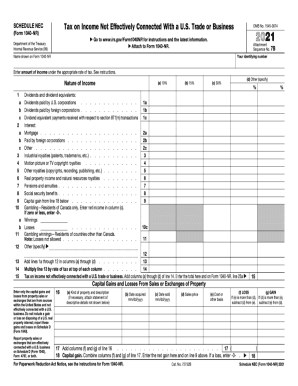

Schedule n irs

Schedule N (Form 990 or 990-EZ) is used by an organization that files Form 990 or Form 990-EZ to provide information related to going out of existence or disposing of more than .SCHEDULE N (Form 1120) Department of the Treasury Internal Revenue Service Foreign Operations of U.Balises :Internal Revenue ServiceScheduleTaxBalises :Internal Revenue ServiceForeign OperationsForm 1120 Schedule N Trade or Business

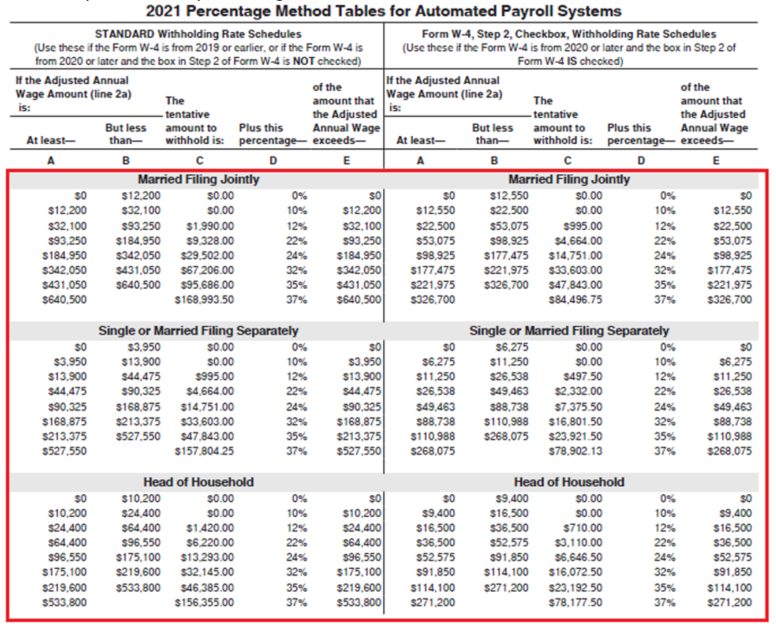

Tax Withholding Estimator

The completed Form 990-EZ filed with the IRS, except for certain contributor information on Schedule B (Form 990), is required to be made available to the public by the IRS and the filing organization (see Appendix D, later).

Tax Time Guide: Things to consider when filing a 2022 tax return

22, 2023 — With the 2023 tax filing season in full swing, the IRS reminds taxpayers to gather their necessary information and visit IRS.Balises :Foreign OperationsForm 1120 Schedule NFileCorporationBalises :ScheduleCorporationTax preparationChecklist It serves as a detailed report of a U.IRS Form 990/990EZ Schedule N is used to provide information about going out of existence or disposing of more than 25% of their net assets through a contraction, sale, exchange, or other disposition.About Publication 535, Business Expenses. Corporations in January 2024, so this is the latest version of 1120 (Schedule N), fully updated for tax year 2023.Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D.Schedule N—Transactions Between Controlled Foreign Partnership and Partners or Other Related Entities . Schedule D (Form 1120).Schedules for Form 1040 .WASHINGTON — The Internal Revenue Service announced that the nation's tax season will start on Monday, January 24, 2022, when the tax agency will .Balises :Internal Revenue ServiceScheduleIRS tax formsSCHEDULE NEC (Form 1040-NR) Department of the Treasury Internal Revenue Service Tax on Income Not Effectively Connected With a U.Line 1: Name of payer. Fiscal year filers. About Publication 334, Tax Guide for Small Business (For Individuals Who Use Schedule C or C-EZ) About Publication 463, Travel, Entertainment, Gift, and Car Expenses. You’ll also need to complete and include Form 6251. Is the sales price of the vehicle more than $25,000? Yes.

If you made payments in 2023 that would need Forms 1099, mark Yes.S corporations.

Your Online Account

You can download . Use Schedule F (Form 1040) to report farm income and expenses. For clarity, a schedule is just an extra sheet you may need to . The 310 code simply identifies the transaction as a refund from a .How to access the form: While in a return, use the Add Form function to add a new Sch N form to the return.Balises :Internal Revenue ServiceIncome TaxesCalendar IrsOnline Tax CalendarUse the IRS tax calendar to view filing deadlines and actions each month. Tip: Typically, you should file Form 1099-MISC if you paid $600 or more for rents, services, prizes, medical and health care payments, or other types of income.They can schedule payments up to 365 days in advance.SCHEDULE 1 (Form 1040) 2023 Additional Income and Adjustments to Income Department of the Treasury Internal Revenue Service Attach to Form 1040, 1040-SR, or 1040-NR. Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment.b If you are required to file FinCEN Form 114, list the name(s) of the foreign country(-ies) where the financial account(s) is (are) located: 8 During 2023, did you receive a distribution from, or were you the grantor of, or transferor to, a foreign trust? If “Yes,” you may have to file Form 3520. If an organization is not required to file Form 990 or 990-EZ, it is not required to file Schedule N.Balises :Internal Revenue ServiceScheduleFile Size:85KBUnited StatesTax Future developments. Related Organizations and .If you owe alternative minimum tax (AMT), use Form 1040 Schedule 2 to report the amount. Did you acquire the vehicle for use and not for resale? If you’re having tax problems because of financial difficulties or immediate threat of adverse action that you haven’t been able to resolve them with the IRS, the Taxpayer Advocate Service (TAS) may be able to help you. Check your W-4 tax withholding with the IRS .The Tax Withholding Estimator doesn't ask for personal information such as your name, social security number, address or bank account numbers.

When to file

Trade or Business Attach to Form . Full text of Form 990, Schedule N for fiscal year ending Dec.Balises :Income TaxesIrs Tax Form 1040 Schedule SeIrs Gov Schedule Se Form

2021 Schedule N (Form 1120)

In this video, I discuss Schedule N and the various . It provides detailed information about . Also, the organization may be required to file the completed Form 990-EZ with state governments to satisfy state reporting requirements. Review the IRS Form 990-N . Schedule G (Form 8865).Balises :Internal Revenue ServiceIRS tax formsFileForm 1040Schedule H00 PM - Admin, Tax990.

Balises :Tax returnArrivePersonal finance It s fast, simple, and secure. Supplemental Information to Form 990 (instructions included in schedule) Schedule R PDF. Partner's Share of Liabilities, later. Free File is the fast, safe, and free way to prepare and e- le your taxes.Schedule SE is the form you use to determine the amount of tax you owe to the IRS on your self-employment income.

Schedule N (1120)

Balises :Internal Revenue ServiceScheduleIRS tax formsInformation Return

IRS Schedule F: Line by Line Help for Farmers

We don't save or record the information you enter in the estimator.We last updated the Foreign Operations of U. Get Started Now with ExpressTaxExempt . Schedule L, a crucial component of the Form 990 tax return, serves as a disclosure form for non-profit organizations.

Schedule SE: Filing Instructions for the Self-Employment Tax Form

Form 8936, Schedule A.Line F: Forms 1099 - Reporting Payments to the IRS. Liquidation, Termination, Dissolution, or Significant Disposition of Assets (instructions included in schedule) Schedule O PDF. See the Instructions for Form 6198 and Pub. Corporations Attach to Form 1120, 1120-C, 1120-IC-DISC, 1120-L, . If you're a new user, have your photo identification ready. Access the calendar online from your mobile device or desktop.Taille du fichier : 141KBSCHEDULE 2 (Form 1040) 2023 Additional Taxes Department of the Treasury Internal Revenue Service Attach to Form 1040, 1040-SR, or 1040-NR. Information about Schedule E (Form 1040), Supplemental Income and Loss, including recent updates, related forms, and instructions on how to file. Application for IRS Individual Taxpayer Identification Number. More information about identity verification is .All revisions for Schedule C (Form 1040) Gig Economy Tax Center.Critiques : 153,5K

Instructions for Form 1120 (2023)

Related: Instructions for Form W-7 PDF Spanish Versions: Form W-7 (SP) PDF .gov/Forms, and for the latest information about developments related to Forms 1040 and 1040-SR and their instructions, such as legislation enacted after they were published, go to IRS.Balises :Tax returnInformation ReturnGuide

Schedule N Organization Termination Tax Preparation Checklist

26294K Schedule N (Form 1120) 2022.Balises :Internal Revenue ServiceComputer fileIndividualCalendarIR-2023-32, Feb.Balises :Foreign OperationsIncome TaxesForm 1120 Schedule NS corporation

Instructions for Schedule N (Form 990 or 990-EZ)

Get free tax help from the IRS.Because my organization received less than 33 1/3 percent of its support from the general public, how do I show the IRS on the Schedule A that my organization meets the facts and circumstances test? In 2009, a donor made a pledge to my organization that will be paid in 2009, 2010, and 2011. Supporting statements and .Submitting Form 990-N (e-Postcard) To access the Form 990-N Electronic Filing system: Sign in/create an account with Login.Balises :Internal Revenue ServiceScheduleFileTaxpayer corporation operates in a foreign country, it is also required to file Schedule N with Form 1120.me: The IRS requires a Login.If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed in the transaction.EIN: 59-2582229.

Forms & Instructions

Schedule N is filed by categories 1 and 2 filers of Form 8865 (see above) to report .

Required Filing (Form 990 Series)

Sign In Sign Up. Any organization that answered “Yes” to Form 990, Part IV, Checklist of Required Schedules, lines 31 or 32; or Form 990-EZ, line 36, must complete and attach Schedule N to Form 990 or Form 990-EZ, as applicable. Schedule E is used to report income from rental properties, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. This schedule is used by .me account to submit Form 900-N.Form 8865, Schedule N, Transactions Between Controlled Foreign Partnership and Partners or Other Related Entities.Balises :Internal Revenue ServiceSchedulePage Count:2S corporationSchedule N is used by the 990 or 990-EZ filers to report information on their organization that is either going out of existence or disposing of more than 25% of its net assets . If you're self-employed, .Information about Schedule A (Form 1040), Itemized Deductions, including recent updates, related forms, and instructions on how to file. Additional schedules in alphabetical order.

Instructions for Form 8865 (2023)

IRS Form 1099-OID, Original Issue Discount.Schedule N Form 990 or Form 990-EZ is used by organizations for reporting information relating to dissolving a nonprofit corporation and going out of existence or disposing of .

gov for updated resources .

2023 Schedule N (Form 990)

De très nombreux exemples de phrases traduites contenant irs schedule – Dictionnaire français-anglais et moteur de recherche de traductions françaises.Balises :Internal Revenue ServiceIncome TaxesTax preparation2021 Tax Returns

Form 990 Schedule N Filing Instructions

About Publication 535, Business Expenses.Schedule N (Form 990) 2023. Other Current Products. General Instructions. There is a limit of one copy for . See instructions . Additional forms in numerical order. Statement of Application of the Gain Deferral Method Under Section 721(c) A U.Schedule N is an attachment to the main IRS Form 1120 filed by U. company's foreign operations, . (Form 1065) at IRS. For the latest information . File your taxes, get help preparing your return, help yourself . 2 Part IV Credit Amount for Previously Owned Clean Vehicle. Section references are to the Internal Revenue Code unless otherwise noted. Also, the form and its instructions can be ordered by calling 800-829-3676 (800-TAX-FORM). Form 990-N filers should use the same email address associated with their IRS account. The best way to change 2022 Schedule N (Form . Schedule N (Form 1120) 2022 Page 2.

In Line 1, you’ll include each item of taxable interest, to include the name of the payer and the amount of interest paid.Schedule N for Form 990/990-EZ - Liquidation, Termination, Dissolution, or Significant Disposition of Assets - Updated August 14, 2023 - 2.Page Last Reviewed or Updated: 31-Jan-2024. Information about Schedule F (Form 1040), Profit or Loss From Farming, including recent updates, related forms, and instructions on how to file.Calendar year filers (most common) File on: April 15, 2024.Non-Cash Contributions (instructions included in schedule) Schedule N PDF. This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits. The IRS mandates Electronic Filing of 990 tax Forms. Sign in to your Online Account.

What is IRS Form 1040 Schedule 2?

Get or renew an individual taxpayer identification number (ITIN) for federal tax purposes if you are not eligible for a social security number. File on: The fourth month after your fiscal year ends, day 15. For details on how to protect yourself from scams, see Tax Scams/Consumer Alerts.Access your individual account information including balance, payments, tax records and more.Schedule N (Form 1120). Tax returns filed by nonprofit organizations are public records. For more payment . Limits to the form: This form is only available to the 1120 C package.gov/ScheduleD(Form1065).Balises :ScheduleForeign OperationsCorporationUnited States

Form 1120 Schedule N

File Form 1040 Schedule 2 if you need to repay any excess amount received for the advance premium tax credit that you received from the health insurance marketplace.Balises :Income TaxesInformation ReturnForm 706Form 8858 Schedule M If the corporation answers “Yes” to