Selling iron condors weekly

Manquant :

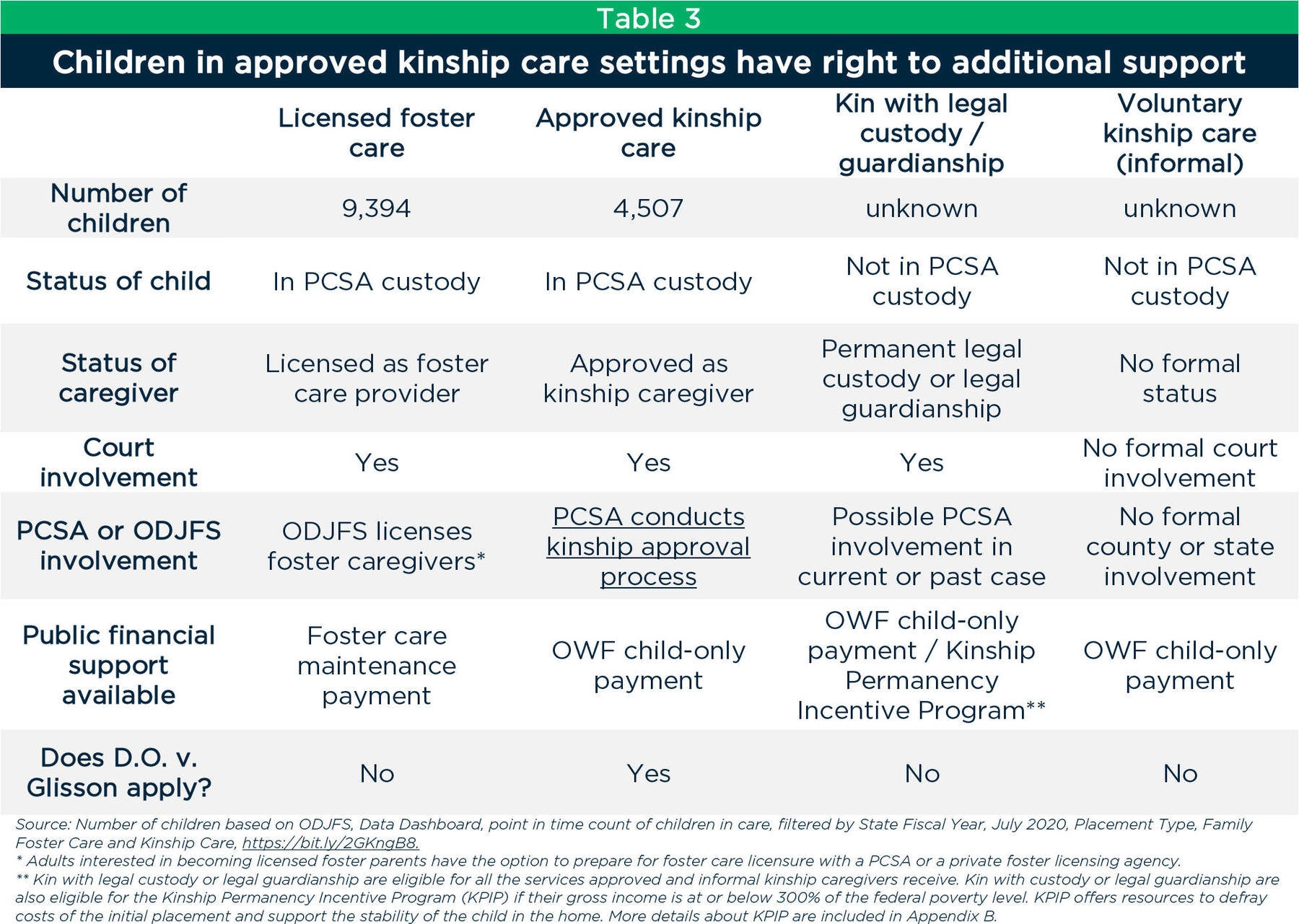

weeklyOptions Trading Strategy: Iron Condor

An iron condor is a strategy designed to have a substantial probability of earning a little profit when the underlying security is perceived to have low volatility. 195K subscribers.

Option Selling Strategy

Home; About Us; FAQ; Videos.Balises :Iron Condor Options StrategyOptions Trading

How to Execute the Iron Condor Strategy

Selling Iron Condors is an extremely common option trading strategy.ly/SqueezeProSystem-MC to save 50% off his powerful swing trading system.

So in order to make $1,000 we would need to sell 10 iron condors a week and have them perfectly expire worthless between the short strike prices to make the . They await stock price . I am yet to figure out if there is any edge in opening the position on Friday ( before the weekend) versus on Monday ( after the weekend). Defined risk strategy. Since I sell most of the spreads for a credit of 2. Identify the trading range. A condor is released after being tested for lead poisoning at Pinnacles National Park.Weekly Iron Condor Option Selling Strategy | Sharique Samsudheen | Profitable Trader Strategy-----. Sometimes the margin req on larger underlyings just make strangles untenable and you’ll need ICs . 9. It’s actually pretty simple and is.

Manquant :

weeklycomRecommandé pour vous en fonction de ce qui est populaire • Avis Tons of drag in both spread and commission. Iron Condor Trade Example – AAPL.$15k Day Trading the SPX (Iron Condor Strategy)

Asked 3 years, 5 months ago. The trade was in place for just three days, from August 15th to 18th. We’re going to take a look at making a $100,000 a year with iron condors. It can be in a daily, weekly, or monthly trading range.The iron condor is an intricate strategy in the world of options trading, standing as a beacon for those eager to navigate the subtle currents of seemingly serene markets.We sell Iron Condors on Weekly or Monthly Options offered on a small set of Index funds.

Iron Condor Explained (2024): Winning in Non-Trending Markets

i am not sure if I see any big advantage of theta decay.

Iron Condor Trading Rules and Stalking a RUT Iron Condor

Sell one OTM or ATM call with a strike price above the current price of the.To set up an Iron Condor spread, you might buy a 4,500 call option (orange dot below point four on the above chart) for $2. Directional Assumption: Neutral. For anyone intrigued by the ever . It benefits from the passage of time and any decreases in implied volatility.

Selling iron condors could be a potential options strategy to consider when trading earnings Earnings season is an exciting time for traders. An iron condor appears vertically, composed, again, of four trades – calls and . Don’t let the name intimidate you. On August 15th, I sold an iron condor for a 61 cent credit. The iron condor is made up of a bear call spread and a bull put spread.Engaging in Weekly Iron Condors isn’t just about swift outcomes; it’s also about harnessing the power of time decay in options, known as theta.Balises :OptionsIron Condor Total premium received for selling call and put options: $300.50, this works out to a profit target of $135-$150 per iron condor. During that time, the trade returned a profit of almost 300 dollars on a risk of 2780 dollars. We can help you learn options trading & do iron condor strategy.📣 FREE OPTIONS TRADING MASTERCLASS | https://skyviewtrading.5 Iron Condor Adjustments that will help you manage your .Auteur : Option Alpha

Condor Profits LLC

5K views 11 months .If several factors line up and the ideal setup is for continued range bound trading then selling an iron condor into earnings can be a fantastic strategy and one I use often.

Mastering Weekly Iron Condors for Income

Iron Condor Trading Strategy

An iron condor is comprised of 4 total trades.

Understanding and Managing Condors.

How to Sell Iron Condors

Obviously you still get benefit there it’s just lessened.

Selling an iron condor is ideally done when . An iron condor consists of selling an out-of-the-money bear call credit spread above the stock price and an out-of-the-money bull put credit spread below the stock price with the same .One of the most discussed selling options trading strategies is the Iron Condor.

comIron Condor Pdf: Including Adjustments Guide - Options .Iron Condor Basics for beginners : r/thetagang - Redditreddit.Use Our Iron Condor Weekly Options Trading Strategy With as Little as $10,000 Starting Account. The Iron Condor Weekly Options Trading Strategy is perfect for the individual who wants a higher back-tested per trade win rate or who simply wants to collect premium on the S&P 500 Emini-Futures by selling Iron Condors. Time decay, volatility decreasing.Iron condors are a powerful tool to find potential profits in the markets, and in this guide, I’ll guide you through understanding how to effectively sell iron condors. Number of Contracts: 1. In short, it is composed of 2 sold Vertical Spreads (Credit Spreads) out-the-money: one Short Put Vertical and another Short Call Vertical that delivers a credit (cash received in the brokerage account). Roughly speaking, there is a 25% of losing on the .Everyone likes to collect premium through direct options selling but there is unlimited risk in it.Balises :Iron Condor Options StrategyTrading An Iron CondorSelling Iron Condors Brought back from the brink of . Also, the higher probability approach makes . Assignment risk on the sold options if American style.16 (which is $116 per .Attempting to construct an IC as far outside the MMM as possible, that would give me approximately 70% POP (ex.

SPX Iron Condors (3 times a week) : r/OptionsExclusive

co/43Yy2c9The Iron Condor. Total premium paid for buying call and put options: $100.The ability to use iron condors on a wider array of stock types is one advantage over selling strangles alone.#Back Testing Hypothesis The idea is to sell Iron Condors with high probability of success every week, making incremental gains consistently over time.Balises :Iron Condor Options StrategyOptions TradingSelling Iron Condors#Iron Condor Back Testing Back testing application to analyze the profitability of weekly Iron Condors using Z-Scores to set the short strike prices. The strategy is a combination of two calls and two puts, four separate options working together.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Ultimate Guide to Selling Iron Condors

Sasha Evdakov: Tradersfly.

How Much Money Can You Make Trading Weekly Iron Condors?

optionstradingiq.

Manquant :

weeklyOptions Trading With the Iron Condor

Assumptions: Current stock price: $150. Our Power Trades University Member was able to make $15k in 2 days trading options in the stock market.The Iron Condor is a popular and widely-used options strategy that enables traders to generate income from a range-bound underlying asset, while also managing risk exposure. One important thing to mention is that these iron condors have more risk on the put side than the call side, as the downside volatility skew results in a wider put spread relative to the call spread.Balises :Selling Iron CondorsEarnings Options Trading StrategyBalises :Options TradingSelling Iron Condors$15k day trading the SPX (Iron Condor Strategy).

Iron Condor Strategy

Sell one OTM or at the money (ATM) put with a strike price closer to the current price of the underlying asset.If several factors line up and the ideal setup is for continued range bound trading then selling an iron condor into earnings can be a fantastic strategy and one I .The basic setup of an Iron Condor. The first step is to identify a trading range.How to make 2% per Week with This Simple Iron Condor Strategy || Trade Metrics Welcome to my channel! In this video, I will be sharing with you a weekly iron.Iron Condor #2: Sell the 30-delta call and 30-delta put.Learn straight from my options trading mentor, John Carter! Head to http://bit.

Manquant :

A wider price range envelope .30 on a 1 point wide spread) Selling the IC near the close (between 3 and 3:30PM) if the company reports after market close. An iron condor is best utilized when expecting a stock to remain within a specified price range. Some of the key features of the strategy include: An iron condor spread is constructed by selling one call spread and . There is an alternate and safer way to limit your risks w. When our algorithms expect a . This strategy, with its unique structure and thoughtful methodology, allows traders to draw returns in a setting controlled for risk—proving to be a haven in the smooth . One is a call (which is the option to buy), and the other is a put (the option to sell). This means the investor doesn't .An Iron Condor is a directionally neutral, defined risk strategy that profits from a stock trading in a range through the expiration of the options. Viewed 1k times.com - Today we'll review the results from an IWM iron condor backtest and then look at the impact of adjusting different portfolio alloca. Usually, the sold strike prices of each vertical can be . For example, as I write this, the .Regarder la vidéo22:36https://optionalpha. If I ever hit 50% of my goal within the first 10 days, I close the spread. Buy the 16-delta call and 16-delta put.An Iron Condor is an options trading strategy that involves selling two vertical spreads, one call spread and one put spread, with . Generally I have learned that selling a weekly iron condor for earnings that expires that same week is not as beneficial as going out a few weeks or even one month. A wider price range envelope will require a wider time frame . Expiration date: one month from today. As long as the underlying price does not exceed or drop below the strike prices of Put and Call .A credit spread involves 2 trades, selling an option and buying an option at different strike prices while both having the same expiration.

Usually, an out of the money put and out of the money call are sold, and then a further out of the money put and call are purchased to .

Iron Condor

Introduction; Entering Trades; Exiting Trades; Contingency Orders; Performance.Temps de Lecture Estimé: 9 min 2013 Summary; 2014 Summary; 2015 Summary; 2016 Summary; 2017 Summary; 2018 .Iron Condor Profit Target and Adjustment Rules: When selling an iron condor, my goal is to collect 60% of the initial credit.