South windsor ct tax collector

Use the below link to access your receipts for tax payments for IRS and state income tax purposes. A reminder from the Collector's Office: Taxes are due July 1, 2020, the last day to pay without penalty is August 3, 2020. Windsor, CT 06074 Make appointment Get started from home.Town of South Windsor - Town Code: 132. Hours: Monday - Friday. **PLEASE NOTE: The Department of Motor Vehicles does not notify the Assessor's . 321 or email Tax Collector by clicking here. Hilinski-Shirley, C.

Town of South Windsor, Connecticut

Sullivan Avenue, South Windsor, CT 06074 | Tel (860) 644-2511 Ext 321 | taxcollector@SouthWindsor-CT.

SOUTH WINDSOR, TOWN OF

No reason was provided for the sudden closure.Declarations can always be emailed to: [email protected] Preparation Services in South Windsor, CT. You may come into the Town Hall Tax Office on the Main Floor at 275 Broad St. Name * First Last.

The last day to pay without penalty is Monday, August 2, 2021. Welcome Filing Requirement.5% per month, 18% per annum from the due date of the tax. Mailed to Collector of Revenue, 1540 Sullivan Ave.

Collector of Revenue

Jennifer R Hilinski Shirley - Collector of Revenue 860-644-2511 ext.

Tax Office(s)

1540 Sullivan Ave.

Use our free property search to easily access detailed property records. 1540 Sullivan Avenue.Collector of Revenue. Linda Russell - Deputy Collector of Revenue 860-644-2511 ext. Home Shopping Cart Checkout. $150,000 $200,000 $300,000 .To avoid long lines, you may pay your current taxes by mail to the Town of Windsor, Tax Office, PO Box 0090, Hartford, CT 06141-0090. Can I write one check for all my bills? Yes, please include your remittances and/or write your bill numbers on your .

Get Directions.

Town of South Windsor

Posted on: July 14, 2020 - 11:41am. If you have questions regarding your account please call 860-644-2511 ext. South Windsor, CT 06074., or use the drop box located at the back of the Town Hall on the median near the customer .The Town of South Windsor Assessor is responsible for appraising and assessing property taxes on real estate in Town of South Windsor, Hartford County, Connecticut. You may come into the Town Hall Tax .com is a platform that allows you to access and manage various online services offered by the town of South Windsor, Connecticut.Town of South Windsor (CT) | Pay Your Bill Online | doxo. Petruff, and Thomas S. It also provides information and assistance .South Windsor Property Records (Connecticut) Property Search by Address Lookup. The site shows the new assessments of taxable .86, you multiply $100,000 x . Posted on: June 23, 2020 - 9:57am. The 2019 Grand List bills were mailed Monday, June 22, 2020.Enter your location in the field below and we will find the best way to get there. April 20, 2024 Saturday, 04:49. General Number 860-644-2511 ext. Town of Windsor: Account info last updated on Apr 22, 2024 0 Bill(s) - $0.Find and pay your tax bills online for real estate, personal property, motor vehicle, sewer and water in South Windsor, CT. You will see the above page, make sure to click on the button below before . Search By see example.

Vision Government Solutions

Learn how to pay taxes, report issues, access GIS .Motor Vehicle Information.

Residential Sewer Use Bills

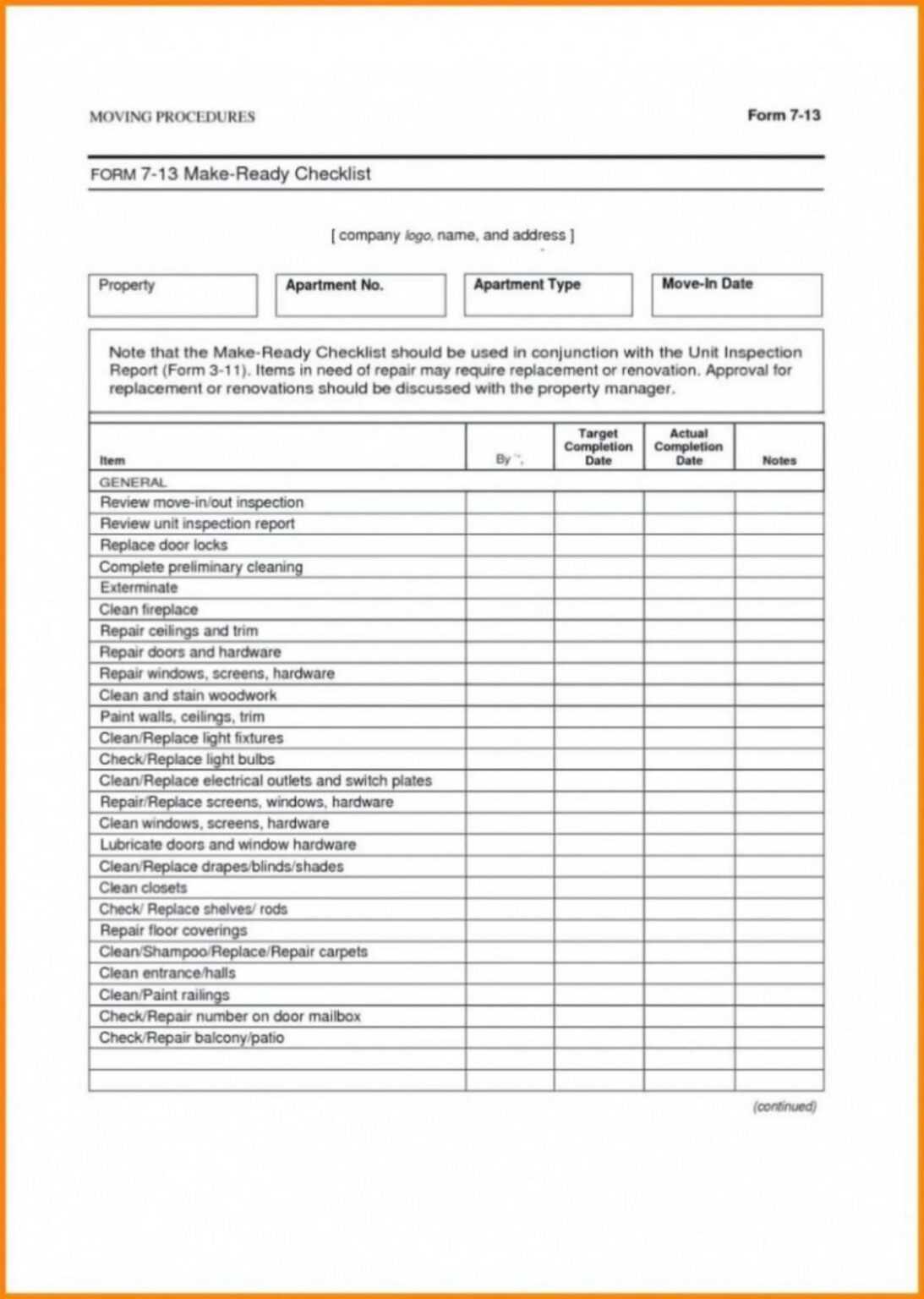

46Motor Vehicle 202138.14Real Estate & Personal PropertyRevaluation Year 32. Applications received after January 13, 2021 will not be accepted. Email: Email Us.Thursday, July 1, 2021.comOnline Services | southwindsorctsouthwindsor-ct. Windsor, CT 06074

Tax Sale

Applications are available by clicking here and may be submitted: Click here to email the Collector of Revenue.

Town of South Windsor, Connecticut Assessor's Office

Grillo was sold to Besheret LLC of 36 Robin Road, Apt.

2022 Current Mill Rate: Real Estate/ Personal Property: 33.

Collector of Revenue

Dropped in the Collector of Revenue’s secure drop box located outside of Town Hall. Revenue Collection Payment Options: When making payment, please bring or send all copies of the bill. Late payments are subject to interest at the rate of 1.The Town of South Windsor Tax Assessor's Office oversees the appraisal and assessment of properties as well as the billing and collection of property taxes for all taxable real . This declaration must be filed with the Assessor of the town where the .orgTown of Windsor - Tax Bills Search & Paymytaxbill.

Tax Preparation Office(s)

Drive Up Drop Box.TOWN HALL 860-644-2511 1540 Sullivan Ave, S Windsor, CT 06074

July Tax Bills

(37) 287 Oakland Rd.govRecommandé pour vous en fonction de ce qui est populaire • Avis

Online Services

Contact Info: (860) 644 2511 (Phone) (860) 648 6389 (Fax) The Town of South Windsor Tax Assessor's Office is .

Notice from the Collector of Revenue

1540 Sullivan Avenue, South Windsor, CT 06074 | Tel (860) 644-2511 Ext 321 | taxcollector@SouthWindsor-CT., between 8:00 and 5:00 Mon.

OpenGov

How is the tax amount determined? Enter your last name and first initial or .46 Mill Rate Cap on Motor Vehicles on May 9, 2022.TOWN HALL 860-644-2511 1540 Sullivan Ave, S Windsor, CT 06074

FAQ

South Windsor Property Records (Connecticut)

OpenGov - southwindsorct.Find online services for the town of South Windsor, including tax collector, assessor, town clerk, and other departments. Enter the search criteria below: Enter Last Name then space then 1 st Initial (example SMITH .Town Annex 860-337-6161 1530 Sullivan Ave S.

South Windsor Tax Office Closes Unexpectedly

The Tax Collector is responsible for collecting local business, property and real estate tax payments; also can provide information about property taxes owed and property taxes .TOWN HALL 860-644-2511 1540 Sullivan Ave, S Windsor, CT 06074 To encourage social distancing please make payment by US mail using the envelope provided or using the drive-up drop box outside .Revenue Bill Search & Pay - Town of Windsor. Fax: (860) 648-6390.199 Main Street owned by Marilyn A. Singh of 8 Mead Farm Road, Seymour CT 06483 for . Find your tax bill, choose a payment method .46Motor Vehicle 202037.orgRecommandé pour vous en fonction de ce qui est populaire • Avis

How To Make Payment

South Windsor current mill rate for the October 1, 2020 Grand List is 37. How To Make Payment.The Collector of Revenue would like to remind taxpayers that the second installment of real estate and personal property taxes along with supplemental motor vehicle taxes are due January 1, 2024. The Town of South Windsor Town Council adopted the 32.77Real Estate & Personal Property 32.viewpointcloud. Kucinskas, Carol A. Address: 1540 Sullivan .46 South Windsor's Mill Rate History Grand List YearMill Rate 202233. Online Payments.Town of South Windsor - Tax Bills Search & Paymytaxbill. Phone: (860) 285-1810.Vision Government Solutions is the contractor for the 2022 state mandated revaluation project of the Town of South Windsor.The Tax Collector's office collects real estate, personal property, and motor vehicle taxes for the Town of Windsor, CT. Forms and Documents for Personal Property Owners: If you are new to filing a Personal Property Declaration, or you have questions, please click on the Personal Property . Kucinskas was sold to Manjit K.Jeopardy Collection §12-163 If between the assessment date and the tax due date, any tax collector, after exercising due diligence, determines the collection of any tax will be jeopardized by delay, they shall subject to the provisions of this section enforce collection by using one or more of the methods provided in section 12-155, 12-161 and 12-162, or any .gov until midnight on the 15th, or USPS stamped postage of December 15, will be considered timely.Small Business Tax Preparation Services in South Windsor, CT.14 Motor Vehicle: 32.

Contact

Open today : 11:00am - .Linda Russell - Deputy Collector of Revenue 860-644-2511 ext.00: View Cart | Checkout. March 5, 2021 .03786 = $3,786. 60 Woodland Drive owned by James A. 305, West Hartford CT 06119 for $34,514. Open today : 11:00am - 7:00pm. Alexia Alberts - Revenue Clerk 860-644-2511 ext. If you are planning on paying off delinquent taxes of any kind, please contact the Collector’s office for an up to date payoff amount . 6553 An Act Protecting Property Owners Age Fifty and Older From Foreclosure . Bookkeeping services also offered nationwide. Assessed Value. Send us a message.SOUTH WINDSOR, CT — The South Windsor Tax Collector’s Office closed unexpectedly Wednesday and will re-open as soon as possible. Residential sewer use bills were mailed September 18 and due October 1, 2020. South Windsor , Connecticut 06074.46 mills for the 2021 Motor Vehicle Grand List. Raised Bill No. Taxpayers who applied by July 1, 2020 and have been approved for deferment in compliance with Executive Order 7S and 7W have an extended due date of October 1, 2020. Supplemental motor vehicle tax bills will be mailed Monday, December 18, 2023.Learn how to pay your Town of Windsor taxes online or by phone using your checking account, debit card, credit card or ACH.