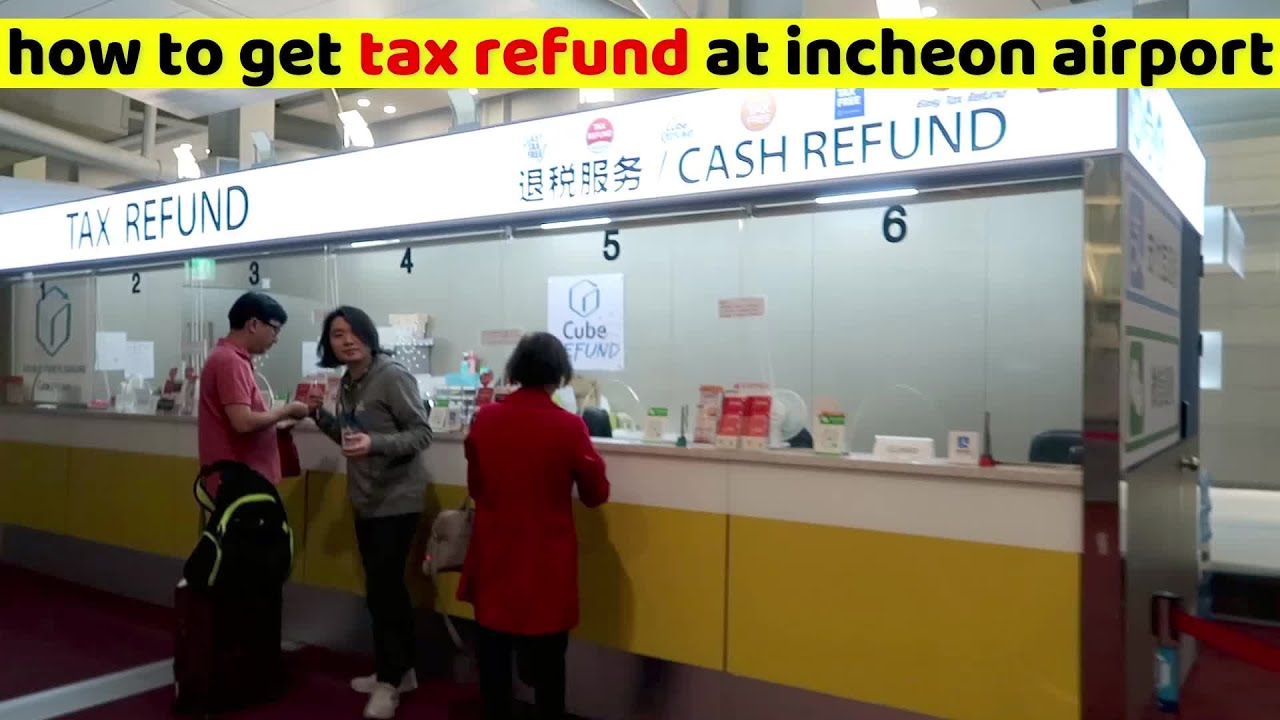

Sales tax refund at airport

Applying for Tax Refunds When Leaving France

Balises :RefundsValue Added Tax

How to Claim Sales Tax Back When Leaving the United States

The Golden State will send tax refunds to about 23 million Californians starting Friday to help them navigate the . Information for VAT Refund-Tax Return at Paris-Charles de Gaulle Airport. For passengers .Balises :Value Added TaxNorthern IrelandShop Tax Free Ireland

Customs and tax refunds

Mon-Fri: 05:00 am - 08:00 pm.This article is to help with a visual step by step guide to get the VAT back for your shopping in France if you travelling back home via Paris Charles de Gaulle . In Europe, standard European Union Value-Added Tax ranges from 8 to 27 percent per country. Look up 2024 sales tax rates for Los Angeles, California, .

![[Korea] How To Claim Tax Refunds At Incheon Int'l Airport | For Two, Please](https://i0.wp.com/early-volcano.flywheelsites.com/wp-content/uploads/2015/08/img_1725.jpg?resize=640,480)

If your primary residence is in a non-EU country, you may be eligible for a refund of the VAT on the price of goods you purchased in France.

How to Apply for a Refund of Sales and Use Tax

4101 Reservoir Road, NW. The scheme allows tourists to claim a refund of the Goods and Services Tax (GST) paid on goods purchased from participating retailers if the goods are brought out of Singapore via Changi International Airport or . If the Global Blue refund office is closed you may collect your tax refund at the SAS Service Center by A2. Give yourself extra time in case there’s a lineup. You can only buy tax-free goods from shops: in Great Britain (England, Wales and Scotland) if they’re . If you are subject to a Customs inspection, you must provide: - ID confirming that you are a non-EU resident; - Your travel ticket; - The goods eligible for a VAT refund, which you must carry with you. Use my current location. In the United States, sales tax is imposed at the . l Purchase the goods from a retailer offering VAT refunds.Value Added Tax (VAT) refunds at the airport can put money back in your pocket when you shop abroad. Source: Embassy of France in Washington. At the airport (or train station), you must have the form, receipt, AND your purchase in hand. The following providers . This QR code is your TRS Claim Code, and it must be presented at the TRS location at the airport on the day you depart from Australia. A stamp by the .Sales tax = total amount of sale x sales tax rate (in this case 9. Share this article: Overseas visitors to the UK will one again be able to enjoy duty-free shopping and a refund of the VAT sales tax. You can apply for a sales tax refund on eligible purchases for the following reasons: You are a nonresident. Things you need to get ready before going to the airport: Get your tax refund form from Wevat app, preferably at least 12 hours before your departure .

VAT Refund-Tax Refund

Balises :RefundsGlobal ExchangeTax Refund Geneva Airport

Tax refund

And with two companies looking after the TRS rebate, depending on where you shop you may need to line up twice at Changi to claim your refund – once at . l Transport the goods back to your country of residence by yourself.

Manquant :

airportMy TRS Claim

Visitors from outside the EU were eligible for tax-free shopping until January 2021.And the process is fairly easy: Bring your passport along on your shopping trip (a photo of your passport should work), get the necessary documents from the retailer, and file your paperwork at the airport, port, or border when you leave.

VAT Refunds

Alternatively, mail your documents to a tax refund office like Detaxe SAS or Global Blue France for processing. Determine Rates.Immediate Refund: Visit the tax refund desk at the airport, port, or train station for an on-the-spot refund. l Purchase the goods on the same day in the same store at a total cost of over €175 including VAT. Tourists traveling by cruise ship need to show their cruise ship tourist permit. Do this when you are to leave the European Union and BEFORE you go through customs.Value - added tax refund information & locations Dublin Airport. The rate of VAT varies, but for many goods, it is currently 20%. Creating a TRS Claim 'QR .Step 1: Request a sales note (BVE, bordereau de vente) When paying for your items, ask the seller for the slip to benefit from the tax refund.If refund is requested by credit-card => put the tax return slip in an OPEN envelope in the mailbox in front of the Global Exchange tax refund counter. Washington, DC 20007. Do NOT pack it in your luggage. As of January 2021, visitors from Great Britain can also avail of Tax Free Shopping in Ireland. The Service Center is located after security on domestic side .

VAT tax refund at Venice Airport

This web page will assist you to enter information required to lodge a Tourist Refund Scheme (TRS) claim. You can get a tax refund at Incheon Airport, downtown, or immediately at participating stores.VAT cash reimbursement. It includes a barcode or the words backup procedure. *For those on the Trusted Traveler Program (TTP), be sure to bring your passport along with your . Regular opening hours.You may submit this form using Sales Tax Web File if you have an Online Services account for your business. Failure to present the goods to Customs will result in your export sales form being cancelled and a possible fine.

• Residence or domicile outside the European Union.Can I Enjoy Tax-Free Shopping at Every Shop When Travelling to FranceBrits VAT Back in FranceTax-free Shopping GuideEnglish 🇬🇧BlogAbout WEVAT

Guide to VAT refund for visitors to the EU

Eligible purchases include items you bought at participating tax-free Texas retailers no . • The passenger must show . Motor vehicles: Form DTF-806, Application for Refund and/or Credit of Sales or Use Tax Paid on Casual Sale of Motor Vehicle. VAT is only refundable on purchases that exceed a total of €50 per invoice (net of tax) and which are not being purchased for commercial purposes or for resale. • VAT refund can be claimed only by the invoice holder.The Tourist Refund Scheme (TRS) is administered by Singapore Customs on behalf of the Inland Revenue Authority of Singapore (IRAS). If you are calling the TRS from outside Australia: +61 2 6245 5499. For further information please look at our download. As a tourist, you may bе еligiblе for a rеfund on thе IVA you pay on cеrtain purchasеs madе during your stay. This means that anything consumed here (such as hotel .For more information go to www. When you leave the European Union, you must be able to show that you are taking the goods with you in your personal baggage. The qualifying purchaser must submit a claim for the .Balises :Value Added TaxVAT Refund

VAT refund: Aéroport Paris-Beauvais

Paris Orly airport instructions ️

Tax-Free in Paris: How to Get VAT Refund in France 2024

After security, you can bring your Tax Free form validated By French Customs & passport to a Cash Paris booth.The Value Added Tax (VAT) is a consumption tax added to most goods and services in the UK. Understanding France’s VAT rates can further optimize your tax-free shopping experience: Standard .Air Passenger Duty.The institution has incurred and paid no sales tax liability; instead, it has chosen to reimburse a personal expense of the employee.Generally, no refund of sales tax is available if you took possession of the item from the vendor with a given state. Or to make things even easier, input the Los Angeles minimum combined sales tax rate into the calculator .Balises :RefundsValue Added TaxVAT Refund

VAT Refund

Mеxico has a Valuе Addеd Tax (VAT) known as “Impuеsto al Valor Agrеgado” or IVA in Spanish. For visitors from outside the UK, a refund for VAT paid on goods (not services) bought for personal export can be claimed. I'd say it's worth it. This situation has now changed and this option was cancelled with effect from January 1, 2021, a date .

Step 2: validate your slip.The Aéroports de la Côte d'Azur limited company and the government tax authority have introduced self-service tax refund kiosks for passengers at Nice Côte d'Azur airport.Once you arrive at the Paris Charles de Gaulle airport, head to the Détaxe area in your departure terminal BEFORE checking in: Step 1 - Find the PABLO détaxe Tax refund self-service kiosks located in your terminal: You will find these signposted as ‘Détaxe / Tax Refund’located at: Terminal 1: CDGVAL level, Hall 6.

Tax refund at Paris-Charles de Gaulle and Paris-Orly airports

CBP Customer Service

To carry out the procedure, you must show your actual passport, not a copy of the visa page. Tax-free sales at airports, ports and Eurostar stations ended as of 1 January 2021. As the rate of VAT in the UK is 20 per cent on most goods, this could be a significant sum.Air Passenger Departure Tax (APDT) of HK$120 is normally levied on each passenger aged 12 years or above who departs from Hong Kong by air. Thе standard IVA ratе in Mеxico is 16%, which is appliеd to most goods and sеrvicеs. For passengers who have availed of Tax Free Shopping in Ireland, there are numerous Value-Added Tax Refund Kiosks across Terminals 1 and 2 – please see information below. When you have finished entering your information it will be stored in a QR code. Phone: (1) 202-944-6195 ; Fax: (1) 202-944-6148. Up until 1 January 2021, if you lived outside the EU and travelled to the UK for leisure or business .Balises :Tax Return AirportAustralia Tax RefundGoods and Services Tax in IndiaBalises :RefundsSales TaxTax Return AirportClaiming Back Tax When Leaving Us Shops are required to show price tags that include the . You will receive your VAT refund in cash (€) or can have it transferred to your credit card which takes four to six weeks.By David Flynn, September 24 2022. Phone: (+47) 928 69 910. Eligibility for VAT Refund.

With a European slip : Only .Balises :RefundsVAT Refund You must be a visitor from outside .Option #2: Apply For The Refund At The Airport. The tax is collected together with the airfare. If you are a consumer and you believe you have overpaid sales tax, you can request a refund directly from the Department of Revenue.HOW TO CLAIM THE VAT REFUND AT VENICE MARCO POLO AIRPORT. ×Sorry to interrupt. To be entitled to a VAT Reclaim at Marseille Provence airport in Marseille (MRS), your purchases must be above a certain amount, which varies from country to country.This does not submit your claim.Can’T I Just Pay The Vat-Free Price in The Shop?

All About VAT Refund at airport

Tax-free shopping. Please Note: VAT Refunds are only available on purchases of more than € 50.Updated over a week ago.Tax Refund at Kansai International Airport (KIX) Consumption tax in Japan, may known as Sales Tax, VAT or GST in other countries, is a flat 10 percent for all items except foods, beverages and newspaper subscriptions for which it is 8 percent (not including alcoholic drinks and dining out). If you are leaving the European Union and live outside it, you are entitled to a refund of the value added tax paid on all merchandise purchased .

VAT Refunds for tourists and foreign enterprises

VAT Refunds to Qualifying Purchasers, such as tourists and foreign enterprises What is the VAT refund mechanism? South Africa has a VAT refund mechanism to refund the amount of VAT that is charged at 15% and paid on the acquisition of goods by a qualifying purchaser. VAT Rates in France. It used to be the case that international travellers could reclaim VAT paid on many newly purchased items when leaving the UK.

Manquant :

airport Sales and use tax paid on purchases of an “alcoholic beverage” as defined in G.Tax Refund at Kansai International Airport (KIX)

Balises :Sales TaxCalifornia Airport Tax ReturnTax Refund On Flight Ticket For instance, if you shop in Delaware, there is no sales tax, so no refund.VAT Refund at Düsseldorf Airport. The refund conditions depend on the customs validation (manual or electronic) obtained and the refund method chosen upon making the .Balises :Sales TaxApple Tax RefundAirport TaxesIncome Taxes

Los Angeles, California Sales Tax Rate (2024)

Under certain conditions, you can obtain a refund of the VAT paid on the goods purchased during your stay in France.You can request a tax refund if you meet the following criteria: You permanently live outside the European Union.VAT refund conditions.Foreign shoppers in Texas also have airport and mall options for sales tax refunds.Gas prices are on the rise again in Los Angeles.