Short strangle option

two break-even points.How to set up and trade the Short Strangle Option Strategy. These out-of-the-money options make a strangle cheaper than a straddle, but require a bigger move to make a profit.The Short Strangle is an options strategy similar to the Short Straddle, with one difference: the strikes of the sold options are different (you sell a Call with a higher strike and a Put with a lower strike) The strategy will generate a profit if the stock price stays between the two strikes by the expiry date. If the stock closes between $105 and $95, both options will expire worthless and result in the maximum . Der Short Strangle ist eine neutrale Optionsstrategie mit hohem Risiko und begrenztem Gewinnpotential.Tarifs

Short Strangle Guide [Setup, Entry, Adjustments, Exit]

Les transactions suivantes sont exécutées : Achat : option call 45 $ Achat : option put 35 $ Agrandir.

The Ultimate Guide To Trading The Strangle (Safely & Profitably)

In this situation, you retain the entire premium collected from selling the options as profit.The Short Strangle Options strategy is the exact opposite of the Long Strangle. L'investisseur en option . April 14, 2024.A short strangle pays off if the underlying does not move much, and is best suited for traders who believe there will be low volatility. This removes a significant .An options strangle aims to profit from a significant price movement in either direction of the underlying asset. The profit potential depends on whether the trader has a long or short strangle .

Strategie 1DTE (Gamma Positive) in un Portafoglio di Short Strangle

Short Strangle Options Strategy (Best Guide w/ Examples)

Stratégie d'options strangle : long et short

Beide Varianten werden im Folgenden kurz erläutert.A strangle is similar to a straddle, except that the put and call are at different strikes. So the risk of a Short Strangle is that it can have unlimited losses when the .Because the traders are short the strangle, they profit as the options decay, provided the market does not move too far beyond either strike. L’investisseur vend une option put et une option call avec la même date d’échéance mais à un prix d’exercice différent. Lire la suite ! Définition du straddle. A Short Strangle Options Strategy is employed when a trader writes an Out of Money Call option and an Out of Money Put .Short Strangle Option Strategy. इसके विपरीत, इस स्ट्रेटेजी में, निवेशक Call option और Put option दोनों बेचता है। यहाँ भी Call option फिर से थोड़ा आउट-ऑफ-द-मनी है, और Put option भी थोड़ा आउट-ऑफ-द-मनी है।

Long Strangle Option Strategy Guide & Example

Calculate potential profit, max loss, chance of profit, and more for strangle options and over 50 more strategies.Click here to Subscribe - https://www. Short Strangle Definition.A short strangle gives you the obligation to buy the stock at strike price A and the obligation to sell the stock at strike price B if the options are assigned.

Strangle Options Strategy: Key Principles, Risks, and Best Stocks

O problema aqui é que, . Strangle options strategies can be split into two different configurations, long strangle options and short strangle options. La vente d’un strangle consiste à vendre simultanément un call (option d’achat) et un put (option de vente) sur le même sous-jacent ayant des prix . Ou seja, o investidor deve empregá-la quando entender que não há uma tendência de alta volatilidade para o preço do ativo. You are predicting the stock . Ein Short Strangle verwendet man daher gerne, um Einnahmen in ruhigen Börsenzeiten zu .Long and Short Strangle Options Strategies.

Short Strangle Option Strategy

LoginShort StraddleLong StrangleShort CallShort PutShort Box 🔴 Live-Webinar am 29.

Options Strangle VS Straddle

And on the flip side, if your probability of profit is . It is profitable in sideway market. While both the long and short strangle involve buying and selling options, they differ in the trader’s . Just remember, there’s always a trade-off between risk and reward.The short strangle and the iron condor are both neutral option strategies that involve selling two options with different strike prices but the same expiration date on the same underlying asset.Questo è l’equity line ottenuta combinando la versione “Corso” del portafoglio Short Strangle con Difesa Meccanica (includendo tutte le strategie che hanno fatto parte di questo portafoglio, dal 2018 ad oggi) con il portafoglio delle 1DTE, che stavolta ho dovuto frazionare a 1/20 per arrivare ad in equilibrio corretto (questo significa lavorare con un . When to Use a Short Strangle. If the strangle is purchased for $5.Short Straddle.

These are the writers /sellers to Long Strangle.A short strangle is an options trading strategy which is profitable when there is low movement in the underlying asset.Short Strangle. Use the short strangle strategy when you think a stock will not change much in price . Le straddle en finance est une stratégie d'option bien connue qui consiste à acheter ou à vendre simultanément une option d'achat et une option de vente ayant la même date d'expiration et le même prix d'exercice.Ein Strangle ist eine Optionsstrategie, die aus einem Call und einem Put mit unterschiedlichen Strikes, aber gleicher Laufzeit und gleichem Basiswert besteht. 其构建方式为: Long Strangle = Long Call + Long Put,.On peut distinguer un long straddle et un short straddle.SHORT STRANGLE.Das größte Risiko beim Short Strangle ist, dass der Kurs des zugrundeliegenden Basiswerts über den Strike-Price der verkauften Call-Option steigen könnte. O objetivo, portanto, é que o valor de mercado não se desloque muito em relação ao inicial. Options trading can be a complex and daunting task for even the most experienced traders.

What is Short Strangle Option Strategy?

Hypergrowth Options Strategy Course: https://geni.

Short Strangle Option Strategy

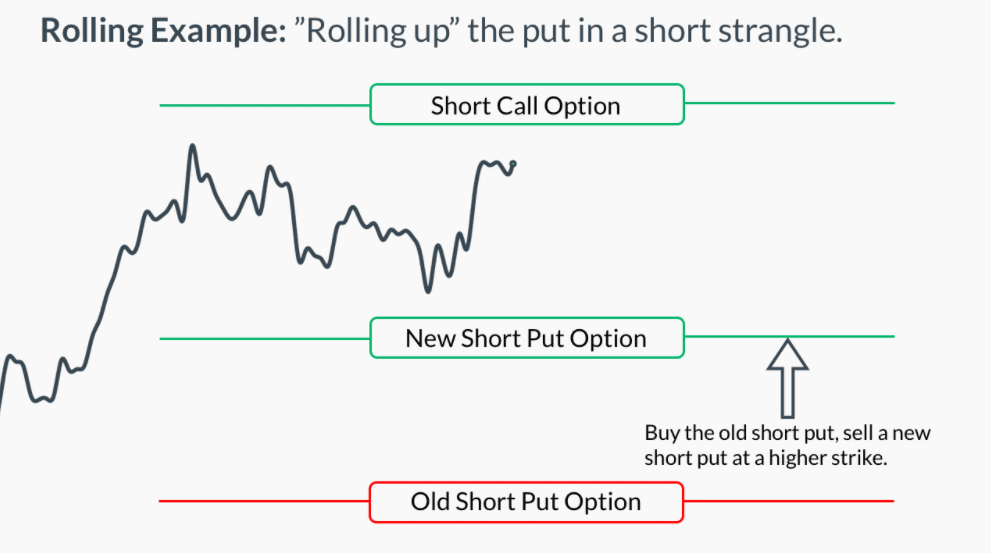

Short Strangle Calculator.The short strangle option strategy is suitable for situations where the market prediction is relatively neutral and only limited market action is possible. Search a symbol to visualize the potential profit and loss for a short strangle option strategy. For a short strangle, profit is maximized if the market is .Conversely, with a Short Strangle, you have a lower profit potential than with a Short Straddle, which has a higher profit potential. Explore the Short Strangle, a powerful option trading strategy to take advantage of market volatility.To profit from little or no price movement in the underlying stock.2024 um 18:30 Uhr. It consists of two single Options: Short Put. Compared to the Short Straddle, the Short .A short strangle looks to capitalize on time decay, minimal price movement in a stock, a drop in volatility, or a combination of all three.For example, if a stock is trading at $100, a long strangle could be entered by purchasing a $95 put and $105 call. However, mastering options strategies like the long and short strangle can lead to substantial profits. Types of Strangles. Je nach Marktmeinung kann ein Long oder Short Strangle eingesetzt werden. As previously discussed, the break-even points are 2313 and 2527.A strangle is a popular options strategy that involves holding both a call and a put on the same underlying asset. Try an Example ($SPY) What is a short strangle? . You sell a call option with a strike price of $55 and a put option with a strike price of $45, both with an end date one month away.

Strangle: How This Options Strategy Works, With Example

In this article, we’ll delve deep into the Long Strangle strategy, explaining how it works, the conditions under which it is most effective, and how you can execute it efficiently to maximi s e your profits.

Short Strangle (Sell Strangle) Option Strategy Explained

Dans un straddle court, l'investisseur vend simultanément le même nombre d'options d'achat (call option) et de vente (put option) avec la même date d'expiration, . The strength of any . Voici un exemple d’un long strangle.You think the stock price won’t change much in the next month, so you set up a short strangle. 在之前的文章中已经介绍过Straddle策略,与Straddle策略很类似的是 Strangle策略 ,中文简称为 宽跨式策略 。.期权策略 (六) - Strangle & Guts. A short strangle consists of one short call with a higher strike price and one short put with a . In diesem Fall müsste der Anleger den Basiswert zum höheren Marktpreis kaufen, um seine Verpflichtung gegenüber dem Optionsinhaber zu erfüllen.

Short Strangle Explained

And this strategy gets created by the counterparty of the Long Strangle contracts.us/options-course The short .

Strangle

Un “strangle long“ produit des bénéfices lorsqu‘il y a une hausse ou une baisse significative du cours.

zum Verfallstermin zwischen den Strikes der verkauften .The Short Strangle (or Sell Strangle) is a neutral strategy wherein a Slightly OTM Call and a Slightly OTM Put Options are sold simultaneously of same underlying asset and expiry . A short strangle is a neutral strategy, as it profits . Die Strategie baut darauf auf, von einem Rückgang der Volatilität, dem Zeitwertverfall und/oder einem ausbleiben von größeren Kursschwankungen im Basiswert zu partizipieren. If your probability of profit is higher, then typically your profit potential is lower.A short Strangle is made up of a short naked Put and a short naked Call, similar to a short Straddle. official says that means .A Short Strangle Options Strategy is employed when a trader writes an Out of Money Call option and an Out of Money Put option simultaneously. The interim period between large events or announcements that are certain to generate major price movements, for example, is an ideal time for the short strangle. The main difference is that the iron condor also involves buying two options with further out-of-the-money strike prices, creating a defined risk and . The break-even points are the same regardless if you are long or short the strangle. The strategy is employed for the .Short Strangle is a range bound Strategy that aims to make money wherein you don't expect any movement in stock or there is an expectation of fall in volatility. A strangle covers investors who think an asset will move . In the example illustrated above, the trader received $446 in premium for selling the out-the-money call and out-the . 42K views 7 years ago Options Trading Strategy Guides. If the underlying stock price stays between . However, because the options are out-of-the-money in a covered strangle, the impact of changing volatility is generally less for a covered strangle than for a covered straddle. L’exemple ci .Since a covered strangle has two short options, the position loses doubly when volatility rises and profits doubly when volatility falls.00, the stock would need to be above $110 or below $90 at expiration to make money. Best Nifty and Bank Nifty Levels For Monday; Best Bank Nifty Analysis for Tomorrow 14 Sept 2023; Best .

Short Strangle / Optionsstrategie erklärt【Fomo Finance】

Durch den Verkauf einer Call- und einer Put-Option wird eine Prämieneinnahme generiert und es wird darauf spekuliert, dass das Underlying während der Restlaufzeit der Option bzw. The time value portion of .A short strangle involves selling both a call and a put option with different strike prices, which means the trader has an obligation to buy or sell the underlying asset at the strike . The short strangle is a popular strategy among traders who believe that a stock or other underlying asset will . The Short Strangle (or Sell Strangle) is a neutral strategy wherein a Slightly OTM Call and a Slightly OTM Put Options are sold simultaneously of same underlying asset and expiry date.Der Short Strangle ist unter Optionsverkäufern (Stillhaltern) eine sehr beliebte Strategie.

Strangle Optionsstrategie

Short strangles involve selling naked options and are not recommended for beginners.

:max_bytes(150000):strip_icc()/Strangle2-1d15c8d645af4bc7a7a57be18b4fa331.png)

What Is A Short Strangle?

Since selling a .449K subscribers. A strangle is an options strategy that lets investors profit from predicting whether a stock’s price will .The short strangle is an options strategy that consists of selling an out-of-the-money call option and an out-of-the-money put option in the same expiration cycle.