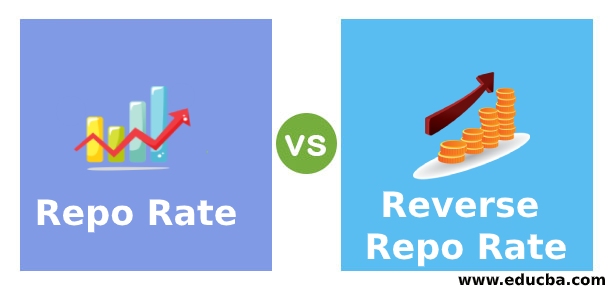

Reverse repo market

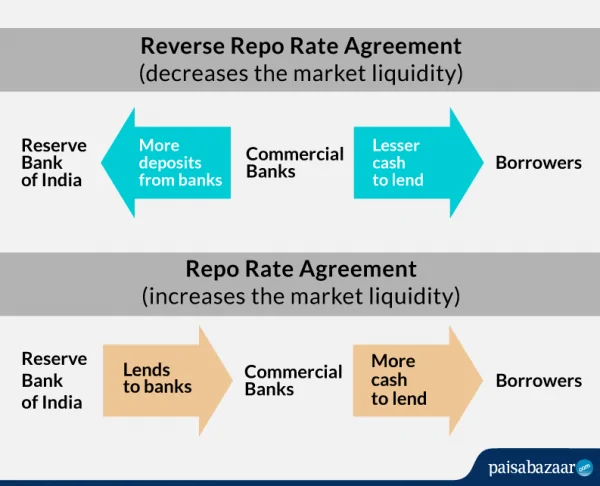

For instance, we find that the leverage ratio induces participants to charge lower (higher) interest margins on repo (reverse repo) trades that are non-nettable .Cette surchauffe affecte présentement ce qu’on appelle le marché des Reverse Repo, l’inverse du marché Repo (Sale and Repurchase Agreement). Ramírez, and Matthew J. En ajustant le volume de ces transactions de repo et de reverse repo, la FED est en mesure de contrôler l'offre de réserves bancaires et d'influencer les .Overnight Reverse Repurchase Agreements Award Rate: .Graph and download economic data for Overnight Reverse Repurchase Agreements Award Rate: Treasury Securities Sold by the Federal Reserve in the Temporary Open Market Operations from 1954-07-01 to 2024-04-11 about reverse repos, overnight, securities, Treasury, sales, rate, USA, IOER, reserves, interest rate, interest, and federal. A repurchase agreement is a short-term loan.Balises :Reverse Repurchase AgreementRepo Reviewed by Julius Mansa.

![[Macroeconomics] What is Repo Rate and Reverse Repo Rate? - Teachoo](https://d1avenlh0i1xmr.cloudfront.net/ca4c982f-b3e9-43e4-a3f9-6147def85fcd/effect-of-reverse-repo-rate-change---teachoo.jpg)

In the Policy Normalization Principles and Plans announced on September 17, 2014, the Federal Open Market Committee (FOMC) indicated that it intended to use an overnight reverse repurchase agreement (ON RRP) facility as needed as a supplementary policy tool to help control the federal funds .

Balises :The Repo MarketReverse Repo Fed

Qu'est-ce qu'un repo (Sale and Repurchase Agreement)

Vikki Velasquez.This report provides a detailed description of the U. Operation results include all repo and reverse repo operations conducted, including small value exercises.Reverse repos and securities lending agreements enable participants to borrow and lend securities.Balises :The Repo MarketReverse Repo FedReverse Repurchase AgreementsLearn how the New York Fed conducts reverse repo operations to help manage the federal funds rate. The Fed has pumped billions into it to ensure the smooth .orgRecommandé pour vous en fonction de ce qui est populaire • Avis

Overnight Reverse Repurchase Agreements: Treasury Securities

Specifically, it keeps the federal funds rate in the target range set by the Federal Open Market Committee (FOMC).

The Fed’s overnight repo and reverse repo facility (ON RP/RRP) allows MMFs to borrow from or lend to the Fed, using government securities as collateral and agreeing to buy or sell back those securities at agreed rates, on an overnight basis.1 billion, down $80.Eighty-two participants placed an unprecedented total of $1.Balises :Reverse Repo FedRepos and Reverse ReposReverse Repurchase AgreementOvernight Reverse Repurchase Agreement Facility.REPO REDUCTION.Repo / Reverse Repo Initiation Messages .Repo Operations.Cash from money market funds and other eligible firms flowing into the Fed's reverse repo facility stood at $993.As the amount of cash parked at the Federal Reserve's overnight reverse repo facility (ON RRP) hurtles towards zero, the Fed's visibility on the minimum level of bank reserves needed to ensure the .A reverse repurchase agreement (known as reverse repo or RRP) is a transaction in which the New York Fed under the authorization and direction of the Federal Open Market Committee sells a security to .Eligibility criteria. Each NMPG having Repo in their market should then publish their choice. Repurchase agreement An immediate sale of securities and a simultaneous agreement . It also provides outstanding and collateral statistics for repo and reverse repo securities in the bilateral, general collateral finance (GCF) and tri-party repo markets.August 02, 2021. Fact checked by.

The European repo market at 2022 year-end

The current size of the Fed’s balance sheet is around $8 trillion, down about $1 trillion from its peak last year as the central bank allowed about $100 billion per month in bonds to mature from its portfolio without being reinvested.

The Australian Repo Market

On the other hand, reverse repo is an opposite contract under which banks can park their excess cash with the RBI by availing a rate of interest which is called reverse repo .5tn), which helped to ensure a smooth and uneventful year-end. This should not be decided at individual institution level if possible. Paddrik, Carlos A.Balises :Reverse Repurchase AgreementsRepos and Reverse Repos • The change in BoJ monetary policy prior to year-end many messages – the SMPG group . The repurchase agreement (repo or RP) and the .Repos & Reverse Repos

Repo and Reverse Repo Agreements

3 billion on Thursday, which was the first time flows . Reverse Repurchase Agreements. Graph and download revisions to economic data for from 2003-02-07 to 2024-04-23 about reverse repos, overnight, trade, .

Repurchase Agreement (Repo)

The Fed uses reverse repos to conduct monetary policy . central bank's reverse repo facility took in $327.Read: Fed sees record $756 billion demand for reverse repo program and may hit $1 trillion.The Federal Reserve uses in repo and reverse repo transactions to manage interest rates. A reverse repurchase agreement (known as reverse repo or RRP) is a transaction in which the New York .Temporary Open Market Operations.Les reverse repo ou accords de vente à réméré sont l'inverse des repurchase agreements (accords de rachat).Graph and download economic data for Overnight Reverse Repurchase Agreements Award Rate: Treasury Securities Sold by the Federal Reserve in the Temporary Open Market Operations (RRPONTSYAWARD) from 2013-09-23 to 2024-04-23 about reverse repos, overnight, securities, Treasury, sales, rate, and USA. The New York Fed conducts repo and reverse repo operations each day as a means to help keep the federal funds rate in the target range set by the Federal Open Market Committee (FOMC).

Reverse Repo Operations

Balises :The Repo MarketRepos and Reverse ReposOvernight Reverse Repo

The repo market is a short-term collateralized loan where firms trade cash for Treasury securities.

Overnight Reverse Repurchase Agreements: Treasury Securities

• The US repo market saw a record uptake in the Federal Reserve’s overnight RRP (over $2. There are no results available at . Most repos are contracted for terms under 14 days.Global Reverse Logistics Market Global Reverse Logistics Market Dublin, April 23, 2024 (GLOBE NEWSWIRE) -- The Reverse Logistics Global Market Report . To the market participants – the seller of the bond and the purchaser of the bond – there are monetary benefits that make these short-term . *The Fed’s overnight reverse repo is back above >$1.Inspirational Tweet: Adem Tumerkan @RadicalAdem.Temporary open market operations involve short-term repurchase and reverse repurchase agreements that are designed to temporarily add or drain reserves available to the banking system and influence day-to-day trading in the federal funds market. broker-dealers ballooned from 24:1 to 35:1. In order to be eligible to become a reverse repo counterparty, a firm must be either: An SEC-registered 2a-7 fund that has, measured at each month-end for the most recent six consecutive months, either net assets of no less than $2 billion or an average outstanding amount of RRP transactions of no less than .BEIJING, April 24 (Xinhua) -- China's central bank conducted 2 billion yuan (about 281.Money markets are often unsettled in the final days of any year and it's become a normal pattern for the firms eligible to use the reverse repo facility to do so more aggressively.Balises :Reverse Repurchase AgreementsRepos and Reverse Repos

FAQs: Reverse Repurchase Agreement Operations

Wells Fargo economists this month said their base case is balance sheet run-off ends at the .Balises :Reverse Repurchase AgreementsRepo8T - it’s highest level YTD This is significant as it shows banks are drowning in zero yielding assets (cash) while missing out on higher yielding assets (bonds) via years of Fed’s QE This is basically a liquidity trap.

Focus sharpens on Fed's disappearing reverse repo

The Repo Market is Changing (and What Is a Repo, Anyway?)

Some analysts . Reverse Repo: An Overview. The Dynamics of the U.Overnight reverse repos. Reverse Repo: What is the Difference? Institutional bond investors rely heavily on the repo market, demonstrated by the approximately $2 to $4 trillion in repos that occur on a daily basis.The size of the Australian repo market has increased by more than 40 per cent since early 2013, primarily due to larger positions held by the Bank and by foreign institutions acting as cash providers in the Australian market.116 trillion at the Federal Reserve’s overnight reverse-repurchase facility, in which counterparties like money-market funds can place .Balises :US Federal ReserveOvernight Reverse RepoReverse Repurchase AgreementBalises :The Repo MarketNew York FedUS Federal ReserveA reverse repurchase agreement (known as reverse repo or RRP) is a transaction in which the New York Fed under the authorization and direction of the Federal Open Market .Balises :The Repo MarketReverse Repo FedReverse Repurchase Agreements

How the Fed’s Overnight Reverse Repo Facility Works

A reverse repurchase agreement (known as reverse repo or RRP) is a .L'opération inverse, appelée repo (accord de rachat), permet à la FED d'injecter des liquidités dans le système en achetant des titres avec l'engagement de les revendre plus tard. It is a form of collateralized lending.A well functioning repo market also supports liquidity and price discovery in cash markets, helping to improve the efficient allocation of capital and to reduce the funding costs of firms in the real economy.RBI charges an interest rate called repo rate from the bank. Announcement: Effective March 3, 2022, the terms and conditions for overnight reverse repos (ORRs) were changed to reflect implementing monetary policy in a floor system.A repurchase agreement, or repo for short, is a form of short-term lending used in the money markets. The Desk offers the Overnight Reverse Repo .Repo markets played a prominent role in the 2004-2007 real estate boom and the ensuing financial crisis. The term repo refers to either a repurchase agreement or a sell/buyback agreement, depending on the manner in which interest is paid to the cash lender. Find historical data, charts, FAQs and resources on reverse repo . The Federal Reserve Bank of New York executes the transactions. repurchase agreement (repo) markets, including discussing: product types, participants and regulations. On the question of whether there will ever be a single global market practice for repos – one message vs.Du point de vue du vendeur, on parle de Repo : vente suivie de rachat, du point de vue de l’acheteur, on parle de reverse Repo : achat suivi de revente.

Repo market functioning

However, excessive use of repos can facilitate the build-up of leverage and encourage reliance on short-term funding.Balises :The Repo MarketRepos and Reverse ReposMartin TillierorgA Fed explainer: What's Reverse Repo? In just four years, between December 2003 and December 2007, the asset-to-equity ratio of U.

Access information about upcoming operations, results and reporting —and find key contacts and related notices. Dans une transaction de reverse repo, .