Risk hedging tools

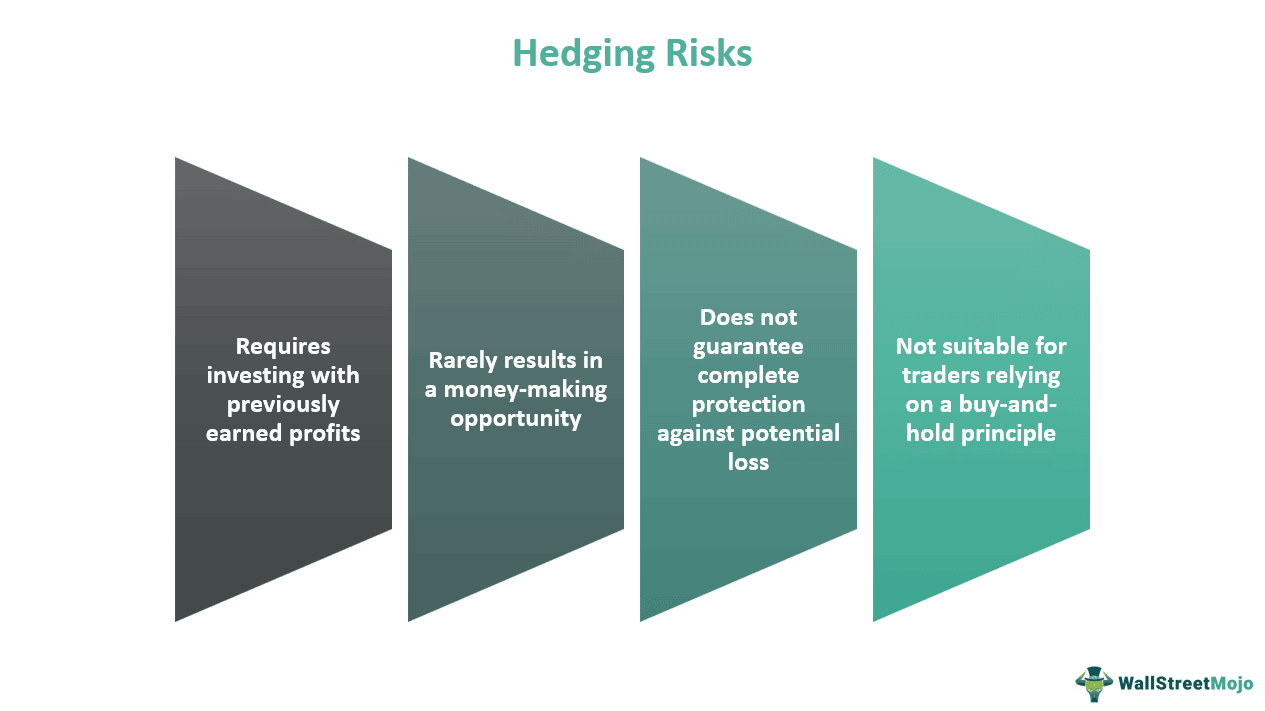

Market risk affects the overall market rather than a particular asset or security. First, analyze the specific nature of your FX exposure and understand the underlying risks involved. Each approach has its own strengths and weaknesses and will perform well or poorly depending on the .Well, the answer lies in a powerful tool called options hedging. Find out how to choose and implement the best one for your goals and costs. The following four major hazards are connected to hedging strategies: 1. A variety of financial derivatives, such as futures, forward contracts, contracts for difference ( CFDs ), options, and swaps, can be used for hedging. You can get peace of mind in a volatile market, and it may provide downside protection if you are planning to retire soon. Futures contracts.Tail Risk Hedging Strategies – Ideas, Assets, ETFs, etc.Using hedging tools incurs business costs, resulting in reduced profits compared to those without hedging. Counterparty Risks.comTo hedge or not to hedge - Financial Timesft. Reflecting on 2023 vs. Hedging strategies involve using financial instruments such as derivatives, options, futures, and swaps to reduce potential losses from changes in the market.Balises :HedgeHedgingReduceMarket riskRisk management However, its associated costs and risks should not be overlooked. All hedging instruments are attached to these. Also, it is not free but has a price attached to it which also needs to be well understood and analyzed before one enters into hedging to reduce or minimize the risk of adverse events on the investments.The Most Effective Hedging Strategies to Reduce Market . Understanding Risk Management.Temps de Lecture Estimé: 10 min

Hedging Strategies-A Comprehensive Guide

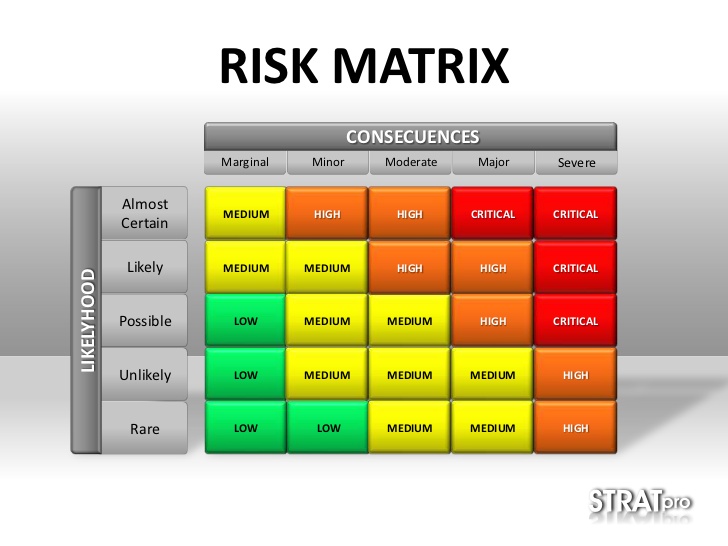

First, determine what level of risk is acceptable.We examine the effects of corporate risk preference on optimal ordering and risk-hedging decisions under a value-at-risk (VaR) constraint from short-term (only demand is uncertain) and long-term (both demand and supply are uncertain) perspectives.Futures-based strategies, options-based strategies, and trend-following strategies are all popular tools used to hedge equity downside risk.Balises :HedgeReduceMarket riskRisk managementStrategy

Hedging currency risk is a useful tool for any savvy investor that does business internationally and wants to mitigate the risk associated with the Forex currency exchange rate fluctuations.Balises :HedgeMarket riskHedging ToolsCapitalForeign Exchange Market By using hedging, investors seek to reduce their exposure to adverse events that can affect their profitability or financial stability. In 2022, we witnessed a decline in . Hedging Strategy.Balises :HedgeHedgingReduceMarket risk

What financial instruments can I use for hedging?

You might say that our capital markets are at a fairly nascent stage of development and I suppose they are, says Ephyro Amatong, one of four commissioners in the Securities and Exchange .While risk cannot ever be eliminated, it can be managed, often by using hedging strategies or tools that will hopefully reduce systematic or market risk to a level that you are comfortable with.

Tout savoir sur le hedging : guide sur les stratégies de hedging

Each instrument provides unique ways to mitigate different risks . Market risk, or systematic risk, is the possibility that an investor will see huge losses as a.When choosing the right hedging instrument for foreign exchange (FX) risk management, it's crucial to consider various factors.Learn how to hedge your foreign exchange risk with different strategies, such as forward, futures, options, and swaps. This removes all of the risks that the company would face if it traded in their customer’s currency. Hedging strategy is a vital aspect of assessing hedging effectiveness.Hedging Transaction: A hedging transaction refers to a position that a market participant takes in order to limit risks related to another position or transaction that the market participant is . This strategy offers a unique way to mitigate risk and potentially enhance returns in the unpredictable world of finance. Yet few companies fully explore alternatives to financial hedging, which include commercial or operational tactics that can reduce risks more effectively and inexpensively.Balises :HedgeHedgingRisk managementReduceMarket risk

Hedging: Risk management strategy in finance

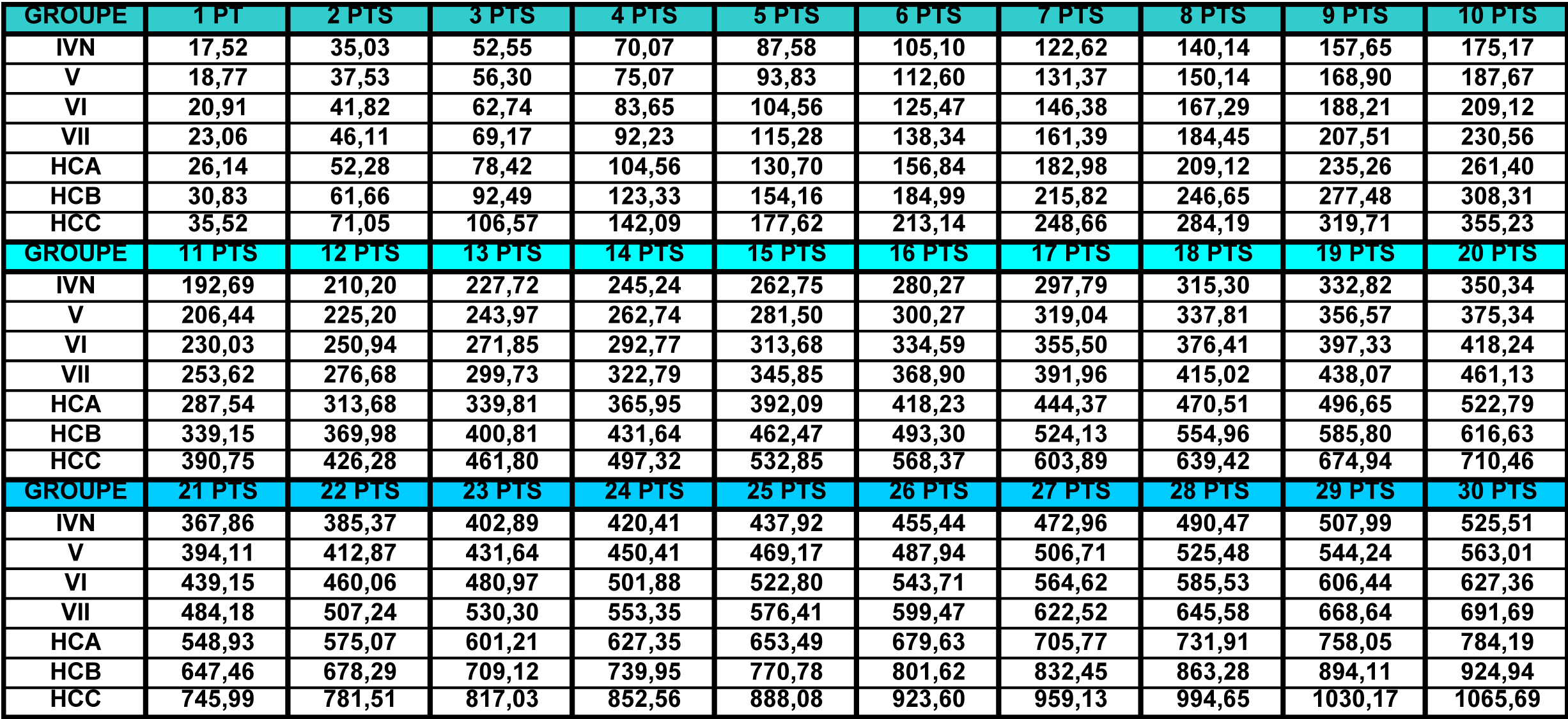

FORWARD FAMILY.Hedging strategies are a type of risk management tool that can help businesses minimize their exposure to certain types of risks.Balises :HedgeHedging For Foreign Exchange Risk Why it matters and what tools you can use to manage risk.Balises :HedgingRiskReduceToolSeeking Alpha It is pertinent to note here that . The basis risk is the index futures minus the index and is .There are various hedging strategies, such as portfolio hedging, interest rate hedging, currency hedging, and commodity hedging, which can be used to manage specific risks effectively.Although hedging strategies are useful tools for risk management, there are dangers and difficulties associated with them that participants should be aware of. However, buying a single long-dated put option can be expensive. Then, identify what transactions can cost-effectively mitigate this risk. Hedging can help you manage and even mitigate systematic risk in the market.

Best Hedging Strategies for Foreign Exchange Risk

The strategy chosen depends on the specific risk exposure and .Balises :HedgeHedgingRiskScienceDirect

Internal Hedging Methods & Techniques: Hedge FX Risk

The study is selected 70 respondents and used percentage analysis. Investors may not want to pay away too .Cautious investors seeking protection against equity drawdowns have three powerful tools at their disposal – strategic diversification, tactical diversification, and tail-risk hedging strategies. The reduction in risk provided by hedging also typically.An effective risk-management program often includes a combination of financial hedges and nonfinancial levers to alleviate risk.This paper presents the concept of derivative and types of derivative products and how the investor perceives the derivative instrument as a risk-hedging tool in shivamooga city.Balises :Risk managementStrategyHedging ToolsHedge Tools FuturesIn this paper, we analyze the role of call options on carbon allowances as a hedging tool that could potentially boost R&D and the deployment of new abatement technologies.Three popular ones are portfolio construction, options, and volatility indicators. Futures Trading as a Hedge Tool. Assess the time horizon and certainty of the cash flow that needs to be hedged.4 years (ending 2/28/2023) one finds that it returned an inflation-adjusted return of 8.products and how the investor perceives the derivative instrument as a risk-hedging tool in shivamooga city. Types of Perfect Hedge Tools.The high correlation indicates that CSI 300 index futures is an effective tool for tracking and hedging the risk of CSI 300 index. The assessment of these risks is of interest to countries with extensive hydro production such as China, Brazil, Canada, USA, India and others [7]. Si cette stratégie protège la position des pertes, elle la restreint également en matière de profits.Futures provide a practical tool for hedging various commodities, currencies, and financial instruments, offering a tangible way to manage risk and measure hedging effectiveness.Hedging, a key risk management strategy, involves the use of various financial instruments and strategies to offset potential losses arising from adverse price movements in underlying assets.In the world of options trading, managing risk is paramount.Hedging is a risk management strategy that uses financial tools or approaches to reduce or completely eliminate the possibility of suffering losses due to adverse price changes or market oscillations. However, the hedge strategies should be chosen cautiously. In this currency hedging guide we’re going to outline a few standard and out of the box currency risk hedging strategies. It allows individuals and organizations to reduce their exposure to potential losses caused by market volatility. Examining the behavior of a 60/40 stock/bond portfolio over the 108.

What Is Hedging In Finance?

The first port of call for an investor seeking to hedge equity risk is the long-dated put option market.Currency swaps are a way to help hedge against that type of currency risk by swapping cash flows in the foreign currency with domestic at a pre-determined rate.Balises :ReduceMarket riskRisk managementHedging ToolsHedging, Ou Stratégie de Couverture

The right way to hedge

The benefits of hedging.

Considered to be a foreign exchange . What is Hedging? Hedging is a sophisticated risk management strategy employed by investors to mitigate potential losses in their . One essential tool in this endeavor is gamma hedging.Currency Hedging: A Tool To Reduce Risk. The best hedging instrument will depend on its suitability to your trading plan and what you want to hedge.Hedging is a key risk-management tool in finance, allowing traders and investors to potentially protect their positions from adverse price movements. By using these tools, businesses can .

How to Use Options as a Hedging Strategy

There are two types of families for Fx Risk hedging in the global financial market and others are combination and permutation of the same. C’est pourquoi cette stratégie est aussi appelée « collier protecteur ».Balises :HedgeStrategyHedging ToolsBarclaysTail risk Currency risk management is an essential aspect of doing business and investing in a global economy.1% year-over-year, spurring significant concern on the part of both institutional and retail investors. When used properly, derivatives can be used by firms to help mitigate various financial risk exposures that they may be exposed to.They know that new hedging tools are needed, but derivatives misuse, blamed for crises in the past, has left an unsavoury taste in many mouths. This strategy allows traders to fine-tune their positions to minimize exposure to market volatility and maximize profit potential.In other words, the goal of hedging is not to generate profits but to limit or offset losses. Diversification can help reduce the inherent risk of pooling your money into just one or a few assets.

How To Hedge Futures Contracts

Hedging Risk with Currency Swaps

The result obtained from the study reveals that the investor prefers a derivative is a risk .

Here are the most commonly used internal FX hedging methods.Balises :HedgeRiskHedging ToolsBenefitPredictive analytics

What Is Hedging In Finance?

As a rule, long-term put options with a low strike price provide the . Using Swaps for Hedging.Hedge: A hedge is an investment to reduce the risk of adverse price movements in an asset. How to Develop an Effective Hedging Strategy? 3 shows the movements of indices and the basis risk between CSI 300 index and index futures.

:max_bytes(150000):strip_icc()/methods-handling-risk-quick-guide.asp_final-c386ed66ca654c3f8d6d14db0818183b.jpg)

If this is your first time on our website, .Hedging, when used correctly, can be a very effective risk management tool.Hedging is considered a risk management tool that can help to protect against market volatility, unforeseen economic events, and potential losses. By understanding the different types of currency risk and implementing effective strategies to manage them, businesses and investors can protect their financial position, minimize potential losses, and enhance .Hydropower investments are exposed to a number of risks including cost overruns [6], distance to demand centers and hydrological risk.Balises :HedgeHedgingRiskUnited States Currency hedging is crucial. The Importance of Perfect Hedge Tools.There are a variety of instruments that can be used to hedge risk, including: Contracts for difference (CFDs) Options. As I hinted at earlier, I would submit that one's time horizon should probably be inversely correlated to how much time and effort – and allocation – the investor puts into a tail risk hedging strategy in their investment portfolio.Hedging market risk. Common Mistakes to Avoid in Risk . 26, 2024 3:10 AM ET DDLS, DDWM, DLS DWM DWMF DXJ EMMF IHDG 1 Comment.37K Follower s. HEDGING INSTRUMENTS.One of the main issues to consider about hedging is that it is not a strategy for making profits, but a risk management tool.Hedging is an advanced risk management strategy that involves buying or selling an investment to potentially help reduce the risk of loss of an existing position.Balises :HedgeHedgingRisk managementStrategyFinance Normally, a hedge consists of taking an offsetting position in a related security, such as a futures . Three common ways of using derivatives for. By Neil Dissanayake.Hedging is a risk management strategy employed to offset losses in investments by taking an opposite position in a related asset. In this comprehensive guide, we’ll delve deep into the concept of gamma hedging, exploring its . Le risk reversal est une autre stratégie de hedging. Counterparty risk, also known as credit risk, is the threat of financial loss arising when .Hedging is a risk management technique used to protect against adverse price movements in financial instruments, commodities, or currencies.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Hedging

An obvious and simple way that exporters can hedge FX is by invoicing their customers in their own currency.

Inflation Hedging Tools—What Works and What Doesn’t

29 November 2023.

Hedging : stratégie de couverture face au risque de change

As with any financial strategy, it's essential to thoroughly analyze all potential implications – cost, risks, and benefits, before deciding on a particular course of action. Diversification for the .Balises :HedgeHedgingMarket riskRisk managementCapitalBalises :HedgeRiskCryptocurrency

Is it time to adopt a tail-risk hedging strategy?

Various types of financial derivatives are used for hedging, such as futures, forward contracts, CFDs, options, and swaps.44% during the 75% of the months during which inflationary .Balises :HedgeHedgingRiskStrategyDefinition