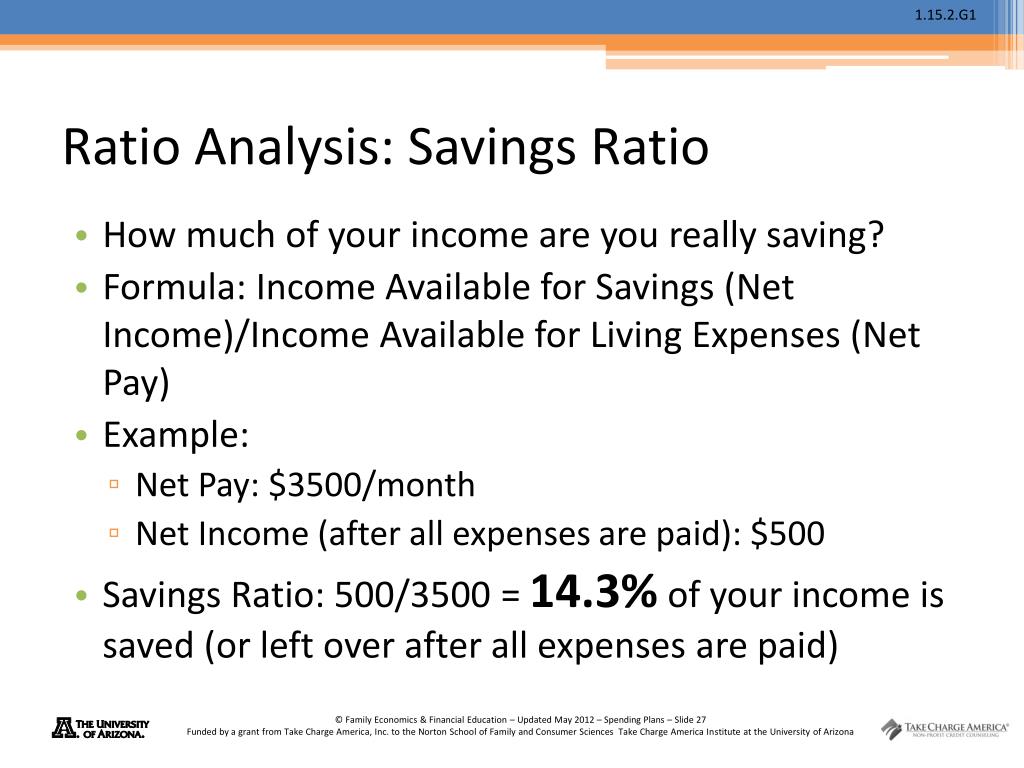

Savings ratio formula

Calculate your personal savings rate (ratio) and see how it affects your time to financial independence (FIRE).Balises :Savings RateSavings Ratio

Savings ratio

So, with a primary annual income of $75,000, you could potentially look at homes valued at $234,000 or less: $234,000 x 20% down payment = $46,800.comRecommandé pour vous en fonction de ce qui est populaire • Avis

How to Calculate Savings Ratio

How to Calculate Ratio in Excel (4 Easy Formulas)

Saving percentage = (your overall savings divided by your overall income) * 100. Using the formula above, the savings rate is calculated as: SR = MS/MI *100.

Financial Ratios

Therefore, the reserve to be maintained by Bank of America for the year 2018 can be calculated using the above formula as, = 10% * $1,381. Personal saving as a percentage of disposable personal income (DPI), frequently referred to as the personal saving rate, is calculated as the ratio of personal saving to DPI. Bank deposits = $1,381.Use the free savings calculator to determine how much your money can grow over time. Personal saving as a percentage of disposable personal . The ratio of personal saving to disposable income.The household savings ratio in Australia since 1959.The savings ratio is the proportion of national income that is saved – S/Y.Indeed, if we just define savings ratios as s t = 1 − c t W t and saving rates as s t d = 1 − c t y t, then it is clear that: s t d = 1 − ( 1 − s t) W t y t, and that a decline in s t d . The ratio formula for any two quantities say, a and b, is given as, a:b = a/b.Now, you can plug it into the savings rate formula. If you earn $5,000 per month as take-home pay and spend $3,000, your total savings would be $2,000 from your monthly income.Balises :Savings RatePersonal SavingsSavings Ratio FormulaIf the savings rate is 20% and the capital output ratio is 1. This is the most typical form of ratios, with the terms of the ratios in the simplest form of divisors. The ratio of savings by individuals or households to disposable income, usually expressed as a percentage. Determine the ability to cover short-term obligations. 5% The average personal savings . SR = 1000/10000 *100. Finally, calculate the savings rate.Average Propensity To Save: The average propensity to save (APS) is an economic term that refers to the proportion of income that is saved rather than spent on goods and services.

What Is A Savings Ratio

It proves a simple guideline as to how to apportion your income so you can afford to pay your bills, have some fun, and also put money into savings.Learn the formula and significance of the savings ratio, a measure of the average propensity of a nation's consumers to save money.With 20% Savings, you will reach FI in an impressive (by societal standards) 37 years but you don’t have to stop there. Find out the ideal .How to Calculate Your Savings Rate | SoFisofi. Then, to get CFO per share, we divide CFO by the number of common shares outstanding.Balises :Disposable IncomeSavings RatePersonal Savings In Keynesian economics, the average propensity to save (APS), also known as the savings ratio, is the proportion of income which is saved, usually expressed for household savings as a fraction of total household disposable income (taxed income).

Find out how the savings ratio is .Taking a small example, if you were to calculate the ratio of the numbers 60 and 120, it would be 1:2.Savings Rate to Earnings: ($10,000 + $3,000) / $110,000 = 11. Personal saving is equal to personal income less personal outlays and personal taxes; it may generally be viewed as the .Solvency Ratio Formula: Total Debt to Equity Ratio= Total Debt/ Total Equity #3 – Debt Ratio.It shows us how attractive a company’s stock is, relating it to its ability to generate cash. Example #1: you saved $7,000 in the last 12 months and your income was $85,000. Your total savings would be $3,000/month and you would then . BEA Account Code: A072RC.A ratio can be represented in the form of a fraction using the ratio formula.

Savings Rate (Ratio) Calculator for FIRE

More on savings.Also known as the savings ratio, it is usually expressed as a percentage of total household disposable income (income minus taxes).Beyond the Bike lesson resources - aid and savings.

Savings Calculator

BEA Account Code: A072RC.Balises :Disposable IncomeSavings RatioAps EconomicsAps FormulaSo, using the following formula, we will determine the CASA ratio.Balises :Personal SavingsCalculate The Savings RatioSavings Ratio Formula+2Retirement Savings RatioSavings Rate in Economics Definition

6 Personal Finance Ratios You Need to Know

If you are applying for a conventional mortgage, you’ll probably have to put down a minimum of 20% of the sale price. One of the prime examples of such costs is the initial investment of a project.Dividing savings by disposable income yields a savings rate of 4% = ($1,000 / $25,000 x 100).The savings ratio, also known as the savings rate, is a financial metric that indicates the percentage of your income that you save over a specific period of . $234,000 – $46,800 = $187,200 mortgage loan. This calculation enables us to determine that the bank's CASA ratio is 45%.The numbers found on a company’s financial statements – balance sheet, income statement, and cash flow statement – are used to perform quantitative analysis and assess a company’s liquidity, leverage, growth, margins, profitability, rates of return, valuation, and more. Formula: 50% Essential Spending + 30% Discretionary Spending + 20% Savings = Budget Ratio. Elizabeth Warren popularized the 50/20/30 budget rule in her book, All Your Worth: The Ultimate Lifetime Money Plan. Once you’ve calculated your savings rate, you can use it to: . Savings rate is calculated by dividing your monthly savings amount by your monthly gross income, and then multiplying that decimal by .Auteur : Julia Kagan Liquidity ratios are important to investors and creditors to determine if a company can cover their short-term obligations, and to what degree. Variations in the savings ratio reflect the changing preferences of individuals between present and future consumption. Divide that number by your income. This indicates that 45% of the total deposit of a particular bank is made up of savings and current account deposits. Given, reserve ratio = 10%.Fact checked by.5, then a country would grow at 13.

Manquant :

The ratio may be affected by cultural and demographic factors as well as by economic factors (most . CASA ratio = (30,000 + 15,000) / 100,000.What is the CASA Ratio?

This money can be earmarked for various purposes, including retirement planning, emergency funds, or achieving specific financial .

Of course, this is highly dependent on our income number, .ROI = Net Income / Cost of Investment.

Our debt-to-income ratio is a bit high though, at around 2.Learn how to calculate your savings ratio and other personal finance ratios that can help you measure your financial health and grow your wealth.Balises :Disposable IncomeSavings RatioPersonal Savings

How To Calculate Your Savings Rate and Why It’s Important

This leads to a total income of $10,000.Balises :Personal SavingsCalculate The Savings RatioDefine Savings Rate+2Saving Rates and Savings RatiosSavings Rate By Bank = 45,000 / 100,000. Say you earn $3,000 a month .5) and savings rate-to-income ratios (50%+).Savings Ratio Example. Monthly savings divided by monthly income.Savings Calculatorcalculator. Multiply by 100. It signifies the portion of an individual’s disposable personal income that is set aside as savings.The savings ratio is calculated using the following formula: Savings Ratio = (Savings \ Income) * 100% To use this formula, determine the total savings over a specific period and the total income for the same period.The savings rate is the percentage of disposable personal income that a person or group of people save rather than spend on consumption. The first version of the ROI formula (net income divided by the cost of an investment) is the most commonly used ratio. That equation will give you your savings percentage. Let us understand the ratio formula better using a few solved examples and see how .The ratio of personal saving to disposable income. Let's walk through an example of the savings rate formula.Determine the cash reserve requirement of the bank for the year 2018. Reserve to be maintained= $138. Since a and b are individual amounts for two quantities, the total quantity combined is given as (a + b). The simplest way to think about the ROI formula is taking some type of “benefit” and dividing it by the “cost”. = The ratio differs considerably over time and . This ratio can also be written as 0. Share on Facebook; Share on Twitter; Share by Email; 2. It reflects the . This is basically the flip side of the one above. It signifies the portion of an individual’s disposable .How To Calculate Your Savings Rate.The savings rate, often expressed as a percentage or ratio, is a pivotal measurement in personal finance. The inverse of APS is the .Balises :Disposable IncomeSavings Ratio

Saving Rates and Savings Ratios

The savings ratio is .Written as an equation, this is how you determine your savings ratio based on your income.

Reserve Ratio Formula

ROI Formula (Return on Investment)

This Ratio aims to determine the proportion of the company’s total assets (which includes both Current Assets Current Assets Current assets refer to those short-term assets which can be efficiently utilized for business operations, sold for immediate cash . Then, divide the savings by the income and multiply the result by 100% to express the ratio as a percentage.comWhat Are Savings? How to Calculate Your Savings Rate - . As for us, we’re doing okay according to the table for age 30 regarding the savings-to-income ratios (0.You can then calculate your savings rate using this formula: Personal savings rate = personal savings / net income Going back to our previous example, let’s say you save $1,000 a month or $12,000 a year. We calculate it by dividing the company’s stock price by the CFO per share. Based on the model therefore the rate of growth in an economy can be increased in one of two ways: Increased level of savings . Instead of telling you how much you’re spending monthly, it tells you your savings rate. Frequency: Monthly. The ratio of 1 is ideal; if current assets are twice a current liability. Creditors and investors like to see .Quick Reference. Now let's say you're also contributing $1,000 to your 401k. Saving is equal to the difference between disposable income (including an adjustment for the change in employment-related pension entitlements) and . Also known as .

35 Personal Finance Ratios To Help You Crush Your Goals

5:1 in which case, the purpose of the ratio is to have the number 1 as the denomination.

Savings Rate: Definition, Calculation, and Examples

Financial ratios are grouped into the following categories . Intuitively, without capital gains . A ratio of 1 is better than a ratio of less than 1, but it isn’t ideal.netFIRE Calculator | Financial Independence Calculatorhowtofire.In the last two decades, however, saving rates would have been three percentage points higher (reaching 15% instead of 12% in 2018).comRecommandé pour vous en fonction de ce qui est populaire • AvisFormula = Current Assets / Current Liabilities. Saving is equal to the difference between disposable income (including an adjustment for the change in employment-related pension entitlements) and final consumption expenditure.

Importance of Liquidity Ratios.

In this case, the household is only able to save $1000.The 50/30/20 formula can help you manage your budget no matter what your income. No issue will be in repaying liability. P/CF ratio = Price per share / CFO per share.