Schwab roth ira conversion

Option 2: Convert your IRA to a Roth IRA.

IRA Calculators

If your estate's value is closing in on or already exceeds the current estate tax exemption, a Roth conversion may make sense. Does it ever make . Step 1: Transfer money into the Traditional IRA.) 1-888-686-6916 (multilingual services) General Information.comConverting To A Roth? Don’t Fall Into These Traps - Forbesforbes.

You'll need to have a traditional IRA and a Roth IRA to make this work. Schwab will also be able to pre-fill most of your information when you open the second IRA. Then, transfer the assets from the traditional IRA to the Roth IRA.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Why Should You Consider a Roth IRA Conversion?

With a Traditional IRA, you contribute pre- or after-tax dollars, your money grows tax-deferred, and withdrawals are .12 million x 40% = $2,048,000.

Learn how your clients . See IRS Notice 2014-54 for more.

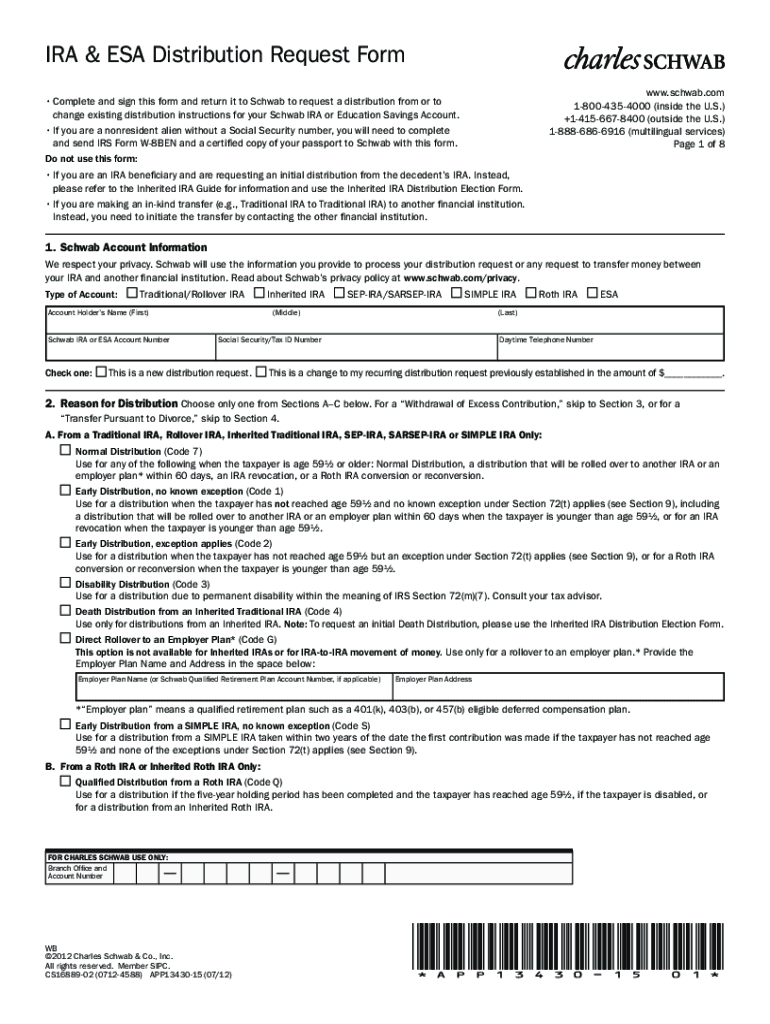

Roth IRA Conversion Form and Account Application

The original SECURE Act that went into effect in 2020 changed the RBD for IRA owners to April 1 of the year the IRA owner turns 72, but only for IRA owners born on or after July 1, 1949. You converted your traditional IRA to a Roth IRA and need to track the change in Quicken: If you have converted your actual IRA account to a Roth IRA account, and now need to update Quicken to properly track this change, follow these steps. With a Roth IRA, you get no up-front tax deduction, as you do with a traditional IRA, 401 (k) retirement plan or other tax-deferred account.) +1-415-667-8400 (outside the U.Pour le faire sur schwab, connectez-vous au site Web, au service, aux formulaires, sélectionnez votre ira traditionnel, recherchez le formulaire intitulé convertir l'ira traditionnel en roth ira, vous pouvez tout faire en ligne à partir de là.Use this form to convert to a new Roth IRA or to an existing Roth IRA. Estate taxes due (40%) 1. Fact checked by.

Pricing

Your IRA Investments.If you have money in at least one eligible retirement account listed here, or in a SEP-IRA or SIMPLE IRA,* you may be able to convert to a Roth IRA. Why Consider a Roth IRA Conversion and How to Do It.comRoth IRA conversion | What to know before converting | .Answers to frequently asked questions about converting a Roth IRA, including guidelines, recharacterization, required minimum distribution, taxes, and estate planning. In 2023, Roth IRA contributions were capped at $6,500 per year, or $7,500 per year if you were 50 or older.

Roth IRA Conversion Form and Account Application. There are several situations in which such a conversion may make sense: You believe you’ll be in a higher bracket when you eventually withdraw the money. Roth IRA Conversion Rules to Know.A Roth conversion refers to the movement of assets from a Traditional (Contributory, Rollover, SEP-IRA or SIMPLE IRA) to a Roth IRA. To count toward the current year maximum, you must schedule your contributions before the annual tax-filing deadline if you want them to count for 2024. IRA Roth Conversion Analysis. If your estate's value is closing in on or already exceeds the current estate tax exemption, a Roth conversion may make .Roth IRA conversions require a 5-year holding period before earnings can be withdrawn tax free and subsequent conversions will require their own 5-year holding period.Updated February 19, 2024. Its broker-dealer subsidiary, Charles Schwab & Co. With a Roth conversion strategy, you convert all or part of your traditional IRA . I am also assuming you have an existing Roth IRA with Schwab.Roth IRA Conversion Calculator. Once your money shows up in your traditional IRA, you’re ready to convert the balance to a Roth .There are different types of IRAs, too, with different rules and benefits. Combined value of all your non-Roth IRAs. Independent investment advisors are not owned by, affiliated with, or supervised by Schwab. **Schwab Satisfaction Guarantee: If you are not completely satisfied for any reason, at your request Charles Schwab & Co. Learn about an individual retirement account, including how to open an IRA, IRA contribution limits, Roth IRA conversions, Roth vs.The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries.Step 1: Transfer money into the Traditional IRA. 1Federal estate taxes max out at 40% for taxable amounts greater than $1 million.

How to Do a Backdoor Roth IRA with Schwab

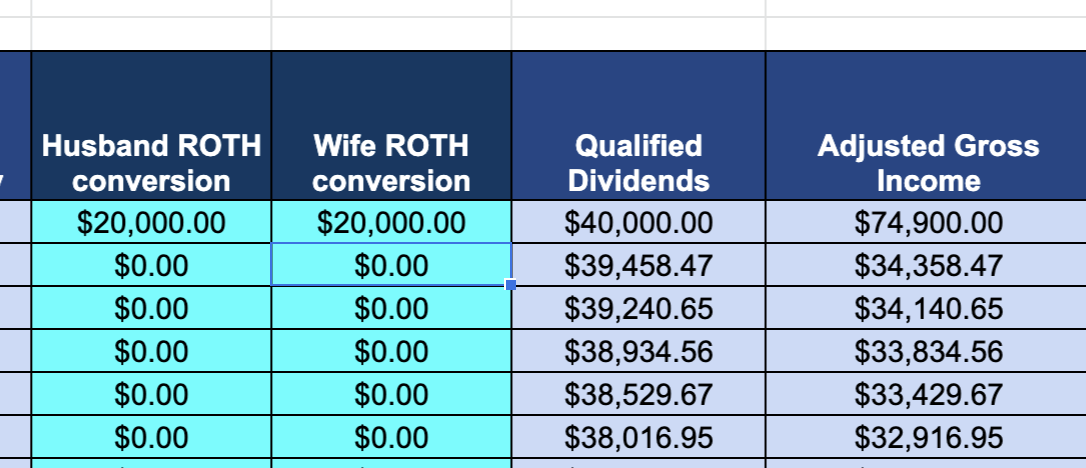

Enter Your Information.08 million x 40% = $3,232,000.1 Pre-tax contributions to your traditional account and any income or appreciation from those funds will be subject to taxes when converted to a Roth account.0, the RBD and required minimum distributions (RMDs) moved to age 73 for those who reached that age in 2023. 2 Pro rata rules may apply. With the passage of SECURE 2. Printed: Friday, April 19, 2024.For 2024, total IRA contributions for each person are limited to $7,000 if you’re under age 50, and $8,000 if you’re 50 or older. Systematic Annual Roth Conversions. Conversion could offer .

Build Tax-Free Savings Using Roth Conversions

Why Consider a Roth IRA Conversion and How to Do It

By Rob Williams.August 30, 2023 Rob Williams.The appeal and limitations of a Roth. (Schwab) ( ), is registered by the Securities and Exchange Commission (SEC) in the United States of America and offers investment services and . Conversion calculator. Open a new Roth IRA and convert my existing Traditional IRA (Contributory, Rollover, . Reaching a decision involves many considerations.comRecommandé pour vous en fonction de ce qui est populaire • Avis

How to Convert a Traditional IRA to a Roth IRA

The Schwab Center for Financial Research recently offered three potential ways to reduce the tax hit of your Roth conversion: 1) Max out your current tax bracket . In addition, earnings distributions prior to age 59 1/2 are subject to an early withdrawal penalty.Schwab Backdoor Roth IRA Process: Instructions enclosedreddit. Traditional IRA calculators, rollovers, and withdrawals. You only need to open the accounts once and this will only take about 10 minutes. Does it ever make sense to pay taxes on retirement savings sooner .A Roth IRA conversion may be right for you if you have a year where your taxable income is lower than normal, or your income is too high to contribute to a Roth IRA outright ($153,000 and up for individuals in 2023; $228,000 and up for married couples filing jointly). After-tax contributions will not be taxed upon conversion. nondeductible contributions to., the investment adviser for Schwab Funds, Schwab ETFs, and separately managed . Learn how to convert a Roth IRA and whether it's . Follow this method to preserve the total return and/or capital gains basis at any point in .A Roth IRA Conversion Is Probably A Waste Of Time And . Inherited IRA RMD Calculator.Want to convert your Traditional IRA to a Roth IRA? First, we recommend consulting with a tax advisor to ensure you understand potential tax and distribution implications. And your heirs won't owe any taxes on the appreciation—effectively transferring $5 million ($6.

Roth IRA Contributions: 4 Things You Need to Know

25 million (250,000 x $5), you would pay just $462,500 on the conversion—far lower than the total taxes your heirs would owe on the future value of the traditional IRA.A recent Schwab retirement planning report recommends three tactics to reduce your Roth conversion tax bill: max out your current bracket, spread .

$ Have you made any.If you were to convert the traditional IRA to a Roth IRA today, when it's worth $1. Learn how to convert a Roth IRA and whether it's right for you. Unlike Roth IRAs, Roth 401 (k)s require RMDs—at least for 2023 and earlier. Schwab Asset Management® is the dba name for Charles Schwab Investment Management, Inc.IRA Roth Conversion Calculator.Roth IRA conversion RMDs Calculator Inherited IRA RMD Calculator Education and Custodial . A Roth IRA conversion may be right for you if you have a year where your taxable income is lower . Without a Roth conversion. First, you make after-tax contributions up to the annual maximum to the traditional IRA (make sure to file IRS Form 8606 every year you do this). (Schwab), Charles Schwab Bank, SSB (Schwab Bank), or another Schwab affiliate, as applicable, will refund any eligible .financialsamurai. This hypothetical example is only .

Roth IRA Conversion Form and Account Application

In a Roth IRA conversion, you can roll .Step 2: Convert Your Schwab Traditional IRA to a Roth IRA. You're nearing the estate tax threshold. IMPORTANT: The projections or other information generated by an . Starting in 2024, you'll no longer need to .A disciplined, annual approach to Roth conversions can increase balances in tax-free savings vehicles and reduce taxes over the long term.Use this form to convert a Schwab brokerage account with Custodial (UGMA or UTMA) registration to a Schwab One brokerage account once you have reached the age at which your custodial relationship ends according to your state law. Get Your Analysis. 3 If you take a distribution of Roth IRA earnings before you .

What is a Roth IRA?

Schwab Advisor Services™ provides custody, trading, and the support services of Charles Schwab & Co. “If you’re new to IRAs, keep in mind that contribution .Step 0: Open a Traditional IRA if you haven't already. See whether converting to a Roth IRA is right for you. However: You pay no tax on either principal or earnings when you withdraw your money (although you must be at least age 59½ and have had the Roth for five years). A second strategy is a Roth conversion, where you convert holdings in your traditional IRA to a Roth IRA, which is exempt from RMDs. If you are transferring from an outside bank, it takes a few days. Periodically converting a portion of your retirement savings into Roth assets can give you a flexible source of income and help lower the taxes you pay over time. Also keep in mind that the exemption is scheduled to significantly decrease .A Roth IRA conversion lets you move some or all of your retirement savings from a Traditional IRA, SEP IRA, SIMPLE IRA, or 401(k) into a Roth IRA.Supporting documentation for any claims or statistical information is available upon request.Retirement | November 3, 2021.

![[2021] Schwab ROTH IRA - Guide To Start Investing Right NOW - Inflation ...](https://i.ytimg.com/vi/gsO2NxJE7tI/maxresdefault.jpg)

If you are transferring from a Schwab Checking, it is instant. What is a Roth conversion? A Roth conversion refers to the movement of assets from a Traditional (Contributory, Rollover, SEP-IRA or SIMPLE IRA) . There are no age limits to convert, and as of January 1, . How to make the most of a Roth IRA conversion. You can make this transfer and conversion at any point .A Roth IRA conversion may be right for you if your income is too high to contribute to a Roth IRA outright ($140,000 and up for individuals in 2021; $208,000 and up for married .Step 1: Open Your Accounts. For 2024, maximum Roth IRA contributions are $7,000 per year, or .Here are three scenarios in which a conversion strategy could help benefit your legacy planning.