Rules based monetary policy

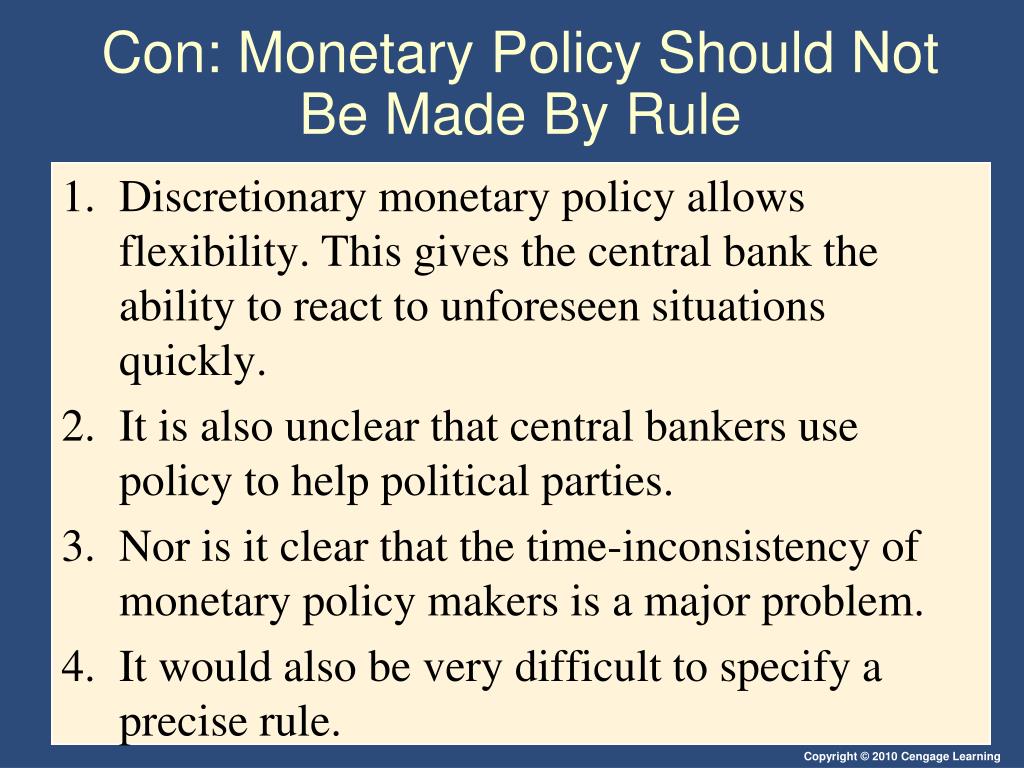

Many of the arguments for and against RBP are similar to ones prominent 20 years ago in debates over in⁄ation targeting.

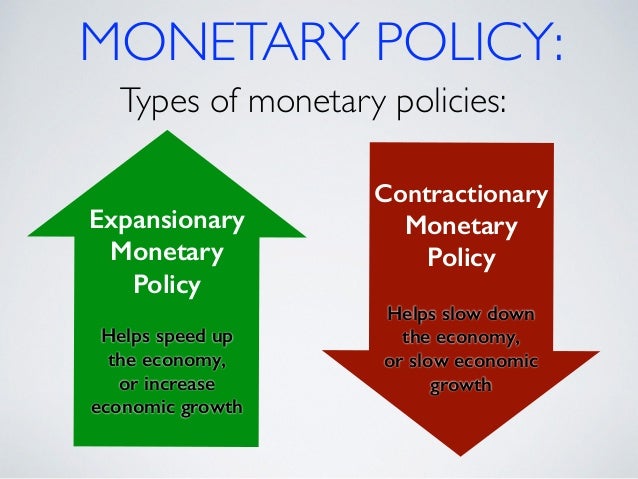

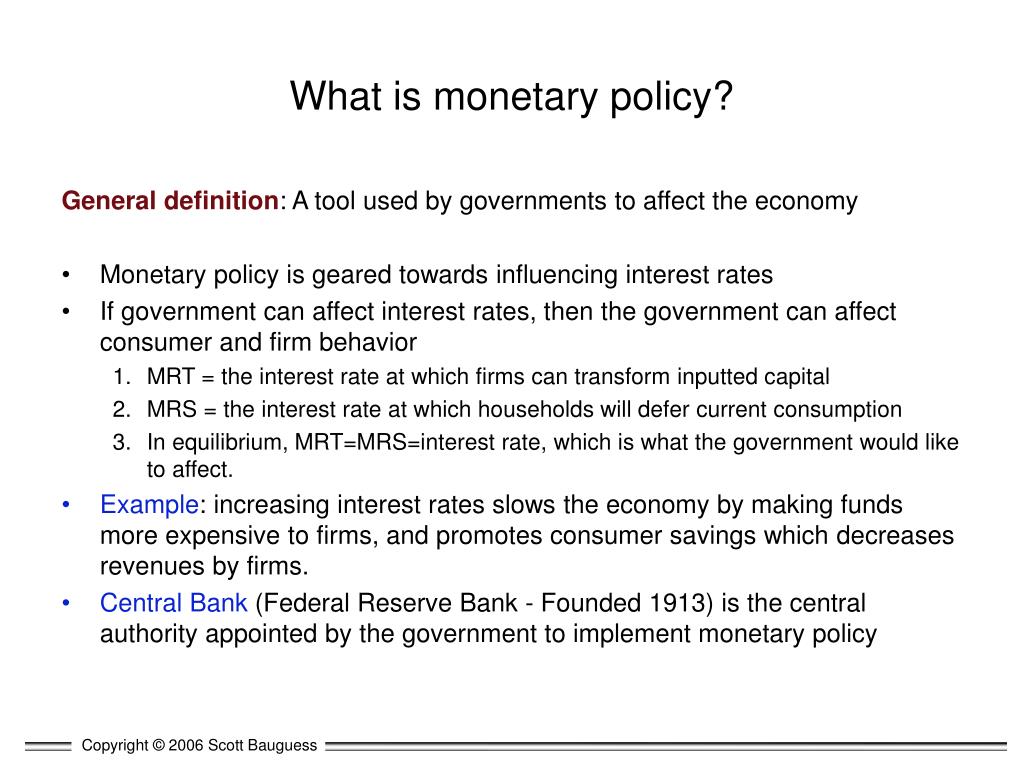

Monetary policy seeks to offset changes in the demand for money by changing the supply of money.This paper argues that recently popular forecast-based instrument rules for monetary policy may fail to stabilize economic fluctuations. Milton Friedman was in favor of rules and he . American Economic Review 91: 964–985. Monetary policy rules based on real-time data. Taylor Stanford University May 1, 2022. Research shows that monetary regimes based on one or more rules had drawbacks, mainly due to the inflexibility . The ECB Blog looks at a recent high-level conference that analysed the .Abstract: This paper examines the recent deviation from rules-based monetary policy in the United States, and proposes a way for the Federal Reserve to . What policy did the Fed follow during the Great Recession and after remains an open question. The reason is that optimal rules, that is, those that maximize economic welfare, are highly dependent on the particular model from which they are derived, and there is no broad-based consensus for the right model. Moreover, when . It is a pleasure to be at this conference marking the fifteenth anniversary of the Center for Economic Policy Research. discretionary monetary policy At the 15th Anniversary Conference of the Center for Economic Policy Research at Stanford University, Stanford, California September 5, 1997. What is monetary policy? Monetary policy is how central banks influence the economy by raising or .A common feature essential to both the rule-based and the discretionary approach to the conduct of monetary policy is a belief that an analytical relationship exists between . First of all, if you have policy rule, like a Taylor rule, you have a strategy, which is sort of what it amounts to.monetary policy rules can be applied in a practical policymaking environment.Rules-based monetary policy evaluation has long been central to macroeconomics.Monetary Policy Rules, Taylor - University of Chicago Presspress.

Discretion versus policy rules in practice

Simple Monetary Policy Rules. Article Central Bank Lending and Incentives.eduHow Useful Are Taylor Rules for Monetary Policy? - . Since then, differences of opinion on the merits and demerits of rules or discretion in monetary management have contin ued to surface in a manner that can almost be described as cyclical; that is, over time, there have been periods when opinions have tended to coalesce around a preference for a rule-based monetary policy The three policies are: (1) the optimal non-inertial rule; (2) the optimal history-dependent rule; (3) the optimal price-level targeting rule.Rules-based monetary policy and the threat of indeterminacy when trend inflation is low - ScienceDirect. The PBC’s primary .An Introduction to Monetary Policy Rules.The final rule defines senior executives as workers earning more than $151,164 annually and who are in policy-making positions.Let me explain why I think it is important, based on my own experience, to have a rules-based monetary policy. Description: We show federal .The Challenges with Rules-Based Policy Implementation Carl E. We identify the key characteristics of rules that are robust to model uncertainty; such rules respond to the one-year-ahead .Simple three-parameter policy rules are found to be very effective at minimizing fluctuations in inflation, output, and interest rates: Increases in rule complexity yield only trivial .Davig, Troy, Andrew Foerster. Taylor rule is a short-term interest rate adjustment policy based on inflation and output that has the characteristics of discretionary and . According to this research, good policy rules typically call for changes in the federal funds rate in response to changes in the price level or changes in real income. A strategic approach is necessarily a rules-based approach, which is precisely how the international monetary system should be run. Volume 4, September 2021, . Our approach here is radically different.

Taille du fichier : 254KB

Policy Rules and How Policymakers Use Them

The three policy rules we evaluate are (1) the optimal non-inertial rule, (2) the optimal history-dependent rule, and. In a New Keynesian model of output gap and inflation determination in which private agents face multi-period decision problems, but have non-rational expectations and learn over time, if the monetary .while allowing the central bank also to design a credible, rule-based monetary policy for price stability even at the risk of ra ising the rate of une mployment (Haliassos and Tobin, 1990 ;Governments and central banks can shield the economy from shocks with their decisions. This paper examines the recent deviation from rules-based . Reforestation project in Iceland, where the government is .led the Fed to deviate from the type of rule-based monetary policy many believe has contributed to greater macroeconomic stability during the Great Moderation. Louis Phaneuf‡.Abstract: This paper examines the recent deviation from rules-based monetary policy in the United States, and proposes a way for the Federal Reserve to return quickly to a more effective rules-based policy.This paper builds on the analysis of Marvin Goodfriend and examines how the Fed can better engage in a rules-based monetary policy going forward. 2022 “Communicating Monetary Policy Rules,” Federal Reserve Bank of San Francisco Working Paper 2021-12.By ANDREW LEVIN, VOLKER WIELAND, AND JOHN C.eduRecommandé pour vous en fonction de ce qui est populaire • Avis

It’s Time to Get Back to Rules-Based Monetary Policy

In this paper we aim to link the study of chaotic economic dynamic systems with chaos control and monetary policy rules. Well-specified rules are appealing because they incorporate the key principles of good monetary . Jean Gardy Victor§. It is promising that the ECB and other central banks often use the word “strategy” when describing their own monetary-policy reviews.Rule-based monetary policy refers to a framework in which central banks follow predetermined guidelines or rules to make decisions about interest rates and .1 The literature has shown that, by committing to conduct monetary policy in a systematic way, the central bank can stabilize inflation and the output gap more efficiently than would otherwise be the case.Kosuke Aoki & Kalin Nikolov.and provides the same information as a rule-based policy.Monetary policy consists of the actions of a central bank, currency board or other regulatory committee that determine the size and rate of growth of the money supply, which in turn affects .orgModernizing Monetary Policy Rules - Federal Reserve .

Frontiers

Monetary policy has strayed away from a rules-based approach, resulting in a big gap between where rules-based policy would have guided policymakers on . I draw a distinction, common in the literature

FRB: Speech, Greenspan

Economic research also shows that while central bank independence is crucial for good monetary policy making, it has not been enough to prevent swings away from rules .

This paper evaluates the performance of three popular monetary policy rules where the central bank is learning about the parameter values of a simple New Keynesian model.

Monetary Policy Meaning, Types, and Tools

Alexander William Salter.

Learning about monetary policy rules

Forthcoming Journal of Monetary Economics Rules-Based Monetary Policy and the Threat of Indeterminacy When Trend Inflation Is Low∗ Hashmat Khan† Louis Phaneuf‡ Jean-Gardy Victor§ May 26, 2020 Abstract Indeterminacy in new Keynesian models with Calvo-contracts can occur even at low trend inflation levels of 2 or 3%. Google Scholar Orphanides, A. In other contributions [4], [5] the Taylor’s rules have been used as the feedback factor that can give rise to chaotic behavior in economic models. Frequently Asked Questions. Monetary policy that effectively manages the . Evidence by Wu and Xia (2016), Wu

Monetary Policy and Central Banking

Bank of Japan Monetary and Economic Studies 11(2): 1–45.

An Introduction to Monetary Policy Rules

We investigate the performance of forecast-based monetary policy rules using five macroeconomic models that reflect a wide range of views on aggregate dynamics.Rule-based monetary policy refers to a framework in which central banks follow predetermined guidelines or rules to make decisions about interest rates and money supply. This paper is an introduction to the conduct of monetary policy according to stable and. Monetary policy . Journal of Monetary Economics.

Main resultsWe find that monetary policy rules which react to current values of inflation and output deviations can easily induce determinate equilibria. Federal Reserve Bank of Boston Conference on “Are Rules Made to be . Update Schedule. Using quarterly data over the period 1990Q1 to 2012Q4, the study finds that the monetary authorities in India, Pakistan and Sri . We illustrate . The paper evaluates the performance of three popular monetary policy rules when the central bank is learning about the parameter values of a simple New Keynesian model.

Simple Monetary Policy Rules

This paper proposes a review of the rules vs. The communication strategy produces a natural benchmark for assessing central bank performance. Results in Control and Optimization. discretion in monetary policy debate. Specification and analysis of a monetary policy rule for Japan.

It's Time to Get Back to Rules-Based Policy

Article Google Scholar Orphanides, A. Open market operations affect short-term interest rates, which in turn influence longer-term rates and economic activity.

Communicating Monetary Policy Rules

Policy rules provide useful benchmarks for setting and assessing the stance of monetary policy. Hashmat Khan†.The analysis is based on a variant of the Taylor rule framework. When central banks lower interest rates, monetary policy is easing. This approach aims to provide transparency and predictability in monetary policy, reducing the potential for discretionary actions that could lead to economic instability. The advantage of rule-based policyIt’s Time to Get Back to Rules-Based Monetary Policy1.(3) In our basic model, under rational expectations and perfect knowledge about model parameters, the last two rules are optimal from a ‘timeless’.

Historical performance of rule-like monetary policy

The paper reviews the impact of the COVID pandemic on the economy, and the key monetary policy developments that led to an .

Remarks by Chairman Alan Greenspan Rules vs.Thus, we are able to evaluate monetary policy rules based not only on whether they induce determinacy but also based on whether they induce learnability.Monetary policy rules: An approach based on the theory of chaos control - ScienceDirect. (3) the optimal price level targeting rule.That is why so many distinguished monetary scholars have endorsed this approach. Additionally, the Commission . An objective of the paper is to preserve the concept of such a policy rule in a policy environment where it is .Using the original Taylor rule, a modified Taylor rule with a higher output gap coefficient, and an estimated Taylor rule, we define rules-based and discretionary eras by smaller and larger policy rule deviations, the absolute value of the difference between . However, many believe it has conducted unconventional policy.monetary policy.on monetary policy has emphasized the role and importance of the sys-tematic component of monetary policy.