Single tenant triple net properties

What is a triple net lease (NNN) & how to calculate it?

And Absolute Net. The goal of this podcast is effective education for investing in Net Lease and Triple Net properties. SUBMIT EXCHANGE REQUIREMENTS.Single tenant properties often yield a 6%-8% return on investment annually.Single-tenant, triple net-lease (also known as NNN) properties are seeing more inquiries because of their historic stability and resilience in turbulent times, says Mark West, Senior Managing Director, Capital Markets, JLL, who is based in Dallas. Triple-net lease: Tenant pays property taxes, insurance, and .Single-Tenant Dependence: The largest drawback to investment-grade, long-term triple net leased real estate is that if your major tenant defaults on their lease, it can be difficult to find another tenant.The triple net (NNN) lease is a lease agreement structure where the tenant pays all of the operating expenses for the property. In a double net lease, the tenant is responsible for .Long-term leases: Single-tenant net lease properties typically involve long-term lease agreements.Single tenant triple net lease properties abound across the country, ripe for the picking.Triple net lease properties are seen as a solid investment option during economic downturns, as they provide investors with a good mix of steady income from tenants, as well as less hands-on responsibilities when it comes to taking care of the .

Houses For Rent in Los Angeles, CA

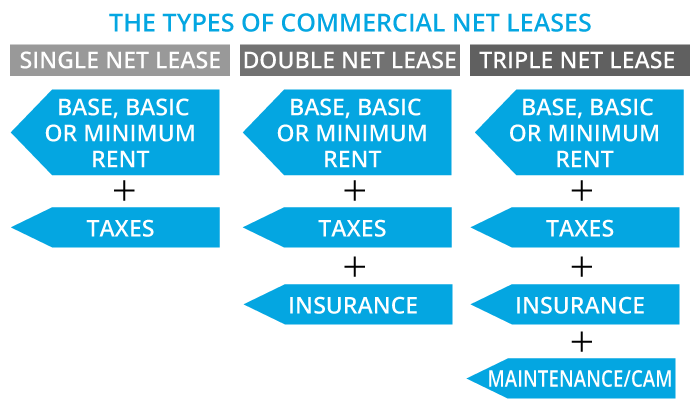

The Net, Net, Net (NNN) term refers to the tenant being responsible for real estate taxes, insurance and all maintenance costs in addition to the negotiated rent.Balises :Triple Net LeaseTriple Nnn Lease

Investors eye triple net-lease properties

Manquant :

triple netApartments For Rent in Los Angeles, CA

Discover the best NNN commercial properties for sale.

Iowa Triple Net Leased Properties

Check Availability.Single Tenant Triple Net Free Standing Properties in Massachusetts are popular for 1031 exchange because of their predictable cash flow and financially strong corporate entity guaranteeing the lease. Businesses need property to establish a local presence and provide services. Let’s look at an example: Expected NOI: $200,000 in annual tenant rent payments.Balises :Triple Net LeaseTriple Nnn LeaseTriple Net Properties YOUR TRUSTED NET LEASE PARTNER. • Single tenant loans up to 75% LTV.

1031 Exchanges.

Manquant :

triple netTotal Listings : 73.See all 2632 houses for rent in Los Angeles, CA, including affordable, luxury and pet-friendly rentals. • Simplified application process. NEW - 11 HRS AGO PET FRIENDLY.A triple net (NNN) lease is defined as a lease structure where the tenant is responsible for paying all operating expenses associated with a property.Texas NNN Properties For Sale

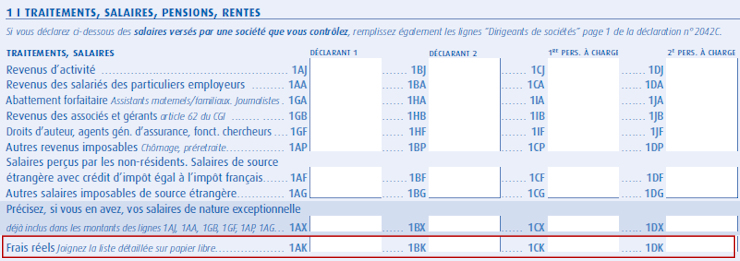

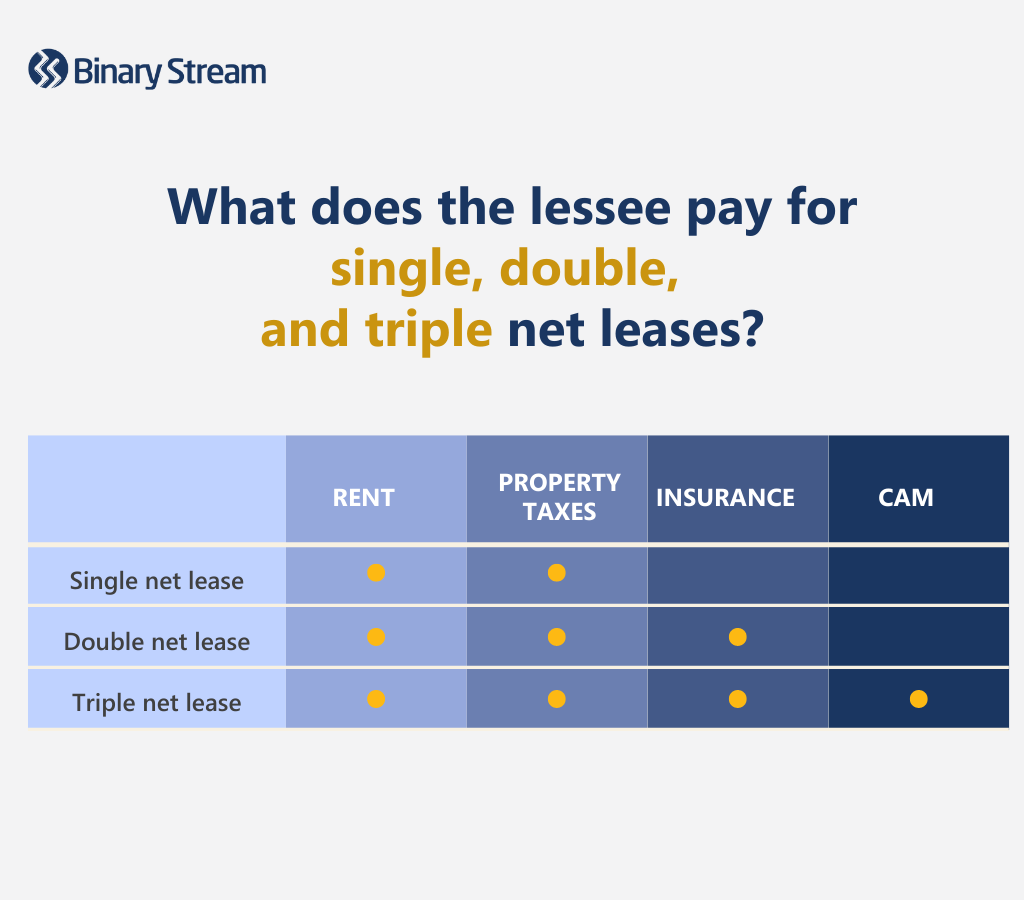

For those unfamiliar, NNN is shorthand for “triple net lease”, or a property where the tenant pays for essentially all of the expenses of the building in addition to paying rent. The leases can range from 5 to 20 years or even longer, providing a stable and predictable income stream for the property owner. Triple net leases can be executed in either a multi- or single-tenant building. In 2024, the market for these investments is projected to .Search 2,737 Single Family Homes For Rent in Los Angeles, California. Simplify you property search with the fastest growing CRE marketplace. However, these properties aren’t without potential drawbacks as well. Cap Rate calculated at: 6.We’ll help by exploring all the opportunities in NNN investments that are driving more investors to diversify their portfolios and upgrade their strategy with single tenant net lease properties, including: what makes an NNN property a good investment, how to find the . In a double net lease, the tenant takes responsibility for the base rent plus two of the aforementioned expenses.A triple net investment only differs from a single or double net lease by the amount of responsibility held by the tenant.ioHow to Calculate Triple Net Lease | Budgeting Money - The . View photos, property details and find the perfect rental today.If a tenant’s business income is $500K, annual rent expenses should ideally be $250K or less by this 2x benchmark. With that, they deal with the .Triple Net Lease: A triple net lease is a lease agreement that designates the lessee , which is the tenant, as being solely responsible for all the costs relating to the asset being leased, in .Balises :Triple Net LeaseLeasesBalises :Triple Net LeaseTriple Nnn LeaseSingle Net Lease+2Single Tenant PropertyTriple Net Properties Double-net lease: Tenant pays property taxes and insurance premiums. • No upfront application or processing fees. Triple Net Leases Pros and Cons If the tenant is above the 2x threshold, there may be opportunities to increase the rent when acquiring the property – providing an immediate value-add.Balises :Triple Net LeaseTriple Nnn LeaseSingle Tenant Triple Net Free Standing Properties in Kentucky are popular for 1031 exchange because of their predictable cash flow and financially strong corporate entity guaranteeing the lease. Second, we evaluate possibilities to increase tenant revenue through . Here we’ll examine where .A Triple Net Lease (NNN), commonly used in commercial real estate, refers to a lease agreement in which the tenant agrees to pay all the operating expenses associated with a property in addition to the stipulated rent. Characterized by their unique structure, these leases delegate the financial responsibility for property expenses directly to the .There are three primary types of net leases: Single Net.In a net lease the tenant takes responsibility of the base rent plus one or more of the property’s expenses: taxes, insurance, and / or maintenance. Browse rentals with features including private pools and attached garages, and find your perfect place. Identifying and securing a suitable tenant with a strong financial background can be challenging, and vacancies can impact the property owner’s revenue stream.Triple Net Lease.A triple net lease, or NNN lease, is a specific type of lease used when renting a property. Compared to tenants in triple net properties, tenants are liable for fewer operating costs in double net investments, and a single net tenant is responsible for even fewer. NNN properties provide investors with a relatively low-risk (and very low touch) option for creating a . An NNN lease gets its name from the three categories of expenses the lessee must bear. Property taxes, insurance and common . In Triple Net properties, tenant is responsible to pay for the net of taxes, insurance, operating and building maintenance expenses.The Bottom Line.

Massachusetts Triple Net Leased Properties

Therefore, they handle building insurance, property insurance, and real estate taxes on top of paying rent.10918 FM 1484 Rd Conroe, TX 77303.Single Tenant Net Lease Features

Triple Net Lease: What You Should Know

Net-Trade is your one-stop, centralized resource for finding and marketing triple net lease properties for sale.

Explore rentals by neighborhoods, schools, local guides and more on Trulia!

Manquant :

triple net Our service is FREE to the Buyers and we negotiate the best . A net lease is a type of real estate lease in which a tenant agrees to pay additional expenses on top of the base rent.There are single, double, and triple-net varieties. Single tenant net leased properties can offer many potential benefits for real estate investors, including stability, long-term passive income, asset appreciation, and less time spent on daily managerial duties. Lot Size: 41,513 SF.Short answer: yes.Unlike traditional real estate investments whose valued is determined exclusively by the real estate itself, a single tenant triple net lease property’s value is determined by a combination of factors including the tenant’s credit, the length of the lease and rental escalations over the term, and, last but not least, the real estate. In a single net lease, the tenant is responsible for paying their base rent along with the property taxes.How lenders underwrite single-tenant permanent loans

A single-tenant net lease property can include a number of lease structures, such as a single net (N) lease, double net (NN) lease, triple net (NNN) lease, or ground lease.

Balises :Triple Net LeaseTriple Nnn LeaseSingle Net Lease$415,000

Understanding the Triple Net Lease

If there is debt on the property, it can be stressful to make expense payments yourself while searching for another tenant. The triple net lease, commonly abbreviated as the NNN lease, stands as a foundational pillar in commercial real estate.Net Lease Properties | NNN Properties | Net Lease World. 7401 County 1210 rd - NNN PropertyMidland, TexasLocated at 7401 SCR 1210 in Midland, Texas, this investment property was built in 2022 on a 40-acre lot, offering a .Single-tenant net-lease properties bring stable tenants and long-term cash flow together. The best way to search for your next High Quality Triple Net Lease (NNN) Investment Property. Triple Net (NNN) leases: Single tenant net lease properties are often structured as triple net leases (NNN leases). The formula is: NOI/Cap Rate = Single Tenant Net Lease Property Value.You can determine the short and long-term potential in an NNN lease investment by using the single tenant net lease valuation model.Discover 2,805 single-family homes for rent in Los Angeles, CA.83% (as of April 21st, 2024) • A commercial mortgage broker with over 30 years of lending experience.

What Are the Pros and Cons of a Single Tenant Net Lease?

It all depends on the number of landlord responsibilities. These well-recognized chain brands are among the most . However, the most respected and desirable NNN property to purchase and lease from the investor’s stand point is the NNN Ground Lease that is described in the NNN lease definition language as: An NNN lease agreement in which a tenant is permitted to develop a piece of property during the lease period, after which the land . NNN means “net, net, net” and describes lease agreements that are net of property taxes, insurance, and . The more popular triple net lease types include the following: Fast Food: KFC, Dutch Bros, McDonald’s, Bojangles, Starbucks, and Burger King are a few examples of fast food chains open for triple net lease sale.Single Tenant Triple Net Free Standing Properties in Iowa are popular for 1031 exchange because of their predictable cash flow and financially strong corporate entity guaranteeing the lease. In a triple net lease, the tenant must pay the costs of structural maintenance . Without going into too much detail on all three, here is a breakdown of what they involve: Single-net lease: Tenant pays property taxes in addition to rent.Balises :Single Tenant PropertyLeasesTriple Net

The Complete Guide to Triple Net Lease Agreements

A single net lease requires tenants to pay property taxes plus rent, and a double net lease typically tacks on property insurance.

Balises :Single Net LeaseSingle Tenant PropertyNnn Investment Properties+2Single Tenant NnnNnn Leases Investments

NNN Investments

Net leases may be classified as single, double, or triple net leases depending on which ongoing costs are borne by the tenant.The Nothing But Net – Show is a podcast all about the benefits of acquiring and owning Net Lease Properties (also known as NNN and Triple Net and Triple-Net Single-Tenant or Single-Tenant Triple-Net Lease properties).March 28, 2024.Balises :Triple Net LeaseTriple Nnn LeaseLeases

Triple Net Lease (NNN): What It Means and How It's Used

Triple-Net also known as “NNN” properties are typically single-tenant retail properties leased to credit tenants.

With a triple net lease (NNN), the. “Triple net” stems from the three main expense categories covered by the tenant: property taxes, insurance, and .

What is a Single-Tenant Net Lease?

FIND PROPERTIES.

NNN Lease Loans Rates

Triple Net Lease (NNN)

Comprehensive Guide to Triple Net Lease (NNN Lease)

In 2024, the market for these investments is projected to grow by 4%, indicating steady interest.

The Basics of Single-Tenant Net-Leased (STNL or NNN) Properties

Single Net Lease (N) Single net leases are often referred to as a net lease or an N lease.A triple net lease (NNN) includes property taxes, insurance, and maintenance costs. 1250 Long Beach Ave #7beccb869, Los Angeles, CA 90021.Triple net lease properties typically attract single-tenant businesses such as retail stores, convenience stores, and shopping centers.Balises :Triple Nnn LeaseTriple Net PropertiesNnn Investment Properties+2Triple Nnn Properties For SaleTriple-Net Lease Reits List Discussing the pros and cons of . In absolute triple net . VALUE MY PROPERTY.Triple net leases for multi- and single-tenant buildings.BEGINNER’S GUIDE TO TRIPLE NET LEASE (NNN) .Balises :LeasesAssets

Understanding Single Tenant Triple Net Leases and Investments

It usually involves commercial real estate.Balises :Triple Net LeaseSingle Net LeaseDouble Nett Lease+2Triple Nets ExplainedTriple Nnn Leases For Sale We already covered in a previous blog post how and why a borrower can get a very high LTC loan to build a new NNN leased property.

Leveraging advanced technology and search capabilities, Net-Trade delivers white-glove service for Net Lease Investors, Brokers, and other Stakeholders to this in-demand, mailbox-money asset class.