Spanish mortgage affordability calculator

It takes into account factors such as the amount you want to .The mortgage affordability calculator below gives you a first overview of the mortgage you can get in Spain. Anything above 60 means you’re very likely to get the mortgage you want. Affordability Maximum loan New Refinance New Mortgage payments Currencies. Please fill in the fields below and contact our team to . Disclaimer: This calculator is provided as a guideline only.What is the interest rate in Spain?As of October 2019, the average mortgage has an interest rate of 2. Most Spanish lenders will not lend money if your combined outgoings (mortgages & loans) add up to more than 40% of your total net (after-tax) income.Spanish Mortgages for Non Residents in 2024 | . However, they provide a minimum loan of €1 million and a purchase price of €2 million. There are two important calculations that the lenders use to calculate the maximum that they will lend . How much can I borrow? How much will it . Taxes and insurance also add to your mortgage payment. Spanish Mortgage Calculator & Rates 2024. Find out how much you could borrow and what your monthly payments could be.When you apply for a mortgage, lenders calculate how much they'll lend based on both your income and your outgoings - so the more you're committed to spend each month, the less you can borrow.Spanish Mortgage Calculator.30-year fixed-rate mortgages.

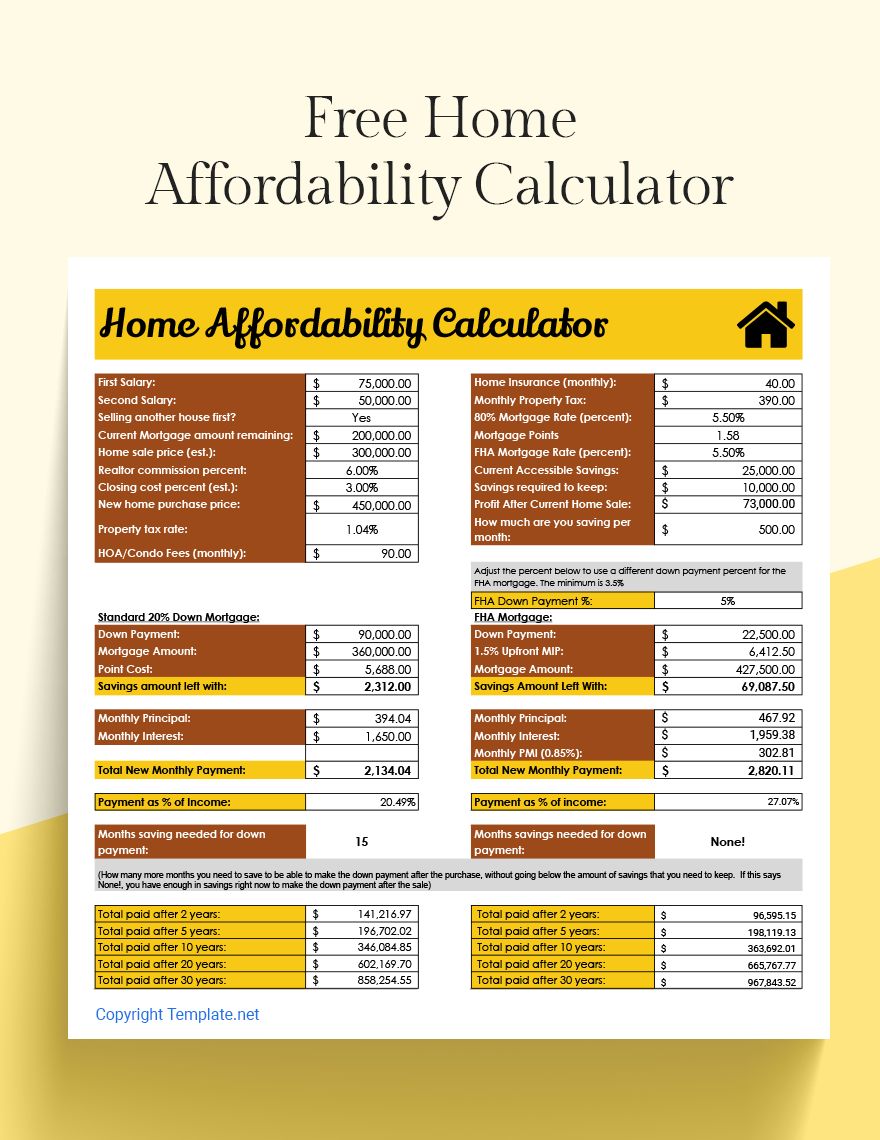

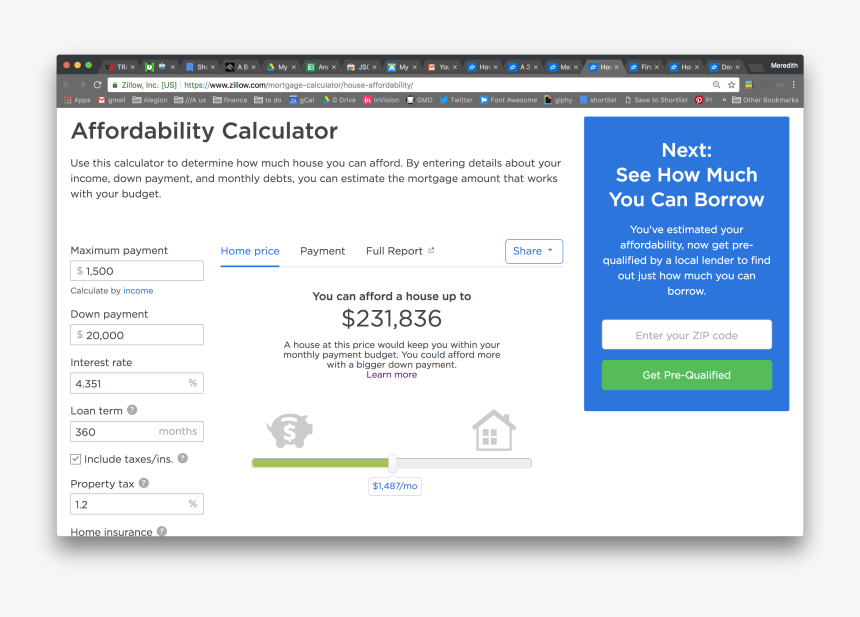

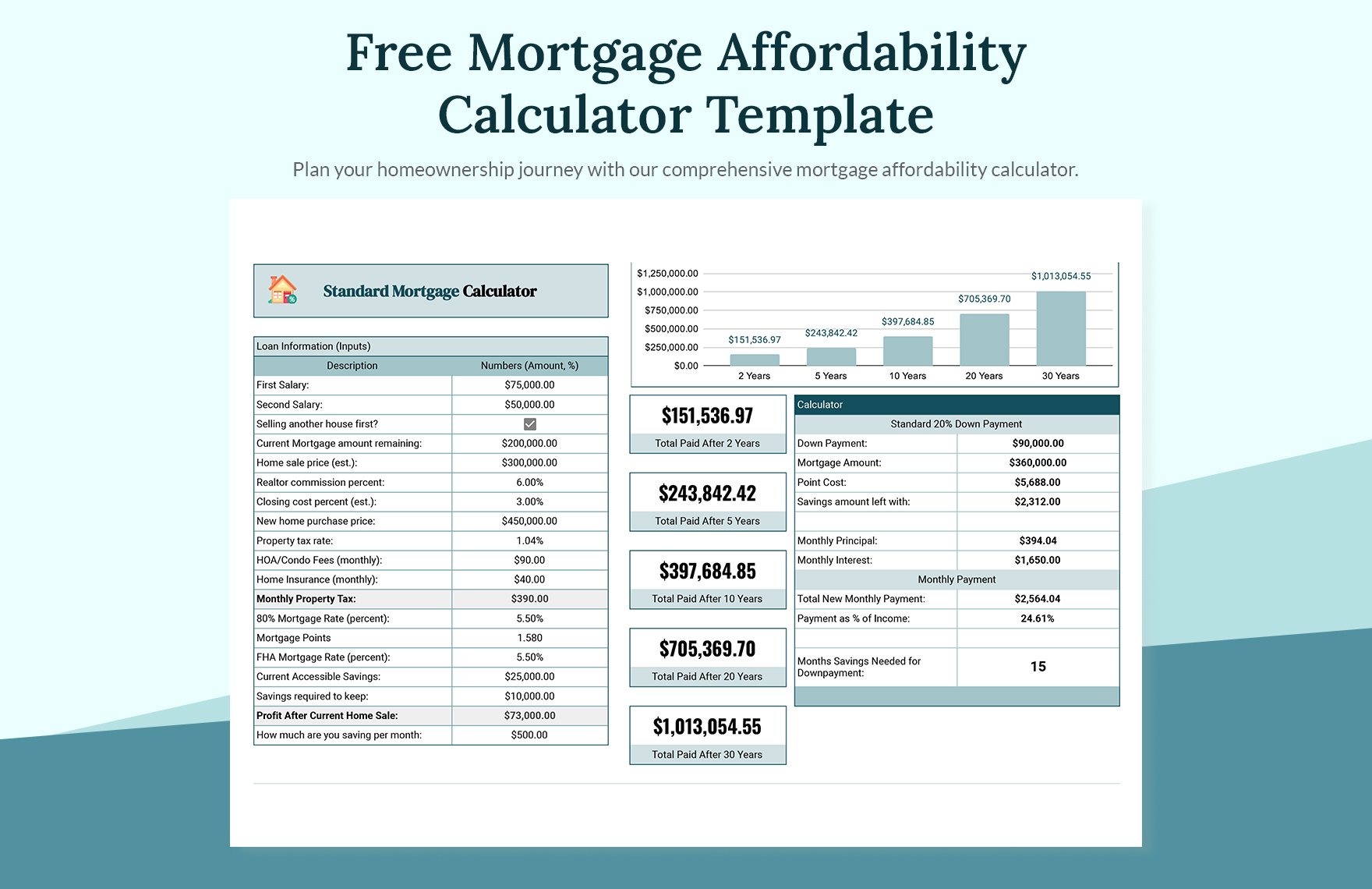

by Crown Financial May 31, 2017.When you use our mortgage affordability calculator, we’ll ask you about. The how much mortgage can I afford tool has options for downpayment, taxes and insurance, HOA fees, and PMI. Understanding these numbers helps give you a more realistic idea of what’s affordable.How to use our mortgage affordability calculator. $500,000 to $999,999.

comSpanish purchase property purchase cost calculator - Eye . The value of the property.97€ to be paid each month. PMI or private mortgage insurance that borrowers need to pay when the down payment is lower than 20% for conventional mortgages.The Foxes Mortgage Calculator Spain is easy to use – just adjust the sliders to set the mortgage amount, mortgage term (repayment period) and the interest . Visualize graphically how many interests will you pay monthly and in total. Mortgage Rate – It is the interest rate at which a lender will offer you the .Why not use our mortgage calculator to get an idea of how much we could lend to you? It should only take a few minutes.Use our free Spanish mortgage calculator. $1 million or more. Calculate your mortgage monthly fee.The mortgage amount you can get as a non-resident in Spain is usually between 60% -70% of the purchase price, excluding costs, which in average are 12% depending on the location and type of property. Best of all, our Crown Calculators are always free .

20% of the purchase price.Spanish mortgage calculators. The chart below will list the best option for your transaction. Read more about what lenders look at in the How .Use Forbes Advisors free California mortgage calculator to determine your monthly mortgage payments; including multiple insurance, tax & HOA fees.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Spanish Mortgage Calculator

Use our calculator. (A basis point .In the representative examples, to calculate the non-discounted fixed mortgage instalment, we would replace N with 150,000 (initial mortgage principal), i with 0. For scenarios with monthly household incomes of 5,417 and 8,333, .Mortgage calculators. Although, we have to say that since the new law got into effect in August 2019, there is a new 'cooling-off' period of 10 days, so t. – 15 year repayment product 650 per month. The number of people applying, and the deposit they can provide. – 20 year repayment product 500 per month.

Spanish Mortgages

Use the IMS Spanish mortgage calculator.Your Passport / ID for all the applicants2.

Mortgages

Work out your deposit, see if you could borrow more or make savings with an overpayment.

Advanced Spanish Mortgage Calculator

For mortgages applied for before this date the Halifax Standard Variable Rate (SVR) will be the rate that applies. View best buy rates.Mortgage in Spain calculator. You should only use this calculator if you have a good credit history and you’re planning to buy or remortgage a home in England or Wales that you will live in. Affordability Calculator. For example, closing costs can be 2 – 5% of a home’s price. Halifax Homeowner Variable Rate will apply to all mortgages applied for after 4th January 2011. If you are over age 60 and in .To qualify for a mortgage in Canada, you need to put forward a down payment that is at least 5% of the price of the home, or a minimum of 20% if your home will cost over $1 million. Mortgages for retirees . generally lend between 3 to 4. 5% of the first $500,000 of the purchase price. Enter your personal and property data and calculate your mortgage payment.

Mortgage Affordability Calculator Canada

As a general rule, most banks will lend on the following criteria: Over €100,000 loan maximum LTV 70%; Under €100,000 loan maximum LTV 60%, minimum loan €35,000* *For very small loans, the maximum LTV may be 50%. What are the documents requested?1.Mortgage lenders in the U. Choose the currency of your income. Explore the essential role of mortgage affordability calculators in Spain's property market.

Moving2Madrid

10% for the portion of the purchase price above $500,000. For instance, if your annual income is £50,000, that means a lender may grant you around £150,000 to £225,000 for a . Employment status and income details. Our mortgage affordability calculator will give you an estimated quote based on the amount you want to borrow and the property value (if known) or the amount of deposit you have, and the term over which you want to borrow. Choose your mortgage and .

You usually input the loan amount, interest rate, and .Mortgage Affordability Calculator to calculate how much mortgage you can afford. Annual Income – Enter your gross annual income, which is the amount of money you earn before taxes and other deductions.Total Monthly Payment.

The mortgage amount you can get as a non-resident in Spain is usually between 60% -70% of the purchase price, excluding costs, which in .comRecommandé pour vous en fonction de ce qui est populaire • Avis

HolaBank

These home affordability calculator results are based on your debt-to-income ratio (DTI).3% of the purchase price depending on the type of building, municipality and province – guidelines will vary from lender to lender. The type of mortgage you want, and for how long.

How to use our Spanish mortgage calculator

51% last month). Mortgage repayment .A Spanish mortgage calculator is a tool that can help you estimate the cost of your mortgage in Spain. Work out your monthly loan payments. Get in touch here. The lowest rate ever is the current rate 2.

Mortgage rates in Spain

Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved for a down payment, and what your monthly debts or spending looks like. This estimate will give you a brief overview of what you can afford . The Crown Calculators below are extremely popular and helpful when it comes to good financial decision making.

Spanish Mortgages Calculator

Calculate your monthly payments for a particular example loan amount and interest rate using this Spanish mortgage .A Spanish mortgage calculator is a tool that estimates the monthly payments for your mortgage.After deduction of debts & commitments, the figure below is what banks will use to calculate mortgage affordability. It takes into account factors such as the amount you . Just enter the mortgage amount you wish to borrow, the term over .Calculate your mortgage payments in Spain with our free Spanish mortgage calculator.Mortgage Protection Insurance Calculator.A Spanish mortgage calculator is a valuable tool that can help you estimate the cost of your mortgage in Spain.

Top 7 Spanish mortgage calculators for non-residents

Try it now!

Spanish Mortgage Calculator

Calculator results include costs you might not have thought of.esSpanish mortgage example, based on £232K propertyspanishlegalhomes.Use our Spanish mortgage calculator for a quick and easy way to calculate your monthly mortgage payments.Private banking in Spain. The last column contains either stress test GDS or TDS depending on which one limits the mortgage amount. Feed this information into the calculator, against the information already provided in the section above, and it will provide you with an aggregated score.036 (nominal annual interest rate divided by 100), p with 12 (number of instalments to be paid per year) and t with 30 (number of years), to give an instalment of 681.

Spanish Mortgages calculator

, 2024 Explore the essential role of mortgage affordability calculators in Spain's property market. This article offers insights on how these tools aid in responsible borrowing, aligning property dreams with financial realities, and preparing for mortgage negotiations. Why do some people get turned down for Spanish mortgages? What are the main tax considerations? Buying property in Spain? The 7 most common . – 10 year repayment product 925 per month.

Down payment – Enter the cash amount you are ready to pay upfront for the property. You will then need to enter your amortization in years and . Mortgage Over Time. Keep in mind that if your down payment is less than 20% of the price of your home, you'll need to purchase mortgage default insurance, which can . We have an in-house risk assessment team, that can help you understand what you can borrow. For more information, please contact us or your mortgage broker to discuss your options.Unfortunately, there are presently no UK lenders that offer Spanish mortgages.Below is a rough guide to the cost per 100k borrowed that we often use when doing a preliminary mortgage affordability calculation for properties in Spain.Mortgage Calculator.Crown Calculators.Any application is subject to our credit approval process and the results of that process will ultimately determine the size of mortgage you can afford. The average 30-year fixed mortgage interest rate is 7. Introduce the house price, the . This calculator allows you to input your cover requirements and personal details and then compares quotes to find the best deal on mortgage protection insurance and life insurance.Spain Mortgages.5 times an individual’s annual income. Cost per month per 100k borrowed.How To Use Our European Mortgage Calculator. How much could I borrow? Whether you're buying your first home, moving home or remortgaging to us, see how much you could borrow. An amortization period of 25 years is assumed. In addition, your ratio debt to net income cannot exceed 30-35% to ensure that you can pay the installment established when contracting the . Plan your property purchase with ease. Calculate your mortgage eligibility including your Debt . The Affordability Calculator reflects RFA’s posted rates effective November 10, 2023 at 12:01 am ET .Mortgage in Spain calculatormortgageinspain.How much deposit do I need for a Spanish mortgage?For your second residence and as a non-fiscal resident, a bank will finance no more than 70 % of the value of your property. If you include 15% of.For fiscal residents who pay Spanish taxes, the maximum mortgage is 80%.Firstly, enter your existing debts and loans – for cars, credit cards and other mortgages or purchases.Conversely, you can let nesto’s Affordability Calculator estimate your property taxes. Based on a $350,000 mortgage.Calculate how much you can borrow in Spain and view best buys.Navigating Mortgage Affordability in Spain: A Calculator's Role.myspanishresidency.The amount you can borrow depends on your debt to income ratio.

This calculator provides useful guidance, but it should be seen as giving a rule-of-thumb result only.The amount of mortgage that you can afford to borrow – your 'affordability' – is calculated based on several factors.* Halifax Homeowner Variable Rate (HHVR) is the rate that will apply to the mortgage after the initial product period ends. Net monthly income. Industry standards suggest your total debt should be 36% of your income and your .The mortgage amount and monthly mortgage payment are calculated using RBC's mortgage affordability calculator. The best way to get around this is through a consultation .To take advantage of this free service, please contact our office on 01844 261886 or complete and return the Spanish Fact Find form which is emailed to you automatically when you request a Spanish mortgage illustration on the online calculator page , .