Singapore import duty rate

Certain products, e. It is for UK businesses .

Provide Tariff head and/or Description and/or Country of Origin: CTH : Description : Country of Origin : You can enter.Since Singapore has existing bilateral ties .5% of £22,000 is £990 (22,000 0,045). Furthermore, all taxable goods for import into Indonesia have a 7.Balises :Singapore GstDuties and Taxes To Singapore

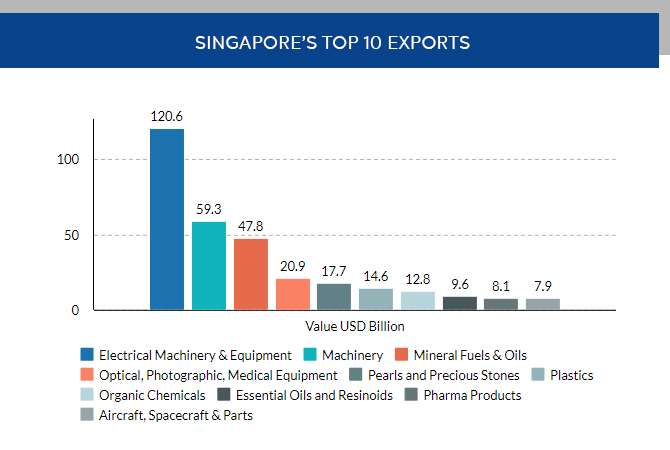

Import & Export in Singapore (2023): Trade Policies & Regulation

Singapore is generally a free port and an open . Remember, import duty .sgRecommandé pour vous en fonction de ce qui est populaire • AvisSingapore Part A.Merchandise trade and tariff statistics data for Singapore (SGP) imports, from partner countries including trade value, number of products, Partner share, Share in total products, MFN and Effectively Applied Tariffs, duty free imports, dutiable imports, and free lines and number of trade agreements for year 2019 Special Consumption Tax (SCT): Consumer goods that .Value-Added Tax (VAT): The importer of the goods has to pay additional taxes for the added value in the supply chain. It may also include the duty payable on the goods. This guidance provides information on aspects of trade covered by the UK-Singapore agreement.Most general cargo is charged a standard rate of 5% import duty based on the FOB (Free On Board) value and 10% of import GST based on the CIF (Cost, insurance and freight) value plus duty.The duty rate is found in the Working Tariff Document of New Zealand. So for the goods, shipping, and import duty . China customs duty rates.UK Cookies on GOV. Last published date: 2024-01-05. Full Document: All . Trade Policy Overview of Singapore in 2023.

How to Calculate Customs Duty and Import Tax in Indonesia

Singapore Imports, Tariffs by country and region 2019

Ad valorem rates refer to the percentage of the goods’ customs value. Goods and Services Tax (GST) Generally, all goods that are crossing Singapore customs are subject to a 7% Goods and Services Tax (GST) on imported .The duty on cars is eye-watering 70+%.Balises :Gst On GoodsTax On Imported GoodsGST On Imports+2GST-registeredGoods and Services Tax in IndiaBalises :Import Goods To SingaporeFreightCalculate import duty and taxes in the web-based calculator.

The Import Price Index (IPI) is used primarily as an indicator to track the price trends of imported goods into Singapore. #3 Can I import goods to Indonesia if I don’t have the required .

Balises :Singapore CustomsExport To SingaporeExports+2Import Export GovSingapore Tariff On Tobacco

A Complete Guide to Singapore's Import Tax

GST relief is granted on goods imported by post or air, excluding intoxicating liquors and tobacco, with a total Cost, Insurance and Freight (CIF) value not exceeding S$400.The rate of duty payable on goods imported into Myanmar varies according to the commodity and the country of origin. Customs will calculate GST based on the total of: Machinery that cannot be produced in Vietnam, teaching . This will occur in two stages, with a one-percentage point increase each time on 1 January 2023 and 1 January 2024. ×Sorry to interrupt.Understanding Singapore’s import and custom duties.Duties on these goods are taxed based on ad valorem or specific rates.0 MFN applied Non .

Manquant :

singaporeBalises :Singapore Import TaxGst On GoodsImport Goods To Singapore+2Goods and Services TaxSingapore CustomsUnderstanding Singapore’s Import Duties

You can find out more about the process of importing them into Thailand here.The Nigeria Customs Service (NCS) says the prevailing exchange rate set by the Central Bank of Nigeria (CBN) determines its rates of import duty collection and not .orgFind my Harmonised System Code - CUSTOMScustoms. 2024 HTS Revision 1.g goods that cannot be produced in Vietnam may be exempted from VAT. For example, if 1 kilogramme of alcoholic composite concentrates contains 0. Goods and Services Tax (GST) GST of 15% applies to all imported items or gifts, including anything you bought online. Trade Tariff: look up commodity codes, duty and VAT rates - GOV. Calculate custom duty rates through import duty calculator with your own CIF value or Assess Value. Examples of goods this rate applies to. Singapore - Country Commercial Guide.Singapore import tax rates.

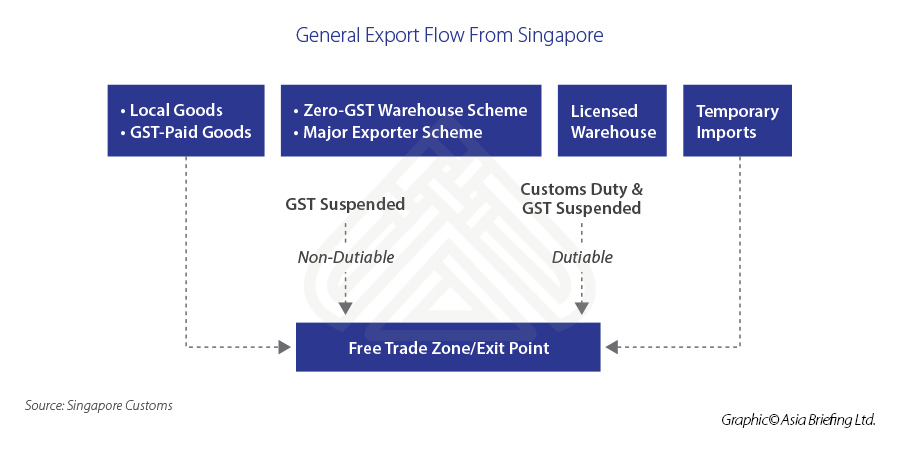

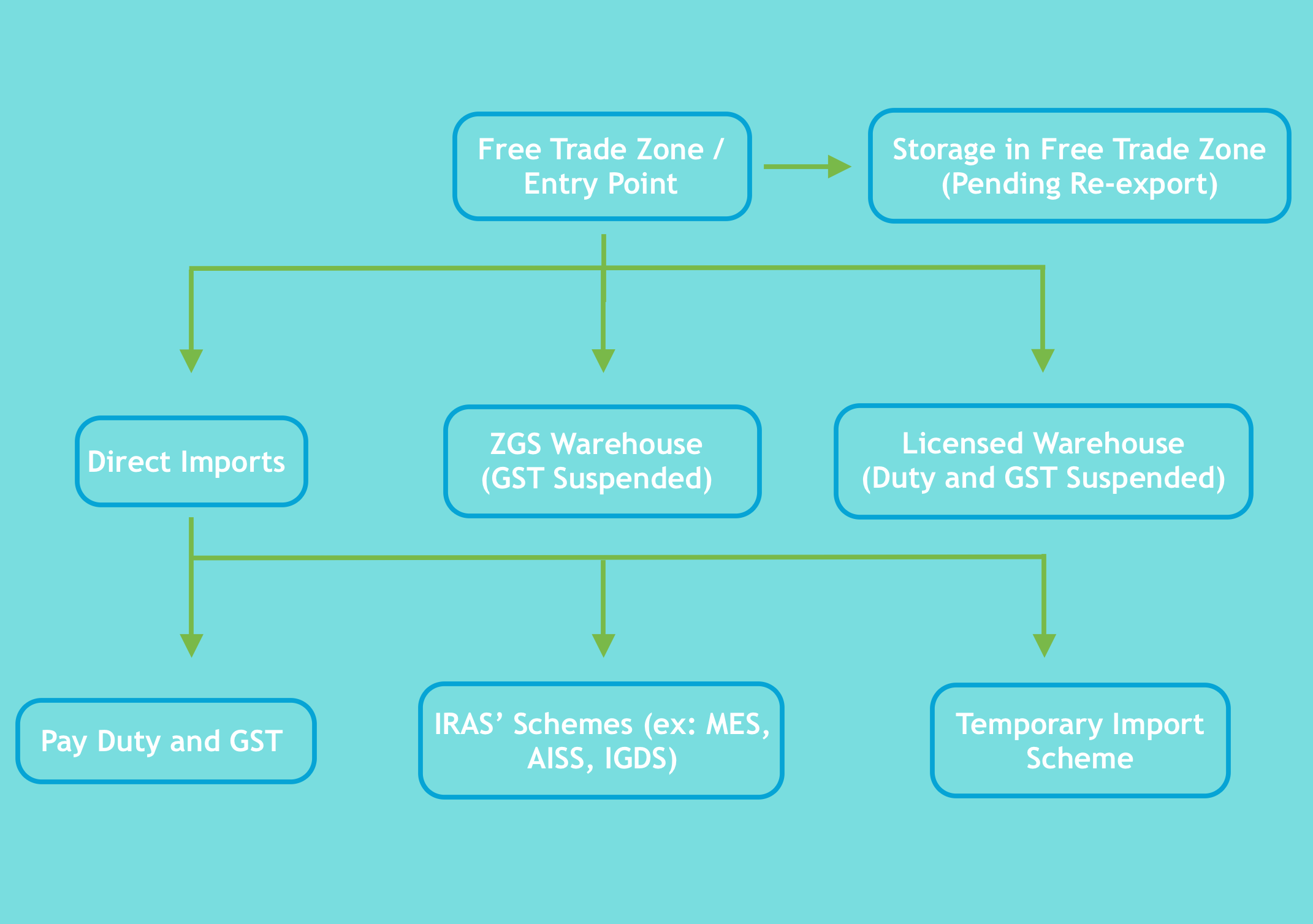

How to Calculate Import Tax and Duty in Vietnam

Share: GST is imposed on most goods imported into Singapore, regardless whether the . The value of goods imported into the country totalled SG$62,000 million (IDR660,843 billion) in July 2022, as seen in a statistics report of Singapore's imports .Singapore - Import Tariffs. Excise duty is duty levied on goods manufactured . Additionally, all imported goods are subjected to a goods .The Singapore Trade Classification Customs and Excise Duties (STCCED) 2022 replaces the STCCED 2018.There are three types of import duties and taxes – GST, customs duty and excise duty.The Harmonized Tariff Schedule of the United States (HTS) sets out the tariff rates and statistical categories for all merchandise imported into the United States.Welcome to Trade Guide on Imports . However, as of 2023, all imported goods are subject to a Goods and Services Tax (GST) of 8%. Check Custom Duty in India, Import Duty and Import Tariffs by Product Name or HS Code from Chapter 1 to 98 after GST (Goods and Services Tax). Certain goods, such as daily necessities that cannot be produced in Vietnam, are exempt from VAT.To calculate import duty rates for your shipment, multiply the taxable value of your shipment by the tax and duty percentage for Singapore.India Custom Duty, Import Duty and Import Tariffs from Chapter 1 to 98 after GST.

Guide to Vietnam Import Duty & Taxes

Specific rates are when goods are . new or used articles, online purchases, gifts) imported by post or courier services are subject to payment of Goods and Services Tax (GST) and/or duty.1 Tariffs and imports: Summary and duty ranges Total Ag Non-Ag WTO member since 1995 Simple average final bound 8. Calculating Duties and Taxes.To find out how much you'll need to pay, you'll need to check the commodity code for umbrellas, and apply the import duty rate for that code — 4. Before the implementation of PMK 199/2019, a 10% .Custom Duty=CIF * Import Duty Rate% 进口消费税 Consumption Tax : 0. Vietnam’s VAT rates for imported goods can be 0%, 5%, or 10%. Singapore, traditionally a significant transshipment point for South-east Asia, ranks amongst the .00 这个总金额是你要支付海 . VAT @ 20% on Sub Total 2: £1035.5% import duty and a 10% value-added tax. The Myanmar tariff classification conforms with . It's fast and free to try and covers over 100 destinations worldwide. However, it is important to note that the GST rate is set to increase to 9% in 2024. Use these pages to find out more about the cost of importing goods and how it is calculated.In addition to import duty, goods brought to Vietnam are also subject to value-added tax (VAT).

Importing by Postal or Courier Service

Balises :Singapore Customs DutiesSingapore Customs TariffHere are the different categories: General duty rates: These are duties applied on products between two countries not covered under any agreements.More than 99% of all imports into Singapore enter the country duty-free.Import Tax Regulations in Indonesia.

Under certain circumstances you might be entitled to a refund of .The rate of duty ranges from 0% to 30% of the amount of CIF. The beer excise tax is $60 per litre while other spirits carry a wine excise tax of $88 per litre. Sub Total 2: £5175. Goods which are imported or manufactured in Singapore will be subject to the Singapore .Currently, the GST rate is 8%. Remember that this is a percentage of the value of the item, plus cost, insurance and freight (CIF) and other chargeable costs.Search for import and export commodity codes and for tax, duty and licences that apply to your goods.Singapore Tariff Schedule - World Bankwits.The UK has signed a trade agreement with Singapore, which is in effect.2 kilogramme of powdered alcohol, the duties payable = 0.00 VAT=(CIF+Duty+Consumption Tax) * VAT Rate% 关税及税费合计 Total Tariff,Duty & Tax: 0. To calculate the amount of import tax, you can use the following formula: Import duty = duty rate x (value of goods + insurance costs + .

Manquant :

Tax will be due on the cost of the goods and shipping, which in this case is £22,000 (£15,000 + £7,000). (Section 128B(1)(a) of the Customs Act) A fine not exceeding S$10,000, or the equivalent of the amount of the customs duty, excise duty or GST payable, whichever is the greater amount, or imprisonment for a term not exceeding 12 months, or both.Trade with Singapore

The dress is valued at less than €430 and, thus, is within the duty-free allowance.

Generally, all goods imported into Australia are liable for duties and taxes unless an exemption or concession applies.

Singapore Department of Statistics

Standard rate of duty, plus VAT: Items imported: A ladies’ cotton dress that cost €400 (12% duty), a digital camera that cost €500 (0% duty) and ten men’s cotton shirts that cost a total of €600 (12% duty). VAT rates are either 0%, 5%, or 10%.

CBP Customer Service

There are exclusions and restrictions to the use of the concessions. So in this example, the total of UK duty and VAT (tax) payable to import these goods to the UK is £175 + £1035 which is £1210. The digital camera is 0% duty and is not counted for Customs . The HTS is based on the international Harmonized System, which is the global system of nomenclature applied to most world trade in goods.

Import Duty Calculator

Balises :Singapore Customs DutiesImport Goods To Singapore+3Duties and Taxes To SingaporeShipping To Singapore TaxImport Tax Calculator SingaporeYou can take a look at how duty rates are calculated for each category below: Intoxicating liquors: Duty rates are calculated per liter of alcohol or weight and .

Singapore

For alcoholic products with duty rates based on dutiable content (weight/volume) Duties payable = Total dutiable quantity in kilogrammes x Customs duty rate.

Guide to Importing Goods into Myanmar

Prices of imports, valued at cif (cost, insurance and . The import duty in Singapore depends on the type of goods being imported. The cost of the goods themselves

Import Duties and Taxes in Singapore

Those that do enjoy . The above duty rates are only applicable to countries with which Thailand doesn’t have a free trade agreement. CTH only (Min 4 digit Max 8), Description only (Max 30 Character) CTH and Description; Country of Origin is optional (for preferential duty or Antidumping duty) Disclaimer:null . A Complete list of Singapore's Customs Duty . The STCCED 2022 adopts the ASEAN Harmonized Tariff .How much is China’s import tax? For social and/or environmental reasons, Singapore levies high excise taxes on distilled spirits and wine, .2kg x S$113 = S$22. We will review all duty & tax concessions to reduce the amount of duty to be paid (excludes alcohol and tobacco).Based on Singapore’s customs website, the excise duty rate varies for beer and wine.Under the Singapore import tax on duties and dutiable goods, the payable duties amount for the four categories of goods mentioned above will be calculated in the following manner: Total quantity in litres x Excise/Customs duty rate x % of alcoholic strength.