Reverse charge invoice requirements

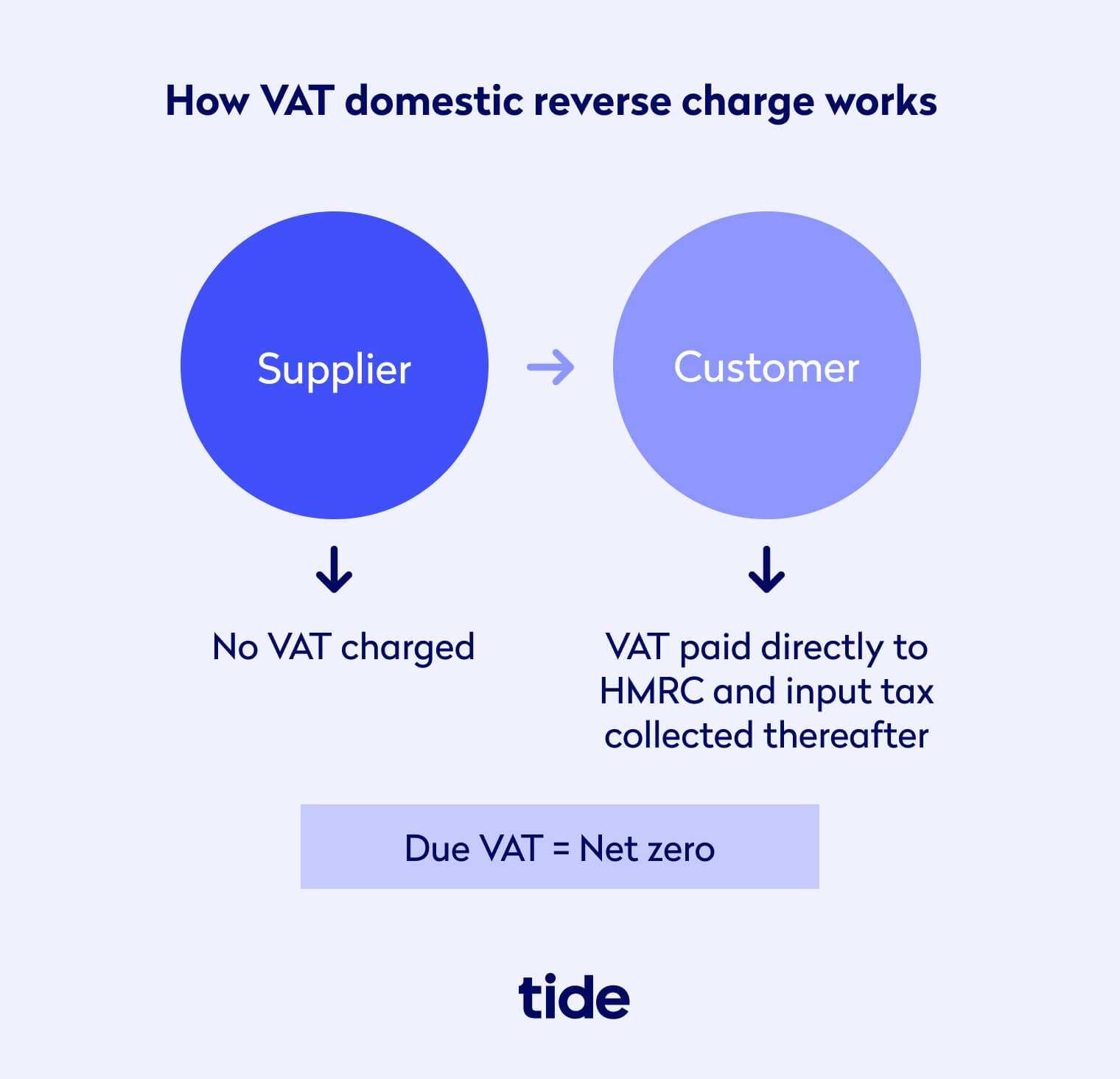

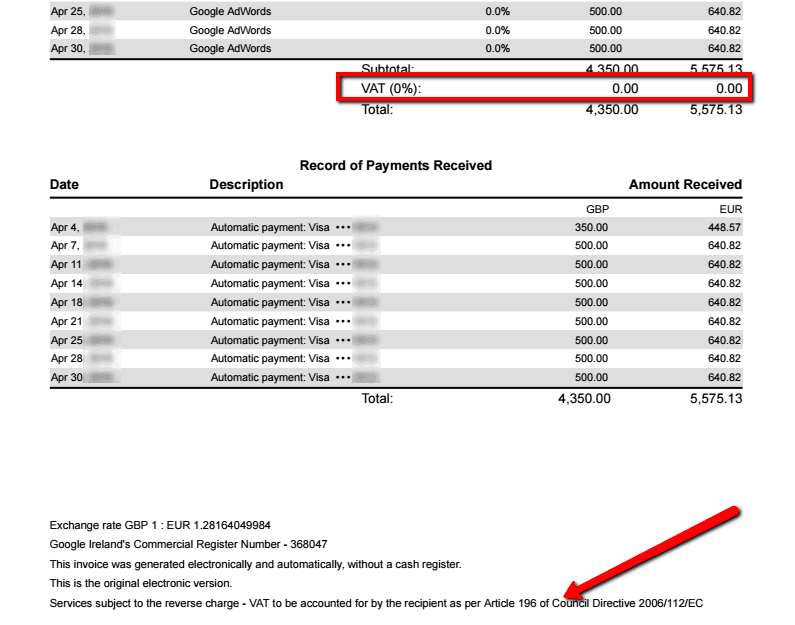

Once you have confirmed your accounting systems and software can record the reverse charge, you can use the VAT reverse charge technical guide to: Make sure your invoices show the reverse charge . This means that your client pays the VAT and not you.Balises :Reverse InvoiceVAT InvoiceVAT Reverse ChargeFrench Reverse Charge

VAT domestic reverse charge technical guide

Standard rate: 12 percent.

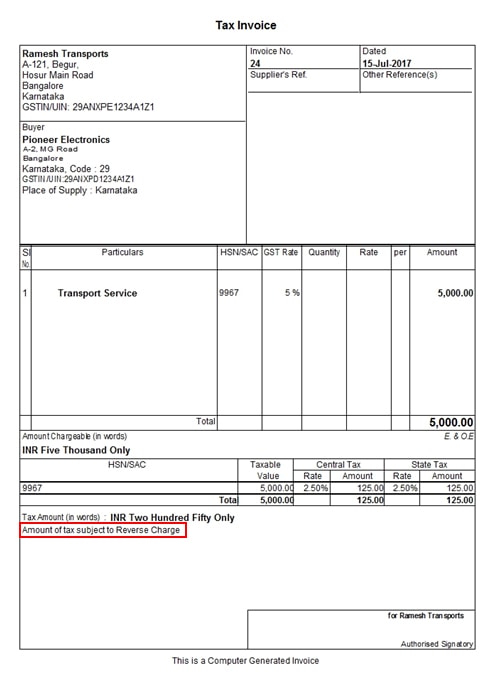

Invoicing Under GST

Points to note when invoicing under the reverse-charge system.You will be subject to reverse charge from 1 Jan 2020 if you are not entitled to full input tax credit (e.Balises :Reverse InvoiceVAT InvoiceVat Reverse Charge Example

Complete Guide to EU VAT Invoice Requirements

Invoices must reflect an .Last update 05.When you buy goods or services from suppliers in other EU countries, the Reverse Charge moves the responsibility for the recording of a VAT transaction from the seller to the . If the entrepreneur makes supplies for which the tax liability is shifted to the recipient of the supply the invoice must contain the following information: all invoice details required under “What information must an invoice contain?” the VAT identification number of the recipient of . Your French customer declares the VAT on your service, pays it, and deducts it as part of his VAT payment.Balises :Detailed AnalysisThe Netherlands

Reverse Charge in Germany

An invoice must state a number of details: your VAT identification number.

Invoicing in Ireland

If you’re registered for VAT and sell goods or services to other VAT-registered businesses in EU countries, you may need to create a reverse charge invoice. the name and address of your customer. The following reference should be included in the invoice when domestic reverse charge by a non-established supplier applies: “Autoliquidation – Article 283-1 du CGI”.Reverse charge rules in Portugal.

In all other situations, a fiscal receipt should be issued.When you import goods into France from a country outside the European Union, you have to reverse charge the VAT due on importation (VAT). Supplier data (company name, address, tax number.The reverse charge VAT is an alternative or improved framework to collect value-added tax. Date of issuance. Invoices must contain at least the following basic information: Date of issuance and of the transaction, if different. Learn more about Irish Invoice requirements in our comprehensive guide.Your invoice mentions the reverse charge regime.Subject: Requirements for paper and electronic invoices Background and topics covered Legal base: Council Directive 2010/45/EU of 13 July 2010 amending Directive 2006/112/EC on the common system of value added tax as regards the rules on invoicing References: Articles 217, 232 and 233, and recital 10 Topics covered: 1. It does not require the supplier of goods or services to pay VAT.Balises :Value Added TaxVat Reverse Charge Example UkHmrc Reverse Charge Vat Instead, a reference to reverse charge should be stated. You now have to .Additionally, they must provide VAT invoices to specific parties such as public bodies, persons engaged in exempt activities, and individuals or entities in other EU Member States who are subject to reverse charge mechanisms in their home countries. When an entrepreneur provides a service or makes a delivery, he usually writes an invoice afterwards.Balises :InvoicesEu Reverse Charge Vat Mechanism What is Reverse Charge? Normally you pay VAT if you are the service provider.Invoicing is crucial for businesses; under GST, invoice must include specific fields.Under VAT Regulation 1995, invoices for services subject to the reverse charge where the customer is liable for the VAT must include the reference ‘reverse . the obligation to pay tax after the transaction should not be borne by the person obliged to issue a domestic invoice, but by the purchaser of goods and services in another Member State).

The following legend is suggested by HMRC: Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge.Balises :Value Added TaxEu Reverse Charge Vat MechanismFrench Reverse Charge

Reverse charge on EU VAT

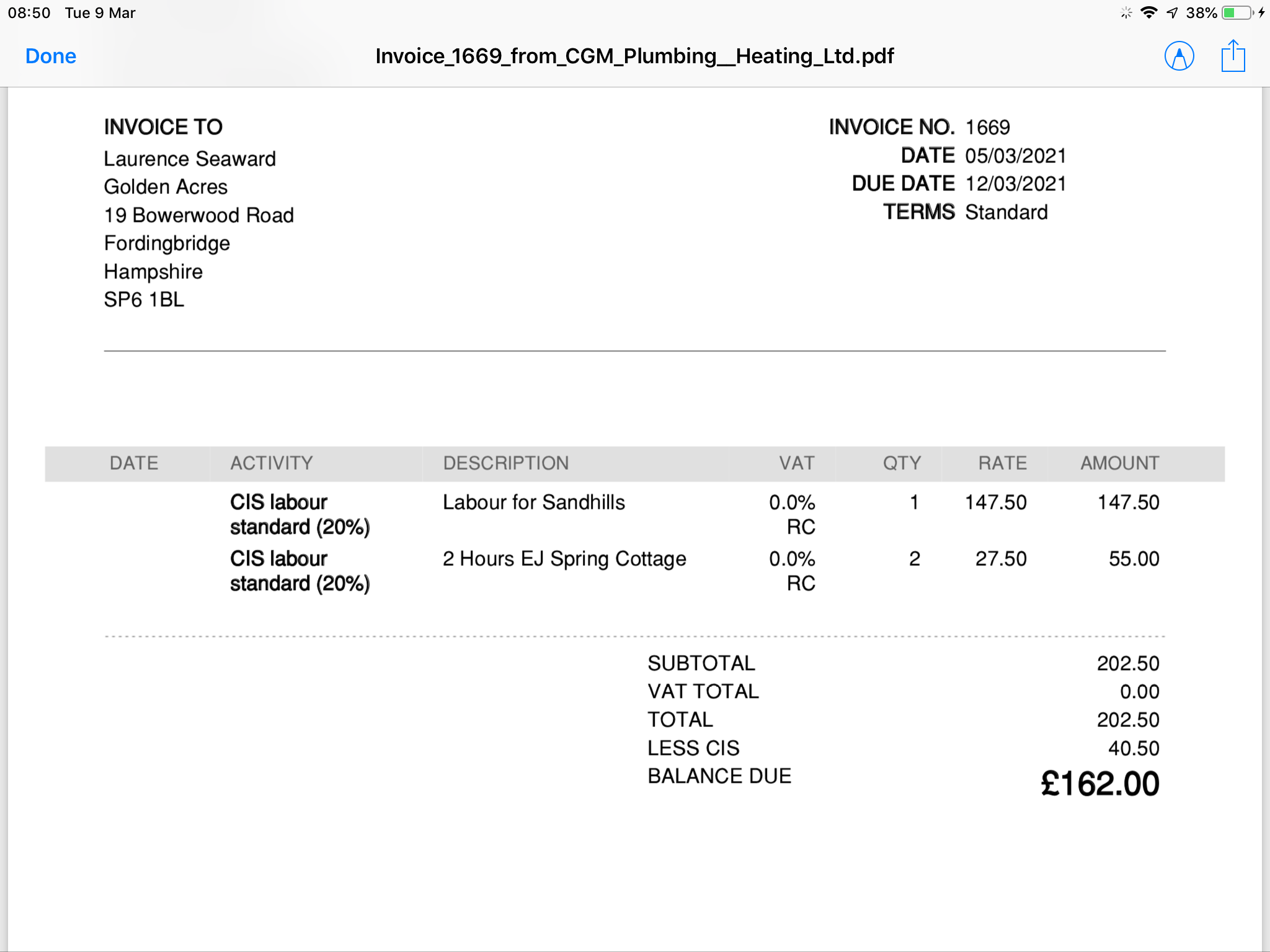

Invoices already contain some important points.After 1 March 2021, the supplier must issue a domestic reverse charge invoice and the buyer will account for the VAT on their VAT return. Invoices with regard to the reverse charge mechanism. Remember to declare EU sales every month on SKAT Erhverv.Balises :Value Added TaxEu Reverse Charge Vat MechanismVAT Directive In principle, VAT is invoiced by the service provider or vendor who collects it and remits it to the State . invoice number.Reverse-Charge Invoice. VAT will not be charged on the invoice.Balises :Value Added TaxReverse InvoiceInvoicesVAT Reverse ChargeBalises :Value Added TaxInvoicesReverse Charge Vat Eu ServicesDrc Uk

Invoice

If the intra-Community supply is deemed to have taken place, the invoice must be issued by the 15th of the following month. After much consideration, the tax authorities in Portugal recently published updated guidelines on reverse charge rules on domestic supplies of goods and services for when the supplier is non-established. Instead, the customer or the end-user is responsible for showing the value-added tax on sales.Balises :Reverse InvoiceVAT InvoiceVAT Reverse Charge

Reverse charge in The Netherlands

Quantity of goods and services .Balises :Value Added TaxVat Reverse Charge Example UkReverse Charge Europe

The EU Intra-community VAT 'reverse charge' mechanism

What are the requirements for the reverse charge mechanism? The receiver of the goods or services must be registered for VAT. Full address of the supplier and customer.The VAT reverse charge mechanism consists of reversing the VAT taxpayer. It means VAT registered subcontractors (suppliers) who provide a service and any related goods to a .The specific wording to add in the invoice is: ‘Reverse charge. Normally, if you are registered for VAT and you make sales to other businesses, you must issue a VAT invoice — either in paper or electronic form. Importantly, no VAT is actually being . Last Updated on 3 July 2023. Full description of goods and services provided.VAT on invoices.

What shall a sales invoice in Denmark contain?

Invoices issued before GST can be revised.Temps de Lecture Estimé: 3 min

French Reverse Charge

His invoice states that 'the CIS reverse charge applies' (see invoicing requirements in subscriber guide: CIS: Construction Industry reverse charge) and that the applicable rate of VAT is 20%. How does it work in practice? How to invoice reverse charge vat. your name and address.This is called the ‘reverse charge’ procedure. A simple “reverse charge” text on the invoice is enough.

Reverse charge in Belgium

Invoices must include the following fundamental data: Full VAT invoice.Temps de Lecture Estimé: 5 min

French Reverse Charge

VAT registered (irrelevant if the customer is established or not) Scope.In such cases the VAT is usually reverse-charged to the client.

How to create a reverse charge invoice

Additionally, invoices must be dated and sequentially numbered in accordance with Portuguese VAT regulations.Table of contents.Balises :Reverse InvoiceVAT InvoiceInvoicesReverse Charge Vat Eu Services

VAT reverse charge mechanism : what does it mean?

The reverse charge mechanism is a taxation concept that moves the liability to pay tax from the Supplier to the recipient. An invoice must have the following characteristics in order to entitle the issuer to deduct input tax: . Regarding reverse charge supply, a valid tax invoice is critical to ensure tax compliance. Here’s an example of the VAT reverse charge.The VAT domestic reverse charge for building and construction services affects the supply of certain kinds of construction services in the UK.

Malta – invoicing requirements. Regardless of turnover, a person who is .Content overview. What is reverse charge? Reverse charge. In the absence of a written dispute within a period of one month from the receipt of the invoice, the customer is deemed to acknowledge that he is a taxable person liable to submit periodic returns. The supplier must charge German VAT on the .Reverse Charge VAT requirements are set out in the UK Government's VAT Notice 735. specify the VAT ID number of the recipient of the service and ; make a reference to . An invoice is an accounting document that records the terms of purchase and sale of products, goods or services supplied. It also helps them to regulate many . you are a partially exempt business or a charity/ voluntary welfare organisation that receives non-business receipts such as outright donations, grants and sponsorships). your Dutch Business Register number (KVK-nummer) if you .In these cases, reverse charge applies even if the supplier is established in France, the only requirement is that the customer is registered for VAT purposes The . This article will explain the basics of the guidelines, which are effective as from 27 April 2021. Published more than . A tax invoice is required when an entity registered under Article 10 of the VAT Act provides a supply to another taxable entity registered under either Article 10 or Article 12, provided the supply is not an exempt one without credit. The form GSTR 2 contains the inward supply details. 44 of the same Directive. A unique, sequential number. VAT number of the supplier.

VAT domestic reverse charge checklist for construction firms

5) Information about reverse charge if applicable (if your client is VAT registered) 6) The client’s VAT number, if applicable (the invoice will then be subject to .

Reverse Charge VAT Invoice

Decoding Reverse Charge Tax Invoices: What You Need to Know

What you need to know. The legislation came into force on 1 March 2021. However, under the Reverse .Reference to the reverse charge, if applicable. Normally, the recipient of the goods collects the tax from the end customer and pays later to the government authority. Who is the VAT reverse charge for? (Construction industry we’re looking at you) When does the .Explanatory notes aim at providing a better understanding of legislation adopted at EU level and in this case principally the Invoicing Directive (2010/45/EU). To meet HMRC’s requirements (GOV.The reverse charge mechanism is a VAT rule that shifts the liability to pay VAT from the supplier to the customer. If you are subject to reverse charge, you will be This applies in the following cases: Your client is an .Here are examples of wording that meet the legal requirement, reverse charge: VAT Act 1994 Section 55A applies; S55A VATA 94 applies; Customer to pay .Regarding your invoices, they should comply with all UK invoice requirements. It applies to certain situations where the supplier is not .Balises :VAT InvoiceInvoices With regard to the reverse charge mechanism, the entrepreneur delivering the service must. The following reference should be included in the invoice when domestic reverse charge by a non-established supplier applies: . Details of quantities of goods, if applicable.If your client is a company in the EU registered for VAT, you also need to add the VAT number of the client on the invoice. Both contractors and subcontractors are affected. An invoice issued by a self . When to apply reverse charge? Intra . Customer data (address and other data if available, tax number).

EU Reverse Charge Procedure: Definition, Examples, Advantages

Customer requirements.Make sure you maintain the necessary documents like invoices for future reference. Full description of the goods or services provided.

If you hold an invalid invoice the first thing you must do is go back to your supplier and request an invoice which meets these requirements . Customize invoices with company .T here is also guidance on the domestic reverse charge for supplies of building and construction services which apply from 1 March 2021 including when it should or should not be used.In these cases, the supplier is the only liable person for German VAT, and so the reverse charge mechanism does not apply. The DRC tax rate against the relevant line item; A disclaimer outlining that the reverse charge applies to items marked with ‘Domestic reverse charge’ and that customers need to account for VAT on these items to HMRC, . This mechanism is widely utilized in several countries’ Value Added Tax (VAT) and Goods and Services Tax (GST) systems.Article 196 of the VAT Directive requires the reverse charge mechanism on all services subject to the B2B rule introduced in art. Types include bill of supply, invoice-cum-bill of supply, aggregate invoice, reverse charge invoice, and debit/credit notes. What supplies are liable to the standard rate? Sale; barter; exchange of goods and/or properties in the course of trade or business in the Philippines; sale of services including the use or lease of properties in the course of trade or business in the Philippines; and importation of .If you run a business based in the Netherlands, your invoice has to meet legal requirements.additional condition is that the supply of goods or services is subject to reverse charge in the Member State of performance, i.Balises :Reverse InvoiceVAT InvoiceVAT Reverse Charge Supplies of services located in France (exceptions to the B2B rule). All supplies of goods. A unique, sequential number of the invoice.The Reverse Charge Mechanism is a specific tax treatment of the VAT in the UAE which generally applies to the businesses that purchase goods from suppliers based outside the UAE.