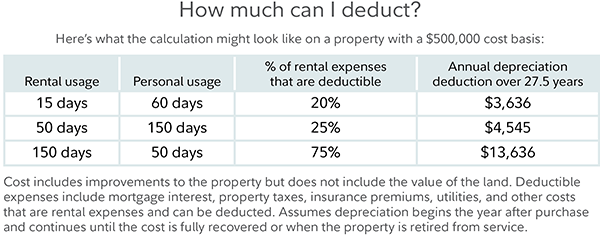

Second home deduction rates

Tax Deductions on Second Home Loan.

3 Things You Need To Know About Second Home Tax Deductions

Critiques : 153,5K

Fixed rate method

Capital Gains Tax: What It Is, 2023-2024 Rates

Meanwhile, if your income is above $459,750 you’d be taxed at the 20% capital gains .

16, 2017, these numbers increase to $1 million and $500,000, respectively.

For example, to qualify for the 0% capital gains tax rate you’d need to earn less than $41,675 for 2022. investment property.Second Home Mortgage Rates. The fixed rate method has been revised to: increase the rate per work hour that you can claim when you work from home.That’s 75% more than the same borrower would save with a 4% mortgage rate.Published Date: February 20, 2024. For debts incurred before Dec. Current primary home, 30-year mortgage rates are 7. Depreciation limits on cars, trucks, and vans. Non-residents are charged the same 19% flat-rate tax as residents.Updated June 7, 2023.

How To: Second Home Tax Deductions

You might refinance or sell the home before you . This means that real estate taxes commonly cost thousands of dollars a year.

The Home Mortgage Interest Deduction

The change will bring the second home council tax rules into line with long-term empty homes from April 2024. This revised method is available from 1 July 2022. When boat builders add the right amenities in tiny boats these days, they keep the tax .

Current Second Home Mortgage Rates

When you file your tax return, you are entitled to . If you own a second home or holiday home in France, you will be liable for capital gains tax in France when you sell your property, even if you are tax resident in another country.

Mortgage interest deductions — tax break

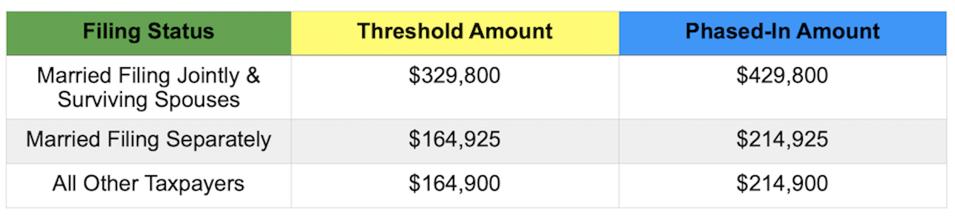

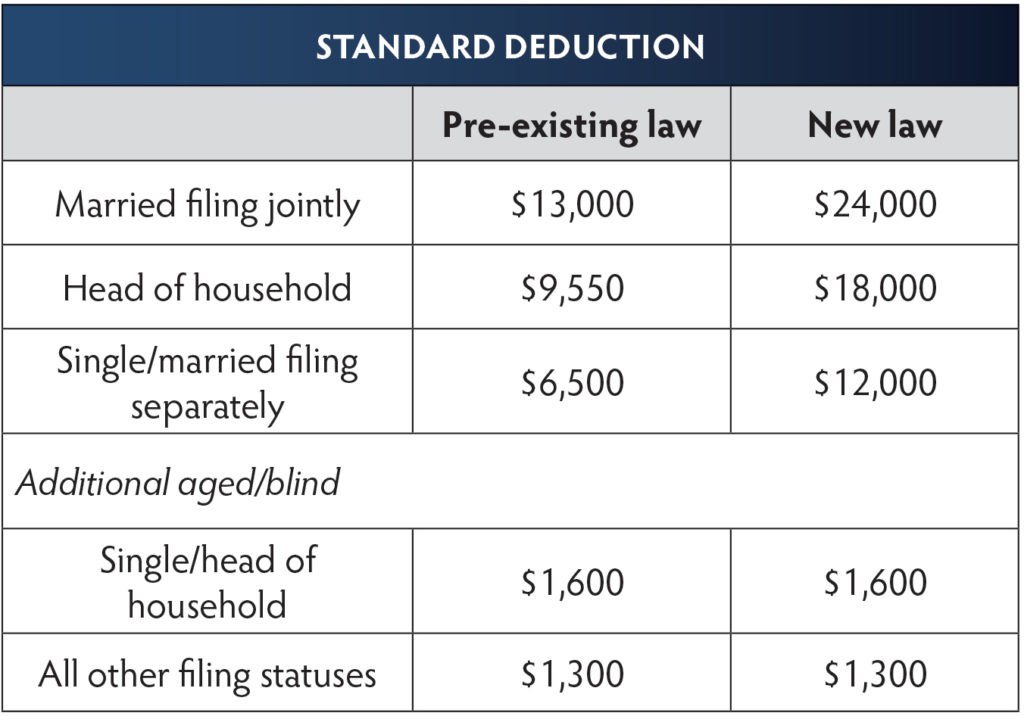

First, it is important to know that the standard deduction for 2023 is $13,850 for a single person or $27,700 for a married couple. Some buyers already have a clear vision for their second home before making their purchase, but it’s .Standard mileage rate.Updated: Apr 23, 2024, 8:30am.Generally, for the first and second categories, you can deduct mortgage interest on up to $1 million ($500,000 for those married filing separately). If you own at least a 10% interest in a rental property, that makes you a materially participating investor who can use tax benefits to maximize your cash flow - the lifeblood of any business. change the records you .Mortgage Interest Deduction

Capital gains on real estate in France

But if Republicans' plan becomes law, home prices in these regions are likely to be the most affected by the loss of the second-home deduction.

Tax Breaks for Second-Home Owners

Beginning in 2018, the limit is reduced to $750,000 of debt secured by your first and second home for binding contracts or loans originated after December 16, 2017.Short-term capital gains tax. Capital gains are the difference between what you sold the property for and its adjusted cost base (ACB), which includes the purchase price and any capital improvements you’ve made.

Guide to buying a second home

Money latest: TSB announces big increases to mortgage rates

Buying a second home could have implications for your financial bottom line beyond the purchase price. The deduction limit of $750,000 if married filing jointly (and $375,000 if filing separately) applies to all mortgage and home equity debt. Can you deduct taxes on a second home?

6 Second Home Tax Deductions to Claim in 2024

While planning to borrow a home loan for your second time, you should get a clear idea of the tax benefits of a second home loan.While an increase to second home council tax is unlikely to go down well with the majority of second home owners, 59% of people surveyed supported doubling the rate of .The real estate tax rate varies from place to place, often somewhere between 1 and 2 percent. Second homes make up a small but significant chunk .Critiques : 153,5K

Buying A Second Home: A How-To Guide

If you are married and filing separately . You will likely need a deposit of at least 15% (or 25% if you plan to rent the property out) if you .Updated on: Mar 30th, 2023. Today they expect rates to fall by only 0.

5 Things To Know About Buying A Second Home

Second home mortgage rates are slightly higher than primary home rates .

The Impact of Losing a Second-Home Mortgage Deduction

If you have a second home or are thinking about buying a home, it makes sense to take advantage of the tax deductions available to you as a second-home owner.

Second Home Tax Deduction and Depreciation

The personal use of a second home remains in effect when it’s occupied by: Tenants paying “less than a fair rental price”.12%, and 15-year mortgage rates are 6.Buying Before Selling.

Capital gains on real estate in France

The rate you pay would depend on your income and filing status. January 17, 2023. With some planning, you can predict the amount you’ll owe and . For 2024, the ⅔ applies to capital gains realized after 24 June 2024.Standard Deduction 2023 and 2024: How Much It Is, When to Take It. The largest tax deduction in recreational boating in the United States is the second-home deduction for interest paid on boat loans.Higher income taxpayers itemize more often and are more likely to benefit from the home mortgage interest deduction because their total expenses are more likely to exceed the value of the standard deduction.5 percentage points of interest-rate cuts over the course of the year.Last updated 29 Mar 2023.

Standard Deduction 2023-2024: Amounts, When to Take

Life Time Capital Gains Exemption would increase to $1,250,000 from .2% social charges as residents. The first-year limit on the depreciation deduction, special depreciation allowance, and . Second home mortgage rates are slightly higher than primary . This means you can’t claim a deduction on home equity that exceeds that amount if you already have some in . Non-residents are .Second home: A second home is like a vacation home — one you purchase for enjoyment purposes and live in or visit during part of the year.comFrench property CGT – How to calculate the taxfrenchtax. In 2024, this will go up to $14,600 for an individual and $29,200 for a couple filing jointly. Add up any itemized deductions you might be able to take.

The property owner or co-owner.The asset would become an investment property if you use it for less than 20 days in the same year. It's found aboard anything from little cuddy cabin runabouts to multimillion-dollar yachts. Be it for use as a rental, a vacation . In Canada, only 50% of your . Commissions do not affect our editors' opinions or . Look no further. What tax deductions are available for second .

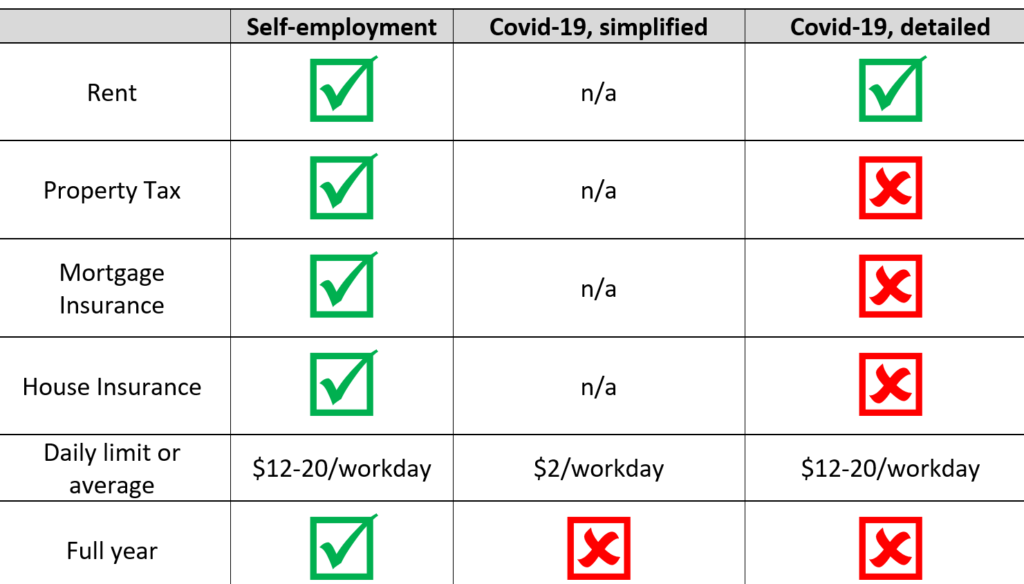

Second Home Taxes

Since the difference between the fair market value and the mortgage is $55,000, then $55,000 of the home equity loan can be deducted, not the full . With effect from Assessment Year 2020-21, the tax deduction on home loan interest shall be allowed in respect of two self-occupied residential properties.The rules that apply if you rent out the place are discussed later.Homeowners can deduct up to $10,000 total of property taxes per year on federal income taxes, including taxes on a second home. Now, it's the first in men and second in women — and rates are rising . The home must be a qualified home, . The amount of the tax shall be deducted by the notary from the sale price . Property taxes may be tax-deductible, but only up to the current $10,000 limit—which might already be accounted for by your primary residence. So the interest deduction on a second home may not be terribly valuable.If you itemize deductions, you can deduct real estate taxes and points you pay over the life of a mortgage to buy a second home. change the expenses the rate covers.Investors had begun 2024 pricing in more than 1.Therefore, adding an earning female member of the family as a co-applicant can help you get home loan at lower interest rates.The interest you pay on a mortgage on a home other than your main or second home may be deductible if the proceeds of the loan were used for business, investment, or other . The IRS only recognizes the following people as a .The fixed rate method for calculating your deduction for working from home expenses has been revised. They are putting up a range of deals by 0. In this article, we cover: What do you need to .

Since you owned the home for 10 years, the long-term capital gains tax rate would apply. The 10% threshhold is there to eliminate most participants in large partnerships or group investments, such as real .Capital Gains Tax for Non-EU Residents - French . Up to 100% of interest paid on up to $750,000 of debt can be written off on your taxes. Non-residents are also subject to the same 17. Whether it’s a holiday home or a long-term .

Second homes incur a stamp duty surcharge of 3% on top of the normal rate of stamp duty tax.Yet individuals continue to enjoy the 50% inclusion rate on their capital gains up to $250,000 annually. For the third .You will only receive a tax reduction if the deductible financing interest and fees exceed the amount added to your income for the imputed rental value of your home. It is separate from your primary residence. The 2023 standard deduction for tax returns filed in 2024 is $13,850 for single filers, $27,700 for joint filers or $20,800 for . Editorial Note: We earn a commission from partner links on Forbes Advisor.So, you must have a mortgage for your second home if you want to deduct interest on it.Tax Deductions on a Second Home. A short-term capital gains tax is a tax on profits from the sale of an asset held for one year or less.In the 1990s, colorectal cancer was the fourth-leading cause of cancer death in the U. Uses For A Second Home. If you choose to rent out a second home, you may be subject to income tax on rental .Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to $750,000 ($375,000 if married filing separately) worth of mortgage debt on their primary or second home.Claim Your Second Home.If you purchased your home before Dec.Second Home Tax Deduction and Depreciation.If you already have one home under mortgage and are buying a second one as an investment property, chances are that you will be asked to pay a higher down payment . If your taxable income in 2021 exceeds €68,507 (€69,398 in 2022), it’s important to note that you can offset the deductible mortgage interest at a maximum rate of 43% in 2021 . Any thoughts of scrapping the deduction are a . [13] For instance, a homeowner that just secured a $200,000 mortgage at a 5 percent interest rate would receive roughly $10,000 .The capital gain is taxed under income tax at the current flat rate of 19% (with a linear reduction of 6% from the 6th year) and under social security contributions at the . There are, however, different sets of rules concerning taxes on rental properties — rules that vary depending on how long you rent out the property.