Separate legal entity definition

LEGAL ENTITY

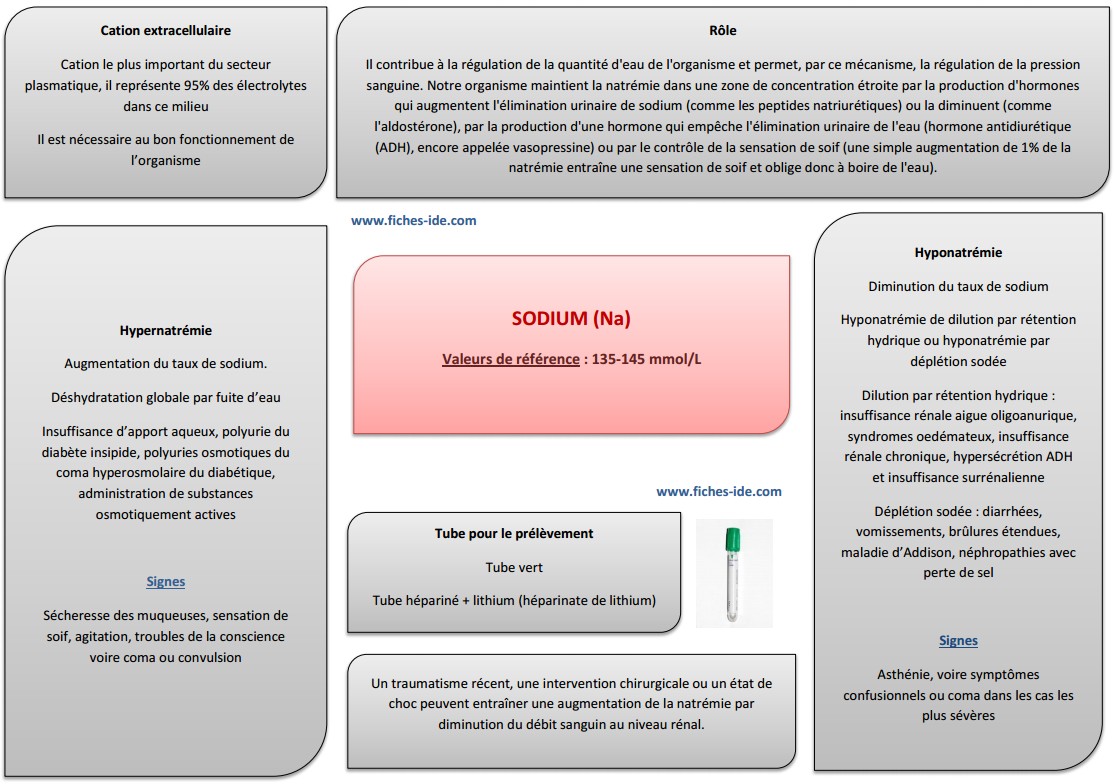

The parent company is typically a larger. It has shareholders, a board of directors, and officers. Limited Liability Companies . The reason for the term legal person is that some legal persons are not people: companies and corporations are persons legally . Under the business entity concept, it . Separate legal entity means any entity created by interlocal agreement the membership of which is limited to two or .; Hip hop is a major commercial entity now (= it is a business, not just a type of music). It is the ‘separateness’ of an entity which protects you – the entity’s owner – from unlimited personal liability.Legal Definition of Entity: Something that exists as its own separate unit.

How To Set Up Your Business as a Separate Entity

For the purposes of this definition, control means (i) the power, direct or indirect, to cause the direction or management of such entity, whether by contract or otherwise, or (ii) .

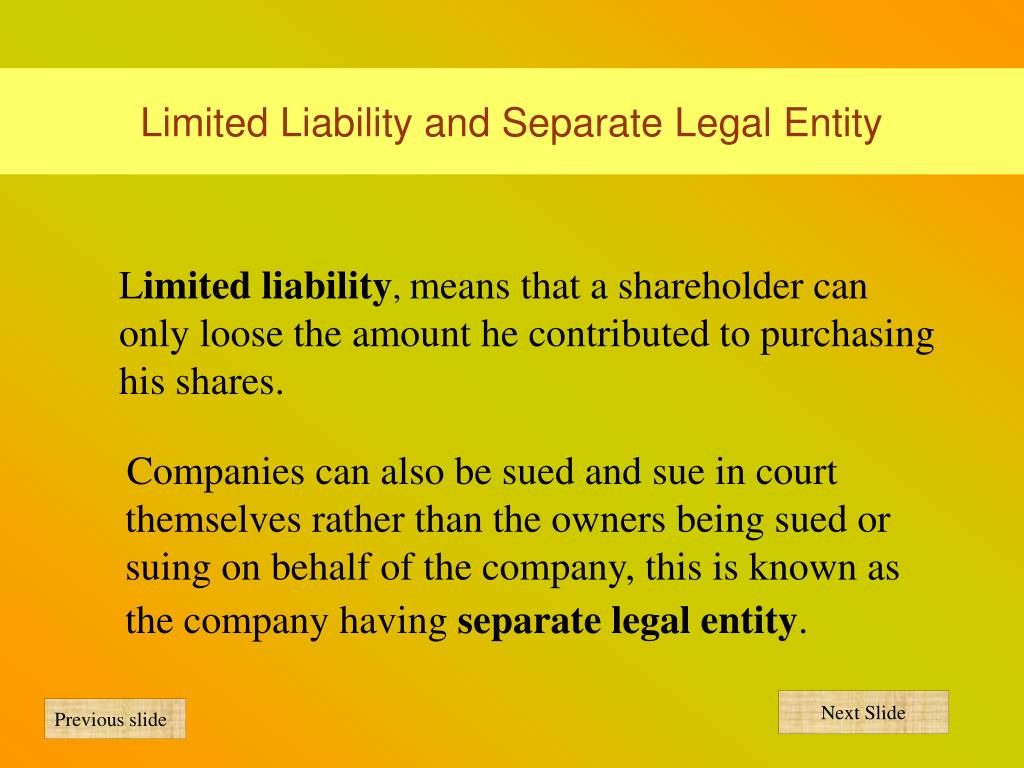

Its legal status gives a company the same rights as a natural person, which means that a company can incur debt, sue and be sued.

![The Delaware Statutory Trust (DST) Guide [2020]](https://www.1031gateway.com/site_media/media/images/1031GW-DST_02-03_separate-legal-entity_1500w..width-1200.png)

In some cases an individual may use the separate legal personality to conduct itself in an unauthorised way and avoid liability. The Separate Entity Principle is a fundamental principle of Company Law applied on a global basis.By Miss Anika Mardiah Chowdhury.

Shareholders’ liability is limited to their contributions, and the company is a separate legal entity. The concept is also known as the separate entity concept and the economic entity concept. When a person starts a company, they are expected to create unique bank accounts, tax identification numbers, and credit card accounts for the business.C 22, which stated that a company has a separate existence from its members. A company is an entity that has a separate legal existence from its owners.; These countries can no longer be viewed as a single entity. For example, in the United Arab Emirates, a branch may not enter into an agreement on its own.

LEGAL ENTITY Definition & Meaning

It can take many of the actions that an individual can take, such as: entering into contracts; providing services; suing others; and ; being sued itself.

What is separate legal entity?

comFrench Company Types – COMPARISON TABLE: all you .Business Contracts to FixFraudulent MisrepresentationStrict LiabilityJoint and Several Liability ClausesBreach of ContractVicarious Liability

Different Types of Legal Business Structures in France

; A corporation is a separate legal .

Definition, Pros & Cons

That is to say, it should be treated as a separate person, one that is distinct from its owner.A separate entity is a business that is separate legally and financially from its owner or owners.Essentially, the doctrine of separate legal personality assures that a company exists as a legal entity separate from its owners and shareholders. As a business owner, it is crucial to have a clear understanding of the legal definition of an entity. a company or organization that has legal rights and responsibilities, for example the right to make contracts and the responsibility to . Essentially, the doctrine of separate legal personality assures that a company exists as a legal entity separate from its owners and shareholders.A separate legal entity is a “legal person” i. It owns its assets and is responsible for its own . Ever since the Salomon case, legal doctrine regards each corporation as a separate legal entity.Definition of a company.A corporation is an independent, legal entity that separates your personal and business assets. TLD Example: As a . It requires at least two shareholders and can have up to 100.” Nowadays, the form of corporation has been .

COMPARISON OF BUSINESS ENTITIES IN SINGAPORE

First of all, it means that companies have certain rights and privileges that individuals do not have. Every company must have at least one member. That business entity often is owned by shareholders.Definition A business owned by one person An association of two or more persons carrying on business in common with a view to profit A partnership consisting of two or more persons, with at least one general partner and one limited partner A partnership where the individual partner’s own liability is generally limited A business form which is a legal .by Leigh Ellis Updated: 24 May 2020.Separate legal personality also enables a company to enjoy perpetual succession which means that notwithstanding any changes in membership, the company will retain its legal identity and continue to exist.something that exists separately from other things and has its own identity. One of the most fundamental legal attributes of a corporation is its status as a separate legal entity. There's more paperwork, and fees are higher.SEPARATE ENTITY definition | Meaning, pronunciation, translations and examples Shareholders’ liability is limited to their contributions, and . a person recognised by law. It’s critical to know that . The business entity concept states that a business is an entity in itself. This concept states that a business is considered to be a .Separate legal entity, also known as the corporate personality of a company, is a concept that states that the company is distinct from its members. Unlike a sole trader or a partnership structure, you’re not liable (in your capacity as a member) for the company’s debts.Accounting Entity: An accounting entity is a clearly defined economic unit that isolates the accounting of certain transactions from other subdivisions or accounting entities. Under the law, corporations possess many of the same rights and responsibilities as individuals. Fact checked by. A wholly-owned subsidiary, on the other hand, is a company that is owned by a single entity. In terms of day-to-day business, a separate entity runs separately from the owner, with a separate bank .

Separate legal personality and the corporate veil

“When coupled with the consequent attribute of limited liability, the Salomon principle provides an ideal vehicle for fraud.A company is a type of legal entity that is a separate legal entity from its owners, directors and management team. A separate legal entity may be set up in the case of a corporation or a limited liability company , to separate the actions of the entity from those of the individual or other company.Temps de Lecture Estimé: 1 min In Foss v Harbottle, the Court upheld the principle of separate legal personality and held that if the company is involved in legal . Salomon and Co. Legal Entity means the union of the acting entity and all other entities that control, are controlled by, or are under common control with that entity. Setting up a corporation is more complicated than setting up a sole proprietorship or partnership.Related to Separate legal entity. Flexible management structure. For example, companies can enter into contracts with other parties, buy or sell property, or sue or be sued in their own name - something that individuals cannot do.The SARL is a private limited liability company and one of the most popular business structures in France.A JV is a firm or partnership that is established and operated by two different companies. Katrina Munichiello.By definition, a separate entity is one that keeps its finances apart from the personal finances of those involved in the company. Definition: The principle of corporate personality arises and suggests that the company has its own separate legal entity.

An example of this occurring was: “Piercing the Corporate Veil”. Separate from persons who govern and/or own the company, the entity has its legal . Although an incorporated company attains a separate legal entity, it acts through certain individuals also known as the agents or authorised representatives of the company . International businesses can take advantage of this principle by engaging in cross-border transactions, establishing subsidiaries, and entering into contracts in foreign jurisdictions.In contrast, a subsidiary is a separate entity that is incorporated or formed by the parent company, may have its own business purposes separate from its parent's and has its .An entity is a separate legal being.Separate legal entity definition. Separate legal entity. This means the company has the same rights as a natural person and can incur debt, sue and be sued.

Separate Legal Entities (Advantages & Benefits) in Business

Business organizations have limited liability. The unit has become part of a larger department and no longer exists as a separate entity.Incorporation is the broad term to describe a business registered with a state to become a separate legal entity. What is a Separate Entity?

SEPARATE ENTITY definition and meaning

Legal Personality: The Cornerstone of a Company’s Identity. So, they don’t have to sell their assets just to pay off the company’s debts. However, in Brazil, that is not the case.SEPARATE LEGAL ENTITY: INTRO TO YOUR ESSAY.noun [ C ] LAW uk us.In law, a legal person is any person or 'thing' (less ambiguously, any legal entity) that can do the things a human person is usually able to do in law – such as enter into contracts, sue and be sued, own property, and so on.

A legal entity refers to any business, organization, or individual that’s required to meet legal obligations as set by local, state, and federal laws.The separate legal entity principle has several implications for businesses.Despite the stake in ownership, the subsidiary and parent companies remain separate legal entities for liability, tax, and regulatory reasons.

Business Entity Concept

Brazilian corporate law recognizes a separate legal

Sep legal entity notes

It allows protecting the owner’s wealth.Separate entity definition — AccountingTools.

Partnership: Definition, How It Works, Taxation, and Types

A limited liability company is the most common type .

Types and Examples

Updated January 14, 2024. Therefore, making the wrong move could mean losing the crucial time, money, and energy your company requires to reach its potential. Open Split View. In addition, the company’s debt is not their obligation as a person. One drawback is that profits can be taxed twice: .

Acts of the Company.

Corporation: What It Is and How To Form One

What is a Legal Entity?

Limited Liability Company Structure and

Add to word list.

What Is a Partnership? An entity can, among other things, own property, engage in business, enter into contracts, pay taxes, sue and be sued.Your chosen legal entity dictates your company's rights, responsibilities, and entitlements.

The Separate Legal Entity Principle

October 12, 2023. Reviewed by Margaret James. An entity is capable of operating legally, suing and making decisions .