Small business audit requirements

Requirements of an audit in South Africa.

Auditing small and medium businesses

Whatever the issue, we will be transparent about our concerns. For a group of companies to be considered a “small group”, it has to satisfy any of the 2 of the following criteria for each of the 2 consecutive financial years immediately .

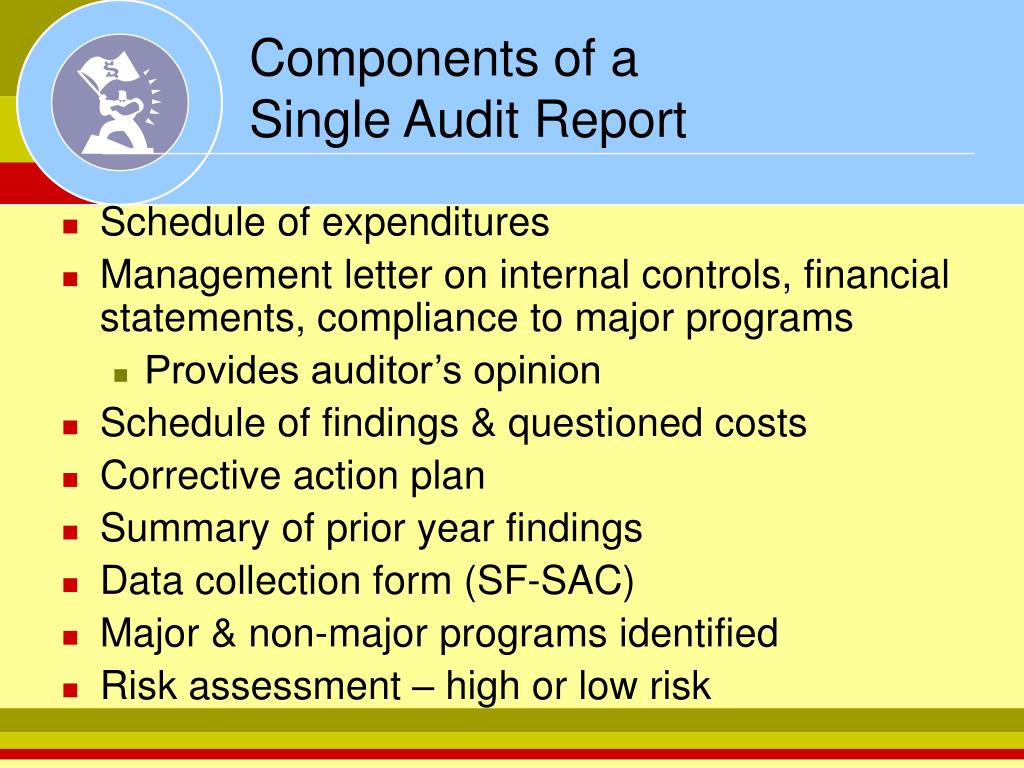

How to handle an audit on your tax returns. But it doesn’t need to be stressful and, if done correctly, it can be beneficial to . Here are 11 of the best audit report templates to get started with: 1. Audits conducted to ensure financial records accurately reflect a business's performance, adhering to accounting standards. assets worth no more than £5.

Are you a large or small proprietary company

An objective, independent assessment focusing on risk management and operational efficiency. If you have recently received a notice in the mail informing you of the IRS’ intention to audit your small business, please contact S.The Companies Act was amended in 2014 to update the audit exemption criteria for companies and introduced the concept of a “small company”.

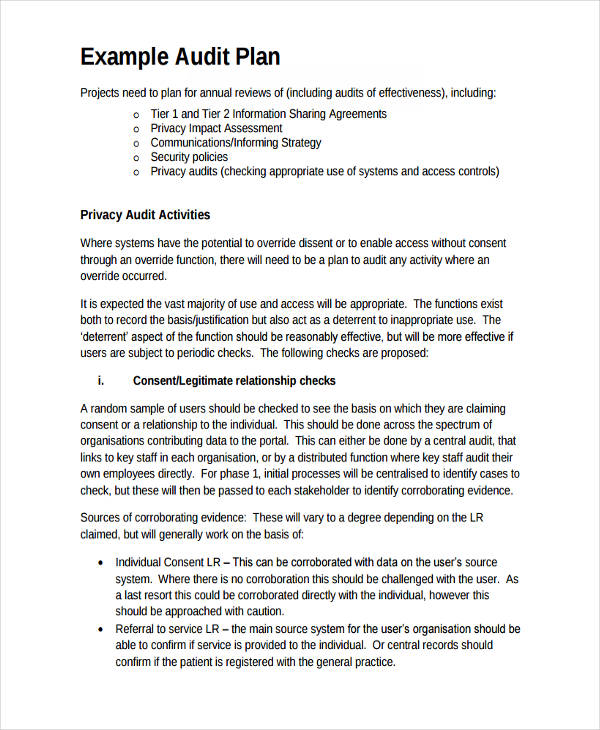

UK companies, including subsidiaries of overseas groups, must comply with UK audit requirements.Prior to bidding, your small business will need a D-U-N-S Number, a unique nine-digit ID number for the physical address of your business. These can include cloud service providers, SaaS providers, payment processors, . Visme has dozens of professional audit report templates in its library—all of which are designed to not only streamline your auditing process but also bring your financial analysis to life.After registering a private limited company, there are many compliances that the company has to follow under the Companies Act, 2013 (‘Act’).Mandatory audit requirement. A small business audit can make any owner nervous.Australian Audit Exemptions: Audit exemptions for small companies controlled by a foreign company, and important ASIC requirements in Australia.Understand SOC 2 compliance requirements, the audit process, typical costs, and find answers to frequently asked questions to help you decide if a SOC 2 .365)

Audit and review requirements for Australian entities

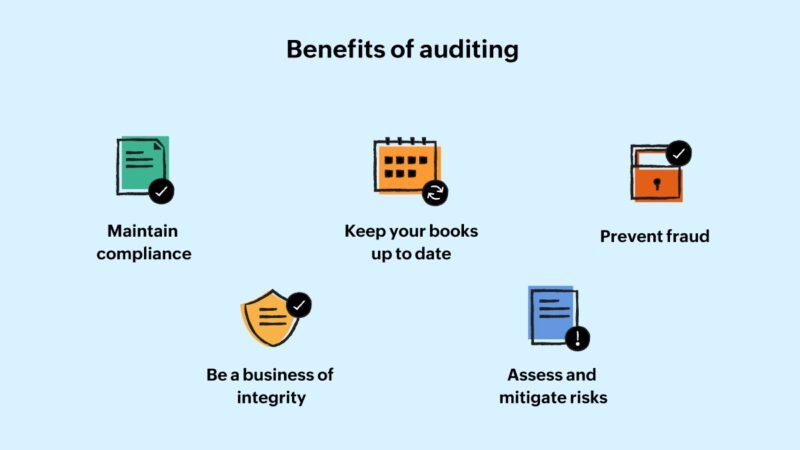

Whenever possible, the auditee must make positive efforts to utilize small businesses, minority-owned firms, and women's business enterprises, in procuring audit services as stated in § 200.H Block Tax Services by completing this brief form or by calling us at (410) 872-8376. In terms of the Companies Act in South Africa, a company must compile its financial statements on an annual basis, which must be done within 6 months after its financial year end.Private companies have fewer disclosure requirements when it comes to external audits in the USA than publicly listed firms, so their audit standards are less strict. 10 A co-operative is considered “small” if itmeets at least two of the following three criteria: revenue <$8m, gross assets <$4m or 20 prospective members during the year and raised >$2m from . We will deal with the auditor directly (in most .Small Business Compliance Audit Requirements: Your Complete Guide to Staying on the Right Side of the Law.SOC 2 audit is essential for small businesses that handle sensitive data and need to meet regulatory requirements. We seek your cooperation so we . For most small businesses, a financial audit is a distant concern.

By Lesley Slack.PCAOB auditing standards, as reorganized beginning Dec. If you’re a business owner, you might feel daunted at the thought of your first audit. Small- and medium-sized practices (SMPs) may require practical support when implementing the International Standards on . You need to determine if your .

How to Handle a Business Audit

Updated Practical Support and Guidance for Small Business Audits

To qualify for the small company audit exemption in Singapore, your company must be a private company within the current financial year and meet at least two of the following three audit requirements for the past two consecutive years. Small privately owned businesses, for example, don’t come under the scrutiny of the Securities and Exchange Commission(SEC), which is one of many agencies that set standards for . Types of Security Audits. Audit services availability (YES/NO) Yes. Navigating the labyrinth of legal requirements .February 1st 2022. Our audit program ranges from relatively quick examinations of source documents to more intensive analysis of complex arrangements and transactions. Table of Contents.71 of 2008 (“the Act”) requires audited financial statements.Jul 17, 2018 | New York, New York | English.360) Dormant company exemption (available to all sized companies) (s. 15% (for the first 245,000 EUR), 36,750 EUR + 25% for amounts of more than 245,000 EUR.The percentage of small businesses negatively impacted by the pandemic declined from 51. They may file an abbreviated balance sheet and, for small companies only, explanatory notes with the Chamber of Commerce. Notwithstanding the general requirements, a micro- or small-sized company may at its discretion prepare financial .

Small Business Audit Requirements

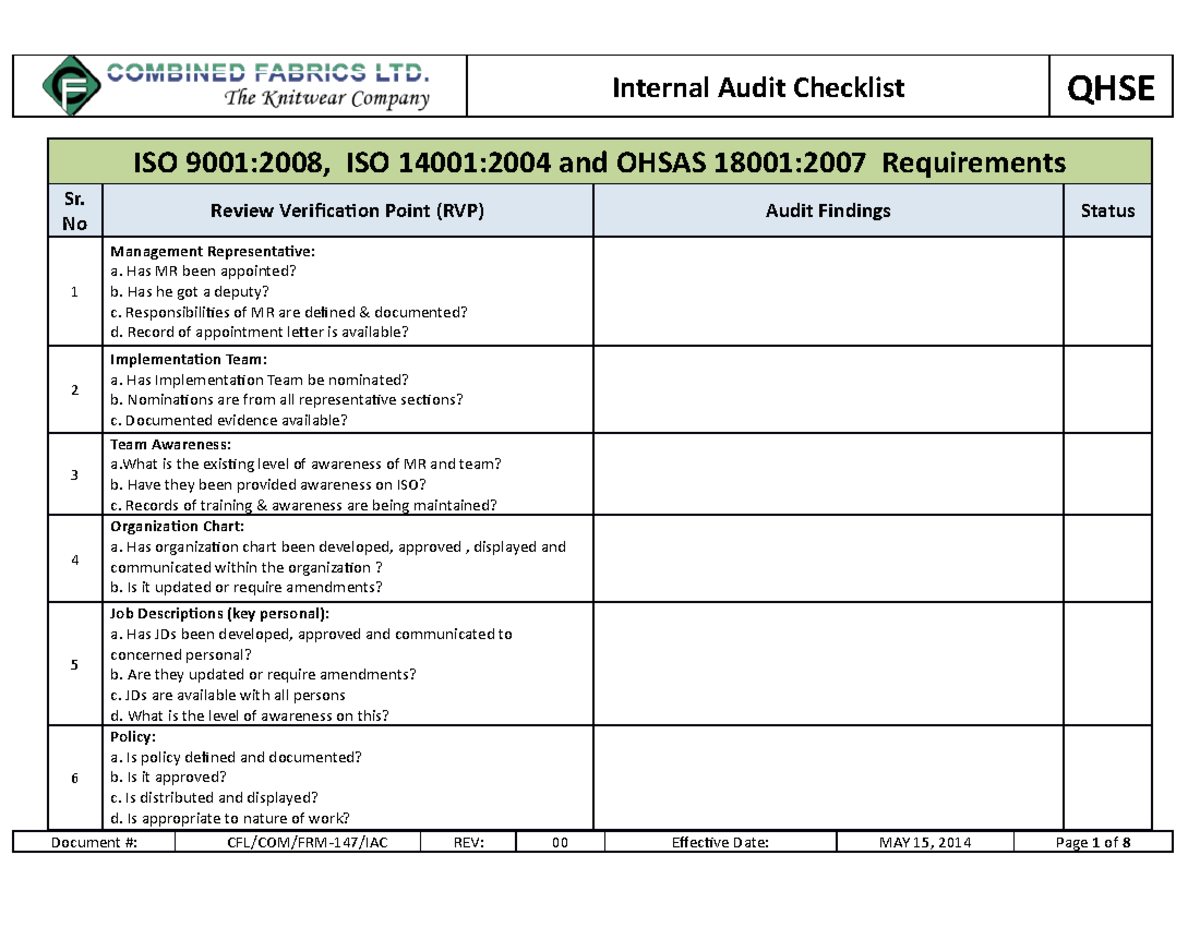

Small Entities Audit Manual (SEAM) Review the audit .

Taille du fichier : 1MB

What Is a Business Audit, and How Can You Prepare?

For instance, let’s say .Micro-sized and small companies do not have to include a directors’ report and have no audit requirement.

11 Professional Audit Report Templates for Business

When Does a Small Business Need Audited Financial Statements?

You’ll also need to be able to verify those records.HMRC is very aware of this amongst SMEs and so carries out a PAYE audit to gauge the level of payroll compliance.

Audit exemption for private limited companies

2014 IBBZ Accounting won the award of Best . But compliance isn’t just about avoiding fines; it’s about building a .

Guide to SOC 2 Audit for Small Business

Your business can use the same guides to gain insight on your small business audit requirements, by seeing what the .

The EU Requirement What size are smaller audit clients?

In addition, the Act prescribes certain requirements regarding the underlying accounting records of a company. 2017 Saurav was appointed as a committee member to New Zealand Public Practice Board of CPA Australia.Some of the key messages are: * The auditor of a small business is required to be as proficient in all relevant standards as the auditor of a large, publically .

A company audit means the inspection of its books of account to ensure that they are .

Legal Requirements To Start A Small Business In 2024

Audited Financial Statements are a complete set of all four financial statements (the Income Statement, Balance Sheet, Statement of Cash Flows, and Statement of .Small Business Compliance Audit Requirements: Your Complete Guide to Staying on the Right Side of the Law .2 percent in July 2021. State owned company. Navigating the labyrinth of legal requirements and industry standards is no picnic, especially when you’re the lean, mean machine that is a small business. 2015 Saurav won the award of Best Accountant of the Year. Public company.Your company may qualify for an audit exemption if it has at least 2 of the following: an annual turnover of no more than £10. Despite this significant progress, . We have seen several recent examples of directors not having a full understanding of what is required, leading to filing and compliance deadlines being missed.Auditing small and medium entities requires a different approach to working with large companies and organisations. Importance of SOC 2 audit for small business.

Audit Exemption

Audit requirements for foreign companies. The impact of this can be late filing fees, prosecution of the company and its directors, . Jump to: Why Regular Security Audits Are Important for Business.

Audits

A small company that satisfies certain conditions can claim three types of exemption: Exemption from filing full Financial Statements (“abridged Financial Statements”) (s.

Audit exemption eligibility

Taille du fichier : 395KB

SME Audits: Challenges and Insights

321, or the FAR (48 CFR part 42), as applicable. A SOC 2 report provides an audited assurance of a formal information security policy and tight security controls implemented by businesses to protect customer data from distortion or . How Often Should You . Your small business must meet some basic requirements before you can compete for government contracts. Corporate tax rate. Branches of foreign companies must file a copy of the parent company's financial statements in the Netherlands. It's free and required.The steps to preparing for an internal audit are 1) initial audit planning, 2) involve risk and process subject matter experts, 3) frameworks for internal audit processes, 4) initial document request list, . An Audit is required only if it meets the requirements test as per the Regulations of the Act.4 percent in April 2020 to 25. A company that qualifies as a small company is not required to appoint an auditor and have its accounts audited. Here are the most basic small business legal requirements you need to know.

Audit Requirements in the Netherlands

Audits are typically required for larger companies, but some small businesses may also be subject to audit requirements. (PDF) For periods not listed above, applicable auditing standards are available in the archive. The Amended Act was made effective starting from July 1, 2015.

How to Audit Your Small Business

The Act requires audited financial statements. One such mandatory requirement a company must follow is to conduct an audit irrespective of its turnover or nature. The company has a total annual revenue of less than or equal to S$10 million.

In instances where it discovers issues, HMRC will calculate the tax and NI lost from the last six years. Block Tax Services for Help with Your Small Business Audit.11 Audit Report Templates to Know.Published By: Chad Silver.We conduct audits where we consider a more in-depth examination of the issue is required.The IFAC SMP Committee has developed this checklist for use by accountants, especially practitioners who operate in small- and medium-sized accountancy practices (SMPs), to .How Can A Business Audit Benefit Your Company?

Small Business Good Practice Checklist

Audit Report Template.Finding industry size standards.