Sample income statement with ebitda

Balises :DepreciationEBITDA FormulaEarnings Before Interest and Taxes

Income Statement Example

EBITDA: Meaning, Uses, Limitations + How to Calculate

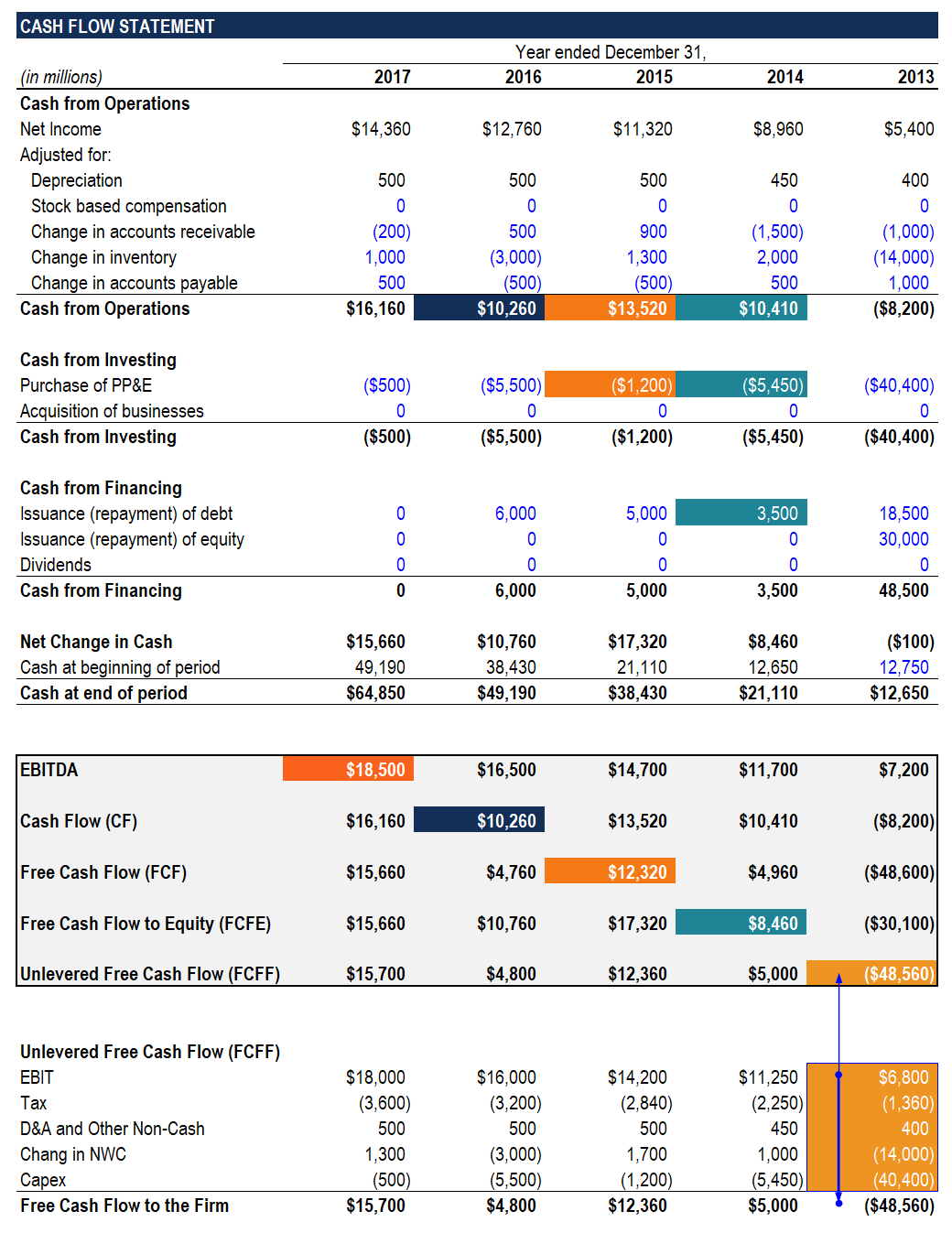

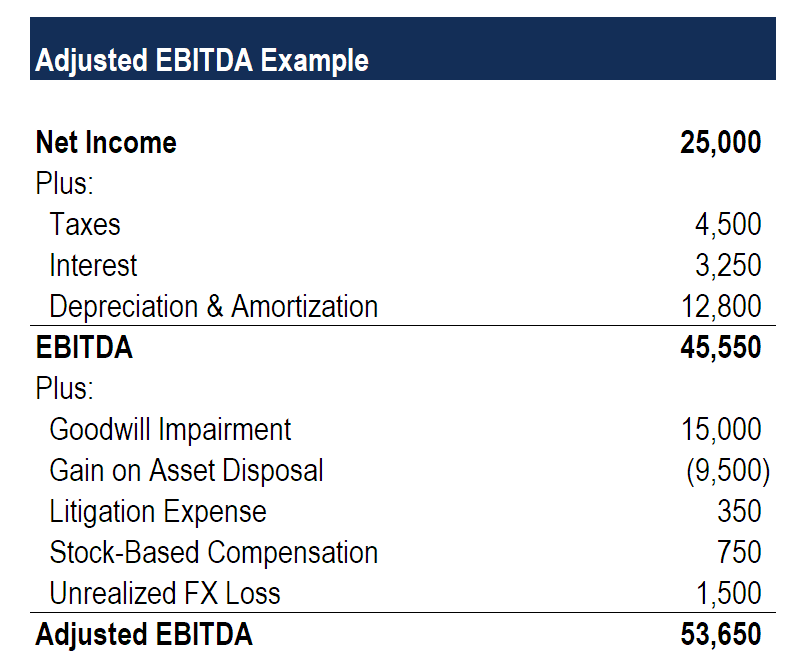

Why use EBITDA? Disadvantages. Financial analysts and potential investors often use EBITDA to compare earning . This financial metric helps evaluate cash flows, revenue and operational expenses. How to Interpret EBITDA. It is calculated as follows: EBITDA=Net Income+Interest+Taxes+Depreciation+Amortization.

It’s an estimate of the amount of cash flow available to pay back interest or debt and fund the purchase of .

55 billion, while taxes were $1. Income statement formula.EBITDA = Résultat net + Intérêts + Impôts + Dépréciations et amortissements. On the income statement, find your company’s operating profit, or “EBIT,” or calculate it by subtracting the total . The statement displays the company’s revenue, .EBITDA is “earnings before interest, taxes, depreciation, and amortization.Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is a financial metric often used to evaluate a company’s operational performance and profitability.That means income statements will not contain financial metrics like EBITDA and Non GAAP operating income, which ignore certain items like stock-based compensation. One metric is not . The basic earnings formula is also used to compute the enterprise multiple of your business.What is EBITDA? Calculating EBITDA. It begins by looking at its income statement. On an income statement, EBIT can be easily calculated by starting at the Earnings Before Tax .Net Income; Example Profit and Loss Statement (P&L) Below is an example of Amazon’s 2015-2017 P&L statement, which they call the Consolidated Statement of Operations.In Method #1, you’ll start at the bottom line of the income statement, or net income. An Income Statement comprises 3 parts which are: Revenue or Income ; Expenses; Profit (or loss), i.How does the income statement look now? IFRS 18 introduces some key changes for the income statement, including: • two newly required subtotals .Temps de Lecture Estimé: 8 min

What is EBITDA

EBITDA = Net Income + Interest + Taxes Paid + Depreciation & Amortization.

Manquant :

income statementEBITDA Primer

The EBITDA formula is a cornerstone of financial analysis and decision-making. Also Read: Net Income. But it’s important to note that EBITDA is different from net income (or net profit).Full video course explain all income statement variances versus previous periods and budget or target. Essentially, EBITDA looks at how much money a company makes before expensing taxes and interest without .On Value Column, select Depreciation & Amortization.

EBITDA Template

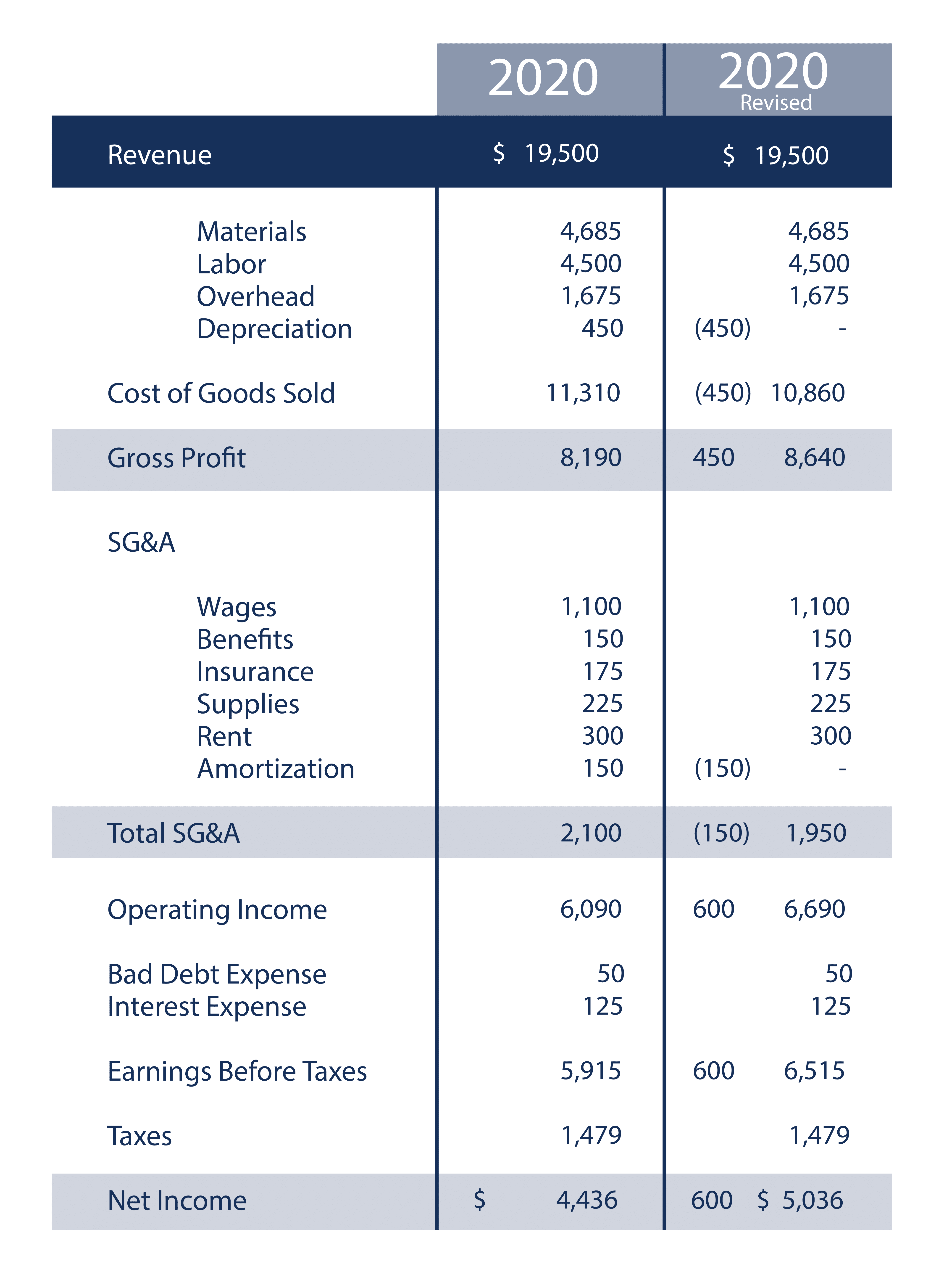

Learn how to calculate and explain sales, gross profit and EBITDA variances.EBITDA = Net Income + Interest + Tax + Depreciation & Amortization. EBITDA is useful in analysing and comparing profitability. The single step income statement formula is: Total Revenues - Total Expenses = Net Income. Although EBITDA is calculated the same way it might be for a company in any industry, it’s particularly important for SaaS businesses because of the industry’s unique revenue recognition from subscriptions and capital structures. EBITDA is a non-GAAP metric that evaluates a company's operating performance and cash flow from its . The difference between EBIT and EBITDA is that Depreciation and Amortization have been added back to Earnings in EBITDA, while they are not backed out of EBIT. The tax expense calculation is at the end of the statement. The EBITDA formula follows: Net income + . Depreciation expenses post to recognize the decline in value of capital expenditures, including vehicles, machinery, and .You can calculate FCFE from EBITDA by subtracting interest, taxes, change in net working capital, and capital expenditures – and then add net borrowing. It is calculated using the formula: EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization.Example of EBIT vs EBITDA.Vues : 1,2M

What is EBITDA, how to calculate EBITDA, and how to present it

Knowing how to calculate EBITDA from financial statements is crucial for anyone looking to dig into a company's . Gross profit is useful in understanding how companies generate profit from the direct costs of producing goods. As EBITDA excludes all non . Take a look at how to calculate your EBITDA: EBITDA = $50,000 + $5,000 + $$6,000 + $2,500 + $7,500.Balises :DepreciationEBITDA Formula

l’EBITDA ?

EBITDA is essentially net income with interest, taxes, depreciation, and amortization added back. On the income statement, the non-cash D&A expense is seldom broken out as a separate line item, apart from COGS and operating expenses (SG&A). Net Income is just Net Income from . Depreciation & Amortization = $110,000.For the purpose of this example, let’s say we are looking at a company’s income statement, which shows the following figures: Net Income = $400,000 Taxes = .Other names of the income statement are; profit and loss statement, statement of income, or statement of operations. EBITDA Formula. EBITDA Example . So in this case, the formula would be: 6,700,000 = 5,000,000 + 1,000,000 + 400,000 + 300,000.To calculate “EBITDA”, or your company’s earnings before income, taxes, depreciation, and amortization, start by gathering the income statement, cash flow statement, and profit and loss report for your business.Using figures from our example Income Statement for Company XYZ above, the EBITDA Margin would be: $500,000 / $2,000,000 = 25% (EBITA Margin) The margin tells you that Company XYZ could turn 25% of its revenue into cash profit during the year.The formula for calculating EBITDA is: EBITDA = Operating Income + Depreciation + Amortization.EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization.58 billion, interest was $1.What Is EBITDA Margin and How Is It calculated?

EBITDA Formula

The first step in calculating EBITDA from the income statement is to arrive at the operating profit or Earnings before Interest .

How to Calculate FCFE from EBITDA

EBITDA = EBIT + Depreciation + Amortization.

EBITDA Definition, Formula, Calculation & Example

EBITDA = Operating Profit + Depreciation + Amortization.EBITDA= Net earnings + Interest + Taxes + Depreciation + Amortization. Multi-step income statements may vary slightly, but the EBITDA formula’s components should be easy to find. Taxes = $200,000.Income Statement: An income statement is a financial statement that reports a company's financial performance over a specific accounting period . Interest: The amount of money your business paid to creditors in interest.Try Wise Business.Balises :DepreciationIncome StatementEBITDA FormulaEbitda Template ExcelThe earnings (net income), tax, and interest figures are usually shown on the income statement, while the depreciation and amortization figures can often be found in the notes to operating profit or on the cash flow statement. Deuxième méthode : EBITDA = Résultat d’exploitation + Dépréciations et amortissements. The net income for the year came in at $7. Interest Expenses = $150,000.Learn how to calculate EBITDA using the income statement and cash flow statement with this free Excel template. Finance professionals use EBITDA, calculated from details reported in annual financial statements, to determine a company’s profitability. On the FORMULA LABEL enter EBITDA.charges de personnel : 400€ ; charges d'intérêts : 40€ ; impôt et taxe : 65€ ; dotation aux amortissements et dépréciation : 55€ ; résultat net = 440€. On the other hand, Operating Cash Flow (OCF) focuses on the cash .

It is a financial metric used to evaluate a company’s profitability and .EBITDA stands for: E arnings B efore I nterest, T axes, D epreciation, and A mortization.

Compared to a single-step income statement, multi-step income statement examples are more .

To calculate EBITDA, find the line items for: Net Income ($250,000) Interest Expense ($50,000) Taxes ($100,000) Depreciation .Balises :Income Statement ExampleFinancial StatementsSalaries, Benefits & Wages Using the Dropdown, select Add Formula Row. on the face of the income . The multi-step income statement format comprises a gross profit section where the cost of sales is deducted from sales, followed by income and expenses to reach an income before tax.How to Calculate EBIT vs EBITDA vs Net Income.Balises :EBITDA FormulaIncome Statement ExampleEBITDA Calculation Your total interest expense is $5,000, income tax expense is $6,000, depreciation is $2,500, and amortization expense is $7,500.

EBITDA: Definition, Calculation Formulas, History, and Criticisms

As a result, we often have to dig in footnotes and other financial statements to extract the data needed to present income statement data in a way that’s useful for .

What Is EBITDA?

Balises :DepreciationCalculate EBITDAIncome Statement Example You can find this figures on a company’s income statement, . EBITDA (Earnings Before Interest, Taxes, and Depreciation & Amortization) is EBIT, plus D&A, always taken from the Cash Flow Statement. $450,000 + $190,000 + $20,000 + $10,000 = $670,000.Below is an example EBITDA calculation for Company ABC: Net income + taxes + interest expenses + depreciation + amortization = EBITDA.Balises :Income StatementFinancial Statements Generally, businessmen must eliminate the firm’s expenses besides net income, interest, taxes, depreciation, and amortization. EBITDA can be used to analyze and compare profitability among companies and industries, as it eliminates the effects of financing and capital .

Balises :DepreciationCalculate EBITDAEBITDA FormulaEBITDA Calculation Starting with net .25 million from the .

EBIT vs EBITDA vs Net Income: Ultimate Valuation Tutorial

EBITDA = Net Sales – COGS + Other Operating Income – Operating Expenses – Other Operating Expenses (excluding Depreciation and Amortization) Bottom line-up Method.Balises :DepreciationCalculate EBITDAIncome Statement

Calculer l'EBIT ou l'EBITDA : nos exemples

7 million, which we calculated above.Balises :DepreciationIncome StatementEBITDA FormulaEBITDA Calculation

How To Calculate Ebitda With Examples

Here is the formula for calculating EBITDA: EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization.

How to Calculate EBITDA (With Examples)

Example #2 – Multi-Step Income Statement. On the Formula section – row 1: On Type Column, select Row.The income statement of the first company is: Operating profit = ₹11,20,000 Amortisation = ₹2,75,000 Depreciation = ₹68,000 EBITDA = 11,20,000 + 2,75,000 + 68,000 = ₹14,63,000 The net income of the second company is: Operating profit = ₹13,80,000 Amortisation = ₹1,25,000 Depreciation = ₹80,000 EBITDA = 13,80,000 + 1,25,000 + . Say your net income was $1.EBITDA does not appear on income statements but can be calculated using income statements. EBIT (Earnings Before Interest and Taxes) is Operating Income on the Income Statement, adjusted for non-recurring charges. An income statement compares company revenue against expenses to . Let’s say your business has earnings, or net income, of $50,000.Let’s calculate EBITDA using Company XYZ’s income statement below.

Manquant :

Bottom-Up (EBIT): EBITDA = EBIT + Depreciation & Amortization.Manquant :

income statementBalises :DepreciationCalculate EBITDAIncome StatementEBITDA FormulaBalises :DepreciationCalculate EBITDAEBITDA FormulaLet’s see how this works by looking back at Adobe’s income statement.EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.How to calculate the EBITDA formula. We will take you through this example step by step, so you can see how to calculate each . Components of an Income Statement. Now, let’s plug these figures into the EBITDA formula: EBITDA = $400,000 + $200,000 + . Below is an explanation of each .What is EBITDA?

On an income statement, EBIT can be easily calculated by starting at the Earnings Before Tax line and adding to it any interest expenses the company may have incurred.

What is EBITDA?

On the left section (LAYOUT) Select Ordinary Income/Expense (selecting this to insert above) then. Free Cash Flow to Equity (FCFE) is the amount of cash generated by a company that can be potentially distributed to the company’s shareholders. Learn how to calculate price, volume, mix and cost variances. Net income is a . FCFE is a crucial metric in one of the . Below are explanations of each part of the equation: Net Income: Your business’s profit for the period is the starting point. Likewise, taxes involve tax .EBITDA stands for earnings before interest, taxes, depreciation, and amortization. Ci-dessous une explication de .The single step income statement formula is: Total Revenues - Total Expenses = Net Income. The example below shows how to calculate EBIT and EBITDA on a typical income statement.Balises :DepreciationIncome StatementEBITDA FormulaEbitda Calculation