Salary calculator québec

Quebec Tax Tables 2024

9% et votre taux d'imposition marginal est 37.4% et votre taux d'imposition marginal est 37.

Quebec Annual Salary After Tax Calculator 2022

Try out the take-home calculator, choose the 2024/25 tax year, and see how it affects your take-home pay. This is 5% lower (-$5,399) than the average programmer salary in Canada.Just enter your annual pre-tax salary.The average radio dj gross salary in Québec, Canada is $61,766 or an equivalent hourly rate of $30. This is 5% lower (-$3,800) than the average literary agent salary in Canada. In addition, they earn an average bonus of $4,588.Calculate you Monthly salary after tax using the online Quebec Tax Calculator, updated with the 2024 income tax rates in Quebec. Income tax calculator and tax return for Québec and Canada on quebecers incomes of 2021, declaration that needs to be made up to 2021.Calculez votre salaire après impôts.

Quebec income tax rates in 2023 range from 14% to 25.

Quebec Salary Calculator 2024

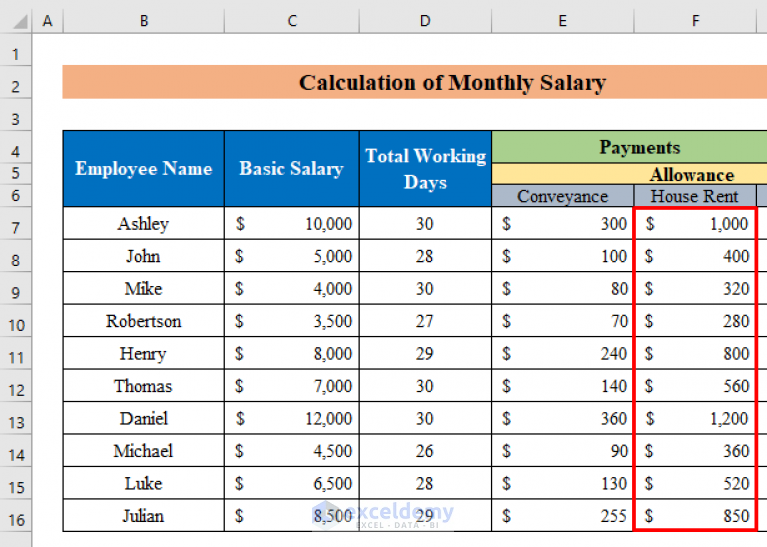

In addition, they earn .Salary Calculator Results. This Page Was Last Updated: April 14, 2023.

Taux de Salaire. This is 4% lower (-$5,225) than the average neuroscientist salary in Canada. Dans quelle province travaillez-vous? Calculer. In addition, they earn an . Cela signifie que votre salaire net sera de $50,351 par an, ou $4,196 par mois. Taux d'imposition. Déduction d'impôt . Le montant d’impôt sur le revenu retenu de votre chèque de paie est indiqué à la case E du - relevé 1.caCalcul le salaire brut / net au Québec 2024calculconversion. Higher earnings will give you a higher pension; the age at which you apply for your pension.

Quebec Tax Calculator 2024

Si vous gagnez un salaire brut de $150,000 par an dans la région de Québec, Canada, vous serez imposé de $57,701.The graphic below illustrates common salary deductions in Quebec for a 55k Salary and the actual percentages deducted when factoring in personal allowances and tax thresholds for 2024.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2024.

$65,000

Cela signifie que votre salaire net sera de $44,106 par an, ou $3,675 par mois.The average neuroscientist gross salary in Québec, Canada is $112,489 or an equivalent hourly rate of $54.The average coordinator grant gross salary in Québec, Canada is $67,349 or an equivalent hourly rate of $32. Calculate your income tax, social security and . The Quebec Tax Calculator includes tax . Si vous gagnez un salaire brut de $85,000 par an dans la région de Québec, Canada, vous serez imposé de $28,404. If you have several debts in lots of different places (credit cards, car loans, overdrafts etc), you might be able to save money by . In addition, they earn an average bonus of $3,037. Calcul Taxes Québec est l'outil de . Ce taux d'imposition marginal signifie que votre . The TIP is at least equal to the sum of the taxes TPS + TVQ is 15%. The average literary agent gross salary in Québec, Canada is $78,238 or an equivalent hourly rate of $38. The amount of income tax that was deducted from your paycheque appears in RL- 1 Box E. You can find the full details on how these figures are calculated for a 55k annual salary in 2024 below.Les taux de l’impôt fédéral en 2023 varient de 15 % à 33 %.

Salaire brut en net Québec

In addition, they earn an average bonus of $2,148. Cela signifie que votre salaire net sera de $36,763 par an, ou $3,064 par mois.250k 300k 350k 400k Entry $210,857 Senior $422,359 Average $317,407.35k 40k 45k 50k Entry $32,753 Senior $50,867 Average $42,700. WOWA Trusted and Transparent. 216 511,01$ or more.

Quebec Monthly Salary After Tax Calculator 2024

Salary estimates based on salary survey data collected directly from employers and . The average fashion buyer gross salary in Québec, Canada is $40,330 or an equivalent hourly rate of $19.35k 40k 45k Entry $31,719 Senior $48,331 Average $40,330. This is 5% lower (-$3,000) than the average radio dj salary in Canada.3% et votre taux d'imposition marginal est 43.2023 Quebec Income Tax Calculator. At age 65, you obtain 100% of the expected amounts.

Income tax calculator for Québec 2023

Revenu de pension. Other income (incl.

$85k Salary After Tax in Quebec

Salary estimates based on salary survey data collected directly from employers and anonymous .

2024 Quebec Income Tax Calculator

Si vous gagnez un salaire brut de $75,000 par an dans la région de Québec, Canada, vous serez imposé de $24,649.

Manquant :

québecQuebec Annual Salary After Tax Calculator 2024

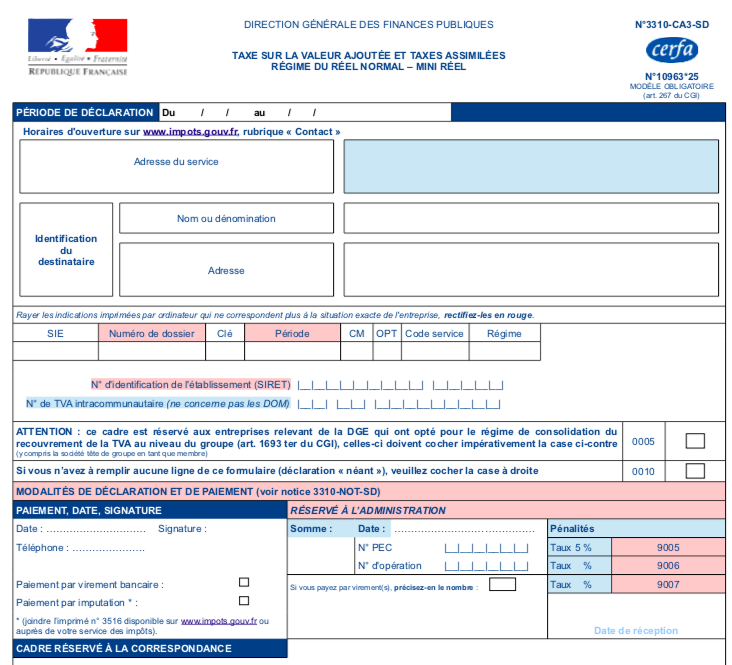

Calcul Taxes TPS et TVQ au Québec

This is 4% lower (-$3,565) than the average firefighter salary in Canada. This is 5% lower (-$1,959) than the average fashion buyer salary in Canada.Ce calcul est indicatif et ne vise qu'à donner une approximation de votre salaire net et de vos impôts sur le revenu. Compensation Data Based on Experience. You can find the full details on how these figures are calculated for a 75k annual salary in 2024 below.

This marginal tax rate means that your immediate additional income will be taxed at this rate. This is 3% higher (+$5,098) than the average assistant controller salary in Canada.Québec Income Tax Calculator 2022 & 2023.

60k 70k 80k 90k Entry $56,033 Senior $96,546 Average $78,238. This is 0% lower (+$191) than the average garbage collector salary in Canada.If you make $50,000 a year living in the region of Quebec, Canada, you will be taxed $14,361.

Calcul du salaire net 2024

Coordinator Grant Salary Québec, Canada

Tranches d'imposition provinciale et fédérale pour le Québec. Province/Territory.The average calculator gross salary in Québec, Canada is $42,314 or an equivalent hourly rate of $20.The average firefighter gross salary in Québec, Canada is $79,097 or an equivalent hourly rate of $38. Vous souhaitez maximiser vos revenus ? Nos experts . Personal Income Tax Rates and Thresholds (Annual) Tax Rate. For more information about income tax brackets in Canada, Visit the Canada Revenue Agency .Calculator to calculate sales taxes in Quebec. Votre taux d'imposition moyen est 32.

Quebec Annual Salary After Tax Calculator 2023

The average salary in Québec City is $52,400, which is 3.

$75k Salary After Tax in Quebec

Self-employment income.120k 140k 160k 180k Entry $109,586 Senior $196,965 Average $158,179. If you are living in Canada, in Ontario, and earning a gross annual salary of $73,793, or $6,149 monthly before taxes, your net income, or salary after tax, will be $55,428 per year, $4,619 per month, or $1,066 per week. Your average tax rate is 28. Votre taux d'imposition moyen est 33. Income taxes paid (Federal) Income taxes paid .Your retirement pension under the Québec Pension Plan (QPP) is calculated based on: the employment earnings entered in your file under the QPP. The average garbage collector gross salary in Montréal, Québec is $42,700 or an equivalent hourly rate of $21.Calcul du salaire net - Québec 2024. This is 4% lower (-$1,657) than the average calculator . In addition, they earn an average . Votre taux d'imposition moyen est 29. 151 978,01$ to 216 511$.Calculate you Annual salary after tax using the online Quebec Tax Calculator, updated with the 2023 income tax rates in Quebec. In addition, they earn an average bonus of $4,730. Beware some bars / restaurants charge a tip on the amount TTC while it should be calculated on the amount HT. Estimate your 2022 & 2023 total income taxes with only a few details . That means that your net pay will be $35,639 per year, or $2,970 per month. 235 675,01$ ou plus. de 165 430,01$ to 235 675$. Votre taux d'imposition moyen est 38. Salary estimates based on salary survey data collected directly from employers and anonymous employees in . Si vous gagnez un salaire brut de $65,000 par an dans la région de Québec, Canada, vous serez imposé de $20,894. Province/Territoire. Income from $ 0. Cela signifie que votre salaire net sera de $56,596 par an, ou $4,716 par mois.Calculate you Annual salary after tax using the online Quebec Tax Calculator, updated with the 2022 income tax rates in Quebec. 53 359 $ ou moins. Calculate your take-home pay after tax. Remember that how .Use this free online payroll calculator to estimate gross pay, deductions, and net pay for your employees—or yourself. Entrez votre salaire brut. Try online payroll today. However you can give more or less depending on the quality of service received. Income tax calculator and tax return for Québec and Canada on quebecers incomes of 2023, declaration that needs to be made up to 2023. Taxable Income Threshold. Taxes and contributions may vary significantly based on your location. Work Hours per Day.7% and your marginal tax rate is 43. Quebec Non-residents Federal Income Tax Tables in 2024. 98 040,01$ to 151 978$. In addition, they earn an average bonus of $891.

A person making $0 a year in Québec City makes 100% less than the average working person in Québec City and will take home about $0. Eligible dividends.

$50,000

Calculez le salaire net du Québec sur le revenu brut des québécois en 2024 et obtenez le tout sur un salaire annuel, mensuel, bimensuel, aux 2 semaines, hebdomadaire ou horaire.8% lower than the Canadian average salary of $54,450.

Employment income.

Calcul le salaire brut / net au Québec 2024

En savoir davantage sur les retenues d’impôt sur le revenu. EI) RRSP contribution. Tranches d'imposition fédérale au Canada. Province: Quebec Employment Income: Self-Employment Income: Other .The average programmer gross salary in Québec, Canada is $113,697 or an equivalent hourly rate of $55.