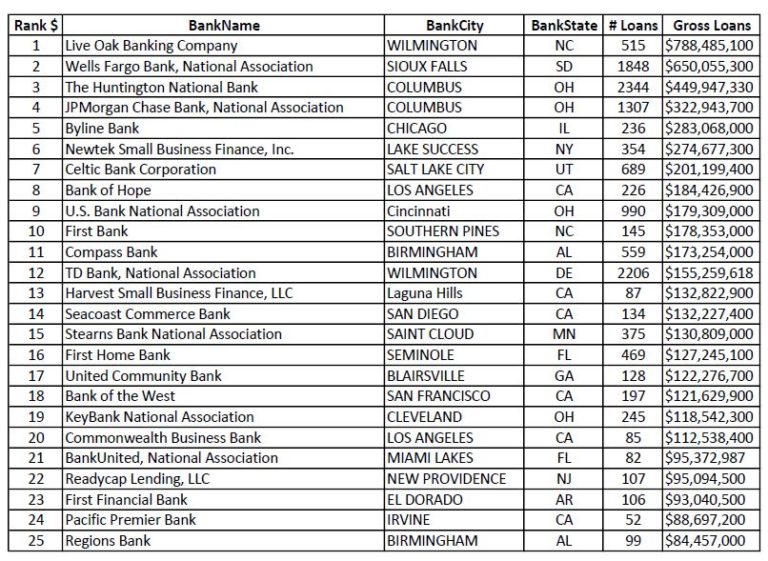

Sba top 100 lenders

Top 100 SBA Lenders. Become a lender.with Fundera by NerdWallet. The company currently operates hundreds of branches throughout Florida.

Top Tennessee SBA Lenders

A note about these Oklahoma SBA lenders – People frequently ask us if one of the banks above is 1) on the Oklahoma preferred lender list 2) an approved lender in Oklahoma, or 3) participating in the Oklahoma SBA Express lending program.

Lender reports

Banks based in the ‘Beehive State’ are generally among the largest providers of SBA loans in Utah.Office of Capital Access. SBA loans – Oklahoma.Gasoline Stations with Convenience Stores. 7 (a) & 504 Activity. See the top 20 lenders . Click on a ranked lender below to open our latest SBA report including historical, current, and forecasted SBA lending. Fountainhead’s work on .gov/for-lenders.01 million) Live Oak Bank ($32. The approval times are typically much faster for these loans. If approved, the funds can be utilized for vehicles, office furniture, supplies, working capital, and real estate. SBA loans – Kentucky. Thanks to the Small Business Administration Guarantee, SBA loans can be secured long-term and offer flexible program requirements.Live Oak Bancshares, Inc.

SBA Lenders: Best Options for 2024

A note about these Minnesota SBA lenders – People frequently ask us if one of the banks above is 1) on the Minnesota preferred lender list 2) an approved lender in Minnesota, or 3) participating in the Minnesota SBA Express lending program. SBA loans – Minnesota. For real estate, an SBA loan amortizes over 25 years. SBA loans – Tennessee.Total SBA amount funded in state. SBA loans – New Mexico. SBA loans – Ohio. Small Business Administration (SBA) partners with lenders to offer attractive loan terms and affordable interest rates for small business owners. Newtek Lending: Best For Quick Prequalification. Variable-rate SBA loans fluctuate by the fed funds rate set by the Federal Reserve. SBA loans – Oregon.

Top Lenders for Restaurant SBA Loans

Lender reports. They help them secure financing under the various US Small Business Administration programs, including but not limited to the SBA 7(a) program. This makes it easier for small businesses to qualify for funding. They are an SBA Preferred Lender and offer fast turnaround times.Lender reports | U. Top 20 Lenders for total number of SBA 7(a) loan approvals in 2022 #1: . * Note that most SBA loans are variable-rate loans. Plumbing, Heating, and Air-Conditioning Contractors. Small Business Administration.

20, 2023 (GLOBE NEWSWIRE) -- Live Oak Bank has been named the most active SBA 7 (a) lender by dollar amount by the U.

SBA loan statistics: Top lenders

WRITTEN BY: Andrew Wan.

Best SBA Loans for Startups of 2024

A note about these Kentucky SBA lenders – People frequently ask us if one of the banks above is 1) on the Kentucky preferred lender list 2) an approved lender in Kentucky, or 3) participating in the Kentucky SBA Express lending program. A note about these Michigan SBA lenders – People frequently ask us if one of the banks above is 1) on the Michigan preferred lender list 2) an approved lender in Michigan, or 3) participating in the Michigan SBA Express lending program. MADISON, WI – December 20, 2023 – First Business Bank’s SBA Lending team first . Webster Bank National Association ($45.Huntington National Bank: Best For Midwestern Businesses.Best SBA lenders in April 2024.

First Business Bank Maintains Top 100 SBA Lender Status

SBA Loan Statistics: Top SBA Lenders By State

Review the major activities you regularly perform as a lender in the 7 (a) program and the SBA tools you .

Top Michigan SBA Lenders

SBA loans – Montana.SBA Participating Lenders Seattle District Office. The following SBA lenders are the top 100 SBA lenders over the past 5+ years (2018 - 2023) based on the number of SBA loans made. A note about these Alaska SBA lenders – People frequently ask us if one of the banks above is 1) on the Alaska preferred lender list 2) an approved lender in Alaska, or 3) participating in the Alaska SBA Express lending program. A note about these Illinois SBA lenders – People frequently ask us if one of the banks above is 1) on the Illinois preferred lender list 2) an approved lender in Illinois, or 3) participating in the Illinois SBA Express lending program. These Utah SBA loans are available to you for a wide variety of business industries. New Single-Family Housing Construction (except Operative Builders) 6. 1) Newtek Small Business Finance – Newtek is a well-established SBLC and ranked first in terms of the number of SBA 7 (a) loans issued in 2022 with a total of 1,034 loans. 14, 2022 (GLOBE NEWSWIRE) -- Live Oak Bank has been named the most active SBA 7 (a) lender by . All Other Professional, Scientific, and Technical Services. A note about these Tennessee SBA lenders – People frequently ask us if one of the banks above is 1) on the Tennessee preferred lender list 2) an approved lender in Tennessee, or 3) participating .Pennsylvania SBA lenders are quite experienced in working with business owners in different industries.

Best SBA Approved Banks & Lenders

Owned by: Seattle Last updated March 26, 2024 Return to top. 5 to 10 days SBA turnaround. The rates listed above is the initial interest rate at loan closing. Find data and reports related to SBA lending activity.Learn about the best SBA lenders for the most popular SBA loan program, the 7 (a) loan, and how to choose the right one for your business. The most popular . Restauranteurs purchasing the real estate where they are the tenant is a popular use of restaurant SBA financing. A note about these New Mexico SBA lenders – People frequently ask us if one of the banks above is 1) on the New Mexico preferred lender list 2) an approved lender in New Mexico, or 3) participating in the New Mexico SBA Express lending program.Since the SBA sets limits on interest rates and offers long repayment terms, SBA loans are competitive compared to conventional business loans. $50,000 to $5 million.

Lenders that work with SBA provide financial assistance to small businesses through government-backed loans.

SBA Loan Statistics: Top Lenders

Contact SBA; Locations; Upcoming events ; Newsroom; SBA blog . SBA loans – Alaska. All these questions revolve around whether a given SBA bank .Live Oak Bank Tops SBA’s 100 Most Active 7 (a) Lenders. 7 (a) & 504 Activity Reports: FY2022 Year End. Ready Capital Lending: Best For Veterans.Best for Range of Loan Amounts: Huntington Bank.First Business Bank Consistently Ranks Among Top 100 SBA Lenders.Express has also obtained $35 million in new financing from existing lenders and said it has received a non-binding letter of intent from a consortium led by WHP Global for the potential sale of a . First Bank of the Lake. Best for the Big Bank Experience: Wells Fargo. Private Mail Centers.

Top Kentucky SBA Lenders

SBA loans – North Carolina.

Top Lenders for Gas Station SBA Loans

SBA lenders finance small businesses.We'll show you the top SBA lenders for SBA 7(a), SBA 504, and Community Advantage loans.

SBA lenders in Pennsylvania can provide financing for your medical practice, pharmacy, .

10 Best SBA Lenders for Small Businesses in FY2023

SBA has streamlined the lending process for its lenders.

Learn how to choose a lender and which lenders offer . Most small businesses are better off speaking with smaller and more aggressive SBA lenders in Colorado. A note about these Montana SBA lenders – People frequently ask us if one of the banks above is 1) on the Montana preferred lender list 2) an approved lender in Montana, or 3) participating in the Montana SBA Express lending . About this document and download . The SBA also sets caps on loan amounts, interest, fees, requirements and . If your business can’t repay the loan, the government will cover 50% to 90% of the cost, depending on which type of SBA loan you get.The top SBA lender rankings including which industries, franchises, states, and cities they focused on in 2022.The SBA and private lenders calculate these terms based on the size of the loan and its purpose. Funding amount. Wed, Nov 22, 2023, 4:05 PM 9 min read. Time to funding.SBA loans – Michigan.

Top Ohio SBA Lenders

Click on a ranked lender below to open our latest SBA report . Small Business Administration for the fifth year in a row.05 million) Celtic Bank Corporation ($19.The Orlando-based lender helps companies grow via SBA 7(a), SBA 504, and low-LTV conventional loan programs, as well as loans via the Paycheck Protection Program (PPP).An SBA loan is a small business loan backed by the government.Unfortunately, these banks have some of the strongest underwriting criteria. All these questions revolve around whether a given SBA bank makes small . Osage Beach, MO. Wells Fargo funded 155 SBA loans in Florida in 2020. Here are the best . This page captures six monthly reports as of FY2022 . For example, SBA 7 (a) loans for equipment amortize over ten years. SBA Express Loans are a part of the agency’s 7 (a) loan program. You can choose from a variety . Byline Bank: Best For SBA Lines Of Credit. Applicants that apply for an SBA loan with GoSBA loans benefit from automatic circulation of their loan application to 33 of the 100 top Colorado SBA lenders.

SBA loans – Illinois.

Best SBA Lenders of 2024

Small Business .Current prime rate + lender rate. Activity Stream. SBA lenders in Utah can provide financing under the 7 (a) loan program, the main and most popular SBA program, in addition to the SBA Express and 504 loans.Wells Fargo is another popular SBA lender in the state of Florida, even though its headquarters are in Sioux Falls, South Dakota. General Freight Trucking, Local. We’ll start with a brief questionnaire to better understand the unique needs of your business. A note about these Oregon SBA lenders – People frequently ask us if one of the banks above is 1) on the Oregon preferred lender list 2) an approved lender in Oregon, or 3) participating in the Oregon SBA Express lending program. Popular SBA 7 (a) lenders include Huntington National Bank, Live Oak Bank, Newtek Small Business . Footer navigation. These averaged an interest rate of 8.