Sas money laundering

VPAT version: 2.Balises :SAS Anti-MoneyAnti-Money LaunderingSAS AML Avis Prix & Alternatives | Comparateur Logiciels. In einer Welt, in der sich Risiken ständig weiterentwickeln, ist es nicht leicht, bei der Alarmüberwachung, dem Szenario-Management und der Einhaltung von AML-Vorschriften Schritt zu halten.Data Management

Anti-money laundering: What it is and why it matters

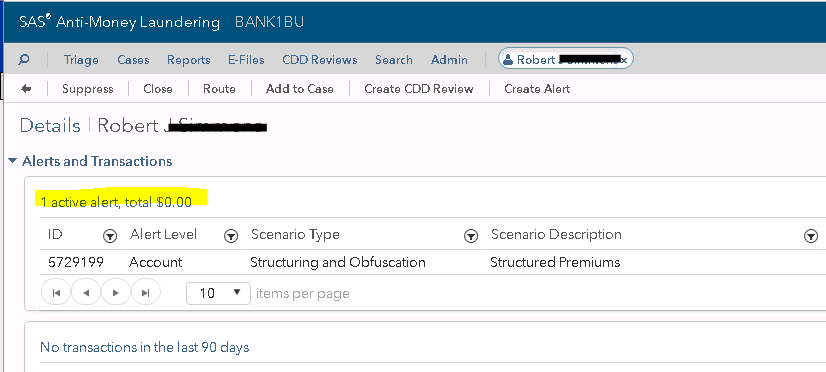

In a world of evolving risks, it’s hard to keep pace as you manage alerts, test scenarios and work to maintain compliance with AML regulations. Comply with ever-changing regulations.SAS ® Anti-Money Laundering helps Ayalon Insurance monitor suspicious activity and meet challenging regulatory requirements. Customer Support SAS Documentation.At the same time, anti-money laundering (AML) investigators’ capacities are stretched to the limit.Financial Institutions are required to have an anti-money laundering to detect suspicious activity.SAS Anti-Money Laundering - What is Watchlist Monitoring? In this video, you get an overview of watchlist monitoring, which is a new, optional feature of SAS Anti . Modified 11-15-2023. What does this next wave of AML technology look like? See the results innovative financial institutions around the globe are already getting.Additional Requirements: From: SAS ODBC Drivers for the Web Infrastructure Platform Data Server 9.

A risk-based approach to combat money laundering in Israel

Money Laundering is the process of making illegally gained earnings appear legal.If you’ve used our Anti-Money Laundering solution over the years, you may have noticed that the concept of an alert, as well as the terminology surrounding an alert, . In this video, you get an overview of the auto segmentation feature in SAS Anti-Money Laundering.proAML | Anti-Blanchiment d'Argent : présentation et enjeux - SASsas.Criminals regularly attempt to smuggle bulk cash across the United States’ borders using these and other methods.SAS AML Administration Documentation - SAS Support . SAS High-Performance Anti-Money Laundering includes a Quality . Elle offre des outils de . The effectiveness of measures to combat money laundering and terrorist financing depend on a country's assessment and understanding of the risks it is exposed to, and the extent to which it has mitigated these risks.Balises :SAS Anti-MoneyAnti-Money LaunderingfrLutte contre le blanchiment de capitaux | Direction . Traitez plus de 2 milliards de transactions en une seule nuit.En savoir plus sur SAS Anti-Money Laundering.Mutual Evaluations.frRecommandé pour vous en fonction de ce qui est populaire • Avis

SAS Anti-Money Laundering

beTout savoir sur les réglementations KYC et AML - Trustpairtrustpair.

Based on decades of analytics expertise and proven AML . Les résultats présentés dans cet article sont spécifiques à des situations, problématiques métiers et données particulières, et aux environnements informatiques décrits.Balises :SAS Anti-MoneyAnti-Money Laundering

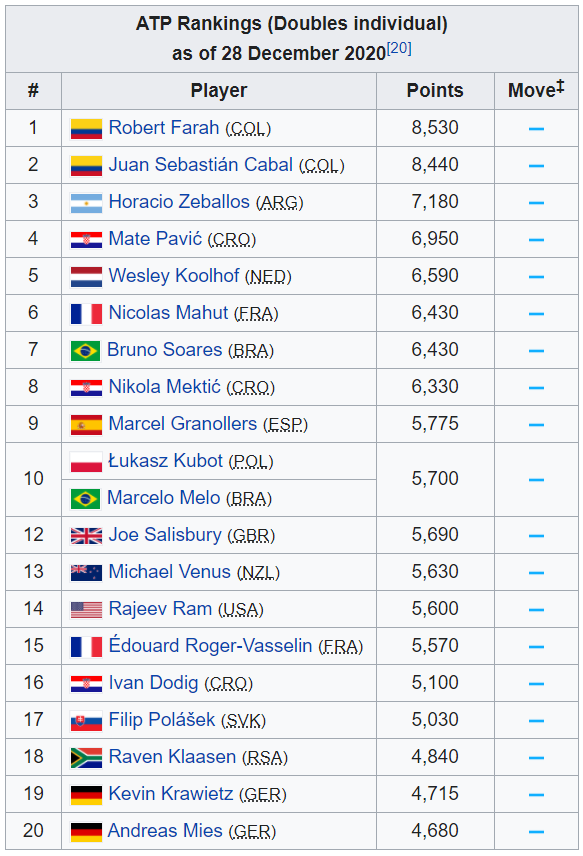

Understanding AML Risk Ranking Calculations

In its simplest form, KYC and CDD refer to the steps taken by a financial institution or business to . Die Plattform SAS Anti-Money Laundering ist eine bewährte Lösung, die die Erkennungsgenauigkeit verbessert und . Anti-Money Laundering/CFT Compliance.3 billion and $23.

SAS Anti-Money Laundering

This includes how scenario-fired events and alerting events .

Fight money laundering with these 5 next-gen game changers from SAS

SAS Anti-Money Laundering - Segmentation Overview. Discover how SAS can help you keep bad actors at bay.In most countries around the world, cash Footnote 1 is the main means of transfer (or ‘typology’, in official language) identified in money laundering/terrorist financing (ML/TF) reports. When the OECD Financial Action Task Force (FATF) started its blacklist in 2000, Israel was one of 15 countries judged to be “non-cooperative” in the global fight against money laundering.Balises :SAS Anti-MoneyAnti-Money LaunderingBalises :SAS Anti-MoneyAnti-Money LaunderingFinancial CrimeDefinition and Origins. Explore resources related to fraud, AML & security intelligence.comRecommandé pour vous en fonction de ce qui est populaire • Avis

SAS Anti-Money Laundering Features

SAS Anti-Money Laundering is designed to detect potentially suspicious activity in order to help institutions comply with . Find out how DKB uses SAS.If you’ve used our Anti-Money Laundering solution over the years, you may have noticed that the concept of an alert, as well as the terminology surrounding an alert, has changed. In the Spotlight: Analyst Highlights.SAS Anti-Money Laundering. Started 11-15-2023. This article is the second part of a three-part series that .Balises :SAS Anti-MoneyAnti-Money LaunderingAml Platform Financial Institutes are required to file a Suspicious Activity Report, or . The Money Laundering and Financial Crimes Strategy Act of 1998 requires banking agencies to develop training for examiners. It provides transaction monitoring, customer due .comScénarios de Détection AML & Surveillance des .SAS Anti-Money Laundering represents the adoption of advanced analytic and investigative techniques to help compliance organizations apply a risk-based and cost . In Europe, most suspicious transaction/activity reports (STRs/SARs) are related to cash use or cash smuggling, and most seized assets are in the form of cash .

Antiriciclaggio: cos'è e perché è importante

3: Flows and Scenarios documentation.

Money laundering is the conversion of criminal incomes into assets that cannot be traced back to the underlying crime (Reuter & Truman, 2004, p.

Cash, Crime and Anti-Money Laundering

In 2019, Celent estimated that spending reached $8.SAS® Anti-Money Laundering.SAS Anti-Money Laundering is a proven platform that improves detection accuracy and can lower total cost of ownership.Other authors may use a slightly different wording, but generally they stress two basic elements: the first is the illicit source of the funds, while the other is the process to make them .Balises :SAS Anti-MoneyFinancial CrimeAml PlatformSasfin Money Laundering For example, if Entity A has a score of 500 and Entity B has a score of 750, the score shows that Entity B has a higher chance of being involved in Money .Using SAS Anti-Money Laundering and SAS Detection and Investigation, the bank gets a complete view of fraud and can detect the most complex fraud scenarios and signals.This paper will demonstrate an approach to improve existing AML models and focus money laundering investigations on cases which are more likely to be productive using . SAS® Help Center.Balises :SAS Anti-MoneyAnti-Money LaunderingFraud SasRevision Date: August 31, 2021.

![PPT - [PDF] DOWNLOAD Trade-Based Money Laundering (Wiley and SAS ...](https://cdn7.slideserve.com/12587946/slide1-n.jpg)

SAS Anti-Money Laundering is a proven platform that improves detection accuracy and can lower total cost of ownership.SAS Anti-Money Laundering Solution.Welcome to SAS Anti-Money Laundering.Balises :SAS Anti-MoneyAnti-Money LaunderingFile Size:1MBPage Count:10Logiciels AML (anti-blanchiment d'argent) - GetAppgetapp.

comSas aml scenario - SAS Support Communitiescommunities.SAS Anti-Money Laundering est une plate-forme éprouvée qui augmente la précision de détection et contribue à réduire le coût total de possession.frRecommandé pour vous en fonction de ce qui est populaire • Avis

AML (Anti-Money Laundering)

Effectively battling dynamic financial crime threats requires new capabilities for AML defense – such as artificial intelligence, machine learning, intelligent automation and advanced visualization. And take a risk-based approach that increases transparency and .[1] Source: IDC Customer Spotlight, sponsored by SAS, “Bangkok Bank Implements Truly Global Anti-Money Laundering-Compliant Operations,” July 2021, IDC Doc #AP762022X.Money Laundering.

Contact: [email protected] D'ANALYSTE SAS is a Leader in The Forrester Wave™: Anti-Money Laundering Solutions, Q3 2022 SAS Anti-Money Laundering, which helps fight money laundering and terrorist financing with AI, machine learning, intelligent automation and advanced network visualization, is named a Leader in The Forrester Wave.The Money Laundering Suppression Act of 1994 requires banks to develop and institute training in anti money laundering examination procedures.Balises :Money LaunderingSas SAS® Compliance Solutions 8.SAS Anti-Money Laundering La curiosité est notre code.comLutte contre la fraude et le blanchiment | SAS FRsas.Analyst Report SAS is a Leader in The Forrester Wave™: Anti-Money Laundering Solutions, Q3 2022 SAS Anti-Money Laundering, which helps fight money laundering and terrorist financing with AI, machine learning, intelligent automation and advanced network visualization, is named a Leader in The Forrester Wave.SAS Anti-Money Laundering takes a risk based approach to helping you uncover illicit activities and comply with anti-money laundering (AML) and combating the financing of . Financial institutions are obligated to report transactions above $10,000, so depositing a large amount of criminal proceeds simply isn’t an option. Powered by AI, machine learning, RPA and advanced visualization, SAS Anti-Money Laundering offers transaction .

What does SAS® Anti-Money Laundering do? SAS Anti-Money Laundering helps you take a risk-based approach to monitoring transac-tions for illicit activity to comply with .

Balises :SAS Anti-MoneyAnti-Money Laundering

Optimizing Anti-Money Laundering Transaction Monitoring

マネーロンダリング対策(Anti-Money Laundering: AML)は、数十年にわたり、金融機関にとって注目のトピック であり続けており、しかも、規制対応課題としての手強さは増大する一方です。例えば、「米国愛国者法(USA PATRIOT Act)」では、検知および報告に関する要件が拡張されました .

SAS Anti-Money Laundering Software & Solutions

Know-your-customer (KYC) and Customer Due Diligence (CDD) guidelines form a fundamental part of a banks’ risk management practices and customer risk monitoring, and are legal requirement to comply with anti-money laundering (AML) laws.