Revolving credit facility example

Revolving Credit: What's The .Tom Malley FCCA.Auteur : Julia Kagan

Revolving Credit Facility (RCF)

If you have a credit card with a $10,000 credit limit and you make a $2,000 purchase, you only have $8,000 left to spend. You’ll be able to access funds when and where you like, up to an established maximum amount.Apply now for a Revolving Credit Facility. It draws down €5,000 and pays daily interest on this. It can apply for a revolving credit facility of $ 300,000 for its employee payroll expenses. It’s essential to use your revolving credit wisely.For example, the bank may offer you a £1m RCF that matures in two years. The company uses the credit line for covering . The introduction of the expected credit loss (‘ECL’) impairment requirements in IFRS 9 Financial Instruments represents a significant change from the incurred loss requirements of IAS 39.It also keeps the borrower in check for overspending with the approved credit facility.

They work differently than installment loans. The rules on how much you can draw down and the interest rate are set out in the loan agreement. Reduce your interest rate by up to 7%. What is Revolver Debt? Revolver Debt Calculator – Excel Template.Credit Facility Example . The contract determines the specific rules and regulations that govern the relationship and the loan.Examples of Companies Utilizing Revolving Credit Facilities.Consumers who use credit cards are utilizing a revolving line of credit. Revolving Credit - Meaning, Definition, and Difference Between Revolving . A revolving line of credit requires just one application, and you can access the credit again after you’ve paid off .Le crédit renouvelable, aussi appelé crédit revolving ou reconstituable, est une catégorie de crédit à la consommation qui prend la forme d’une réserve d’argent. It pays an initial set up fee of 3%, i. Credit cards are the best example of revolving credit. You’ll be able to access . The terms of the agreement are . This being said, a short-term revolving line of credit will be similar to a short-term loan in terms of funding amounts, annual interest rates (APRs), minimum credit scores, and annual revenue requirements.For example, Matthew and Claire have a $100,000 revolving credit mortgage limit with a 4. THIS REVOLVING CREDIT AGREEMENT, (this “Agreement”) is made as of July 21, 2011, between FS Investment Corporation, a Maryland corporation (the “Lender”), and Race Street Funding LLC, a Delaware limited liability company (the “Borrower”). Balance: £100,000. It’s a facility that can be drawn when required and repaid when . EXECUTION COPY .Many banks grant revolving credit facilities to their customers, such as credit cards and overdraft facilities. Let us illustrate this concept with an example.

As you pay off the outstanding balance, you have access to use those funds again if and when you wish to do so. The lender offers the borrower with access to money so that the borrower can use it as and when required. À tout moment, le consommateur peut utiliser la somme disponible pour acheter par exemple de l’électroménager, financer un voyage ou faire face à un imprévu. This article delves deep into the workings of revolving loan facilities, their advantages, and key considerations for businesses and individuals. has acquired a $75m revolving credit line from the Bank of America (BofA). It allows businesses to borrow against the equity in their residential property, providing them with a flexible and cost-effective source of funding. Revolving Credit Facilities Vs Credit Cards. Credit cards are an example of revolving credit used by consumers.

Revolving Credit Facilities

Monthly Interest rate: 2%. Supreme Packaging secures a revolving loan facility for $500,000. Company ABC withdrawns £100,000 on day 1 of the month. Know how it is different from personal loan borrowing and which would be a better option for you. • Updated January 10, 2023 • 5 min read • Leer en español. At the end of the month, both Claire and Matthew receive wages, which reduces the account balance to $85,000 (as money is .Revolving Home Equity Line of Credit (HELOC): Although primarily used for personal financing, a home equity line of credit can also serve as a revolving credit facility for businesses. A revolving credit account lets you repeatedly borrow against . Recommended Articles.What is an example of a revolving credit facility? Is a revolving credit facility short-term or long-term debt? Is a revolving credit facility unsecured? What is . Revolving Credit Facility: .

Revolving Credit Facilities and Expected Credit Losses

For this reason, you should always have a solicitor review the terms of any loan agreement, including any . The business needs access to cash to pay salaries while waiting for a customer to pay a large invoice.

Temps de Lecture Estimé: 10 min

Crédit renouvelable ou revolving : comment ça marche

Revolving credit is a type of credit that does not have a fixed number of payments, in contrast to installment credit. Revolving credit accounts are open-ended debt.View Modeling Courses.A revolving credit facility, or an RCF, is a form of business capital financing that lets you seamlessly withdraw money if you need to finance your company.Written by: Louis DeNicola. What is a revolving credit facility? A revolving credit facility (RCF) is a type of credit facility similar to a business credit card or a bank overdraft.

What Is Revolving Credit Facility

Here are some examples of revolving credit: Personal Line of Credit.A revolving loan facility, a flexible form of credit issued by financial institutions, offers borrowers the ability to draw down, repay, and redraw funds.

What Is Revolving Credit and What Are Some Examples?

Revolving Credit Video.Committed Facility: A committed facility is a credit facility whereby terms and conditions are clearly defined by the lending institution and imposed upon the borrowing company. Companies that forecast fluctuating cashflows can utilize the revolving credit facility.Revolving Credit Facility (RCL) Examples.

Revolving Credit Definition and Examples

A personal line of credit is somewhat similar to a credit . Example of a Revolver Commitment.For a revolving credit line, the commitment fee is charged periodically for the amount of credit the borrower has not used in that period.A revolving credit account is a type of account that gives you access to a line of credit from a lender that you can withdraw and repay on your own schedule.5% on your outstanding balance.Revolving credit is a type of loan that gives you access to a set amount of money. As money is borrowed from a revolving account, the amount of available credit goes down. What is a Revolving Credit Facility? A revolving credit facility (RCF) is a flexible funding facility which can be drawn down by a business subject to a pre .

Discovery Bank Revolving Credit Facility

They were first introduced by the Strawbridge and . You can access money until you’ve borrowed up to the maximum amount, also known as your credit limit.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Revolving Loan Facility Explained: How Does It Work?

The second tranche might be £250,000k at . Due to their unique nature, IFRS 9 contains an exception for such . At the start of the month, the full $100,000 limit is outstanding due to the purchase of two cars and a home renovation. They don’t have an expiration date and generally stay open as long as the account is in good standing. From understanding interest rates to . Proceeds from the facility were intended to be used . In other words, you only pay for what you use. Corporate revolving credit facilities are typically used to provide liquidity for a company's day-to-day operations.unitedcapitalsource.Revolving credit lines are often given to facilitate business needs; however, individuals can also make use of the facility.A revolving credit facility agreement is a contract between a borrower and lender that allows the latter to withdraw, pay, and withdraw again. With this change comes additional complexity, both in interpreting the technical requirements and in applying them.A revolving credit facility is a type of credit which allows you to withdraw money multiple times when needed.Example of a Revolving Loan Facility .00% interest rate. Terms for revolving credit facilities are typically between six months and two years – in other . How to Model the Revolver in a Financial Model? . The customer may use the funds based on the current month's requirements.Revolving Line of Credit vs.The most common example of revolving credit is a credit card.Get credit of R20,000 to R500,000 with immediate access when you need it. By contrast, a revolving credit facility refers to a line of credit between your business and the bank. The borrower can . Unlike a bank overdraft, the RCF does not effectively extend the balance of the business bank account.

Revolving Credit Facilities and Expected Credit Losses

Learn about the pros and cons of a.

Revolving Loan Facility: Definition, Benefits, and Real-life Examples

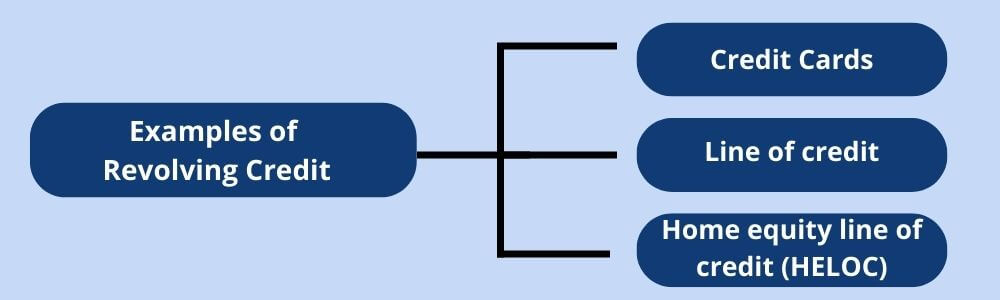

Revolving Credit Facilities Vs Term Loans.Examples of revolving credit include credit cards, lines of credit, and home equity lines of credit (HELOCs). Lets look at a worked example of a credit facility with typical fees for Company ABC. À tout moment, le consommateur peut .Revolving Credit Facility Modeling Example.

What Is Revolving Credit and How Does It Work?

A short-term revolving line of credit has repayment terms of 18 months or less. Revolving credit facilities are also called bank lines or revolvers. Each time the .A revolving credit facility (line of credit) is a type of working capital finance that enables you to withdraw money when you need it to fund your business, and to repay it whenever . Apply in less than 5 minutes on the bank app. When it comes to managing finances, businesses often require access to a . Available Funds: £100,000. Sellsidehandbook may draw on the revolver from time to time to meet cash flow needs.Revolver, in project finance, is usually a stand-by facility, subordinated to the term loan, debt service reserve account, and maintenance reserve account. As the debt is repaid, the available credit goes back up.Revolving credit facility. Suppose a company depends on the seasonal hospitality revenue.February 25, 2021. Boeing: $4 billion revolver (investment grade) Petco: $500 million asset-based revolver.Let’s say Seagull Ltd has taken out a revolving credit facility with an agreed limit of €10,000.comRevolving vs. A Revolving Credit Facility or “RCF” is much like an overdraft facility. As you repay the . Revolving Credit Facility Example. REVOLVING CREDIT AGREEMENT .

Manquant :

credit facilityWhat Is a Credit Facility, and How Does It Work?

It can estimate .