Sprintax tax filing

Not only this, but nonresidents will receive their MAXIMUM legal US tax refund.By using Sprintax Returns, individuals who are filing their taxes will ensure they are fully tax compliant with Internal Revenue Service ( IRS) rules.95) if you file using Sprintax.

To gain access to the software you will need to complete the online registration form.Yes, if you earn investment income as a nonresident in the US, you will be taxed on it. Offers automatic generation of completed tax return forms.Sprintax is an online tax preparation software, specifically for nonresident alien students.49K subscribers.That’s why Sprintax is here! We specialize in making tax as straightforward as possible to newcomers in the US. What should I do? When . To determine your tax filing status, create a free Sprintax account. Sprintax Returns is the home of nonresident federal tax e-filing and state tax return preparation. Email Address * Forgot password? Password * Log-in page for Sprintax tax filing software - 1040NR tax .

How to file a J-1 Visa Tax Return

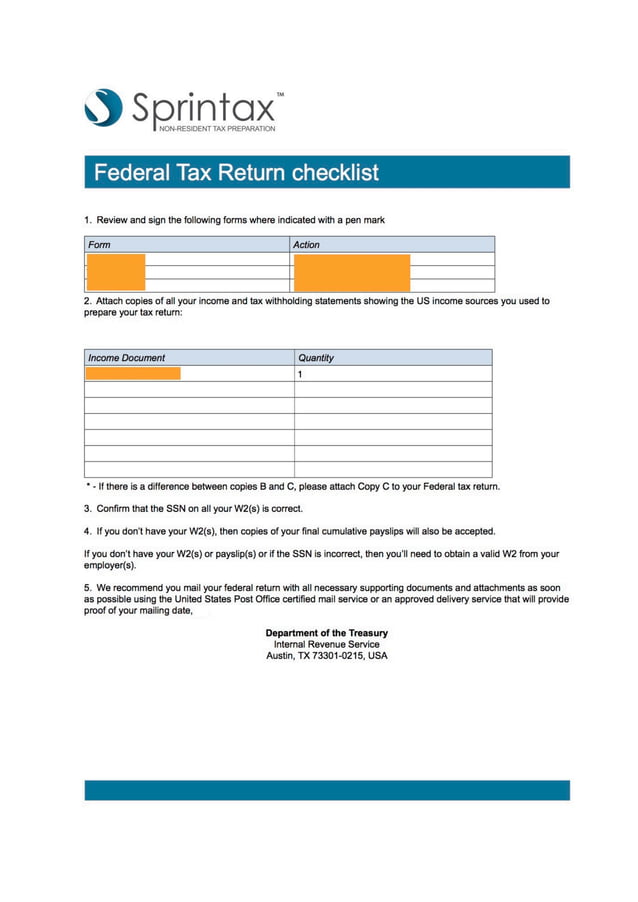

Scholarship or Fellowship grant letters (if no related Form 1042-S) Copy of past year’s tax forms (if you had any) 2.com blog! On April 17, 2024 by Sprintax 0 comments. Note, if Sprintax determines you are a resident filer, you will not be able to continue to file your taxes with Sprintax.Every nonresident alien in the US is obliged to file a federal tax return before the tax deadline, which in 2024 is 15 April. But, with some planning, organization and a little help from your friends at Sprintax, filing your documents can be easier than you think! In this handy guide, we’ve got 5 top tips to follow if you’re filing your nonresident tax documents from outside the US.Valentin helped me with all my questions and answered them in detail.The US tax deadline in 2024 falls on 15 April.Now Sprintax lets you file your tax return electronically! With e-filing, there's no need to print your return and mail it to the IRS.

Tax software for J-1 visa participants

Check out the videos below for your step-by-step guide to filing with Sprintax. To e-file, log into Sprintax following .States are independent from one another in their taxing authority, and all state tax forms differ in some respects. Amended returns take up to 12 weeks to process. Don't have an account? Sign up. If you’re an international student or scholar in the US, by law you must file Form 8843 at least, but depending on your circumstances, you may also need to file a Federal tax return by filing a 1040NR, a State Tax .Sprintax Tax Preparation Software. Create your Sprintax account with the link provided below.On February 23, 2024 by Sprintax. Tax software for J-1 visa participants. Five-star service! Date of experience: April 12, 2024. То file your old tax returns, you will need the W-2, 1099, and 1042-S forms you received for those years in order to report your income.Sprintax Returns makes tax filing easy for J-1 students, teachers and researchers, interns and trainees, au pairs, summer work & travel and camp counselors, physicians and specialists.Accessing 1042-S Job aid - you have never activated Sprintax Calculus; Tax Year 2023 federal tax filing in Sprintax Tax Prep is now live. With a Sprintax account, you can access an expansive online tax education library, receive help filling out tax forms, and file your federal tax . Federal tax return E-Filing (form 1040NR) Preparation of state tax returns and Form 8843. In the case of the 1099 form, taxes are not usually withheld by the . When filing your tax return, you will use Form 1040NR for .Login to your Sprintax Returns account.

F-1 International Student Tax Return Filing

Local income tax (depending on where you live) State income tax (depending on where you live) Federal Social security and Medicare tax- (FICA) While living in the .The major difference between the W-2 form and 1099’s has to do with the type of income reported on the form and the tax withholdings. Please file as early as possible. Dividends received from your investments will .J-2 visa holders who have earned income in the United States are generally required to file a federal tax return, even if they are nonresident aliens.

Filing Your Non-Resident Tax Forms using Sprintax (F and J)

Sprintax Returns makes tax preparation easy for J-1 students, .

How to E-file 2023 Nonresident Federal Tax Return with Sprintax

com

Nonresident alien tax filing explained

This form comes with detailed instructions—you may also use Sprintax to prepare your state tax forms for a fee of $29.

Sprintax Blog » Tax Information for US Nonresident Aliens

All you need to know about your tax obligations and filing your tax returns. If you have a state filing requirement, this will not be covered by the code and you must also mail . It is created specifically for NYU .(Updated for 2024) Resident or Nonresident – this is the question! Determining your tax residency status is important, as it will determine how much tax you .Sprintax for J-1 visa holders.

On average it found that almost 90% of those that had a Federal filing requirement got a tax refund- with an average refund of about $1,100. Usually, any share of investment profit you make will be charged at the regular Capital Gains Tax ( CGT) rate of 30%. Fast tax residency determination .Filing your Tax Return with Sprintax in 6 Easy Steps.

Sprintax will ask you a series of questions based on the substantial presence test to determine your residence status for federal tax filing purposes.All relevant tax form (s) for taxable purposes: Form (s) W-2, 1042-S, or 1099 as applicable. You’ll receive a W-2 form if you’re an employee. The code can be used for Federal taxes. It’s vitally important you file your taxes in time for the deadline. If you are filing an income tax return (examples include: Form 1040NR or 1040NR-EZ) and worked in Illinois in 2023, then you must also file the Illinois State form. The Dashew Center has purchased discount . By not filing you risk having issues with future Green Card and visa applications as well as fines and penalties. Gather your paperwork. Sprintax is ONLY for non-resident tax filers. To file a federal tax return, you can purchase a Sprintax discount code from the ISSO for $4.WashU partners with Sprintax Tax Preparation, which is a tax preparation software for filing nonresident tax returns. If you are filing an amended tax return to claim an additional refund, you’ll have to wait until you have received your original tax refund before filing a Form 1040X.Sprintax Returns. If you want to claim any credits or deductions that you might be entitled to, you will have to gather old receipts to prove your eligibility.Access Sprintax Tax Preparation Software. J-1 visa taxes explained – the ultimate US tax return guide for J-1 visa holders.The Office of International Services provides members of the UIC international community with discounted access to Sprintax as an option for meeting the tax filing responsibilities required of visa holders in the U. Learn more here. These taxes will include: Federal income tax.Tax filing for international students made easy.When is the tax filing deadline? I will not be able to send my return on time.If you work in the US as an H1B worker, you can expect to pay between 25-35% of your wages in federal, state, and local taxes.

Tax Resources

Keep your tax records when Tax season is over.

US Non-resident Taxes Explained for International Students

Not only this, but . Where do I send my tax return?

Tax Information

By using Sprintax Returns, individuals who are filing their taxes will ensure they are fully tax compliant with Internal Revenue Service ( IRS) rules.SPRINTAX (online self-preparation software for filing taxes) Supports federal and state tax filing for international students & scholars. You must access Sprintax via the links on our website (see below) to benefit from this discount. State filings can be . Federal filings are covered by the Harvard license.The ISSO provides access to Sprintax for you to use at no cost for federal forms so you don’t have figure out the forms you need and how to fill them in. The discount code allows you to file a federal tax return and complete Form . Returns File your US nonresident tax return (forms 1040-NR, 1040X, 8843, claim a FICA tax refund) Forms Prepare your pre-employment tax forms (W-4, .

Sprintax

Can international students file taxes online? Yes. Sprintax US Tax Preparation STEP 1 – .Just follow the simple instructions, answer a few questions, and Sprintax will do the rest.Email : hello@sprintax. How to fill out form 8843 easily online with . Once you receive your 1099 form from your .Tax return from $69.It’s also important to know that the 2022 tax filing deadline falls on 18 April (for 2020 tax returns, due to COVID-19 outbreak, the tax deadline was extended to 17 May, 2021). Sprintax will guide you through the tax preparation process, arrange the necessary documents and check if you’re due a tax refund.What Is e-filing?Sprintax Returns can help you complete your 1040NR form so that your investment income is reported properly. Sprintax is a tax . UMass has teamed up with Sprintax to host two webinars for international students, scholars, researchers, faculty, and staff who are nonresident aliens for U. File your J-1 visa tax return with Sprintax.Sprintax is a web-based tax return preparation system designed exclusively for foreign students, scholars, teachers, researchers, trainees, and their dependents to . There are a limited number of Sprintax codes offered by Yale for each tax year.

Filing taxes on H1B visa

Sprintax supports e-filing of nonresident federal tax returns.The Office of Global Services has arranged access to Sprintax for you. Last year Sprintax helped almost 100,000 international students with their IRS tax obligations. Provides an all-in-one solution covering tax return forms for non-resident individuals in Canada.In this video, we walk through the steps required to E-File your US nonresident federal tax return using Sprintax. Upon completing the form, you will receive a unique code to enter when filing your Federal tax return via Sprintax. Find more information on our blog: https:/. For questions regarding Sprintax software, please . Sprintax - The name for nonresident tax.What is Form 8843 and who should file it with the IRS? Deadlines, filing instructions, penalty for not filing form 8843. All posts ; Español; Português; 中文; 한국인; Русский; Go To Sprintax; Contact us; Welcome to the official Sprintax. Sprintax, which also has a YouTube channel, will help you determine your tax status, guide you through the US tax preparation process, prepare the necessary documents for your tax return, and check if you are due a refund. You may cash your original refund check while waiting for the additional refund.Sprintax will prepare your tax return; Learn How Sprintax works & visit their website for more! Sprintax Free Educational Tax Webinars: You will find below, a list of the free, educational tax webinars that Sprintax will be making available to nonresidents prior to and during the US tax filing season. If you are claiming an additional tax refund. ReturnsFile your US nonresident tax return (forms 1040-NR, 1040X, 8843, claim a FICA tax refund) FormsPrepare your pre-employment tax forms (W-4, . Create a Sprintax Account. In this video, we walk through the steps required to E-File your US nonresident federal tax return using . 31K views 2 years ago.Sprintax can guide you through determining your tax filing status and completing the appropriate forms. However, many nonresidents are not aware of this tax on investment income in the US.