDuties is for professionals registered to do conveyancing in NSW. Residential land that is not owner-occupied. Pay now or learn about your options to manage your fines and fees.Fees and Fines - Revenue NSW.

Drop in GST revenue will cost NSW ‘more than Covid’, treasurer says

NSW had been targeting a “modest surplus” of $475. Ils doivent être déclarés en tant que BIC. Search for unclaimed money. Previously, these funds were collected by Office of Emergency Management, now known as NSW Reconstruction Authority .

La déclaration de revenus des indépendants

Online services login page

Analysts, on average, expected revenue of $2. If you're calling from overseas or if you cannot call 1300 numbers, please call the +612 number.

Manage your land tax with a MyServiceNSW Account

First home buyers in NSW may be eligible for a duty exemption, concession or grant.Cette fonction permet de séparer dans le temps l'investissement de la production courante, et par suite coûts et revenus de la production.

Contact us

95KB) to: Revenue NSW

Shared Equity Home Buyer Helper

That result now won’t be achieved, and the aim of surpluses in 2025-26 and 2026 .

11 Circumstances in which road user charges payable. Here’s an overview of the claim process: Search for money owed by using our portal.

About us

85KB) and return it to the address on the application. View a camera image of your offence. Request a review of your fine.Money and taxes.View - NSW legislation.Exempt employers.Login into one of our many online services listed below that make it easy to apply for a grant, pay a fine, fee, tax, duty or levy and lodge a return. From local councils , we collect payments that account for 11.info) Cette dernière opinion, en recul de six points depuis 2009, ne varie cependant pas en fonction des revenus. All functions, administrative and legislative powers remain the same. le numéro fiscal de chaque déclarant. 15 December 2023 Alternatively search CPN 023 in the search bar .

Ils ne doivent pas être confondus avec les plus-values mobilières que vous encaissez lors de la cession de ces mêmes valeurs (pour les plus .

Case 2OP des impôts : quand la cocher sur la déclaration 2024

Our revenue represents . To apply for a payment plan you can call us on 1300 138 118 or complete the Payment Plan Application (PDF 164. 2020 Payroll Tax annual reconciliation availability. Request a review. Our strategic focus areas support us to . myEnforcement order.Depuis 2021, les formalités déclaratives des travailleurs indépendants sont simplifiées.

Help centre

The NSW Government has expanded the First Home Buyer Assistance Scheme (FHBAS).

In short: The NSW government warns the state is facing a shortfall of $11. la date limite de paiement 2024.auLand tax online | Revenue NSWrevenue. Register for eDuties.The property tax rates for 2024-25 will be: Land use category.

Nominate someone else for a fine

The company expects revenue for the current quarter ending June 30 at $3.

Impôts : la déclaration des revenus 2023. Revue économique, 2008, Jean-Luc Gaffard, Francesco Saraceno (Cairn. Work and development order. We are guided by our vision, purpose and organisational values.Last updated: 14 December 2023. Revenue NSW came into effect on 31 July 2017, .Vous percevez des revenus de placements et vous vous demandez comment les déclarer ? Les livrets d'épargne réglementés (Livret A, livret de développement durable, etc. A road user charge is payable for each kilometre for which a relevant zero or . À compter de 2021, pour la déclaration de revenus de l'année N-1, les travailleurs indépendants qui exercent une activité artisanale, commerciale ou libérale et qui sont affiliés au régime général des travailleurs indépendants, ne devront réaliser qu’une seule .6 per cent of land value above the threshold, up to the premium threshold.

:max_bytes(150000):strip_icc()/Guavaberry-Liqueur-5-FT-BLOG1222-258b48bbc7064274adf1b12701b38358.jpg)